Mauricio Graiki/iStock via Getty Images

A U.S. Dollar Hedged Lifestyle

I’ve never figured out why babies insist on taking off their socks and throwing them out of the stroller when the parents aren’t looking. I had become unwillingly trained to accept baby socks as largely disposable items by the time my wife and I took a trip to France and found ourselves in need of yet another pair of replacement socks for our (once again) barefoot infant. But I was left utterly aghast when I did the currency conversion and found that pair of nondescript, grocery-store-quality baby socks cost over $30 in France!!! I thought “there is no way we could ever afford to live in Europe with the US Dollar trading at $1.30 … and what if the U.S. Dollar keeps dropping!” And guess what? It did! A few years after the Great Sock Shock, the Euro ascended tirelessly from about $1.30 to a dizzying nosebleed level of nearly $1.60 – which would have jacked the price of those little cotton socks up to $40 or more.

I never fully recovered from the Great Sock Shock. It scarred me sufficiently that when we were contemplating moving to Portugal in 2015, I was very leery of currency fluctuations and the sobering impact they can have on an American expat’s budget. I still am nervous about currency fluctuations but after seven years living in Portugal, this year in particular has caught my attention. The reason why is because we have garnered some real life experience with that which we never anticipated: living abroad can provide somewhat of an accidental hedge against falling stock prices.

Our portfolio is down this year – probably like yours and most other people’s. We weight most of our portfolio towards U.S. stocks that pay dividends in U.S. Dollars (which we use for all our spending needs here in Europe). Thanks to a surging U.S. Dollar (which is up 16% against the Euro this year according to Google Finance), our spending power has risen substantially this year even after factoring in the cost of inflation.

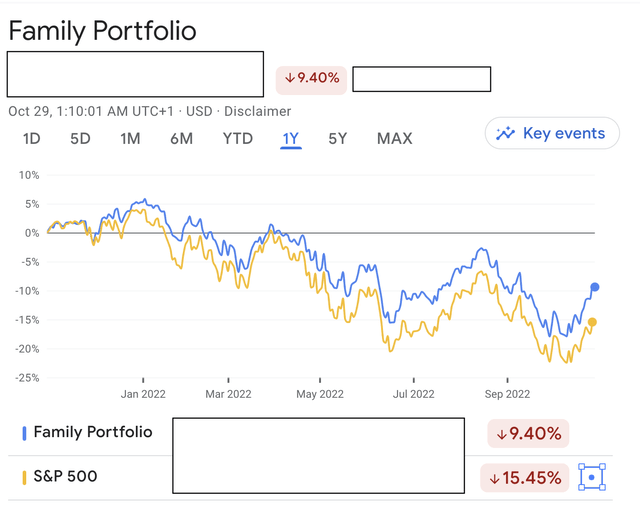

And what about our (mostly) US Dollar denominated net worth? Here’s a snapshot of our family portfolio over the past year, measured in US Dollars. Ignoring reinvested dividends, Google Finance calculates our total one-year loss at -9.4% compared to a -15.45% loss for the S&P 500. Not much fun there.

Portfolio in USD (Google Finance)

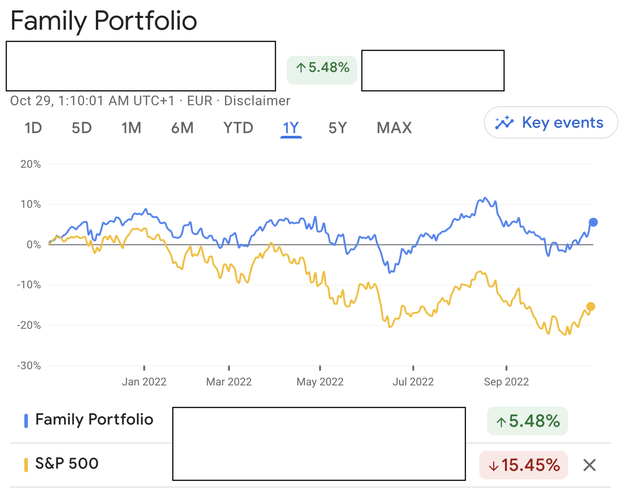

But since the overwhelming bulk of our spending is in Euros, changing the denomination of our portfolio to Euros better reflects changes to our actual economic situation over the past year. When measured in Euros, our portfolio is actually up by 5.48% over the past year according to Google Finance – thanks to a surging U.S. Dollar. So even after taking a very unwelcome stock market beatdown, the bear market hasn’t made a dent in our spending capacity.

Portfolio in Euros (Google Finance)

So was the 2021 accidental hedge some kind of a fluke? To find out, I downloaded all of the closing prices of the US Dollar against the Euro from December of 2003 and all closing prices for the S&P 500 Index ETF (SPY) over the same time period (both data sets I found on Yahoo Finance). Then I calculated the statistical correlation between the two data sets and learned that there is a moderate inverse correlation of about -.58 between the US Dollar vs. the Euro, and the S&P 500 (you can access the calculations here). That means if you own US stocks and live in Europe, history shows that gains on your stock portfolio are somewhat likely to cushion the blow to your spending power when the US Dollar falls against the Euro. Conversely, when your US stock portfolio drops, it’s somewhat likely that the US Dollar will be higher and probably offset some of your spending power losses. So it turns out 2021 wasn’t entirely a fluke at all, and living abroad can be a moderate hedge against falling stock prices… just as rising stock prices can be a hedge against a falling US Dollar. In that sense, you can maybe think of living abroad as a sort of “lifestyle hedge.”

