jetcityimage/iStock Editorial via Getty Images

Raymond James Financial (NYSE:RJF) remains one of the best-run financial companies out there- not only does it boast strong fundamentals, including a track record of robust organic growth through the cycles, but it also holds significant excess capital, allowing it to be opportunistic with its deployment. Yet, the updated mid-term financial targets seem overly conservative, as management accounts for current market uncertainty but not the accretion potential from the TriState Capital (TSC) deal nor the impact of significantly higher rates in the coming quarters. As a result, the stock appears to be pricing in more of a bear than a base case at ~8x mid-term EPS power – significantly below where it traded at during the last rate hike cycle. Given that RJF’s organic net new asset growth rate is also outperforming the prior rate cycle’s run rate, current valuations present an attractive entry point for long-term investors looking for a steady compounder with limited credit risk.

A Conservative Pre-Tax Margin Outlook

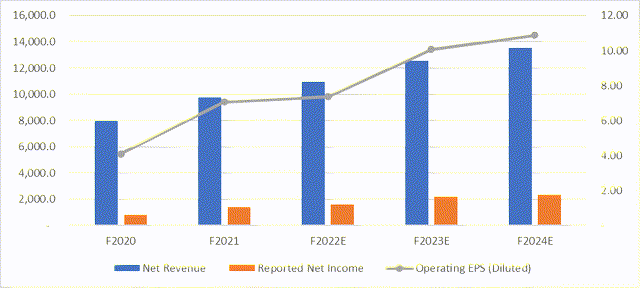

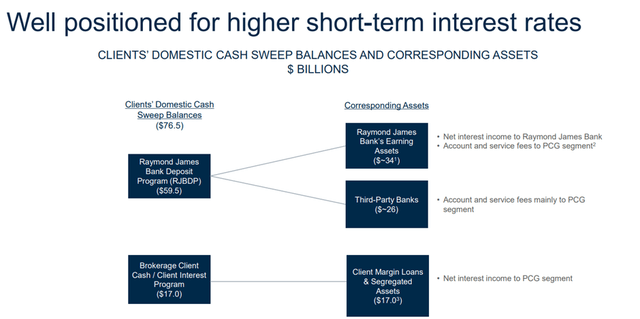

RJF announced an updated mid-term pre-tax margin target of 19-20% – a step up from the 15-16% target in 2021 and the highest pre-tax margin target over the last five years. That said, these numbers incorporate some rather conservative assumptions – perhaps a prudent move given the level of uncertainty in today’s environment. Still, the bar is far too low, in my view – from the 16.5% margin starting point (“based off of last quarter as a baseline” per management), RJF incorporates a -45% QoQ decline in investment banking despite the robust pipeline already in place. These numbers don’t include any accretion from the TSC deal either, nor a potential ~$600m benefit (equivalent to 300-350bps of margin contribution) from a 100bps parallel shift in the yield curve on the ~$76bn cash pile.

