Alistair Berg/DigitalVision via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on June 2nd, 2022. Please check latest data before investing.

“High-High-Low” Closed-End Fund Report

Quantitative screens help to rapidly narrow down attractive candidates from the database of 500+ closed-end funds [CEFs] for further due diligence and investigation. The “High-High-Low” report was inspired by a member of CEF/ETF Income Laboratory, who wrote:

Stanford, you should do a follow up article on CEF that distribute 8%+, have 90% or more coverage and trade under NAV. What does that look like in today’s world? How many funds are doing that?

What are the Z scores? I think many investors would be interested who are pushing for higher yield to identify best in class of aggressive funds that are coming close to covering dividends. Allows people to reevaluate risk/reward.

The “High-High-Low” report, therefore, screens for the following three attributes that we would like to screen for:

- High distributions (>6.5%) (i.e., 6.5% or higher yields)

- High coverage (>85%) (i.e., 85% or better coverage)

- Low premium/discount value (<+5%) (i.e., trading at a +5% premium or less)

Note that the above thresholds are subject to change, based on the number of eligible CEFs there are that satisfy all three of the criteria. I try to aim for a minimum of at least 20 eligible funds so that the “top 10” list actually means something (top 50% of the screen).

As for the Quality CEF report, I should mention some caveats about using coverage as a screen. Firstly, the coverage ratios are calculated using earnings data from CEFConnect. No efforts have been made to independently verify the coverage ratios from the individual fund annual/semi-annual reports themselves. Secondly, having a coverage ratio >90% does not guarantee that the fund’s distribution is secure. Many funds reduce their distributions periodically in line with market conditions in order to maintain good coverage. Thirdly, a coverage cut-off ratio of 90% is, ultimately, an arbitrary number. A fund with 89.9% coverage will be excluded from the rankings, whereas funds with 90.1% coverage will be considered, even though only a sliver of difference separates the two.

The coverage ratio is calculated by dividing the earnings/share number provided by CEFConnect on the “distributions” tab by the distribution/share. CEFData also provides earnings coverage numbers as well.

I should also note that having both high yields and less than 100% coverage (though greater than 80%) makes this a more aggressive screen compared to the Quality report (which only selects for >100% coverage). Furthermore, note that because the universe of eligible funds is pretty small, some of the CEFs will appear in multiple top lists, just in a different order…

I hope that these rankings of “high-high-low” CEFs will provide fertile grounds for further exploration.

Key to table headings:

P/D = premium/discount

Z = 1-year z-score

Cov = coverage

1Y NAV = 1-year NAV total return

Lev = leverage

BE = baseline expense

Data were taken from the close of June 1, 2022.

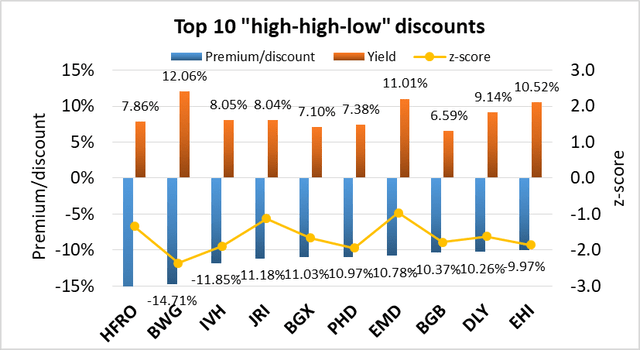

1. Top 10 widest “high-high-low” discounts

The following data show the 10 CEFs with the widest discounts, yield >6.5% and coverage >85%. Z-scores, leverage and baseline expense are shown for comparison.

| Fund | Ticker | Category | P/D | Yield | Z | Cov | 1Y NAV | Lev | BE |

| Highland Floating Rate Opportunities Fd | (HFRO) | Senior Loans | -24.62% | 7.86% | -1.3 | 116% | 22.3% | 11% | 1.61% |

| Ivy High Income Opportunities Fund | (IVH) | High Yield | -11.85% | 8.05% | -1.9 | 105% | -6.8% | 3% | 1.51% |

| Nuveen Real Asset Inc and Grwt | (JRI) | Global Allocation | -11.18% | 8.04% | -1.1 | 86% | 2.2% | 31% | 1.47% |

