BalkansCat/iStock Editorial via Getty Images

(Note: This article was posted in the newsletter on June 11, 2022).

The Warner Bros. Discovery (NASDAQ:WBD) common stock price is under selling pressure. The big sellers are likely institutions that are panicking to result in a steady downward stock price pressure. This points out that institutions are generally no friends of the average investors. Instead, one has to plan to get into an investment (first) that institutions are likely to purchase in the future and then get out before they all head for the exits as is the case right now. Exact timing is not nearly as important as staying out of the way of the “big boys”. David Dreman covers this in his book “Contrarian Investment Strategies: The Psychological Edge”.

It generally hurts the pocketbook tremendously to do the investment equivalent of standing in front of a runaway truck. Instead, that is the time to get out the 10-K and do a lot of due diligence until all those institutions are finally gone. One of the things about a large company like Warner Bros. Discovery is that many of those institutions will be back because there are only so many stocks that many of those same institutions can invest in. So, patience can pay big dividends (and potential appreciation) when it comes to waiting out the big sellers.

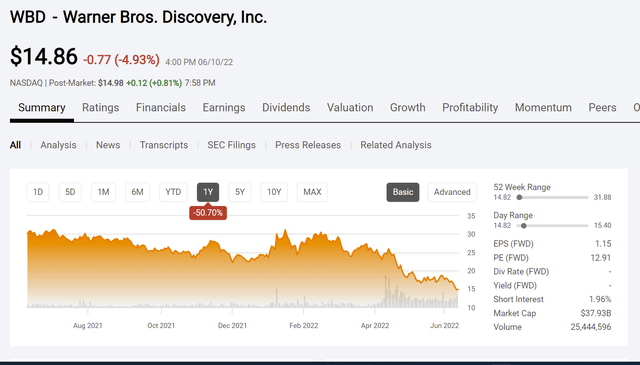

Warner Bros. Discovery Stock Price History And Key Valuation Measures (Seeking Alpha Website June 11, 2022.)

The stock market appears to be heading towards a “throw them all out” phase. It will pass as does many of the market’s focuses. But not before it makes more than a few investors nervous.

The main problem is a fair amount of debt acquired from the latest acquisition combined with the admission by management that financial reports for the current fiscal year will be “noisy”. Mr. Market does not like debt and Mr. Market hates uncertainty. Here Mr. Market gets both along with a management assertion that specific guidance will be provided “in a few weeks” (roughly).

The funny part about this is that same market just loved rapid growth without earnings enough to assign other stocks a sky-high valuation. Now the market appears to be heading towards the other extreme of a lot of certainty as the “one decision stock” period comes to an end. The only certainty the market loves is when the stock price keeps rising. Anything else is a distant second. Unfortunately, that includes risk assessment.

Immediate Focus

The market recently appears to have discovered that some companies will never make all the cash that was promised “in the future”. Therefore, there is an emphasis on debt service that was not there in the past.

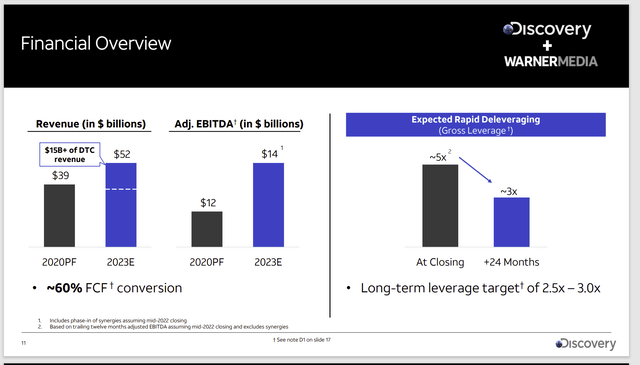

Warner Bros. Presentation Of Post-Acquisition Finances (Warner Bros. Discovery Of Acquisition From AT&T)

Unfortunately for investors, the market is fully aware of the debt situation. But that “noisy” comment by management means that the market is giving little credence to the projected EBITDA shown above. Instead, there are a fair number of institutions heading for the exists because of the lack of faith in the EBITDA guidance.

