SeanPavonePhoto/iStock via Getty Images

I’ve been a long-time holder of Rhode Island-based regional bank Washington Trust Bancorp, Inc. (NASDAQ:WASH). I first wrote about the company back in 2016, saying it was a Great Bank at a Good Price. Since then, I’ve periodically added to my WASH stock position during corrections.

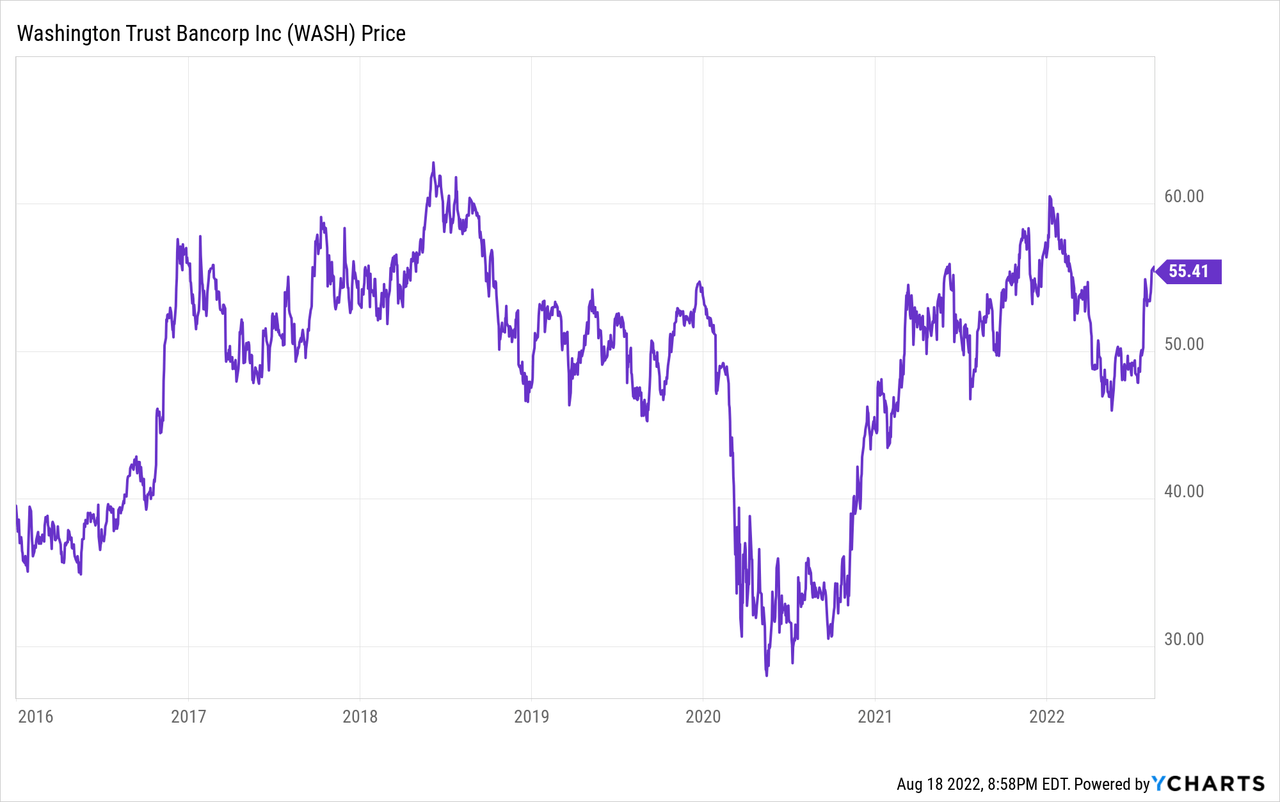

While shares aren’t at their lowest levels today, they are still at a fine entry point. More broadly, I’d note that the stock, following its sharp late 2016 rally, has now traded sideways for the past five years:

While the stock price hasn’t advanced much recently, the underlying business is looking better than ever. That being the case, it’s time for a renewed look at Washington Trust Bancorp.

