Jacek_Sopotnicki

Investment Thesis

Warner Bros. Discovery, Inc. (NASDAQ:WBD) is a company that offers media services and provides content across several platforms worldwide. Through its business model, WBD owns and operates various television networks under the Discovery Channel, HGTV, Food Network, TLC, Animal Planet, and many more. The company can bring in sales from its production studios that develop and produce content directly to the box office and offer streaming via direct-to-consumer subscription services on platforms like HBO Max. WBD has premium sports rights worldwide and can capture value not only at the box office but also through its extensive content library.

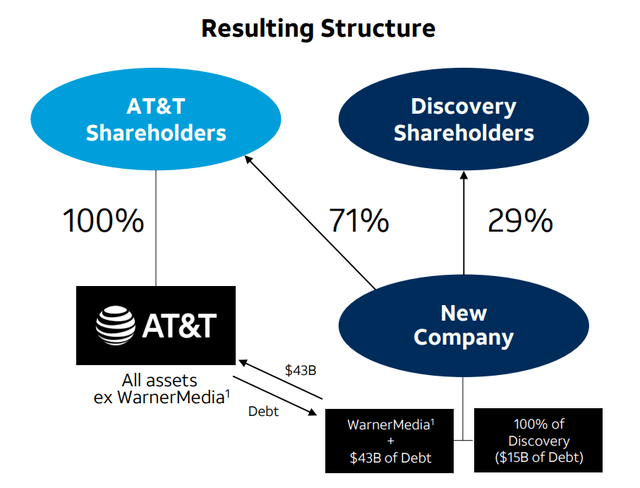

After splitting from AT&T (T), Warner Media merged with Discovery to create an absolute media beast. Although the combination of these two entities seems perfect, both carry massive debt burdens, to the likes of nearly $60 billion ($43 billion from Warner Media and $15 billion from Discovery). With only a market cap sitting at around $35 billion, this is a significant number and risk that prospective investors must assess before buying in.

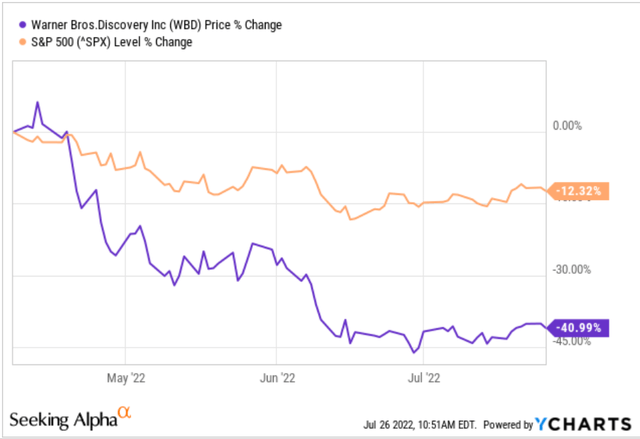

Because the stock has nearly halved since its first trading day in early April, I believe that buying WBD stock at these levels means it will perform robustly ahead of the market in the next few years. The stock has likely tumbled this year because of heavy selling pressure from dividend-expecting AT&T shareholders, who previously held shares in (T). Of course, paying a dividend is something WBD is not focused on right now, so this is likely the reason for a lot of selling from value investors over at AT&T. The subsequent year of owning this stock might show a lot of uncertainty because of how new this merger is; however, if WBD can prove to allocate its strong revenue projections into FCF to deleverage, there won’t be much risk in owning this stock.

Why WBD’s Recent Collapse Opens Up a Deep Value Opportunity

Over the course of the last few months, it has not only been a rocky road for the broader market but a brutal run for Warner Brothers’ stock. WBD has more than tripled the declines seen in the S&P 500 since the stock’s inception, and I’ll discuss why I think it is not as bad as it may look for the company.

