Erik Khalitov

Warner Bros. Discovery (NASDAQ:WBD) is an American multinational mass media company and one of the largest media companies in the world along with Comcast, Netflix, and Disney. The company has the lowest valuation though at $25 billion as the company has struggled to integrate its assets and generate cash flow.

Despite that, we expect the company to generate substantial shareholder returns.

Warner Bros. Discovery Synergy

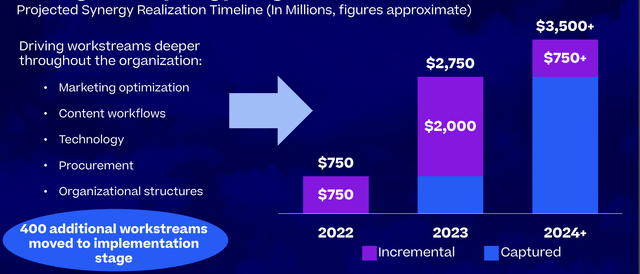

Warner Bros. Discovery has worked to ramp up synergies in the market that it can achieve.

Warner Bros. Discovery

Warner Bros. Discovery Synergy – Warner Bros. Discovery Investor Presentation

The company has added $750 million in incremental synergies for the year but it’s rapidly ramping up the synergy process. From 2023-2024 those synergies are expected to ramp up significantly. to $2.75 billion for 2023 and $3.5 billion in 2024+. That’s a ramp up from the company’s original synergy guidance showing increased efficiency in the business.

These synergies are essential to the company improving its margins and we expect that to support the company’s future earnings.

Warner Bros. Discovery Financial Performance

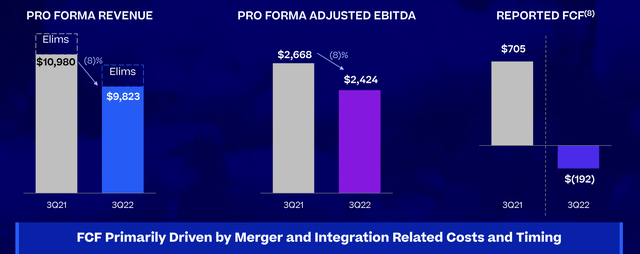

The company’s financial performance has suffered YoY, however, 2022 was a transition year for the company to work towards its goals.

Warner Bros. Discovery

The company’s revenue was primarily negatively impacted by a decline in network revenue as advertising took a substantial impact. Impressively, the company’s adjusted EBITDA matched the revenue decline which is fairly respectable given the high amount of fixed costs that exist within the studio industry.

The company’s reported FCF was negative, however, with more than $2.4 billion in quarterly adjusted EBITDA, we see that as temporary. The negative FCF was primarily merger and integration related costs.

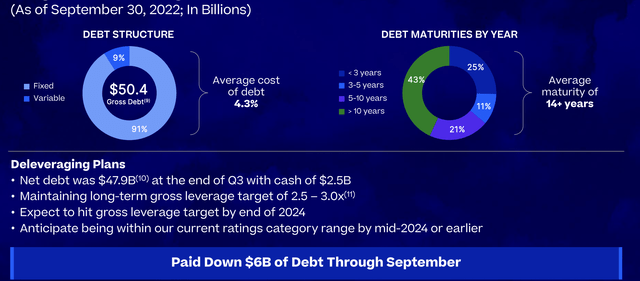

Warner Bros. Discovery Capital Structure

The company’s struggle is its massive pile of debt that needs to be paid off by the company.

Warner Bros. Discovery

Warner Bros. Discovery paid down $6 billion of debt, however, it still has a massive $47.9 billion of net debt with its $2.5 billion cash. The company is fortunate to have 91% fixed debt with an average cost of debt at 4.3%, however, with the company’s current market cap and financial markets, it needs to be able to pay off the debt as it comes due.

The company is aiming for a long-term gross leverage target of 2.5x-3.0x implying that it still needs to pay-off $20 billion in debt. The company expects to hit that by YE 2024 implying both EBITDA growth and billions in debt pay down each year. So far the company has been handling its debt fine, however, this is the kind of thing investors will need to be patient about.

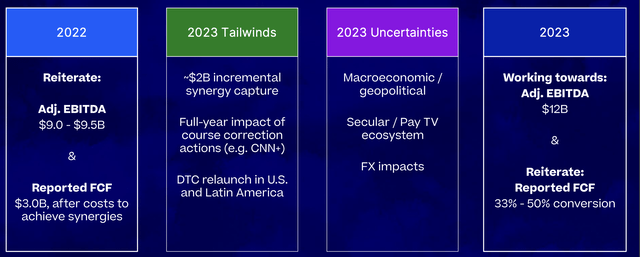

Warner Bros. Discovery Guidance

The company’s guidance help to indicate how its shareholder returns will increase.

Warner Bros. Discovery

Warner Bros. Discovery is expected to be only $3 billion in 2022 FCF, however, that number is expected to increase significantly. The company’s 2023 guidance with substantial parts of the transition done, is still at a midpoint of roughly $5 billion in FCF. For a $25 billion company with a $50 billion debt load, that’s still quite significant.

However, $5 billion in FCF that’s expected to increase is significant. As the company pays down debt its FCF ratio should increase enabling stronger shareholder returns.

Our View

Warner Bros. Discovery is clearly proceeding across its path slower than anticipated. The company has been slow to integrate Discovery+ assets and dealing with both that and spinning off AT&T was a substantial lift. However, the company is starting to put things together, and it’s actually managed to increase its synergy guidance.

Unfortunately for the company as well, it’s starting this mess around a recession time. Despite all of this, we expect the company to eventually turn around and provide substantial shareholder returns. The company can continue paying down its debt towards its target over the next few years, and free up almost a billion dollars in annual interest payments.

At this level we’d like to see the company start buying back shares as well. Regardless of how the company spends its FCF, we expect strong shareholder returns.

Thesis Risk

The largest risk to Warner Bros. Discovery is the company is continuing to work through an expensive integration of its businesses. The company expects it to pan out and it expects that transition to accelerate significantly going into 2023. However, there’s no guarantee that it pans out, which is a risk paying close attention.

Conclusion

Warner Bros. Discovery has an impressive portfolio of assets. The company’s merger with Discovery gives it one of the premier content portfolios in the industry and the company’s HBO Max streaming service is approaching 100 million subscribers. The company is working to continue to integrate Discovery into the portfolio.

Going forward, investors need to be patient, which on the tip of a recession, is something that the market struggles with. Despite that, we expect the company’s fortunes to change over the next 1-2 years enabling substantial shareholder returns. Let us know your thoughts in the comments below!

Be the first to comment