Source: Raymond James Investor Day 2022 Deck

Leveraging Growth and Efficiency Initiatives in PCG

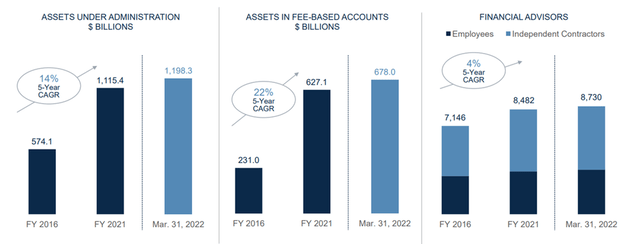

RJF’s advisor-centric model is best-in-class, from the strong technology offering to the competitive product set as well as its scale. No surprise then that RJF continues to resonate well with financial advisors, as evidenced by its <1% attrition rate and recruiting strength. Even with the market volatility, RJF has posted double-digit net new asset growth in recent quarters. While total client assets of ~$1.2tn were down ~6% sequentially amid the broader market downtrend, net inflows were likely >$6bn for April adjusted for the mark-to-market impact (adjustment factor based on LPL Financial’s (LPLA) monthly disclosures), implying +6% organic growth for total PCG assets. I suspect continued equity market headwinds could see share gains at RJF as well – as industry recruiting packages normalize lower toward more “sustainable” levels in line with lower asset management fees and higher borrowing costs, RJF’s relative appeal should shine through given it typically runs below average. Over the long term, RJF’s renewed focus on efficiency within the PCG segment also presents a structural tailwind for segment margins, so I see ample room for upward revisions down the line.

Source: Raymond James Investor Day 2022 Deck

Accretion Potential from TSC Deal Adds to Capital Deployment Optionality

The TSC acquisition highlights management’s ability to deploy capital into accretive deals, in my view. For context, TSC is a branchless bank with ~$12bn of total deposits and total loans of ~$11bn (mostly securities-based). Thus far, loan growth has remained well above historical growth rates at +30% YoY, and with TSC’s loan book skewed toward floating rates, higher interest rates should accelerate the revenue and earnings run-rate going forward. While management refrained from providing a quantitative guide for the potential post-deal accretion, the odds are that the acquisition will add significantly to RJF’s pre-tax margins. On paper, the addition of an asset with a (pre-synergies) ~38% pre-tax margin profile (double that of RJF’s current pre-tax margin) bodes well for the financial outcome. From here, the key lever will be RJF’s ability to reprice the deposit base (i.e., replacing TSC’s higher-cost funding with RJF’s lower-cost deposits). The good news, though, is that management has historically been conservative with its guidance, so the accretion bar is likely low.

Source: Raymond James Investor Day 2022 Deck

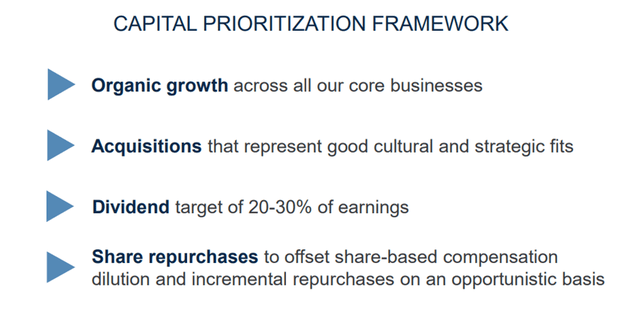

With RJF still conservatively maintaining its tier-1 leverage ratio at ~11.1%( well above the regulatory requirement and its ~10% target ratio), the company has ~$1bn of excess capital at its disposal. That said, its capital return priorities remain unchanged, with the focus still on organic growth, followed by strategic acquisitions and a 20-30% dividend payout target as well as stock repurchases. In the near-term, management has committed to using repurchases to offset any share dilution from the TSC transaction before moving into M&A opportunities, so equity holders shouldn’t lose out. While the 20-30% payout for the dividend is relatively low, I suspect RJF will deliver strong YoY growth alongside higher earnings in the coming quarters.

Compelling Setup into the Rate Hike Cycle

RJF has set the bar low with its new medium-term target of 19-20% adjusted pre-tax margins, accounting for the market uncertainty but assigning little credit to its strong rate sensitivity, organic balance sheet growth, and accretion potential from TSC. Should management execute as planned, I see a clear path to significant improvement in pre-tax margins to ~22% (from 19.5% in 2021) as the twelve rate hikes currently embedded in the forward curve filter through to the P&L. All in all, I have RJF’s earnings power stepping up to ~$11/share in 2024 (>50% increase from 2021) as a base case – without factoring in the optionality from its excess capital position. The stock trades at a discounted P/E multiple relative to the S&P and where it was in the prior rate hike cycle, so the risk/reward seems very attractive at these levels.

Be the first to comment