Drew Angerer/Getty Images News

Where the Economy Appears to Be Taking a Hit, Luxury Goods Bring Out Their Qualities

Where the economy seems to be taking a hit, luxury goods show their qualities. But why? What is happening to the economy?

The current monetary policy tightening by western central banks is still not delivering the results their policymakers are aiming for. Inflation is not abating, and economies are shrinking, with US gross domestic product [GDP] slowing for the second straight quarter, while UK GDP was hit by a sharp fall in household spending [-3.6% in Q2 2022 vs. +12.6% in Q1 2022].

The European Central Bank [ECB] fears a deterioration in the growth prospects for the eurozone and does not rule out a technical recession. Technical recession means negative GDP growth reported for two consecutive quarters.

Since this runaway inflation is not demand-driven inflation and its triggers – the energy crisis and the war in Ukraine – are beyond the influence of the world’s central banks, the monetary tightening will most likely plunge the economy into stagflation. Stagflation, also known as recessionary inflation, consists of a slowing in the rate of expansion of economic activity combined with persistent inflation.

This scenario will most likely have an impact on company sales and profits as not every business can pass on higher prices for energy and other inputs to end users. Since stock prices are the stock market’s place to absorb the blow of lower sales and gains, stagflation will only add to the bearish sentiment in these stocks.

Among the securities that will provide a shield against the headwinds that will arise are those that represent the suppliers of luxury goods. Since the negative economic climate does not even have a minimal impact on spending on certain goods when they meet a basic need [this is well known], luxury goods will not be affected either since their consumers, who belong to the riches society, will still go shopping.

Tapestry Inc. Holds High Growth Potential Between Luxury Goods Stocks

Luxury goods stocks may be somewhat overlooked at the moment, but among them, Tapestry, Inc. (NYSE:TPR) appears to have high growth potential that can unfold in the coming periods.

The company is well positioned to benefit from the disproportionate distribution of wealth among social classes in Western economies and from the ongoing economic expansion in the People’s Republic of China.

The Chinese central bank continues to support growth with an accommodative monetary policy, as it aims to become the world’s first economy in a few years. To achieve this very quickly, it focuses heavily on the globalization of world markets.

The Business of Tapestry Inc: Resilient and Iconic

The company is a provider of luxury accessories and branded lifestyle items in the United States and overseas, including Japan and Greater China, through the three segments Coach New York (939 stores as of July 3, 2021), Kate Spade (407 stores) and Stuart Weitzman (104 branches).

The first segment is an American fashion house that focuses on leather goods such as handbags and luggage, but customers can also shop for accessories and ready-to-wear products.

The second segment is also an American fashion house specializing in women’s clothing, bags and jewelry.

The third segment also focuses on luxury stores where women can buy expensive shoes, boots, ankle boots, sandals, pumps and other items.

Tapestry’s prospects for success are based primarily on two things. First, customers here look for that particular brand to show off, demonstrating that they can afford the authenticity of certain clothes, shoes, or jewelry. They are therefore recognizable in society and brands design products to meet the needs of these consumers, who belong to the upper class of both a western country and an Asian society.

Secondly, although they are separate brands, each offers products that combine convincingly with those of the other brand when shopping in these luxury goods stores.

In addition, Tapestry also combines the online sales channel with its brick-and-mortar stores and uses the potential of the Internet to reach a large number of potential customers around the world in the shortest possible time.

These are the hallmarks of competitive advantage that come from the consistency and strength of the company’s brands. These aspects of Tapestry’s business will enable the company to deliver significant growth in shareholder value through consistent sales and earnings, CEO Joanne Crevoiserat said in a comment on the fourth quarter of fiscal 2022 results.

From Q4 fiscal 2022: Ongoing Positive Sales and Earnings Streak, a Shareholder Return Program and Mixed Quarterly Results

Results for the fourth quarter of fiscal 2022 on Thursday before the market open were mixed as pro forma earnings of $0.78 (20% higher year on year), beat the median consensus by $0.01, while total sales of $1.62 billion (unchanged year on year) fell short of forecasts by $20 million.

Despite the increase in transportation costs and higher inflationary pressures, annual revenue and earnings have performed very well in the fiscal year 2022, continuing the positive trend following the recovery from the year of the pandemic, as shown in the table below. However, higher transportation costs and pressures from increased inflation impacted the profit margin a little bit.

|

Item |

12 Months Jun 2020 (pandemic year) |

YoY Change (2020 vs. 2019) |

12 Months Jul 2021 |

YoY Change (2021 vs. 2020) |

12 Months Jul 2022 |

YoY Change (2022 vs. 2021) |

|

Total Revenues |

$4.961 billion |

+17.68% |

$5.746 billion |

+15.82% |

$6.68 billion |

+16.18% |

|

Earnings From Continuing Operations |

($652.1 million) |

Negative turnaround |

$834.2 million |

Positive turnaround |

$856 million |

+26.13% |

|

Margin |

Negative |

Negative turnaround |

14.52% |

Positive turnaround |

12.81% |

-170 basis points |

For the next fiscal year 2023, Tapestry is poised to reward its shareholders through both a repurchase program, retiring up to $700 million of shares, and by paying quarterly cash dividends.

