Above: Too many screens for limited realistic number of eyeballs confronts WBD. But this company has a new approach. Vertigo3d

“Too much of anything is bad, but too much good whiskey is barely enough…” Mark Twain

Holders: Hold

Non-holders with patience: Begin to accumulate at $13.03 CEO David Zaslav has just begun to fight.

Non-holders with low risk profiles: Stay clear for at least the next quarter.

The dip: This week’s market swoon inched Warner Bros. Discovery, Inc. (NASDAQ:WBD) a tad lower. On the theory of a dead cat bounce for the market somewhere ahead, we’re keeping the entry price at writing. But as we suggest, in this collapsing economy presided over by broad-based incompetence, new business models for many sectors are emerging. Media entertainment is one of them.

Note: This is the first of our expanded coverage of core entertainment stocks focused on their prospects in a post-pandemic world. We will cover selected live and electronic entertainment companies.

Mass entertainment: A dying business model

There is no more apt analogy to define today’s mass entertainment business as a chronic, possibly incurable case of The Emperor’s New Clothes, a fairy tale long dispensed to children bearing a warning moral for life. For those readers unfamiliar with the story, here’s a quickie synopsis of this famous little telltale advice:

There was once a realm long ago populated by people who loved and admired their king. His public appearances drew massive adoring crowds. Then one day, a little boy watching the oration from the crowd began laughing. He was angrily shushed for his irreverence. He kept laughing anyway and pointed at the King. “Look, the emperor has no clothes, He’s naked and looks like a fool….” he shouted.

At first, there was roaring anger demanding that his lack of respect be punished by the police.

“Look,” he repeated. “I tell you, the emperor is naked and looks like an idiot.”

The crowd, shaken by his accusations, turned their heads to the rostrum. They seemed stunned. For the first time, the masses took a long, hard look at their king. He was indeed jaybird naked. And yes, he looked like a damn fool. And yes, his message lost meaning. And yes, his people never felt so taken by blind faith—the wisdom of crowds turned on its head.

Thus you have IMHO the state of affairs in much of today’s entertainment media sector and the key reason why it is that its business model is broken. Fortress entertainment companies like Walt Disney (DIS) may not be naked yet, nor does everyone automatically assume they will produce exponential earnings increases quarter after quarter into infinity anymore.

If you need any more proof, consider the dismal ratings of the Emmy Award show the other night, which drew a record low of 5.9m viewers, down 24% y/y. Now all award shows have nosedived from highs since the 1990s. It is because viewers realize they’ve become boring, self- congratulatory, politically correct blathering by the overpaid and over-celebrated.

Beyond that, award shows have really tanked because viewer interest in most shows (a few of which are prize worthy for sure) has tanked. The emperor’s clothes factor: nobody cares anymore about the shows or their stars. The horrific ratings are a voting machine that is signaling to the industry. It is telling the media gurus that it is time to rethink how to make money in a business that is a blend of raging change in technology married to a crap shoot. Yet they continue to operate under the delusion that aside from niche cadres of fans, that what they put on the screen still works as it did decades ago for the masses. Clearly there is an excess of programming out of whack with the number of eyeballs.

