Kimberly White/Getty Images Entertainment

The surprise return of Bob Iger to the CEO position of Disney (DIS) could have huge ramifications for the video streaming sector where Warner Bros. Discovery (NASDAQ:WBD) pays. The streaming model isn’t working for the sector and Iger was brought in to fix the problem where costs have escalated and revenues aren’t covering higher expenses. My investment thesis remains Neutral on the stock at best with risks that Iger shakes up the sector to the detriment of weaker players.

Killing The Golden Goose

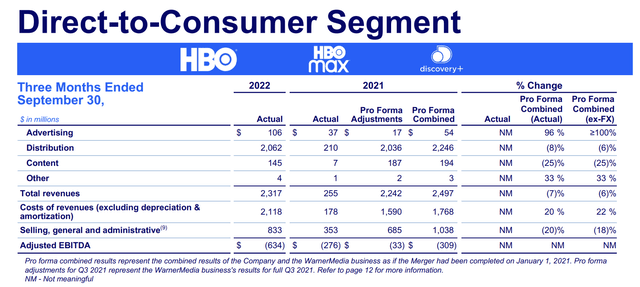

Similar to Disney, Warner Bros. hasn’t exactly seen a lot of benefits from the shift to the streaming business. The pro-forma Q3’22 results show the DTC segment revenues actually fell $180 million while costs were still rising leading to a big miss in the quarter.

Source: Warner Bros. Q3’22 earnings release

The company saw the DTC adjusted EBITDA loss double to $634 million with the cost of revenues surging by $350 million. The higher content costs didn’t even lead to a boost in revenues for the business despite the global DTC subscribers growing by 2.8 million sequentially.

The market knows the Networks segment is under major pressure due to cord cutting. The industry is spending more on streaming content without the rewards while Networks saw adjusted EBITDA slip with revenues falling a massive $556 million.

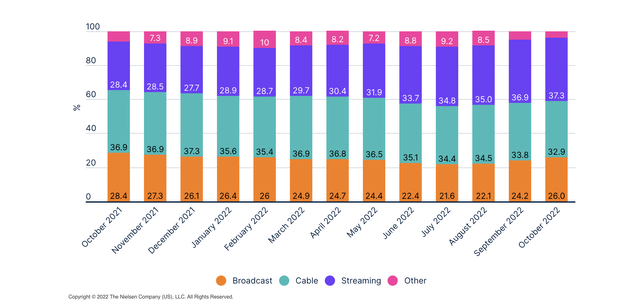

The industry faces structural problems with consumers clearly shifting towards streaming without the financial benefit for the streamers. According to Nielsen, streaming now controls 37.3% of viewers time compared to only 32.9% for cable and 26.0% for broadcast. Video streaming has seen the time spent on their platforms surge from only 28.4% last October with both cable and broadcast losing time in the period.

The problem is that video streaming services like Discovery+ and Disney+ don’t charge enough for the services offered to consumers. People paying $100 to $150 a month on cable are suddenly just spending $6.99 (ad-free) for Discovery+ or only $12.99 for the Disney+ bundle in Q3 with prices recently hiked to $14.99. A lot of the platforms offer promotional discounts with Discovery+ offering a $0.99 Black Friday deal allowing for early cancellation after 3 months.

Remember, HBO was charging $15 per month prior to the streaming wars. Disney alone is probably worth this price, but viewers get all of the content of ESPN+ and Hulu thrown into the bundle.

Warner Bros. obtains an average domestic DTC ARPU of $10.66 on 41.4 million subs. The global ARPU is only $7.42 due to very low amounts obtained on most International subscribers.

Source: Warner Bros. Q3’22 earnings release

Disney is far lower with domestic ARPUs at just $6.10 and ESPN+ at $4.84. The media company doesn’t charge what would appear anywhere close to high enough prices for paying subscribers. In addition, the average Disney+ ARPU fell 10% YoY due to a shift towards the cheaper bundle pricing when prices were hiked.

The problem is that the market got people to move to streaming at these ridiculously low costs likely making large price hikes difficult. Iger is likely to make a big push to right size the financials in DTC via either hiking prices or reducing content spending. The question is whether any such move could be successful.

Looking For A Turn

Warner Bros. has fallen to only $10 due to the weak results following the combination of Discovery and Warner Bros. Analysts forecast limited profits for the next couple of years with a hope the EPS finally tops $1 by 2025.

The consensus estimates are for very limited revenue gains during this period with 2022 revenues of $43.5 billion rising to $49.2 billion in 2025. The company will need substantial leverage in order to turn current losses into over $2.5 billion in net income.

Where the stock will turn is if Iger can shift away from the video streaming wars. The company still plans $3.5 billion in synergies to help boost the bottom line, but the stock is precarious here with nearly $50 billion in net debt on the balance sheet following the merger and the company generating negative cash flows in the last quarter.

Warner Bros. has to boost DTC revenues while cutting back on content spending. The task appears very tough and probably the path is determined on whether Iger can implement a plan to restore balance in the industry with a return to premium content obtaining premium revenues via theatrical releases followed up by DTC revenues.

Takeaway

The key investor takeaway is that Warner Bros. isn’t appealing on Iger coming back to Disney. The biggest risk is that Iger returns Disney to a leader in the media space and Warner Bros. is left in a precarious financial position with $50 billion in debt. Where the stock gets interesting is if the return of Iger shifts the business model in the sector to more financial discipline. For now, investors should steer clear of the stock.

Be the first to comment