Erikona

Thesis

Warner Bros. Discovery (NASDAQ:WBD) reported earnings on August 4th and shares dropped by more than 11% after the announcement (after market reference). WBD’s results strongly disappointed against market consensus estimates and I believe investors should turn more cautious on the company’s stock. I still believe that WBD is deeply undervalued, but the reward comes with highly elevated risk. As WBD’s Q2 results have shown, the integration of Warner Bros. and Discovery is highly complex and pro-forma estimates for the combined firm are starting to be revised downwards. The high level of debt, especially considered in rising interest rates environment, adds a further level of risk. After Q2 2022 results, I reiterate my Buy rating, mainly as a function of valuation and value proposition quality, but I decrease my target price for the stock down to $20/share, given the lower EPS outlook.

WBD’s June Quarter Results

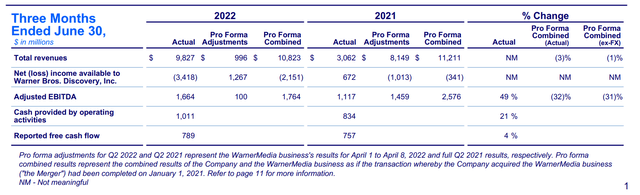

During the period from April to end of June, Warner Bros. Discovery generated total revenues of $9.83 billion, which is a decrease of about 1% as compared to the pro-forma results of the combined entity one year prior. Respectively, adjusted EBITDA was $1.66 billion, which is 31% less than what the pro-forma entity achieved one year prior. Needless to say, both metrics were significantly below consensus estimates (miss of about 10%). Net loss available to Warner Bros. Discovery shareholders was $3.4 billion. This result includes $2.0 billion of write down of intangibles, $1.0 billion of restructuring expenses, and $983 million of transaction and integration expenses.

Weak DTC Performance

WBD’s streaming business did not perform well: The combined entity added 1.4 million subscribers versus consensus expectations at 4.1 million. In the US, WBD lost 0.3 million subscribers (+ million estimated) and internationally, the company gained million (2.2 Million estimated). Moreover, WBD restated prior subscriber definitions, which resulted in a material downward revision of the company’s subscriber count by about 10 million. The company said it had 92 million global subscribers by end of the June quarter.

That said, the streaming business has strongly disappointed. But should it matter to investors? Netflix’s (NFLX) business model has increasingly been scrutinized by the market and WBD is seeking to adapt “a more sensible” approach to streaming. David Zaslav, CEO, said:

Strategically we’ve looked hard at the direct-to-consumer streaming business … This idea of expensive films going straight to streaming, we cannot find an economic case for it

Challenges Are Plentiful

Debt is a material problem for WBD. The company closed the June quarter with only $3.9 billion of cash and short term investments against gross debt of $53.0 billion. That said, the company’s net leverage is about x5. However, there is very little interest rate risk, or refinancing risk for the foreseeable future. With the earnings release WBD highlighted that the average duration of the firm’s outstanding debt is about 14 years, with an average cost of 4.2%.

Apparently there are also some misunderstandings/challenges with regards to WBD’s content pipeline. Recently WBD has announced to cut the movie Batgirl, which will likely cause the company to incur about $70 million of sunk cost. But the focus on quality versus quantity could also be seen as a long-term win. Zaslav said:

The Warner Bros. Motion Picture Group has fantastic IP and a great history. We think we could build a long-term, much more sustainable growth business out of DC, and as part of that, we’re going to focus on quality. We’re not going to release any film before it’s ready

Despite the challenges, and the very bad quarter, the company’s CEO remains a cheerleader for WBD’s potential. Zaslav announced:

We’ve had a busy, productive four months since launching Warner Bros. Discovery, and have more conviction than ever in the massive opportunity ahead

We’re confident we’re on the right path to meet our strategic goals and really excel, both creatively and financially, and couldn’t be more excited about the future of our company.

At this point, it is worth considering that WBD still trades ridiculously cheap. For reference, if you compare WBD’s valuation vs company peers, you note that WBD’s EV/EBITDA multiple is priced at an approximate -50% discount to the industry and the P/B multiple is priced at a -60% discount (Source: Bloomberg Terminal, August 4th 22nd).

Moreover, WBD still remains one of the world’s best content producer and the conglomerate’s content/asset library is perhaps matched by only Disney (DIS). This makes me confident to believe that WBD’s struggles are temporary.

Conclusion and Recommendation

WBD reported below consensus and the company highlighted the complex challenges surrounding the Warner Bros. and Discovery integration. Reflecting on the announcement, I would expect the stock to trade down in the short/-medium term – and likely we touch the $13/share bottom again.

However, as a value investor, I still believe that WBD is one of the most underrated assets on the market. And the valuation is ridiculously cheap as compared to industry peers. Thus, despite the disaster quarter, I reiterate my Buy rating. However, I decrease my target price for the stock down to $20/share, given the lower EPS outlook.

My coverage initiation article: Warner Bros. Discovery: Ridiculous Valuation And Michael Burry Is A Buyer

Be the first to comment