WBD gets it and its stock is cheap

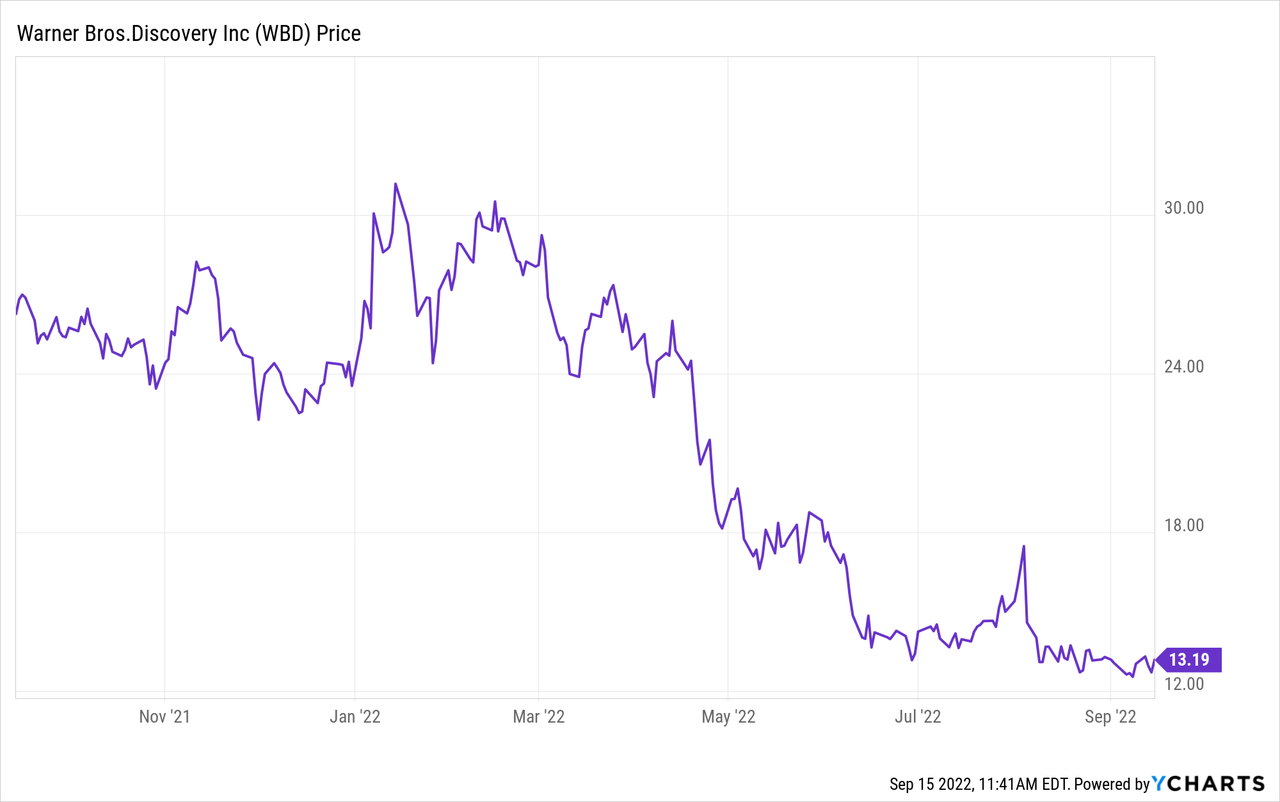

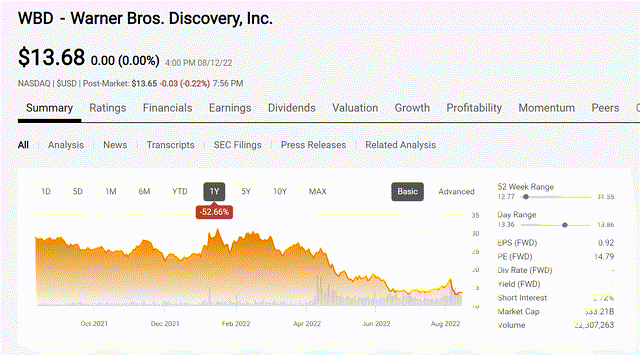

Above: Mr. Market does not yet believe in the bullish scenario discussed here.

Despite its mountain of debt, WBD stock is cheap in our view because we see into the decisions of its new management. They seem to signal a clear understanding that the old world of entertainment business is indeed dead. They are attempting to rearrange their business model to match the reality of where real-world consumers’ likes and budgets reside. This is not a popular take on Wall Street yet. Investors still don’t seem to believe WBD can find new, profitable ground and reduce its massive debt in a steady way. Nor does the promise of great content to come do anything but echo as hollow for most participants in the sector. However, we believe WBD got the message. We see earnings moving strongly north no later than 2Q23.

Analyst reports on the WBD shares, owner of some 30-odd broadcast, cable, and streaming channels, has likewise stirred lots of investor unrest. It is now a holy mess, brought on by the acquisition of fumbling AT&T Inc. (T) at a staggering valuation of $85b. That mess was handled to new CEO David Zaslav. Valuation has since been shrunken by Wall Street to $33b.

There are, for the most part, well–supported analyst breakdowns of WBD key metrics. Some better than others, all seem to focus on that hot-take word: Show me the new blockbuster content before anything. Without it, we’re talking impending doom as to any chances for the stock to move up if WBD is managed with the same diffused focus as its previous owners. Zaslav is sending a new message to producers: Show me the money.

Above: David Zaslav dressed for combat against the endemic waste in the mass entertainment sector by setting down hard goals for earnings ahead.

What I did not find anywhere was a direct challenge to what is, in my view, the foundational business of many of today’s entertainment giants: Wall Street has long been dazzled by soaring subscriber rolls of many streaming services which will be losing money for years to come. And believes constant treads and retreads of comic book superheroes, and endless me-too-ist crime drama, and fantasy hits will go on forever.