The Quarterly Cash Dividend: A Significant Increase over the Previous Payout

Thanks to a strong balance sheet and profitable operations, Tapestry’s Board of Directors has decided to increase the allocation to pay the quarterly dividend. The payout went up 20% from $0.25 on June 27 to $0.30 per common share, and shareholders will be paid out on September 26. The payment leads to a forward dividend yield of 2.69% vs. S&P 500”s yield of 1.49% as of this writing.

The company has also said it will do whatever it takes to keep its shareholders happy by increasing dividends faster than earnings growth going forward.

A Solid Balance Sheet Will Support Additional Growth

The company’s balance sheet looks resilient, although cash and short-term investments of $953 million as of the fourth quarter of fiscal 2022 were lower than total borrowings of $1.69 billion. An Interest Coverage Ratio of 4.11 indicates that the company can easily pay the interest costs because of borrowing. The ratio is calculated as an operating income of $242.5 million dividend by interest expense of $59 million.

The full Year 2023 Revenue and Earnings Guidance: Tapestry Sees Higher Revenue and Earnings

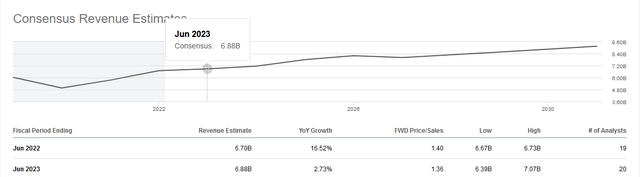

For the fiscal year of 2023, the company expects total revenue to increase about 3.3% year over year to $6.9 billion, compared to a median forecast by analysts of $6.88 billion.

seekingalpha symbol TPR earnings estimates

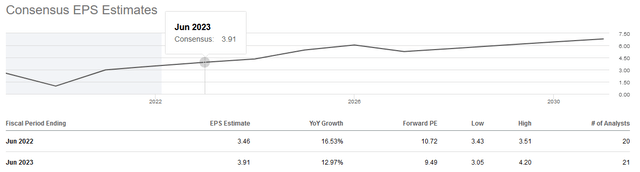

For the fiscal year of 2023, the company expects earnings per share to rise about 9.5% to 12.4% year over year and reach a range of $3.80 to $3.90, compared to a median analyst forecast of $3.91.

seekingalpha symbol TPR earnings estimates

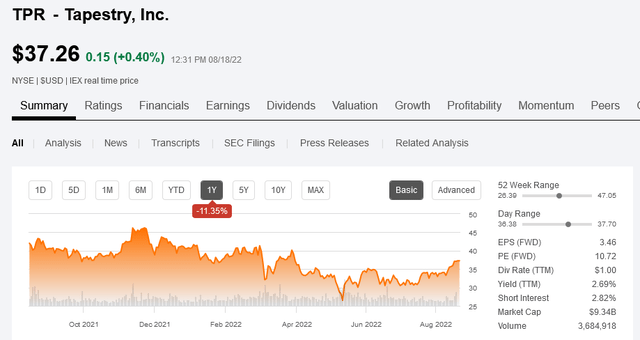

How Appealing Is the Stock Price?

Shares were changing hands at 37.26 U.S. dollars during regular trading on Aug. 18 determining a market cap of $9.34 billion and a 52-week range of $26.39 to $47.05. The stock also has a forward Price-to-Earnings ratio of 10.72, which usually is considered good.

Moreover, currently, the stock price is slightly above the 200-day moving average of $36.64. The 200-day moving average is a well-tracked indicator by investors to ascertain whether the long-term trend of the security is up or down.

Conclusion – Tapestry Could Provide a Strong Shield Against Current Headwinds and Potential Recession Inflation

The economy of 2/3 of the world is going into stagflation, creating severe headwinds for stock markets. Not only do defensive stocks, the U.S. dollar currency and precious metals offer protection, but also luxury goods as the wealthiest go on a shopping spree regardless of the cycle. Tapestry Inc will benefit from both Western wealth accumulation and Chinese expansion.

Thanks to iconic resilient brands, Tapestry is achieving steady and significant growth in sales and earnings and aims to increase its dividend faster than net profit growth. The financial condition is also robust to support this growth strategy in the next share buyback. Higher dividend and buyback programs usually produce positive effects on the stock price.

Be the first to comment