| Blackstone Long-Short Credit Income | (BGX) | Senior Loans | -11.03% | 7.10% | -1.7 | 122% | 0.9% | 40% | 2.06% |

| Pioneer Floating Rate Fund | (PHD) | Senior Loans | -10.97% | 7.38% | -1.9 | 90% | 1.4% | 35% | 1.88% |

| Western Asset Emerging Markets Debt | (EMD) | Emerging Market Income | -10.78% | 11.01% | -1.0 | 101% | -17.3% | 34% | 2.43% |

| Blackstone Strategic Credit | (BGB) | Senior Loans | -10.37% | 6.59% | -1.8 | 112% | 0.6% | 38% | 2.17% |

| DoubleLine Yield Opportunities Fund | (DLY) | Multisector Income | -10.26% | 9.14% | -1.6 | 86% | -6.5% | 28% | 1.32% |

| Western Asset Global High Income | (EHI) | High Yield | -9.97% | 10.52% | -1.9 | 103% | -12.40% | 36% | 1.37% |

| BNY Mellon High Yield Strategies Fund | (DHF) | High Yield | -9.59% | 8.76% | -1.1 | 103% | -6.49% | 32% | 1.06% |

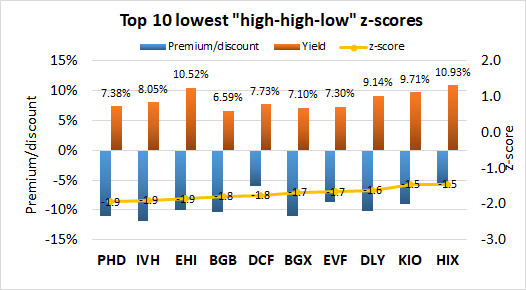

2. Top 10 lowest “high-high-low” z-scores

The following data show the 10 CEFs with the lowest z-scores, yield >6.5%, coverage >85% and premium/discount <+5%. Leverage and baseline expense are shown for comparison.

| Fund | Ticker | Category | Z | P/D | Yield | Cov | 1Y NAV | Lev | BE |

| Pioneer Floating Rate Fund | (PHD) | Senior Loans | -1.9 | -10.97% | 7.38% | 90% | 1.4% | 35% | 1.88% |

| Ivy High Income Opportunities Fund | (IVH) | High Yield | -1.9 | -11.85% | 8.05% | 105% | -6.8% | 3% | 1.32% |

| Western Asset Global High Income | (EHI) | High Yield | -1.9 | -9.97% | 10.52% | 103% | -12.4% | 36% | 1.37% |

| Blackstone Strategic Credit | (BGB) | Senior Loans | -1.8 | -10.37% | 6.59% | 112% | 0.6% | 38% | 2.17% |

| BNY Mellon Alcentra Gl Crd Inc 2024 Tgt | (DCF) | Multisector Income | -1.8 | -6.02% | 7.73% | 88% | -1.7% | 32% | 1.65% |

| Blackstone Long-Short Credit Income | (BGX) | Senior Loans | -1.7 | -11.03% | 7.10% | 122% | 0.9% | 40% | 2.06% |

| Eaton Vance Senior Income | (EVF) | Senior Loans | -1.7 | -8.66% | 7.30% | 90% | 3.5% | 36% | 1.96% |

| DoubleLine Yield Opportunities Fund | (DLY) | Multisector Income | -1.6 | -10.26% | 9.14% | 86% | -6.5% | 28% | 0.00% |

| KKR Income Opportunities Fund | (KIO) | High Yield | -1.5 | -9.07% | 9.71% | 109% | -3.6% | 39% | 2.12% |

| Western Asset High Income II | (HIX) | High Yield | -1.5 | -5.91% | 10.93% | 93% | -10.7% | 31% | 1.27% |

Income Lab

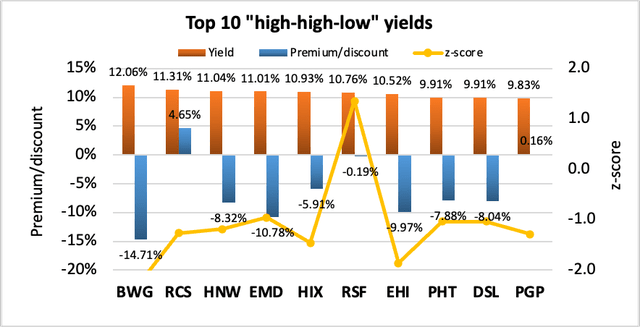

3. Top 10 highest “high-high-low” yields

The following data show the 10 CEFs with the highest yields, coverage >85% and premium/discount <+5%. z-scores, leverage, and baseline expense are shown for comparison.