Why Washington Trust Bancorp?

Washington Trust has been in business since 1800 and is the largest local bank serving its home state of Rhode Island. The company has been paying dividends for a century now, and — as you’d expect for a firm that has survived this long — it is run conservatively.

The bank thrived during the 2008 financial crisis, remaining profitable and taking lending market share from larger banks which lost ready access to funding. Management has commented that the crisis helped the bank’s standing as it was able to deliver needed funds at a crucial time; that’s the sort of service that builds tremendous trust and loyalty with customers.

Unlike many conservative banks, however, Washington Trust is able to post reasonable growth and profitability metrics. The bank has grown its loan book and deposit base at 7% and 9% annually over the past 10 years, respectively. Since 2012, earnings rose from $2.13 to $4.39 per share. Over the same span, the dividend more than doubled, rising from $0.94 to $2.10 per share.

In addition to its lending operations, Washington Trust has a significant asset management arm. This tends to produce higher-margin recurring revenues that add some heft to the bank’s overall numbers.

Is Washington Trust Fairly Priced?

By one metric, purely looking at book value as compared to return on equity “ROE,” WASH stock might seem expensive. I have a shortcut for banks which is based on a rule of ten. I don’t want to pay more than 10x book value in terms of ROE. In Washington Trust’s case, book value is currently 2.0x so I’d want to ideally see an ROE of 20%. Instead, Washington Trust’s 10-year median ROE is 12.1%, which would suggest shares should trade closer to 1.2x book value.

So why am I comfortable disregarding my own rule of thumb in this case? For one, Washington Trust’s ROE has climbed sharply in recent years. While its median is 12%, it has been earning 14% and 15% ROEs since the pandemic started. This both supports a higher book value ratio in general and specifically indicates that the bank’s operations have positively inflected in recent years. Some of that is due to higher interest rates in general, but management has done a good job shaping the loan book and duration curve to maximize its gains from the current market opportunity.

Also, I’d note that the asset management arm deserves a premium valuation. As discussed, this is a high-margin business that should be worth more per dollar of earnings than the core bank operations. In recent years, so much focus has been put on banks maximizing their non-interest-based income, and owning an asset management operation is a fantastic way to do that. For these two reasons, I’m comfortable paying what might seem like a steep premium to book value for the bank.