Investing For U.S. Dollar Cash Flow.

I’d say the key challenge to owning U.S. assets while living abroad boils down to constructing a portfolio that pays steady and growing dividends paid in U.S. Dollars. That way, when the U.S. Dollar is strong, your living expenses in Euros will tend be lower, making it easier for you to save money that you can reinvest. Since stock prices tend to track lower when the U.S. Dollar is strong, that means you’ll be more likely to get good deals every time you reinvest. Conversely, then the U.S. Dollar is weaker, you’ll find that your day-to-day expenses in Euros will rise. Since stock prices tend to move higher when the U.S. Dollar is lower, you’ll probably find that you have a larger cushion of capital in case you need to sell shares to supplement your dividend income to keep pace with those rising Euro expenses. Either way, my personal experience is that dividend growth investing can work particularly well if you’re an American living abroad.

And it’s astonishingly straightforward to construct a portfolio of ETFs that deliver a relatively steady and growing stream of dividends paid in U.S. Dollars; you could own the Schwab US Dividend Equity ETF (SCHD) which yields 3.37%, the Vanguard Dividend Appreciation ETF (VIG) which yields 1.99%, the Proshares S&P 500 Dividend Aristocrats ETF (NOBL) which yields 2.06%. Or there is my approach: create your own dividend growth ETF by purchasing (and then passively holding) a cross section of individual stocks that funds such as (SCHD), (VIG) or (NOBL) might own. I chose that approach because I have several investment criteria that no dividend growth ETFs explicitly follow. First, I insist on owning nothing besides companies with either low debt or no debt. When interest rates rise, highly indebted companies face higher interest expenses that devour a larger share of earnings and shrink dividend payment capacity. That’s why roughly 90% of my portfolio capital is concentrated in companies with either no debt or a credit rating of A or above. I will not own any company with less than an investment grade credit rating. Second, I only own companies with very high profit margins and sustainable dividend payout ratios. Third, I only want to own companies with locked-in revenue sources (such as long-term contractual income, wide business moats such as unreplicable train lines or proven and unshakeable brand loyalty). Low risk dividends from low risk businesses increases the likelihood of actually receiving the dividends that you expected. For let us never ever overlook the single most important thing about income: actually getting it in your hands in full and on time.

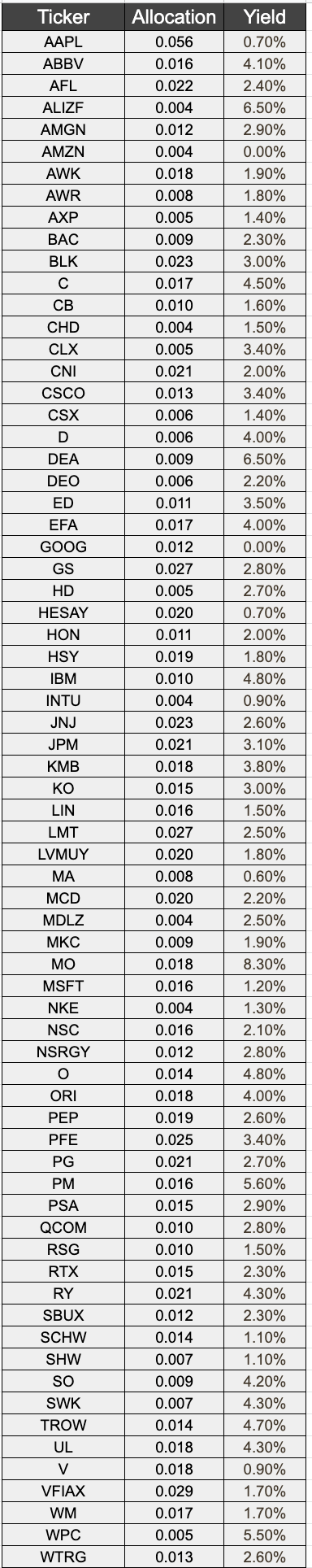

Here is our current portfolio. The majority of our income comes in the form of U.S. Dollars but we also own non-U.S. stocks that pay dividends denominated in Swiss Francs, Canadian Dollars, Pounds Sterling and Euros (although we receive the actual distributions in U.S. Dollars according to whatever exchange rate is then in effect). For that reason, our portfolio is not a perfect “U.S. Dollar lifestyle hedge” but when it comes to creating a D.I.Y. stock index based on quality and income safety, I believe that the company’s functional currency is far less important than the quality of the company’s products and services.

Author’s Portfolio (Authors spreadsheet, Yields from SeekingAlpha.com)

Which brings me back to the notorious case of the grocery store $30 French socks. We ultimately opted to affix those socks to the baby’s pants by means of two diaper pins (which only somewhat assuaged my sticker shock). And the days of requiring weekly resupplies of infant socks are now well in the past, leaving us with all the other good reasons to enjoy life in Portugal:

(1) Brilliant Lisbon sunsets (with our erstwhile infant who now towers over her mother);

Sunset in Bairro Alto (Author’s Photo)

(2) gorgeous tiles and architecture;

Old wine and tobacco store in Cascais (Author’s Photo)

(3) thunder storms on the beach with a thermos of hot coffee; and

Guincho Beach as a storm approaches (Author’s photo)

4) Aged sheep’s milk cheese and white wine at the mercado.

Be the first to comment