On the surface, WBD stock is a spinoff from DISCA stock back in April 2022. AT&T shareholders got roughly 70% of the company, while Discovery shareholders got the rest of the pie. Because most of the original WBD shareholders were T investors, they were primarily value individuals seeking a dividend ratio. Unfortunately, this was not the case, given that WBD does not currently pay a dividend and likely will not for the next couple of years as they are looking to allocate free cash flow (“FCF”) towards deleveraging strategically. Per the AT&T and Discovery Joint Investor Presentation dated May 17, 2021, the company’s “Robust FCF† supports deleveraging, reinvestment, and financial flexibility.”

New Stock and Debt Structure Post Stock Merger/Spinoff (Warner Bros. Discovery Investor Relations)

Of course, dividend-seeking investors would not want to take on an investment with numerous risks, which sums up WBD; however, it can pay off greatly by looking at various valuation metrics. WBD now has around $58 billion in debt, accredited to $43 billion from T and 100% rights of Discovery with a $15 billion debt burden. Currently valued at $36.77 billion by the market, this is well under its total debt from the merger, but there are tons of growth opportunities with its extensive content library. Likely most of the selling pressure since its inception has been from the majority of shareholders from AT&T selling the stock because of its zero % yield, opening up an attractive opportunity.

Compelling Collection of Personalities, Franchises and IP (WBD Stock Presentation)

Like I said earlier, the merger of Discovery and WarnerMedia is huge from a content library perspective, given their extensive collection of renowned franchises of the past decades. With premium sports rights to organizations like the NBA, MLB, NHL, etc., as well as ownership of channels like TLC, TNT, HGTV, and franchises like Scooby-Doo!, Sesame Street, and Harry Potter, WBD has its name out there in the streaming world. This merger has the most extensive content library of over 200,000 hours of content available in 50 languages spanning 220 countries.

WBD’s Attractive Industry Valuation Comps and Revenue Projections Moving Forward

When looking back at DISCA stock, it is clear that WBD is trading at levels not seen since 2009, which is pretty shocking to me. Not only is there so much potential from its movies, being “#1 TV studio by revenue and volume, and also a top 2 movie studio by box office 11 of the last 12 years,” but there is also money to be made from its premium streaming service, HBO Max. The power of capturing value at the box office and from people streaming at home is outstanding in the uncertain economic state that we are living through now.

DISCA Historical Chart (Seeking Alpha)

