Scott Olson/Getty Images News

Q1 recap and Q2 outlook

My last article on Amazon.com, Inc. (NASDAQ:AMZN) is co-produced with Sensor Unlimited. That article focused on clearing the confusion between margin and profitability. In particular, we compared Walmart (WMT) against AMZN to show that although AMZN boasts a 2x margin over WMT, its profitability is not necessarily better. In this article, with AMZN Q2 earnings just around the corner (July 28), I wanted to shift the focus to some areas that I will pay special attention to during the earnings report.

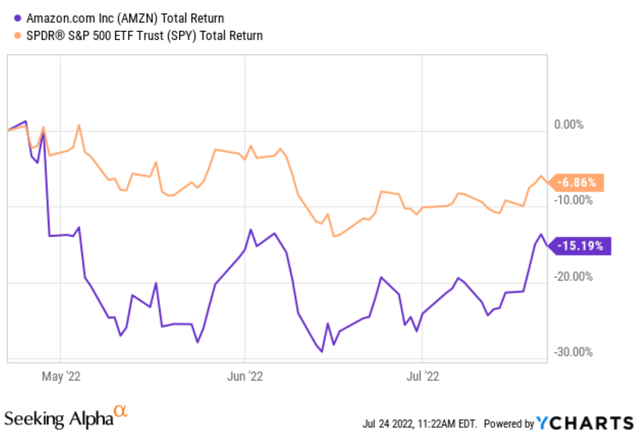

To anchor the preview, let’s first recap its Q1 earnings. The market viewed its Q1 results negatively, for good reasons. The business reported its first consolidated net loss in years, and its free cash flow (“FCF”) decreased to a negative of $9.1 billion TTM. As a result, the stock price has suffered a sizable correction since the Q1 earnings report as you can see from the following chart. Its stock prices fell by almost 30% shortly after the Q1 ER. It has recovered some of the losses since then, but it is still 15% below its price 3 months ago. To put things under perspective, the broader market (represented by SPY) has only suffered a correction of 6.8%.

Looking forward, I am still concerned about its negative cash flow problem. And I will pay special attention to its cash flow, capital location, especially the financial leasing obligations during the incoming ER. Another area of particular concern to me, related to cash flow, is its inventory.

I see signs that the bullwhip has overdone its job on multiple major stocks across sectors, and AMZN is no exception as we will see in the next two sections. And I am seeing signs that the bullwhip has overdone its job at AMZN. AMZN has hoarded too much inventory at this point. I am concerned that such buildup will further choke its cash flow and constrain its capital allocations, which could impact its investment decision in other areas such as AWS (elaborated in the last section).

The bullwhip effects

The bullwhip effect describes the tendency of businesses to over-estimate the amount of inventory they will need for a range of reasons (fear of lost sales, the misreading of market signal, et al). In the chip sector, for example, my recent article examined how the hoarding of inventory has quickly turned the chip shortage earlier in the year into a glut. Misreading the chip shortage signal earlier in the year, companies hoarded chips “just in case” they need them and cannot get them (just like people hoarding toilet paper when COVID first broke out). And the dynamics are quite similar in the retail sector, WMT, Target (TGT), and Gap (GPS) have all reported similar inventory buildup since the pandemic and Russian/Ukraine war disrupted the global supply chain.

Next, you will see why I am concerned that AMZN is in the same situation.

AMZN’s inventories in focus

AMZN reported some overcapacity earlier, as its CEO Brian Olsavsky commented during the Q&A session in its last earnings report (abridged and emphases added by me):

But what we see is that the fixed cost deleverage will narrow as we go through the year, and we’ll be really glad we have this capacity in Q3 when Prime Day hits because that’s always a big surge of both, inventory and orders, and then definitely in the holiday season. So, we will — the way we see it as we’ve come out of a very tumultuous two years. We are glad we made the decisions we made over the past two years. And now we have a chance to more rightsize our capacity to a more normalized demand pattern.

As you can see, management foresees that such overcapacity will be the right decision given the anticipated demand. However, that remains to be seen and I will pay special attention to their updated view during Q2 ER. Currently, my view is that management overestimated the consumer demand and over-hoarded inventory as you can see from the following two charts.

