AzmanJaka

While shares of Waste Management (NYSE:WM) have held in relatively well over the past year, shares have taken a hit over the past two months as concerns around the recycling unit have grown. However, WM’s diversified business and strong pricing power make it a long-term winner. I am reminded that Warren Buffett once said, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Waste Management is a “wonderful company” in my view, and pullbacks like this offer an opportunity to add to positions.

Before discussing the recent concern around recycling, it is worth taking a moment to review results. In the company’s second quarter, revenue rose 12% to $5.03 billion, driving an 8% increase in adjusted EBITDA to $1.4 billion. Operating margins compressed 120bp to 28.1%, which is why EBITDA growth was a bit slower. Higher fuel prices were a 100bp headwind, so with gasoline and diesel prices having come off their summer high, some of this headwind should fade. Adjusted EPS rose 13% to $1.44, and quarterly free cash flow was $600 million.

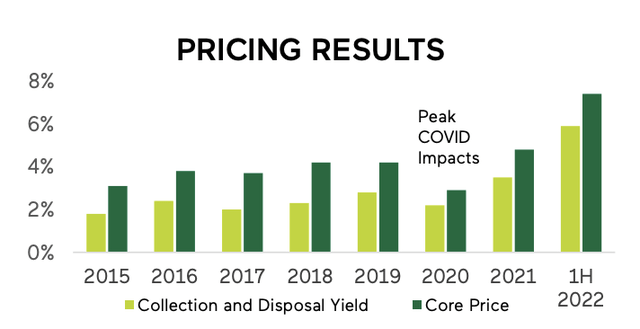

In fact, results were so strong that alongside these earnings the company raised guidance. Revenue growth is now expected to be 10% this year from 6% previously. Collection and disposal yield (which combines price actions with mix shift and customer churn) is about 8.5%, driving the majority of the revenue gains. About 40% of its contracts are tied to inflation, so this has provided a direct life to WM’s revenue.

Alongside higher revenue, it raised EBITDA guidance $5.5-$5.6 billion (up $175 million) with margins of 28.1% stable at Q2 levels, due to a 60bp full-year fuel headwind. As a consequence, calendar year 2022 EPS should be in the $5.60-5.80 range. Free cash flow should be about $2.15 billion, which includes $550 million of growth cap-ex on its upstart and high-growth sustainability business.

The fact management just raised guidance just last quarter and has a history of strong performance with 18 years of dividend growth should be remembered given the concerns around its recycling unit. These concerns stem from reports that recycled corrugated container prices have fallen by 70% since July. Because WM sells the material it recycles, this price decline will pose some headwind to the top-line.

As a long-term investor in WM, I immediately thought of 2018 when recycling prices plummeted due to a surge in Chinese exports (the domestic Chinese market for recycled goods was over-supplied and the excess supply poured onto the US market). To this point, WM’s recycling economics essentially relied solely on the revenue it sold the recycled products for—it essentially underpriced recycling collection services to get the recycled product for resale. With prices falling substantially, the company revamped its recycling business model to earn more from collections and de-risk its business from swings in recycled prices. After a weak H1 2018 as recycling weighed on results, the stock started a comeback as this new pricing model provided more certainty, and the stock has rallied over 70% since then.

When the company reports third quarter earnings on October 26, I suspect investors will be reminded of the resilience of WM’s collection-oriented business model and that recycled goods revenue does not drive earnings volatility like it did in the past, which may help to put a floor in shares. Recycling may still create some noise on a quarterly basis, but not to the degree it once did when it could impact full-year results by up to $0.20.

This is a company with 15,500 collection routes and 260 landfills, giving it unmatched scale in the US waste business. 63% of its revenue comes from collection and transfers, 19% from its landfills (as smaller waste collectors dump waste at WM landfills), and just 8% from recycling. 75% of its collections business come from long-term contracts, making it a stable source of recurring revenue. Importantly, just 4% of its collection business is tied to construction, one of the economy’s more cyclical sectors, which undoubtedly faces headwinds from the Federal Reserve’s policy tightening.

As noted above, a significant portion of its contracts are tied to inflation, and after years of consolidation, waste collectors have significant pricing power. Accordingly, WM’s pricing and yield have picked up substantially over the past 18 months alongside inflation, helping to insulate margins. WM has also been making significant investments in labor productivity. Like other industries, WM has experienced labor shortages, and it has rolled out new trucks that can pick up garbage cans to reduce the number of crew per truck. Due to these innovations, management expects margins can expand when inflation falls toward 3% as costs have been rebased lower but price increases stick.

While we think of WM as a waste company, it is also making significant inroads in sustainability as a business, which now accounts for about 20% of its cap-ex. Most notably, it is using landfills to generate renewable natural gas. This represents just 1% of the business today, but it will get to $400 million of EBITDA by 2026. By using this gas to drive their fleet, the company doesn’t have to purchase gas in the open market and actually generates tax credits at $40/MMbtu. It can also sell the gas to utilities or industrial customers at $17-20/MMBtu.

For now the company is prioritizing using this renewable natural gas to power its own operations as the economics of the tax credit favor it. Given it has finite demand for natural gas, as its RNG production continues to rise with more plants coming online, it will begin selling more in the open market. This is a new revenue opportunity for the waste WM collects, and it makes its uniquely large collection of landfills an even more compelling differentiator for the company. With the world looking for more natural gas given Russia is no longer exporting gas to Europe, this clean natural gas represents a durable growth opportunity for the company, beyond its existing operations.

WM’s diversified operations, large scale, and significant pricing power provide a large moat that has rewarded shareholders well. The company has increased its dividend eighteen straight years and at a brisk 8.4% pace over the past five years. I would expect a high single-digit increase announced this December. The dividend payout is just 40% of earnings providing plenty of capacity for continued increases beyond 2022.

On top of this, WM has a fortress balance sheet with debt/EBITDA at 2.7x, comfortably inside of its 2.5-3x range. Thanks to its strong cash flow, it was able to do so within two years of closing its debt-financed purchase of ADS for $4.6 billion in 2020. Given this, management has been able to turn on its share repurchase program, and after buying $520 million in H1, H2 repurchases will be about $980 million. These repurchases have added up, reducing the share count by about 10% since the end of 2013 even as the company has done over $6 billion in cash acquisitions.

With strong pricing power and modest volume growth, WM can grow the top-line of its core waste business by mid-single digits in coming years, while the combination of margin recovery and share repurchases should boost earnings per share by a 2-4% beyond that. Then as its sustainability business scales up, it provides about 7-8% of incremental top-line growth between now and 2026 or about an additional 2% per year.

In 2023, I am looking for WM to generate about $6.10-$6.30 in earnings and grow that 6-8% per year with 85-95% free cash flow conversion through at least 2026, meaning the company can grow its dividend by upper single digits and afford to buy back about 2% of shares per year. Right now, WM is trading about 25x earnings. This is admittedly not a bargain price, but for a highly cash-generative business with recurring revenues, upsides from sustainability, it is a “fair price” to quote Mr. Buffett. As the fears around recycling fade, I think WM can return to about a 3% free cash flow yield, which when factoring in the business’s mid-single growth provides the scope for 8+% long-term returns. At $2.2 billion in free cash flow next year (this assumes another $600 million invested in sustainability), shares can return to the $170-175 area, providing over 10% of near-term return potential

During bear markets, investors are presented the opportunity to buy into great companies and benefit from strong long-term compounded returns. Such an opportunity is presenting itself in WM. I would recommend buying shares and continue to add if they fall further. The company has low-single digit exposure to recycled product prices, and its long-term tailwinds far outweigh this potential headwind.

Be the first to comment