hoozone/E+ via Getty Images

Above: Will live movie audiences ever return, especially upcoming demos.

“Everyone has to sacrifice at the altar of stupidity from time to time…” Albert Einstein

For those either too young or unaware of the famous Peter Principle theory in corporate management, here’s a brief summary for the uninitiated among readers:

In 1969, corporate researchers Laurence Peter and Raymond Hull published a best-selling book titled “The Peter Principle”. After delving deep into the process by which executives move up the corporate ladder, their conclusion was this: A person who is competent at one level, gets promoted to the next but usually lacks command of the new skill sets required.

However, the way corporations work, that individual will likely continue to be promoted, ultimately reaching a level of total incompetence. And that is among the core reasons for underperformance of many large cap companies.

The Peter Principle theory is the secret sauce of the success of activist billionaire, Carl Icahn. From his earliest days, his guiding strategy was to study companies led by old boy networks who were products of the Peter Principle. Icahn bought their stock cheap, threw out the overpaid dummies at the highest level and rode a rocket to huge gains under managers he and his investors hand-picked for their smarts. And he still readily admits he’d built his $18.4b fortune as a very astute detector of corporate stupidity (see HBO’s Icahn documentary “The Restless Billionaire”).

Right after the recent 3Q22 earnings release of Warner Bros. Discovery (NASDAQ:WBD), we reviewed a mass of commentary throughout the financial and media entertainment communities on all players in the space. Our objective was to learn just how each company was responding to the onrushing new media universe and how their strategies to meet challenges head on might impact investors in the space.

Big media is in danger of becoming a land of dinosaurs as an economic ice age looms. So investors need to know who the most likely survivors will be as they inevitably consolidate and transform much of its traditional business model.

The smartest guys in the room theory

Going through the numbers and nostrums proposed by executive teams on earnings calls, it appeared to me that they were all singing from the same song sheet. That’s understandable. They are all facing the same headwinds and nobody appears to have a tight grasp on a path forward that would clearly reward their shareholders with returns superior to their competitors.

But as in every sector, operating teams run the gamut from out and out clueless placeholders to very smart people. So despite the welter of numbers and ratios, formulae and metrics, we arrived at the most direct appraisal of management among the peer companies. Time will tell if we picked the right horse.

Right or wrong, we came to the shares of Warner Bros. Discovery, loaded as were many of its peers with heavy debt, sagging advertising revenue, fickle audiences, and growing price resistance to monthly fees. And at the same time, there were companies who all had trophy content sprinkled here and there among the mountains of electronic garbage that comprises much of media content today. As many of these executives view their content with pride, what we hear from millions of their customers is the mantra we all experience: “What’s on tonight? Sorry. There’s nothing much to watch…”

Our conclusion: Bet on the smartest guys in the room. And in our view, the duo closest to x-ray eyes on the future of their company are David Zaslav and John Malone, both having shoved all their WBD chips to the center of the table, betting that they can find their way fastest out of the thick media jungle. They can either build the best mousetrap, or evolve a way to break it all up by selling off viable units on the theory that the parts may well be worth more than the whole.

Many cite the somewhat sardonic strategy that the best place to start WBD’s haircutting would be taking a scissors to Zaslav’s pay package ($246m in 2021). Malone already sits on a net worth of $9.5b, so what’s in it for Mr. Market to lay down their money for the shares of a company like WBD? Malone is confident Zaslav can deliver ~$3.5b in synergies.

Stipulation: We don’t mean to imply that beyond the WBD duo here that the total crew of media types who run these companies are a ship of fools. There are lots of smart people populating these companies for certain. It’s just that by their past track records and demonstrated ability to make money that the WBD guys seems like a great place to start at ~$10 a share and a long, for certain, pot-holed road ahead.

google

It is just as noted in the quote at the head of this article, that everyone now and then has the penchant to make a stupid move. And remember, its author, Albert Einstein, was referring to some of his most distinguished fellow genius physicists. Some of these guys ultimately who did early, error-filled research still resulted in the nuclear bombs that ended the Pacific War in 1945.

It’s hard to find a stupid blunder in the careers of either Zaslav or Malone. Not perfect for sure, but pretty savvy operators.

