marchmeena29

Monday’s huge rally was trumped by an even bigger one yesterday in a two-day rebound of 5.7% for the S&P 500. We have not seen such a surge in stock prices since the index emerged from the pandemic-induced bear market in April 2020. Granted, the move was clearly a function of resolving an extremely oversold condition in the market at the end of the third quarter, but it was also accompanied by a modest change in sentiment. I think the consensus is starting to recognize that the tightening of financial conditions to date is having a significant impact on the rate of economic growth. It is showing up in the high frequency data, which means demand is waning and price increases for goods and services should follow. That suggests that the Fed may be closer to its peak Fed funds rate than the futures market or its rhetoric suggests.

Finviz

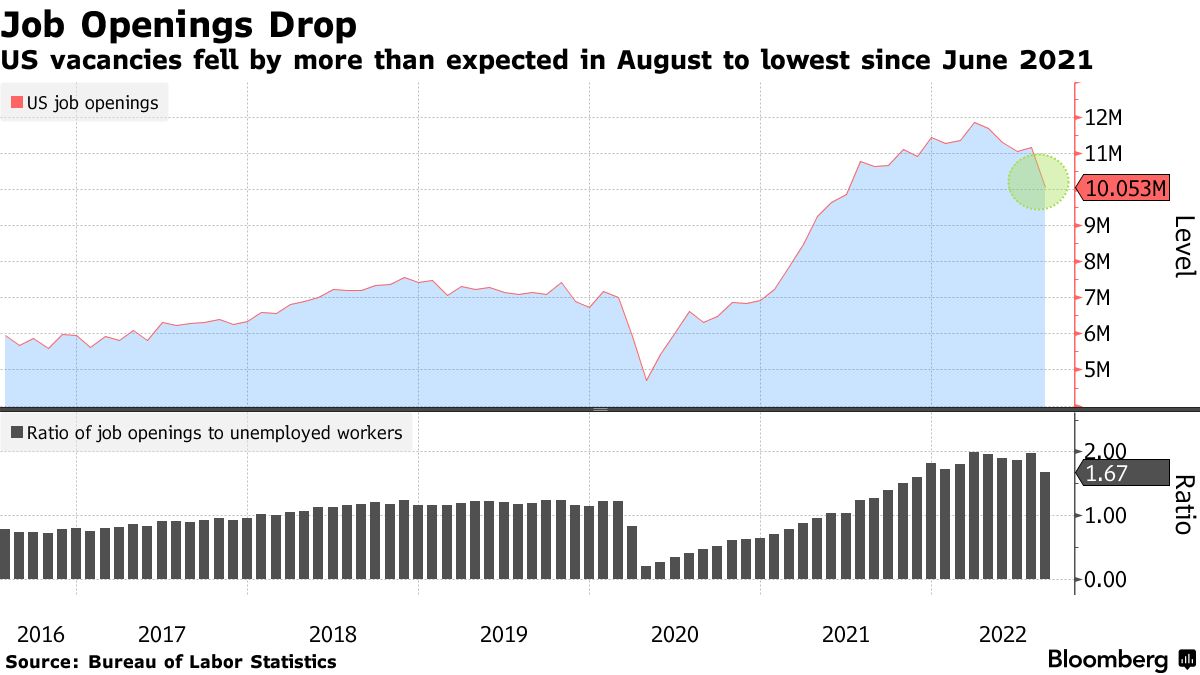

The number of job openings in the U.S. plunged by more than one million in August, according to the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS). That was a larger decline than every estimate on Wall Street, bringing the number of job openings per unemployed worker down from 2 to 1.7. We can be sure that there was even more progress on that front last month. This means the supply and demand for labor is rebalancing to ease the wage pressures that the Fed fears are helping sustain high prices. Another report like this next month should support a smaller rate increase from the Fed in November, which could also be the last.

Bloomberg

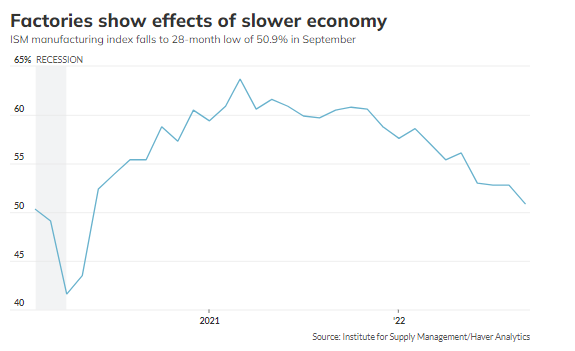

The JOLTS report is consistent with what we learned from Monday’s ISM manufacturing index, which fell in September to just above the line of demarcation between expansion and contraction at 50.9. Manufacturing companies do not need as many workers today as they did earlier this year when there was an explosion in demand for goods. Consumers shifted their spending focus from goods to services as this year wore on, so new orders have declined.

MarketWatch

This is another leading indicator of next year’s inflation number. As demand for goods and the workers who produce them fall, so should the prices of those goods. This is already showing up in the prices that manufacturers pay for supplies, which has fallen for six consecutive months to the lowest level in two years.

Friday’s jobs report will be more important to the Fed than both JOLTS and the ISM manufacturing index. The consensus is looking for the economy to create approximately 275,000 jobs, which would be down from 315,000 in August, with the unemployment rate holding steady at 3.7%. A lower number of jobs should build more upward momentum in risk asset prices, as it reduces inflationary pressures, as well as the need for the Fed to continue tightening monetary policy. I wouldn’t be surprised if we give back some of the gains from the past two days, as it felt like too much too soon, but it does feel like we are slowly turning the corner into what has been the seasonally strongest period of the year for the stock market.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment