Kevin Dietsch

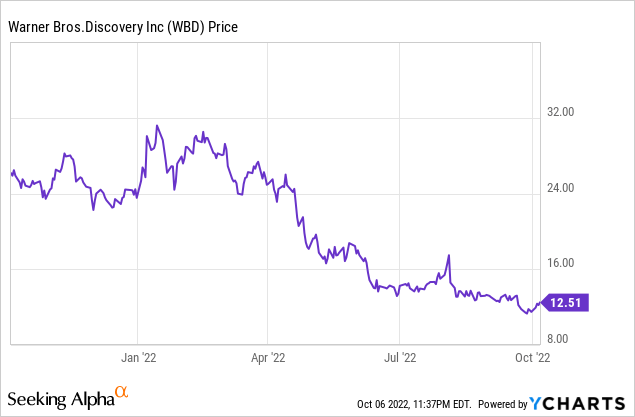

Warner Bros. Discovery (NASDAQ:WBD) has been mired in controversy in recent months. WBD’s slew of layoffs, cost-cutting measures, and strategic shifts have been met with a great deal of skepticism to say the least. The growing skepticism is clearly reflected in the company’s plummeting stock price, which is near its lowest point since the spinoff-merger. WBD’s decision to cancel a nearly completed Batgirl epitomizes the company’s new radical approach to thrive in an increasingly competitive industry.

WBD’s extreme actions make more sense when considering the fact that WBD has ~$47 billion in debt. This stunning amount of debt translated to a debt-to-equity ratio of ~1.7, making it far and away the most indebted company compared to its peers both on a proportionate and absolute basis. Despite WBD’s shaky financial situation, the company is well-positioned for a turnaround.

WBD has seen its valuation nosedive since its spinoff-merger.

Strong IP

A media company’s competitive edge ultimately comes from its library of IP (intellectual property) and its ability to capitalize on its IP. As such, it makes sense that Disney (DIS) is far and away the most valuable company in the space given its collection of popular franchises and its track record of successfully leveraging its franchises. In fact, Disney’s Marvel and Star Wars franchise are some of the most profitable and popular franchises in the history of media.

While Disney is the gold standard when it comes to popular IP, WBD is not far behind on this front. In fact, many would argue that WBD has an even more impressive IP library than DIS. WBD boasts franchises such as DC, Harry Potter, and Game of Thrones, which are some of the most popular franchises in their respective genres.

Although WBD has yet to fully capitalize on these franchises the way Disney has done with Marvel or Star Wars, this may change with the new management. WBD International chief Gerhard Zeiler recently stated that the company would “focus more on the development of franchises” and is specifically prioritized top-performing franchises like Game of Thrones.

WBD is clearly taking a quality over quantity approach, which is already showing signs of success with Game of Thrones and House of the Dragon’s massive and growing popularity. In fact, WBD reportedly spent over $100 million on House of the Dragon marketing alone despite the company’s growing reputation as a stingy operation. WBD’s willingness to spend so much money on House of the Dragon at a time when it is cutting HBO Max originals to save on royalty costs is telling.

The waning popularity of top Disney franchises Marvel and Star Wars could help divert attention to WBD’s top franchises given their overlapping fandoms.

DC

Brand Protection

New management is putting a heavy emphasis on protecting its brand image, which helps explain the company’s spree of cuts/cancellations. Although cost-savings are obviously part of the equation, establishing a strong overall brand is likely the company’s main priority. After all, cutting the nearly completed ~$90 million Batgirl film makes absolutely no sense from a cost savings perspective.

By focusing on quality over quantity, WBD has the opportunity to differentiate itself from its main competitors Netflix (NFLX) and Disney. At a time when top media companies are burning through billions of dollars pumping out content in an attempt to win a streaming arms race, WBD is smart to focus on quality content as opposed to pursuing growth at all costs.

Debt Remains an Issue

With ~$50 billion in debt and only ~$10 billion in quarterly revenue, it is not surprising that so many investors are skeptical of WBD’s future potential. Not only does WBD have to survive the streaming wars in which competitors are plowing billions of dollars into content, but it also has to deal with its enormous debt load.

Such a high debt load will undoubtedly limit WBD’s ability to grow as the company will not be able to spend as freely as its competitors. Moreover, the current interest rate environment will make it even more challenging for a high-debt company like WBD. Luckily, most of WBD’s debt is fixed, making it more manageable.

While such a high debt load will certainly cause issues, WBD is more than capable of paying off its debt over time. After all, WBD’s focus on quality over quantity means that the company will not have to spend countless billions on lower-quality movies/shows. Rather than burning through billions of dollars participating in an unwinnable streaming war, WBD is focused on cultivating its slate of established and high ROI franchises.

WBD is making a bet that spending billions on its established franchises will yield far greater return.

Conclusion

On the surface, it could appear as though WBD is on the verge of collapse given the recent slate of news-worthy events like the cancellation of CNN+, the cancellation of Batgirl, and the mass layoffs at HBO Max. Upon closer inspection, however, WBD is transforming into a streamlined operation more focused on quality.

WBD is incredibly cheap at its current valuation of ~$30 billion, which translates to a P/S ratio of 0.66. In fact, the company’s latest quarterly revenue of ~$10 billion is approximately one-third the size of its total valuation. While debt is obviously a major factor suppressing the stock price, WBD is more than capable of managing its debt load.

Be the first to comment