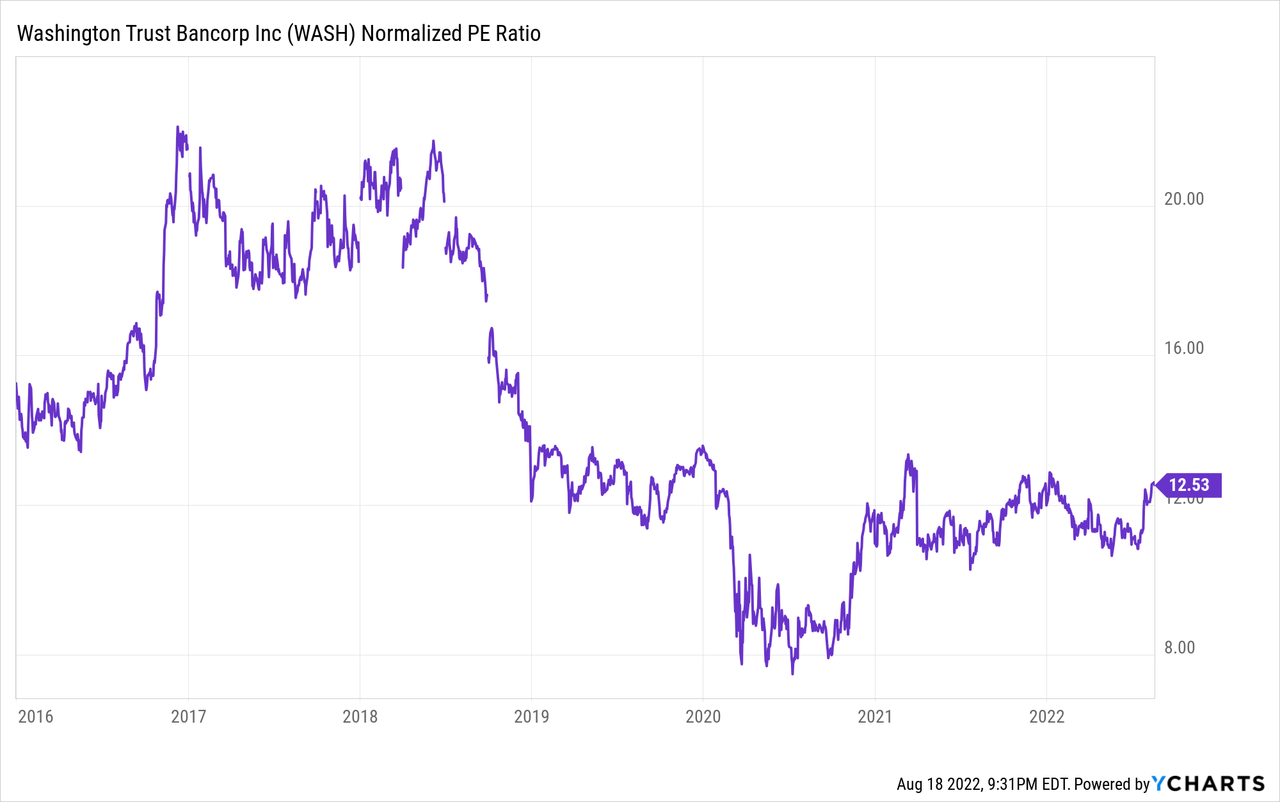

I’d further highlight that WASH stock’s P/E ratio tends to be in line with other regional banks, since it produces a lot of earnings out of its assets. Also, its current P/E is on the lower side of its historical range:

I started buying Washington Trust stock around a 16x P/E multiple and it actually got over 20x (quite rare for a bank) during 2017 and 2018. In late 2018, earnings soared but the stock price did not, leading shares to trade closer to 12x earnings. Since then, shares have ranged between 8x and 13x earnings. The current entry point, on a P/E basis, looks totally fine both compared to its own history and that of rival high-quality regional banks.

Valuing WASH Stock On Its Dividend

I started buying Washington Trust stock in 2016 at $35/share with around a 4.0% dividend yield. Fast forward to today and the stock is at $55/share while offering a 3.9% dividend yield. Such is the magic of consistent dividend growth.