Clearly among the dumbest, seminal corporate moves equal to, or even more idiotic than the Ford Edsel (1957) or New Coke(1985), was the monumental blunder of AT&T (T) in shelling out $85.4b for Warner Media in 2018. Talk about the altar of stupidity – AT&T gets an Oscar for that one having to sell it in extremis to WBD for $43b in 2021.

So what it comes down to for all investors in the space here is simply: Who to bet on?

Above: Buying on price alone is a flawed strategy unless there is context. In the case of WBD, it’s a bet on management.

Zaslav worked at NBC for 18 years before taking up the challenge of the fledgling Discovery Channel. He proved to be the master of niches that brought tons of profitable, non-fiction tv programming to the cable operator, building its revenue from $5b to $22b by the time he left. In the end, it’s all about track record. Never a guarantee, but it’s still why favorites win 35% of all races. Add second favorites bring in another 18%. All other runners either never win, or win anywhere from 1% to 5% of the time. So betting favorites over time at least minimizes your possible losses and maximizes your possible gains. That’s the simple part of the Zaslav resume investors can bet on here.

As to John Malone, it would take a massive tome to catalog the brilliant moves he has made over a lifetime for his Liberty Media. He is possessed of a vision few possess, that is the ability to take what is essentially a utility, a commodity company and deftly moving chess pieces around, make mountains of money in the process for investors in his deals.

In short, these are two guys who inspire confidence in their ability to find a pathway to a reinvention of WBD into a viable leadership position that churns out EBITDA worthy of its share price regardless of where it rises to going forward.

The WBD investor pitch is no different than peers. The rationale for a buy on the stock has got to be about betting on the smartest guys you can find in most media rooms at ~$10 a share at this writing.

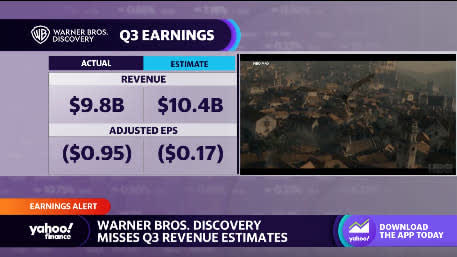

Plowing through the masses of opinion and analysis of the entire sector, it seemed to me that the prevailing smartest ploy is this: If you believe that Zaslav and Malone are indeed the smartest guys in the room in the media business, and you can buy their vision for WBD at $10 a share, why would you sit on the sidelines? There is a good no thanks answer to that question without doubt. But the 3Q22 numbers just reported by the company are hardly inspirational:

Here’s a few 3Q22 highlights:

WB Studio revenues: -5%

Networks: -8% (Ad headwinds getting stronger as advertisers begin cutting back budgets in the light of imminent recession.)

Distribution: -2%

Cost of revenue: Up 20%.

Negative FCF: -$192m

Total debt (mrq): $50b.

Synergies (savings) target: $3.5b.

Repaid: $2.5b debt.

EBITDAE22: $9.5B

Savings this year: E$750m

Synergies E23: $2b

Long term EBITDA goal: $12b

DCF value (earnings based formula) -$5.65

The plan as best we can discern from WBD results, earnings calls and conversations with industry associates, we believe they’ve identified these key corporate priorities for 2023:

Content:

Led by the success of House of Dragons plus their complete portfolio of sports, entertainment, streaming, cable and movies, they will try to focus on material that can be spread over multi-platform delivery to consumers. This is fine, but so is everyone else doing the same thing. But WBD is being very careful. It will not invest big time on movies made for streaming as they have proven unprofitable. Cutting debt and costs is a top priority no matter how much the creative community may scream foul. There is a way to do content people want to see without investing the crown jewels.

What we like better is an effort to repurpose their formidable library, the biggest TV/movie inventory in the space, and distribute it through existing channels they control. What we like is the simple common sense of bypassing massive content costs by distributing their past hits in TV and movies already in the can as it were. Some lend themselves to low cost subscriber outlets, others outright licensed to other distributors. This is what Disney did in the eighties as I have pointed out in prior articles. And it works. Film releases for 2023 are heavy on the superhero side with Flash, Shazam and Blue Beetle. Part of this will be to extend the characters into video games. This is somewhat of a fading genre, but it can still produce profits.