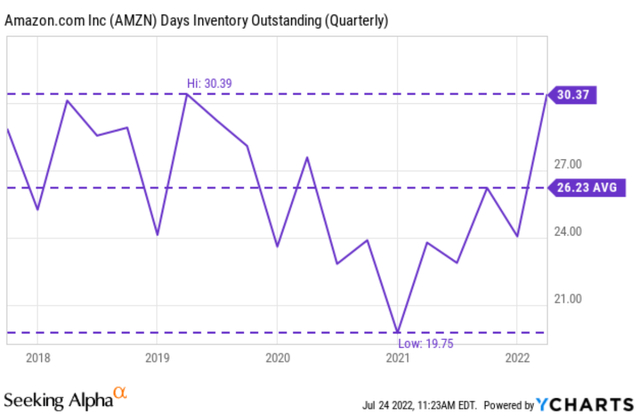

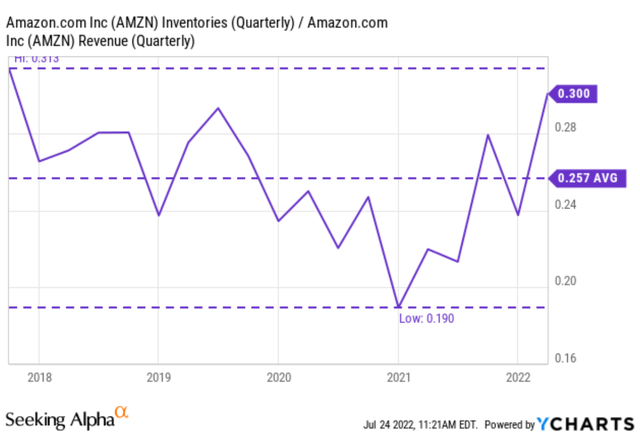

The first chart shows its days of inventory outstanding on a quarterly basis. Its outstanding inventory has been fluctuating in a range between about 19 days to 30 days in the past 5 years with an average of 26 days. You can clearly see the lowest level of inventory at end of 2020 when the global supply chain disruption was at its worst and also consumer spending has tilted more toward online due to the pandemic. And then I am guessing it started hoarding inventory because it sees both factors to worsen or at least persist. However, reality did not exactly play out that way. And as a result, you can see its current inventory stands at a peak level in 5 years. The second chart shows its inventory as a percentage of sales, and it essentially paints the same picture.

It is very expensive to maintain such a large inventory and it creates considerable risks, as we will elaborate on next.

Final thoughts and other risks

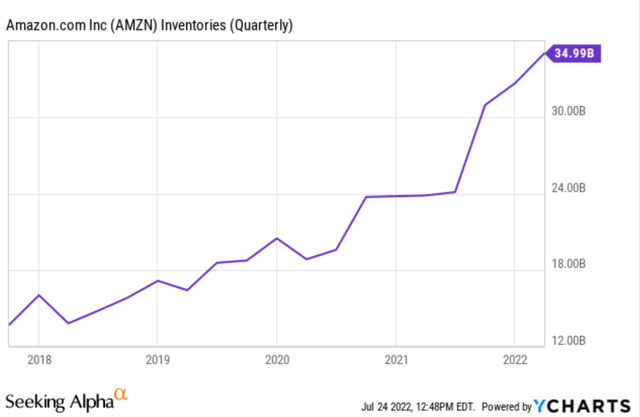

The above charts showed its inventory in relative terms to gain a historical perspective. And the next chart shows it in absolute terms to provide a sense of the manganite of the problem. As you can see, AMZN has more than $35B tied up in inventory as of Q1, almost a whopping $12B increase from a year ago (or a 47% increase in relative terms). It’s expensive to carry such an enormous amount of inventory, and it introduces huge balance sheet risks. Furthermore, I view the increased inventory as part of the reason that has caused (and will continue to cause) its negative cash problem in recent quarters. To provide a context, its FCF decreased to a negative of $9.1 billion TTM as of Q1 compared to a positive $31B TTM as of December 31, 2020.

Finally, besides the balance sheet and cash flow risks, it could also have implications for its other growth areas such as AWS. AWS is a bright spot during Q1 ER. It reported YoY growth both in the top (37%) and bottom lines (57%). However, AWS will continue requiring large CAPEX investment going forward, and management expects infrastructure spending to grow in 2022 in large part due to AWS. The buildup of inventory could constrain its capital spending and leads to undesirable operation and capital allocations (e.g., clear the inventory at a reduced price, scale back on its AWS investment, issue more equity while stocks prices are low, et al).

Be the first to comment