Ironically, management stated, during the first quarter 2022 earnings conference call, that the debt ratio is likely to be closer to 4.6. The worst-case scenario noted in the above slide just will not be happening. Clearly there are a lot of investors worried far in excess of the management statement.

Even if they believe in the EBITDA guidance, there are quite a few institutions that really do not want to be holding when there are probably several quarters of negative comparisons due to that “noise”. A comment like that to institutions and big holders often implies expenses, write-offs, and losses. After years of investing in stocks with rosy stories where the prices went up, exactly who wants the risk of expenses that might never end?

The old saying about “the market staying irrational longer than you can stay solvent” is a good reason to continue to watch this one from the sidelines. Sooner or later the selling will end. But there is no reason for anyone to bet when it ends. Investors do not have to get “the bottom price” because the market usually heads in a direction and goes way overboard.

For me, I am not selling the shares that I received recently. But I will buy some more shares when this selling has run its course.

An Example From The Past

This kind of selling pressure has happened in the past and will likely happen again. When the selling persists as it has here, I often get “the stock will never get back to (you name the price)”. But that is where investor due diligence is very important. It is real smart to have a strategy no matter what happens before you invest. I frequently get a fair number of “what do I do now?” type questions that to me, mean that step got skipped and now the investor is terrified.

On to the Example:

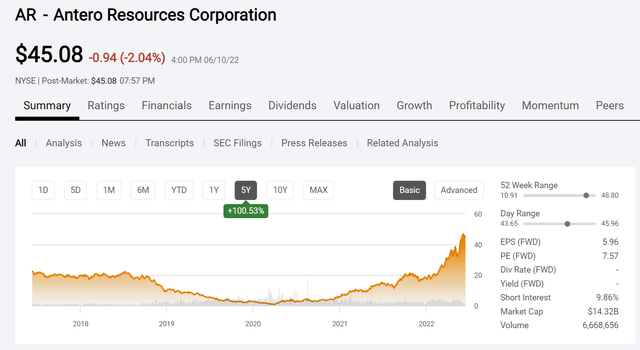

Antero Resources Stock Price History And Valuation Measures (Seeking Alpha Website June 11, 2022)

Some may remember this particular panic. It drove the stock price all the way down below $1 even though natural gas prices were beginning to strengthen. Management waited a little bit (maybe too much a little bit) to resolve the upcoming debt due. But the company used the bank line to repurchase debt at a discount and then refinanced the whole thing by selling a royalty interest and reissuing the debt. This is one of the few managements I follow that took advantage of the market panic to make a couple hundred million repurchasing debt at a discount.

Then it became apparent that natural gas prices were cyclically strengthening, and the debt issues were resolved to the satisfaction of the market. That realization has resulted in an extremely large rally. Maybe no one saw that gas prices were headed to current levels. But even a normal recovery was going to bring a sizable appreciation of the stock price. An investor had plenty of time to invest at $5 per share or below to still make a decent profit on the stock price increase.

This kind of action is often true for stocks that go out of favor. Warner Bros. Discovery hopefully will not get to the extreme shown above. But the market will likely overshoot the cheap target to provide a lot of time to get in at a decent price to enjoy the coming recovery.

Management will spend the year cleaning up an acquisition whose businesses they know pretty well. The same management guided to a lower debt ratio than was shown in the slide above. Right now, the only thing the market cares about is “noisy” quarterly reports. But that should change as management cleans up the operations to begin reporting mostly good operating results.

One thing about “noise” is that it makes for easy and large positive comparisons in fiscal year 2022. There is always a risk that the acquisition does not have the growth prospects, or the benefits management thought it had. But those risks decline when management knows the business.

I think that this acquisition has a darn good chance to succeed. With that success will be some darn good stock price appreciation that will only improve from all the current selling pressure.

Be the first to comment