Nikada/iStock Unreleased via Getty Images

Apple Inc. (NASDAQ:AAPL) is an iconic U.S. and worldwide company. The late Steve Jobs founded Apple, which was incorporated in 1977 in Cupertino, California. On April 1, 1976, two college dropouts, Steve Jobs and Steve Wozniak, founded Apple with a vision of changing the way people viewed and used computers. The two Steves wanted to make computers small enough for people to have them in their homes or offices, and they wanted a “user-friendly” experience. Their efforts began in Steve Job’s garage.

Steve Wozniak left Apple in 1983 as he lost interest in the company’s day-to-day operations. Steve Jobs left in 1985 after conflicts with John Sculley, the company’s President. Steve Jobs pursued other interests, starting NeXT Software and buying Pixar from Hollywood director George Lucas. In 1997, Steve Jobs returned to Apple, becoming the CEO. He passed away on October 5, 2011, and his hand-picked successor, Tim Cook, continues to run the company. Apple rose to become the world’s leading company by market cap. At $137.13 per share on June 10, AAPL was worth $2.309 trillion. AAPL only recently relinquished its role as the publicly traded company with the top market cap, but it remains the leading technology company in the U.S. and worldwide.

We love AAPL, but the APS was short the shares as of June 10, 2022.

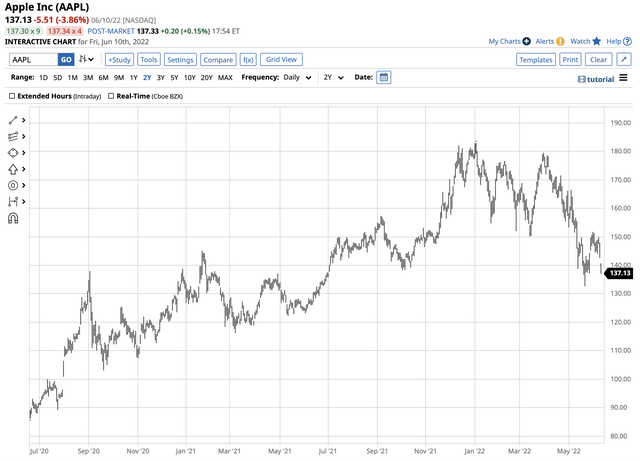

Apple Has Been Trending Lower Since The January 2022 High

AAPL shares reached a record high of $182.94 on January 4, 2022, the second trading day this year, when it ran out of upside steam.

One-Year AAPL Chart (Barchart)

The chart shows that AAPL share fell to a low of $132.61 on May 20, a 27.5% decline from the January 4 all-time peak. At the $137.13 level at the end of last week, the leading U.S. company was trading not far above the May 20 low.

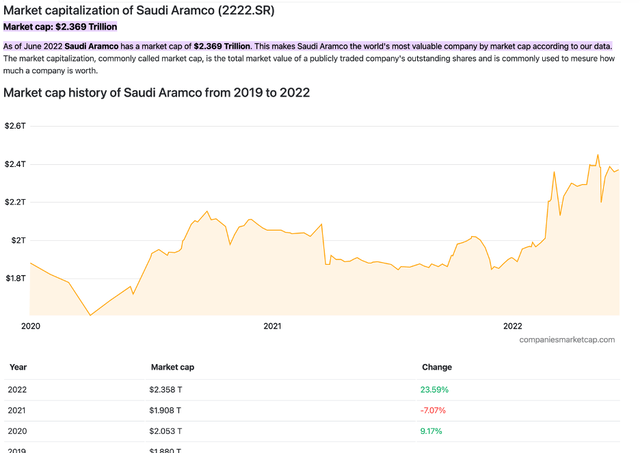

Aramco Replaced Apple As The World’s Most Valuable Publicly Traded Company

Saudi Aramco shares trade on the Saudi Stock Exchange, the Tadawul. The world’s leading oil company considered listing on the U.S. or other worldwide exchanges, but decided that the Saudi Exchange and its reporting requirements best suited the company. In June 2022, rising oil, oil product, and natural gas prices pushed Aramco shares to a level where it became the world’s most valuable company with the highest market cap, surpassing AAPL, the U.S. technology giant.