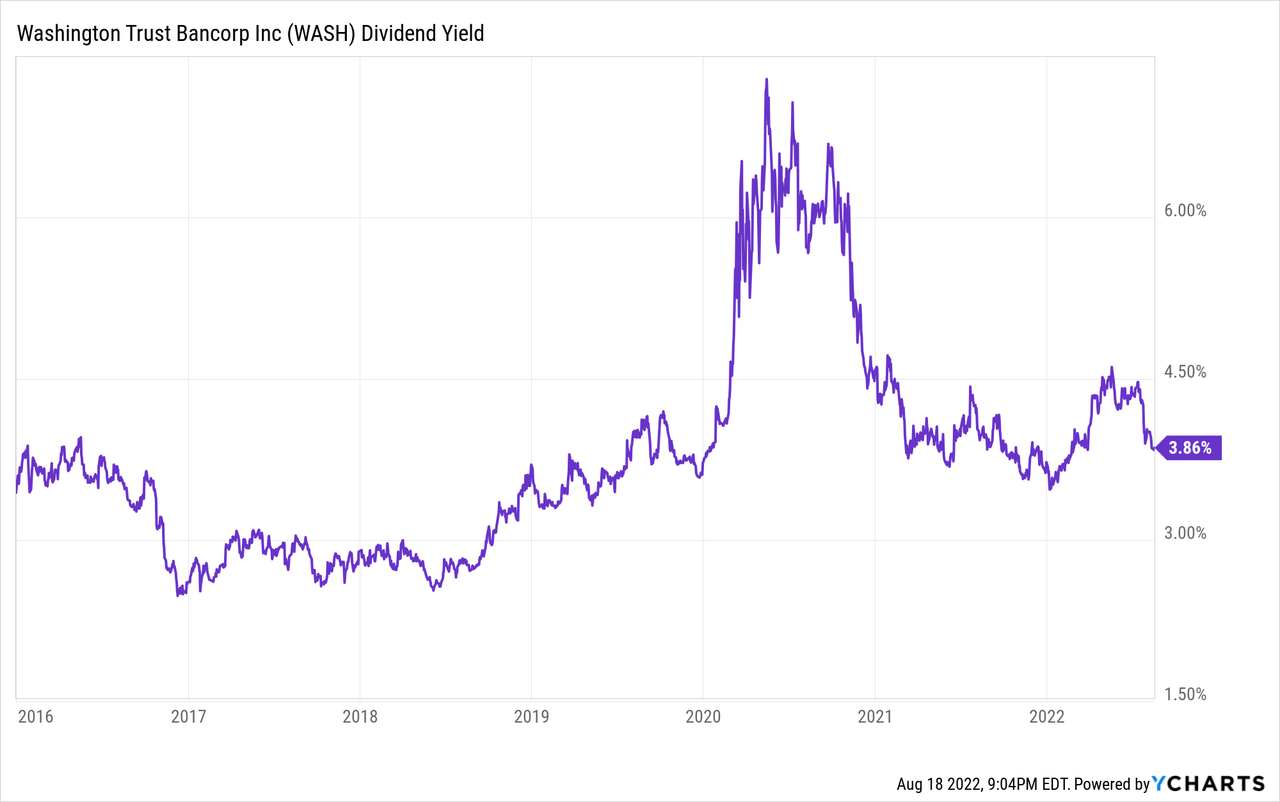

In recent years, WASH stock’s yield has fluctuated significantly, ranging from the high 2s to the mid-6s:

However, I’m skeptical that we’ll see anything like the Covid-19-level yields we saw on regional banks, including Washington Trust. Investors were worried about major chunks of the economy totally freezing up and that leading to widespread defaults and foreclosures. While the housing market is turning downward now and the economy may head into a recession, I don’t foresee conditions getting anywhere near as bleak as they were in March 2020.

As such, I doubt we’ll be looking at WASH stock with a 6%+ dividend yield again anytime soon. Aside from that panic point, the highest the yield got was 4.5%, which it hit this spring. That was a great entry point for the stock. Regardless, I’d argue that 3.9% is still a more than fair entry point for this stock both compared to its own past history and compared to the banking industry more broadly.

Generally, when you find a bank with a relatively high yield, it tends to have slow dividend growth. That’s not the case with Washington Trust. It has enjoyed robust dividend growth, including always appreciated twice-per-year dividend increases on several occasions in recent years. Also, the company managed a dividend increase in 2020 when many banks froze their payouts.

Overall, Washington Trust has grown its dividend for 11 years in a row and has a 7.4% annualized dividend growth rate over the past five years. More than 7% annual growth on a starting 3.9% yield is a fairly attractive offering.

Washington Trust Bancorp’s Bottom Line

You could reasonably say this article would have been more useful a few months ago. Indeed, WASH stock was available at quite the entry point back in May. However, I’d note that almost all stocks have rallied significantly over the past few months. Comparatively to other opportunities, at today’s prices, I’d argue that Washington Trust remains a high-quality offering at current levels.