| Fund | Ticker | Category | Yield | P/D | Z | Cov | 1Y NAV | Lev | BE |

| PIMCO Strategic Income Fund | (RCS) | Investment Grade | 11.31% | 4.65% | -1.3 | 90% | -12.6% | 46% | 0.96% |

| Pioneer Diversified High Income | (HNW) | High Yield | 11.04% | -8.32% | -1.2 | 98% | -5.5% | 36% | 1.60% |

| Western Asset Emerging Markets Debt | (EMD) | Emerging Market Income | 11.01% | -10.78% | -1.0 | 101% | -17.3% | 34% | 1.30% |

| Western Asset High Income II | (HIX) | High Yield | 10.93% | -5.91% | -1.5 | 93% | -10.7% | 31% | 1.27% |

| RiverNorth Specialty Finance | (RSF) | High Yield | 10.76% | -0.19% | 1.4 | 172% | 6.4% | 36% | 6.53% |

| Western Asset Global High Income | (EHI) | High Yield | 10.52% | -9.97% | -1.9 | 103% | -12.4% | 36% | 1.37% |

| Pioneer High Income | (PHT) | High Yield | 9.91% | -7.88% | -1.0 | 107% | -3.9% | 35% | 1.06% |

| DoubleLine Income Solutions Fund | (DSL) | Global Income | 9.91% | -8.04% | -1.0 | 123% | -10.9% | 34% | 1.32% |

| PIMCO Global StocksPLUS & Income | (PGP) | Global Allocation | 9.83% | 0.16% | -1.3 | 104% | -8.3% | 39% | 1.66% |

| KKR Income Opportunities Fund | (KIO) | High Yield | 9.71% | -9.07% | -1.5 | 109% | -3.6% | 39% | 2.12% |

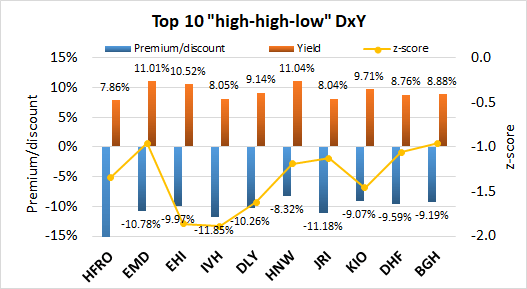

4. Top 10 best combination of “high-high-low” yield and discount

For possible buy candidates, it is probably a good idea to consider both yield and discount. Buying a CEF with both a high yield and discount not only gives you the opportunity to capitalize from discount contraction, but you also get “free” alpha as a result of the distribution being paid out. This is because paying out a distribution is effectively the same as liquidating part of the fund at NAV and returning the capital to the unitholders. I considered several ways to rank CEFs by a composite metric of both yield and discount. The simplest would be yield + discount, however I disregarded this because yields and discounts may have different ranges of absolute values and a sum would be biased towards the larger set of values. I finally settled on the multiplicative product, yield x discount. This is because I consider a CEF with 7% yield and 7% discount to be more desirable than a fund with 2% yield and 12% discount, or 12% yield and 2% discount, even though each pair of quantities sum to 14%. Multiplying yield and discount together biases towards funds with both high yield and discount. Since discount is negative and yield is positive, the more negative the “DxY” metric, the better. Only funds with >6.5% yield, >85% coverage and <+5% premium/discount are considered.