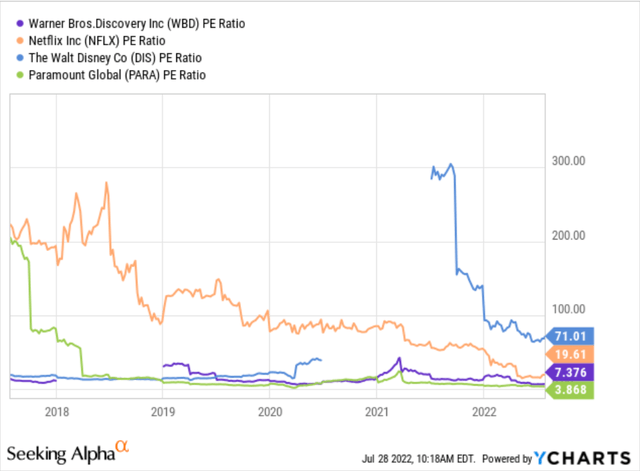

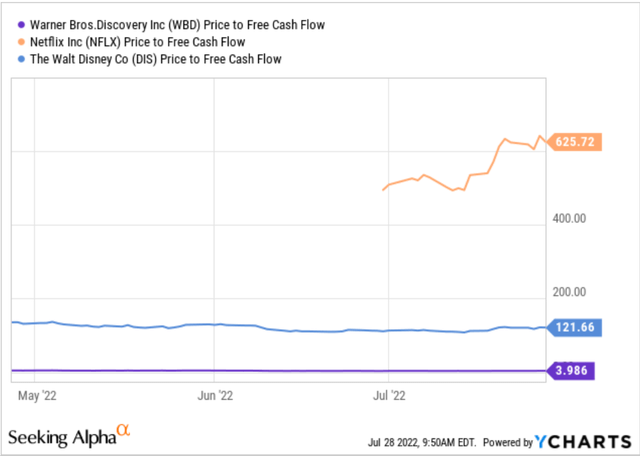

From a fundamental perspective, things are at the low end of historical ranges at this stock. P/E is sitting right around a 7x multiple, and PFCF is just over 3.8x, both being in deep value territory, in my opinion. When looking at industry standards and peers like (NFLX), (DIS), and (PARA), the valuation of WBD looks like an attractive discount.

Industry P/E Multiple Comps. (YCharts)

Of course, there is the risk of a highly saturated streaming service marketplace; however, I think this can be an industry with hyper-competition and low margins like the semiconductor and airline spaces. I believe there can be several winners and losers in the future as long as the public positively perceives the content from various service providers.

Industry Comps. PFCF (YCharts)

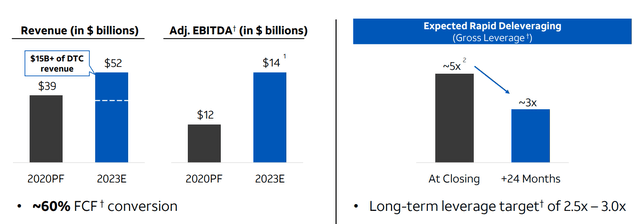

Warner Bros. Discovery now projects around $52 billion in anticipated revenue for 2023 and $14 billion in AEBITDA. A large portion of these sales will come from direct-to-consumer (DTC) advertising, in which WBD expects to target $15 billion in revenue. As illustrated above, WBD has a robust free cash flow multiple and is looking to rapidly deleverage from a 5x multiple to 3x in about two years. Warner Bros. Discovery has a long-term leverage target of 2.5x-3x.

2023E Revenues and Leverage Targets (YCharts)

With aggressive deleveraging targets, I think the management of Warner Bros. Discovery is making the right decision to stay afloat in the recession that just printed. Given that there is slowed economic growth across almost every sector in America, it’ll be the right decision for WBD and other peers to allocate free cash flow towards deleveraging. The streaming industry houses companies with a ton of leverage, and I think it’s an excellent time for WBD to exit the cycle of constantly reinvesting capital into new content. Now’s the time to focus on consistent growth by reinvesting some cash flow into content while also paying off long-term debts and delivering a potential dividend.