After the CNN+ disaster, WBD learned a hard lesson about assumptions based on distorted interpretation of data. It apparently is cleaning house, ridding the news channel of extreme wokeism – long overdue – and making a stab at reforming CNN into a far more straight news provider it once was.

Most important of all, and by far the toughest road to traverse, will be the total integration of all of WBD’s businesses harnessed into a single system yet holding onto the distinctive content created by managers of that product. This means lots of cross promotion and more critically, savings they anticipate will yield $3.5b in synergies next year.

WBD faces multiple tough headwinds as noted, such as ad spend reduction by advertisers, the testing of ad supported content that creates frowns and churn, and the roll out of its packaged fee system by mid-year. WBD says it scored $3m new subscribers YTD but will not compete in the race for new subs at any cost such as that which some peers engage in as a matter of survival.

WBD currently says it has 94.5m subscribers, nothing near the sector leaders but enough to be considered in a leadership group of the top streamers in the space.

The bottom line strategy here:

The goal is to operate as one company, not a collection of related and semi-related businesses which have traditionally become fiefdoms for teams of executives in this industry. By any measure, this is one tough contract for Zaslav and his people.

By its nature, the entertainment business is a crapshoot. It is also a business of personal dynasties built up on the often lucky shots in the dark development executives fall into that produce blockbusters. Controlling unit heads, who all too often become prima donnas, if they produce hits make mammoth salaries. (For a while Zaslav was one of them, but from the get-go, he always was a show me the money guy. And that was his signature management style).

So what Zaslav is trying to build here is an integrated network of oversight that does not stifle creativity but adds to it. We shall see where that takes WBD’s results in the next three years. The point here: Do you believe in this guy?

That gets us to the WBD stock at ~$10

In my view, WBD is entirely a price/management play. Analysts can dissect the assets, unit by unit, ascribe a theoretical value for that business and total them up against the market cap (~$25b) of the stock to extract a valuation that either begs one to buy or take a pass based on expected EBITDA performance.

The result sometimes is that one analyst’s screaming bargain is another analyst’s flashing caution light. Both these endgames are perfectly part of the news flow that makes markets. Using them as one’s grail in making buy, sell or hold decisions is understandably comforting for many investors. But in our view, it all still comes down to management and execution.

We think the mounting uncertainties rife in the entire media/entertainment sector are so overwhelming that cases for or against a stock mainly compounded of numbers alone aren’t enough. Yes, they do present at least a foundational underpinning for making a call on a stock. They deserve to be part of a decision to move or pass on a move. However, what they often do not take into account is the quality and track record of management.

We assume that a team rose to company leadership because of their golden resumes applied to the opportunities and challenges they face when coming on board. But also, we need to beware signs of the clear intrusion of the above noted Peter Principle. The leadership of companies can easily fall into the hands of incompetents, marginal, scared rabbit term servers, with politically safe friendships with the CEO or board members. They know which buttons to press in earnings calls, they command the right lingo, and put bluntly, haven’t the vaguest idea as what to do to improve earnings.

That is why after all the deep diving I have done on the sector, the only viable rationale in my personal opinion that makes sense for investors here is: The smartest guys in the room theory. What I am saying is that more or less, god is not an equal opportunity distributor of the valuable skills of corporate management in a business as fundamentally chaotic as media and entertainment. So the next best way to arrive at a decision is as simple as this: Who would you like to be in business with? With whom would you best feel that your money was safest entrusting it to the likes of the leadership of the company?

Some may see this as an oversimplification, but my conclusion that an entry point of ~$10 a share for a company in the very adept hands of Zaslav and counsel from Malone with a rich portfolio of assets is the smartest bet in the space now. And as we had noted in a prior SA article, DraftKings (DKNG) looks ever more enticing as a takeover target at $11 a share should the dynamic WBD duo find a path to it that made sense.

Yes, there is no margin of safety here. Yes, there is no guarantee that WBD’s tough minded approach to slashing costs, reducing debt as fast as reasonable, creating viable new content and bringing some order to the chaos of the business will pay off with best in class returns.

But for $10 a share, being in business with Zaslav and Malone signals betting on a favorite. No guaranteed wins here, but worth a laydown before the best of what they can accomplish shows up in explosive earnings beats in the years ahead.

Be the first to comment