It seems to me, at first blush at least, that Zaslav has uncovered the load-bearing issues that will seal the fate of current entertainment business models. His take-no-prisoners attack on what constitutes me-too, expensive filler content is a start in a journey. In the end, I believe his hard-nosed approach will take WBD stock considerably higher over the next year.

First out of the box, to the shock of the purveyors of conventional wisdom, was Zaslav’s move to cancel the finish of $90m Bat Girl’s sunk cost and send it to the ash heap. The reasoning: what was already on film, quite simply, stunk. To commit the balance of cash required to get to a wrap, plus marketing costs, was killing a sacred cow of the entertainment business.

It is not the content that is king. It is the content that makes more than Emmy awards, or stars rich, that rules. Nor even the over-budget content becoming an ace harvester of paying eyeballs makes sense anymore. The skill set lies in the ability to produce great content at a smart cost so that the hefty margins in that business that could be reached, are reached and reached again. And, if you believe WBD’s vision is to become a money rather than an awards-making machine, its current price presents a cheap entry point in my view.

HBO

Above: Endless repurposing of content decades old is no answer for companies who need to rationalize the financial realities of the post-pandemic market.

Zaslav is in effect saying that we cannot ad infinitum take for granted that pay tv cable and streaming can go on growing to the sky with over-budget me-tooism content. But first, clearly, what WBD has to do at a deliberate pace is find $3b to $4b in cost savings slashing away at the company’s massive debt load. That’s a direction Mr. Market is bound to approve of going forward.

He also needs to houseclean, perhaps materially shrink, WBD’s stable of brands and focus attention on the real gold mines in the portfolio.

He needs to and is already revamping CNN, by unloading its foaming-at-the-mouth partisan anchors and getting the news channel back to its origins as a no-nonsense dispenser of real journalism.

His junking of Bat Girl was a shot across the bow of producers who churn out the mountains of garbage far too many consumers these days complain, “We’re paying more each month and there’s nothing to watch.”

There is a remarkable similarity between the growing pains of the sports betting sector and TV streamers. They pour out content, promote like hell, overspend hoping to attract enough eyeballs to cross into profitability at some vague future time. The price tiers that Netflix (NFLX) is now implementing to give consumers a choice between monthly fees with commercials vs. those without is aimed at staunching the decline of new subs. WBD is reportedly mulling on a similar strategy. In our view, that would be a bandage, not a cure.

There is perhaps another problem here. What we are beginning to see is what all streamers must realize, namely, that hard as it may seem to believe, there is no endless supply of eyeballs when there are 200 streaming channels available globally.

Even the spectacular entry of Disney+ with now 152m subscribers is beginning to see the pace of new signups lagging behind its debut months. Netflix’s subscriber churn has become negative enough to force its hand in offering a two-tier price deal. Will the collective streamers promise to spend $100b or more in content produce a greater ratio of winners? Probably not. There are never enough Game of Thrones, Sopranos, Breaking Bads, and Ozarks to go around. Viewer fatigue has become an issue for all the rest.

You can slice and dice audiences, create niches, but in the end there are just so many dollars people will spend per month to assure receiving all of the 30 plus channels under the WBD banner.

But the entertainment industry today is still held hostage to the old Hollywood studio mantra that the blockbuster dollars generated by one mega-hit can cover up the 10 dogs you released that lost a ton that year. That is no longer the case.

Blockbusters, as always, are few and far between. But the cost of producing dogs is so far up that the occasional blockbuster has a ton more financial failure to overcome to bring great earnings power to the bottom line that will move the stock to strong returns.

It appears clear to me that this is the direction Zaslav seems to be moving on. He recognizes we are indeed in a new day of excess content that cannot forever support massive menus containing few biggies. With WBD channels active in 200 countries in 50 languages, it’s a fair bet that there’s a ton of fat to cut away both in content costs and staffing.

The eponymous vertical of the company, Warner Brothers pictures, faces the same daunting post-pandemic threats to its viability, as do all the top motion picture studios. Theatrical movie attendance may never again come near its apogee either in the U.S. or globally. In 2018, movies generated $42.5 in global revenues, with the U.S. accounting for $11.8b (down 4%). Other than Top Gun, how many super blockbusters can you name that harvested record grosses this year?