How HBO Max and Discovery+ Bundle Can Compete and Succeed Moving Forward

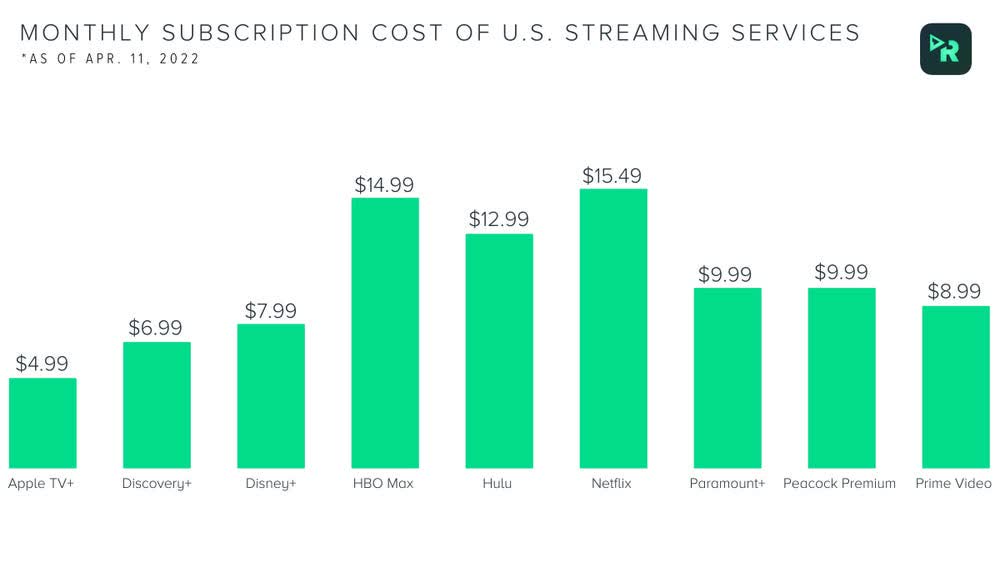

Currently, Discovery+ costs $4.99/month with ads and $6.99/month without ads, which is what the majority of the 22 million year-end 2021 global subscribers own. HBO Max and HBO are much more popular, with around 74 million worldwide viewers. At HBO Max, its service is $9.99/month with ads and $14.99/month without ads, so a costlier service but one that has a ton of growth and content.

Streaming Subscription Costs Comps. Without Ads (Business Insider)

From AT&T’s Q1 report, management noted:

“At the end of the quarter, there were 76.8 million global HBO Max and HBO subscribers. Global HBO Max and HBO subscribers increased 12.8 million year-over-year and were up 3.0 million sequentially…At the end of the quarter, there were 48.6 million domestic HBO Max and HBO subscribers versus 44.2 million in the year-ago quarter, up 4.4 million year-over-year.”

This is great to see, considering that competitors like Netflix are struggling with growth, and HBO Max grew just over 10% year-over-year. Even though HBO Max is in much earlier stages than Netflix, it’s still a great sign to see ongoing growth in its attempt to combat Disney’s Disney+ 129.8 million subscribers and Netflix’s 221.64 million subscribers. Discovery+ also shows modest growth numbers, of just under 10% year-over-year, which illustrates that a potential bundle of HBO Max and Discovery+ can flourish.

Potential Risks to My Thesis and Conclusion

Undoubtedly, there is a ton of risk in owning WBD, given that the company has nearly $60 billion in debt with a lower than $40 billion market capitalization. Warner Bros. Discovery can fail to capture market share in a highly competitive streaming marketplace and also see growth slow, just like Netflix, however, at a much younger stage. This would take a massive blow to revenues and have headwinds towards its free cash flow strategy to deleverage aggressively.

Although the company has extremely low multiples from a P/E perspective, forward EV/EBITDA perspective, and PFCF perspective, this does not mean the stock will take off. DISCA, before WBD, was a stock that also struggled with solid fundamentals, which is not out of the picture for WBD. Without a dividend and shockingly high debt obligations, any remaining AT&T holders will likely continue to have selling pressure and move the price lower. A recession can significantly hinder growth as consumer sentiment dissipates, bringing down demand for subscription services like HBO Max.

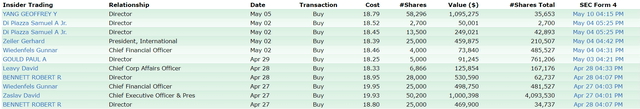

Insider Buying at WBD (FINVIZ)

All in all, there is a clear risk of a streaming war continuing to linger with giants like Amazon (AMZN), NFLX, DIS, and many more, as well as continuous high volatility towards the downside in Warner Bros. Discovery stock. While all these risks are justified, I think one must see the deep value they are currently getting WBD at under $15/share. From a valuation perspective, WBD trades extremely cheap given industry averages and continues to grow its subscription services while competitor growth wanes consistently.

Something else interesting is the stock’s recent insider and institutional buys/ownership. Along with several directors and executives at the company purchasing stock from $18-19.50, famed investor Michael Burry also added shares. Per MoneyWise, “Media giant Warner Brothers Discovery is now the third-largest holding in Burry’s portfolio. He added 750,000 shares in the first quarter.” With heavy insider purchasing at levels much higher than the present price levels and Burry aggressively adding shares, I think WBD is no question a buy right now.

Be the first to comment