Saudi Aramco Market Cap (Companiesmarketcap.com)

Source: Companiesmarketcap.com

The chart shows the rise in Aramco shares that took the company’s market cap to a level that eclipsed AAPL to become the world’s most valuable publicly traded business.

AAPL Is In A Class By Itself

AAPL is no slouch with a $2.309 trillion market cap, and the company is a technology leader. Long-term investors and holders of AAPL shares have seen explosive returns.

Long-term AAPL Chart (Barchart)

The chart highlights the move from 11.0 cents in 1984 to the nearly $183 high in early 2022. Apple has been on at the forefront of personal computers, smartphones, and other technology products for decades. Apple is an iconic American company that many investors and funds have as a core holding in long-term portfolios. AAPL’s earnings record has been stellar as the company refined the art of underpromising and overdelivering each quarter. AAPL is in a class by itself, and we love the business and prospects, but that does not mean we will not short the shares when the trend dictates.

AAPL Is Not Immune To An Overall Stock Market Correction Led By The Tech Sector

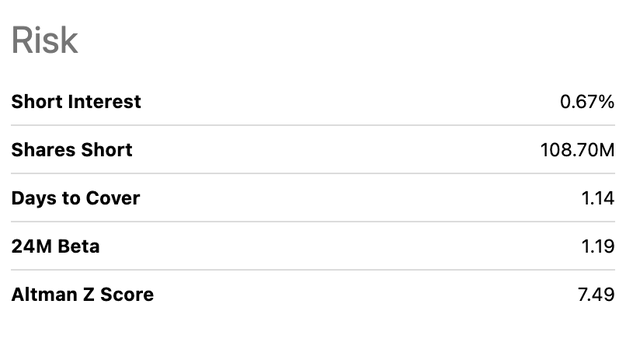

Beta measures a stock’s volatility compared with the overall stock market’s price variance. The entire market has a beta of 1, and stocks with a greater than 1 value are more volatile. A beta over 1 means that a stock tends to outperform the overall market on the upside and underperform on the downside.

24M Beta of AAPL Shares (Seeking Alpha)

Source: Seeking Alpha

The chart shows that AAPL’s 1.19 twenty-four-month beta makes it more volatile than the overall stock market. The 2022 stock market correction on the back of rising inflation, a higher dollar, increasing interest rates, and geopolitical turmoil have weighed on AAPL shares which were 27.5% lower than the January high at the recent low and trading not far above the May 20 bottom on June 10.

The APS Is Short AAPL And Will Remain Short Until The Trend Bends

As of June 10, 2022, the trend in AAPL shares was lower. The APS was short AAPL shares, as the trend is always your best friend in all markets. APS holds highly-liquid and optionable stocks and ETF products. AAPL is a component as it meets the strategy’s requirements. At $137.13 per share, the leading U.S. technology company has been trending to the downside, making lower highs and lower lows.

Following trends via an algorithmic system requires strict adherence to rules. We do not attempt to pick bottoms or tops in any markets, and are typically short at bottoms and long at tops. Taking the most significant percentage out of trends requires removing emotional impulses from trading and investing. We ignore fundamentals, news, and all the daily noise. Our signals are never intraday, and they can only change at the end of a session. Our system does not get caught up in the daily frenetic trading activity. News and noise are at a frenzied level with the war in Ukraine, inflation raging, and pundits opining on the central bank’s next move. We ignore the noise. The APS is always long or short its components.

The price of any asset is always the correct price because it is the level where buyers and sellers meet in a transparent environment, the marketplace. Crowd behavior that determines trends can be the optimal market approach across all asset classes. As of June 10, the crowd’s wisdom points to a bearish trend in AAPL. The APS will issue a buy signal for the AAPL when the trend changes. We love AAPL and believe in the company’s future, but the trend is our only friend, and it continues to point to lower lows.

Be the first to comment