The highest grossing film of all time was The Avengers in 2009, which brought in $2.87b in world ticket sales. If we adjust over 80-year-old Gone With The Wind’s ticket prices at the time (average 25c), it would translate to $3.4b, beating The Avengers as the top all-time moneymaker. Adjusted for population, that in terms of penetration of the entertainment world would translate to near $10b. That wouldn’t compute today, of course, with consumers having the ability to spend their entertainment dollars across so many verticals in live, tv, streaming, cable, and broadcast.

Our point here: Theatrical movies as a profit center for WBD will contribute if they can strategize a formula with less dependence on theatrical release and smart deployment across their cable or streaming services. As well as bringing down the hammer on production costs, marketing spend, and star salaries.

In other words, the old studio approach that one blockbuster is paying for the inevitable 10 to 15 dogs produced no longer works the way it once might have.

That, in effect, is Zaslav recognizing that the emperor indeed has no clothes and the general idea is to make money for shareholders. That’s why guys like him are given these monster contracts. (Cynics have weighed in that a good place to start cutting expenses might be to take a hatchet to Zaslav’s huge contract.)

The stock: A good bottom for true believers

Thus far, Mr. Market doesn’t seem to see a pathway to a stronger valuation for WBD. We do because we think Zaslav has demonstrated the guts to act.

Price at writing: $13.03

52-week range: $12.87-31.55

Market cap at writing: $31.6b

1-year analyst target: $24.74

Our “Bet on Zaslav” PT: $28.75 by 2Q23

5-year high: $53

TTM profile

Revenue: $19.3b

EBITDA: $3.48

Diluted EPS: $1.81

Analyst annual earnings estimates:

2022: —$0.02 (Actual: –($O.02)

2023: $0.98

Balance sheet highlights

Operating cash: $3b

Total debt (mrq): $55.7b. This is a rubber-meets-the-road number and challenge #1 for WBD. We think carving it down cannot only be achieved with massive staff and content cuts but that many of its empty calorie cable channels need to be sold. Many of these could be attractive if content costs can be rationalized.

Interest expense: $977b

Current ratio: 1.07 — This is a reasonable starting place indicating that WBD appears to be in no imminent danger of being forced to the debt beggar’s bowl in a borrowing environment bound to get more expensive.

Plans afoot

WBD says it will rebrand HBO Max to Discovery+ next year in an effort to better diversify content, build on HBO’s reputation for quality and control costs.

CNN: A move toward pure journalism from advocacy blabber that could recapture its former center position as first-mover on breaking news and analysis holds the promise of taking more to the bottom line off CNN’s estimated $1b annual revenues stream.

One of the greatest challenges of media empires is to maintain sustainability of earnings on existing content channels while seeking to find exponential growth on new ventures, i.e., streaming. This in our view will be the core challenge of management going forward.

Everyone in the business talks the same “great content” promises, backing it up with that mystical power known as “we have great relationships in the creative community.” Nonsense of course, it’s a mantra Zaslav has also talked because it’s simply impolitic to tell the truth by saying (this is not a Zaslav quote):

We’re through with these overpaid dunces who drown us with copycat junk projects, wokeist nonsense, and exercises of their collective egos.

We’re setting cost standards for programming designed to enter the game with better odds for adding to profit than what we now gamble on.

The truth in the new world of mass entertainment is that there is no such thing as creative community relationships. Big time success is the same crap shoot whether it comes from “creative community” icons or nobodies. It is the crapshoot element in the entertainment business that will never go away. So what makes the best sense in a crap game is to always to bet the line and take the odds. Forget the prop bets.

So a bet on WBD stock comes down to this: despite the creative community criticism that has poured down on Zaslav and company since they took the helm, do you understand that the guy is saying: we’ve seen the emperor and he has no clothes. We’re going to find a way to make money in this business and let someone else collect the Emmys. If we cop a few here and there that’s great, if not, Mr. Market still loves our dividends.

The odds never change for anyone. The lightening strike of a mega-hit can visit any operator big or small, no matter whose behinds they either kick or lick.

If you buy into that, $13 a share seems to us a bet on the line right now for believers. It’s at the same time a wait-and-see sideline stock until you see evidence that Zaslav means what he says and begins to bring real shape and substance to a business model that works.

Within WBD’s media products there are enough gold mine properties which skillfully managed could produce outstanding accretion to earnings. There is also a lot of junk TV that could find new owners who could nurse them forward for improving profits. A consolidated WBD with a better grasp on lower debt and tightened focus on fewer verticals could command a very healthy upside for investors.

Be the first to comment