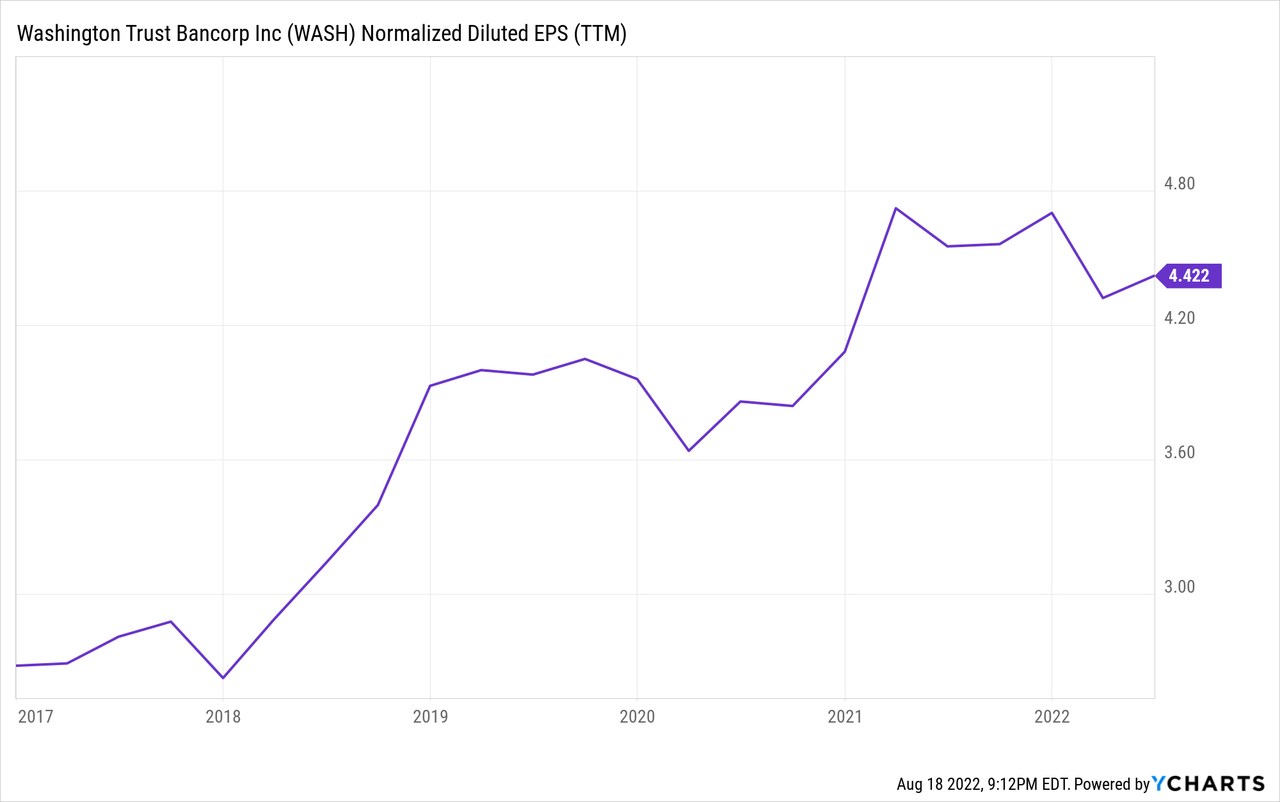

Since the beginning of 2017, WASH stock is effectively flat, with the total return all coming from the dividend. Yet, over the same period, earnings have grown from less than $3 per share to almost $4.50 today:

That’s some pretty serious multiple compression to post 50% earnings growth and not get any uptick on the stock price.

People are worried about a slowdown in the housing market hitting Washington Trust’s mortgage profits. And if the bear market in equities has another leg down, that could hit results out of the asset management side of things. But Washington Trust reported 5% total loan growth this quarter, has been enjoying favorable interest rate developments, and management has guided to strong loan demand in the back half of the year as well.

All that to say that the market is too pessimistic on the bank’s outlook. Profits have grown dramatically in recent years and the outlook remains favorable on that front. The bank pays a large and growing dividend. Meanwhile, the share price is at the same level it traded at back in 2017. I don’t anticipate that the discrepancy will last forever. Look for shares to head to new all-time highs over the next 12 months while paying a healthy dividend along the way.

Be the first to comment