| Fund | Ticker | Category | P/D | Yield | Z | DxY | Cov | 1Y NAV | Lev | BE |

| Highland Floating Rate Opportunities Fd | (HFRO) | Senior Loans | -24.62% | 7.86% | -1.3 | -1.93 | 116% | 22.3% | 11% | 1.61% |

| Western Asset Emerging Markets Debt | (EMD) | Emerging Market Income | -10.78% | 11.01% | -1.0 | -1.19 | 101% | -17.3% | 34% | 1.47% |

| Western Asset Global High Income | (EHI) | High Yield | -9.97% | 10.52% | -1.9 | -1.05 | 103% | -12.4% | 36% | 1.37% |

| Ivy High Income Opportunities Fund | (IVH) | High Yield | -11.85% | 8.05% | -1.9 | -0.95 | 105% | -6.8% | 3% | 1.51% |

| DoubleLine Yield Opportunities Fund | (DLY) | Multisector Income | -10.26% | 9.14% | -1.6 | -0.94 | 86% | -6.5% | 28% | 0.00% |

| Pioneer Diversified High Income | (HNW) | High Yield | -8.32% | 11.04% | -1.2 | -0.92 | 98% | -5.5% | 36% | 1.60% |

| Nuveen Real Asset Inc and Grwt | (JRI) | Global Allocation | -11.18% | 8.04% | -1.1 | -0.90 | 86% | 2.2% | 31% | 1.32% |

| KKR Income Opportunities Fund | (KIO) | High Yield | -9.07% | 9.71% | -1.5 | -0.88 | 109% | -3.6% | 39% | 0.88% |

| BNY Mellon High Yield Strategies Fund | (DHF) | High Yield | -9.59% | 8.76% | -1.1 | -0.84 | 103% | -6.5% | ||

| Barings Global Short Duration High Yield | (BGH) | High Yield | -9.19% | 8.88% | -1.0 | -0.82 | 122% | 1.4% | 30% | 1.62% |

Income Lab

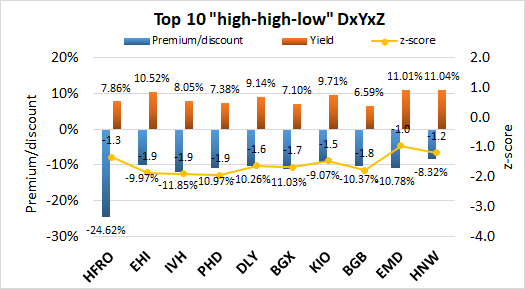

5. Top 10 best combination of “high-high-low” yield, discount and z-score

This is my favorite metric because it takes into account all three factors that I always consider when buying or selling CEFs: yield, discount and z-score. The composite metric simply multiplies the three quantities together. As both discount and z-score are negative while yield is positive, the more positive the “DxYxZ” metric, the better. Only funds with >7% yield, >85% coverage and <+5% premium/discount are considered.

| Fund | Ticker | Category | P/D | Yield | Z | DxYxZ | Cov | 1Y NAV | Lev | BE |

| Highland Floating Rate Opportunities Fd | (HFRO) | Senior Loans | -24.62% | 7.86% | -1.3 | 2.59 | 116% | 22.3% | 11% | 1.61% |

| Western Asset Global High Income | (EHI) | High Yield | -9.97% | 10.52% | -1.9 | 1.95 | 103% | -12.4% | 36% | 1.47% |

| Ivy High Income Opportunities Fund | (IVH) | High Yield | -11.85% | 8.05% | -1.9 | 1.80 | 105% | -6.8% | 3% | 1.51% |

| Pioneer Floating Rate Fund | (PHD) | Senior Loans | -10.97% | 7.38% | -1.9 | 1.57 | 90% | 1.4% | 35% | 1.88% |

| DoubleLine Yield Opportunities Fund | (DLY) | Multisector Income | -10.26% | 9.14% | -1.6 | 1.52 | 86% | -6.5% | 28% | 0.00% |

| Blackstone Long-Short Credit Income | (BGX) | Senior Loans | -11.03% | 7.10% | -1.7 | 1.31 | 122% | 0.9% | 40% | 1.87% |

| KKR Income Opportunities Fund | (KIO) | High Yield | -9.07% | 9.71% | -1.5 | 1.29 | 109% | -3.6% | 39% | 2.12% |

| Blackstone Strategic Credit | (BGB) | Senior Loans | -10.37% | 6.59% | -1.8 | 1.22 | 112% | 0.6% | 38% | 2.17% |

| Western Asset Emerging Markets Debt | (EMD) | Emerging Market Income | -10.78% | 11.01% | -1.0 | 1.14 | 101% | -17.3% | 34% | 1.30% |

| Pioneer Diversified High Income | (HNW) | High Yield | -8.32% | 11.04% | -1.2 | 1.09 | 98% | -5.5% | 36% | 1.60% |

Income Lab

Be the first to comment