Stadtratte

Transcript

The European Central Bank is gearing up to lift interest rates for the first time in over a decade.

But we see the ECB pausing rate hikes earlier for a couple of reasons.

1: Europe faces earlier recession risks

In a world of production constraints, central banks face a stark trade-off: crush growth or live with inflation.

Growth in Europe was already under pressure from the energy crunch following the invasion of Russia into Ukraine. So, the ECB may have to confront the reality of weaker growth sooner than the U.S.

Recession risks are also reflected in the euro’s weakness against the dollar – now at its lowest level in 19 years.

2: Euro area fragmentation risks

High debt and higher rates are causing bond volatility in more vulnerable member states like Portugal, Spain and Italy. That prompted the ECB to announce an anti-fragmentation tool.

However, historical challenges to unite Europe as well as political uncertainty in Italy could complicate the ECB’s plans.

Monetary policy can’t save the day, in our view. We see the ECB quickly raising rates out of negative territory and then pausing. Continued fiscal support is likely, but with limited appetite.

So, we have dialed down overall risk in the short run. We prefer credit over equities and are overweight inflation-linked bonds.

_____________

Parity pain

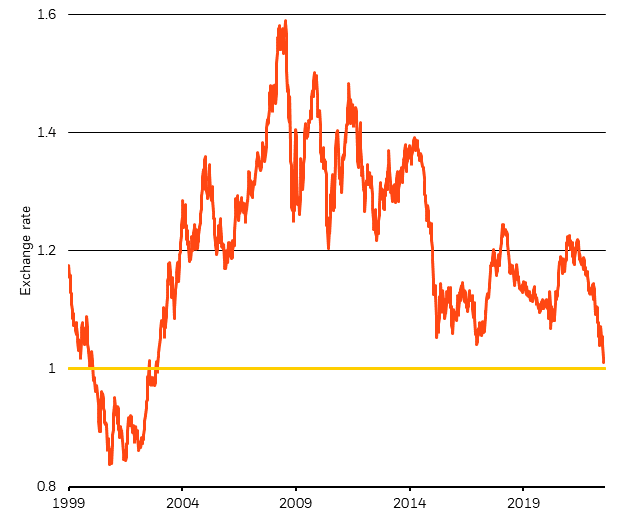

Euro To US Dollar (Refinitiv Datastream and BlackRock Investment Institute, July 2022)

Notes: The chart shows the exchange rate of the euro against the dollar since the euro’s creation in 1999. The red line shows the USD to euro exchange rate. The yellow line marks the point of parity, or a 1:1 exchange rate.

In a new regime of increased volatility, the ECB faces an even starker trade-off between crushing growth and living with inflation amid the energy shock. The central bank has yet to acknowledge this, in our view, as its forecast assumes inflation can come down in a growing economy. We think that’s unlikely – and see the euro area growth falling into recession even if rates rise only very little. Why? We’ve argued since right after Russia’s invasion of Ukraine that the energy shock will drag down economic activity. We see the ECB pausing when faced with rapidly slowing growth. Yet, markets are still expecting significant hikes in the next year, Refinitiv data on futures pricing show. The dollar’s strength against the euro reflects the more pessimistic growth outlook for Europe, in our view. It’s near parity with the U.S. dollar, its weakest level in 19 years. See the chart above.

Why is Europe’s growth slowing? Surging energy prices have heralded a recession in Europe since the invasion, as we said here. The impact on Europe is similar to the oil price shock in the 1970s, in our view. Europe’s reliance on imports means it’s more sensitive to higher energy costs than the U.S. Persistently high energy prices will likely squeeze real incomes, dampen business and consumer confidence, as well as elevate financial stress. The drag on growth could be much bigger if Russia restricts supply, spurring rationing and production interruptions. Rationing is of particular concern for Germany, where some worry Russia may use pipeline maintenance as an excuse to cut off the flow of gas.

Peripheral stress

There’s another challenge weighing on the ECB: the risk of the eurozone fragmenting. High debt loads in peripheral nations such as Italy mean slowing growth and higher rates have contributed to widening yield differentials between peripheral bonds and their German counterparts. That prompted the ECB to plan to launch an anti-fragmentation tool: a program to purchase bonds from countries where borrowing costs deviate materially from the rest of the euro area. The ECB is set to give details this week. It hasn’t been easy historically to unite Europe around what is effectively sharing debt. The plan is likely to come with strings attached that could prove politically unpalatable for countries like Italy, where a brewing political crisis is adding to the stress. It’s also not clear when the ECB would use the tool.

Monetary policy can’t save the day, in our view. The ECB faces some brutal trade-offs to get inflation back down to target. We expect the ECB to raise rates out of negative territory to levels not seen since 2013. Yet, the fallout of the energy shock and stress in peripheral bonds will force the ECB to pause its rate hikes sooner than the Fed, in our view. That ultimately means the euro area lives with more persistent inflation.

What this means for investments

Tactically, we’re underweight European equities because we see the energy shock stalling growth. We do see opportunities within sectors like healthcare that derive a large portion of revenues from U.S. sales. We favor credit instead amid higher yields and limited default risk. Overall, we dislike U.S. Treasuries and most other government bonds in this inflationary environment. We see the ECB pausing its hiking cycle sooner than the market expects, so we’re neutral on European government bonds. This includes peripheral bonds, even with the vulnerabilities. A key question there is whether markets are over- or underwhelmed by the scope and flexibility of the anti-fragmentation tool. Among global inflation-linked bonds, we prefer Europe. We believe the market underappreciates pressure from the energy crunch.

Market backdrop

Last week’s U.S. CPI data showed inflation reached fresh 40-year highs in June. This likely cements the case for a significant Fed rate hike at its policy meeting later this month, in our view. We also see elevated inflation persisting in Europe, bolstering the ECB’s decision to raise rates this week for the first time in over a decade. Markets showed high intraday volatility, with stocks recovering most losses and long-term bond yields ticking lower as the euro leveled with the U.S. dollar.

This week’s focus is on the ECB monetary policy decision. We see the ECB raising interest rates by 0.25% amid persistently high inflation and despite growing recession fears. We also expect more details on the anti-fragmentation tool that’s intended to limit borrowing cost divergences. A series of PMIs will be a key gauge of economic activity around the world.

Be the first to comment