Drew Angerer

Despite all the chatter in recent weeks about the possibility of easing the zero-Covid policy in China, the latest resurgence of the virus in the capital city of Beijing shows that it’s too premature to expect any pivot from this policy anytime soon. Right now, the number of Covid-19 cases in Beijing is higher in comparison to the number of infected in Shanghai earlier this year after which wide lockdowns were implemented, which indicates that China is failing to contain the virus that negatively affects its economy and the ability of its private sector to operate without any restrictions.

Just earlier this month, NIO (NYSE:NIO) in particular was required to shut its assembly lines in its production facility in Hefei due to the resurgence of Covid-19 there as well, which is more than likely going to lead to the company’s weak performance in Q4. Add to this the fact that in order for NIO to successfully expand its market share it constantly needs to reinvest the available resources into the launch of new models, and it becomes obvious that the company is unlikely to realize its global ambitions in the current environment anytime soon.

In my latest article on NIO, I’ve already stated that China is a one-man show now and Xi Jinping’s praise of the zero-Covid policy along with the latest implementation of movement restrictions in the capital city signal to investors that strict movement curbs are here to stay. As a result of this, we could expect more downward pressure on Chinese stocks and NIO in particular despite the fact that the company recently reported decent results.

The Good, the Bad, and the Ugly

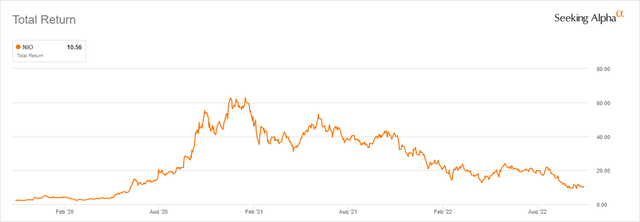

A few weeks after my latest article on NIO came out in which I highlighted the outcome of the 20th National Congress of the CCP and the lasting negative effects that they would have on Chinese-based stocks, the automaker released its Q3 earnings results. Even though during the three-month period the company increased its revenues by 32.6% Y/Y to $1.83 billion, its vehicle margin decreased from 18% to 16.4%, while its non-GAAP earnings were below the street estimates by $0.14 per share. At the same time, even though NIO has been reporting a double-digit Y/Y top-line growth rate for most of the previous quarters, its stock nevertheless has been mostly depreciating since January 2021.

NIO’s Total Stock Return (Seeking Alpha)

Going forward, there are several challenges that NIO is facing, which are more than likely to negatively affect its own performance and the performance of its stock in the foreseeable future. First of all, in addition to improving the lineup of its electric SUVs to expand its market share within the high-range market, NIO is also actively trying to access the mass market by increasing the lineup of its electric sedans. Earlier this year, the company has already released two sedans under the names ET7 and ET5, and it plans to offer additional models in the following years.

Such an expansion of the lineup is never cheap, as the EV business especially is extremely capital-heavy. That’s why NIO is more than likely to once again dilute its shareholders by selling additional shares in the foreseeable future. Slightly more than a year ago, NIO has already raised $2 billion at the at-the-market offering, which has raised its cash reserves to $8.3 billion at the end of Q4’21, up from $6.7 billion at the end of Q3’21. However, due to the constant need to fund its expansion, most of that reserves are already gone since at the end of the latest quarter its cash reserves stood at only $6.3 billion, which indicates a heavy cash burn in the last year. At the same time, NIO is also sacrificing its bottom-line performance to fund its growth, and as a result, in Q3’22 its net loss stood at $582.2 million against a net loss of $443.3 million a year ago.

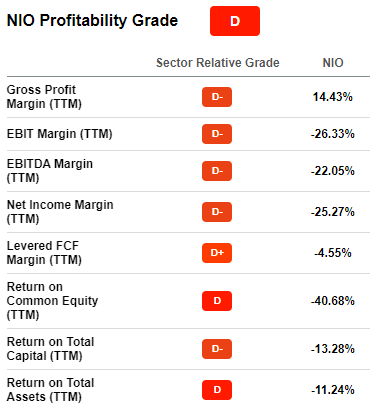

On top of all of this, the decision of Tesla (TSLA) to decrease prices for some of its models in China could spark a beginning of a price war due to the increased competition within the industry in recent years, which would make it even harder for NIO to become profitable anytime soon. Its negative earnings and net margins indicate that it’s unlikely that the company would improve its bottom-line performance anytime soon. Therefore, it’s safe to assume that another round of dilution is upon us in the foreseeable future, as NIO’s latest financials show that the company would need additional cash to sustain its current burn rate and continue to aggressively expand at the same time.

NIO’s Profitability Grade (Seeking Alpha)

What’s worse is that in addition to the lack of profits, NIO would also continue to be exposed to the headwinds that are caused by the zero-Covid policy. Earlier this month, the company was already required to shut down the assembly plants on its Hefei plant, as the region has experienced an increase in Covid-19 cases. On top of that, the recent movement curbs in Beijing signal that China is unlikely to contain the spread of the virus on the mainland, and as a result, we could safely assume that NIO’s operations would continue to be disrupted because of that in the foreseeable future.

What’s Next?

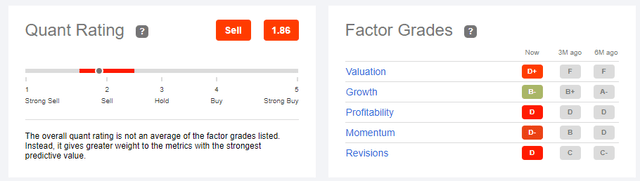

For Q4, NIO expects to deliver a total of 43,000 to 48,000 vehicles. The problem is that in October, it managed to deliver only 10,059 vehicles, down 7.5% Q/Q, and after requiring to shut down its Hefei plant at the beginning of this month it’s more than likely that its November deliveries would be down as well Q/Q. As a result, it’s unlikely that NIO would be able to achieve its deliveries goal, especially if the number of Covid-19 cases continues to increase and the movement curbs expand to other major cities and regions. UBS already started to question NIO’s ability to execute its goals in the current environment, while Seeking Alpha’s Quant rating system has given the company’s stock a ‘Sell’ rating.

NIO’s Quant Rating (Seeking Alpha)

In addition to the zero-Covid environment and the profitability argument, we shouldn’t forget that the political risks are not going away as well. Even though it seems that the U.S. auditors had a successful trip to the mainland and got full access to the books of Chinese firms, Sino-American relations continue to be at historical lows after the Biden administration implemented new chip export restrictions, which affected NIO as well due to its reliance on Nvidia’s (NVDA) A100 GPUs. On top of that, weak growth of the Chinese economy along with declining demographics are also other major reasons to be cautious when investing in Chinese stocks and NIO in particular, as it’s unlikely that its stock would be able to generate meaningful returns anytime soon given those and other developments.

The Bottom Line

The resurgence of Covid-19 in Beijing along with the subsequent implementation of movement restrictions shows that China is unable to contain the spread of the virus. As a result, the government is more than likely going to continue to stick with its zero-Covid policy for the foreseeable future. This would undoubtedly hurt NIO’s operations, as the shutting down of its assembly plants earlier this month is more than likely to already prevent the company from achieving its Q4 goals and greatly improving its top-line performance.

At the same time, as the competition within the Chinese EV industry intensifies and forces NIO to increase its spending in order to expand its market share, it becomes even harder for NIO to become profitable and improve its bottom-line performance anytime soon.

Therefore, it’s safe to say that NIO along with other Chinese stocks is uninvestable at the moment, as the political headwinds along with the capital-heavy requirements to run the business are more than likely to prevent the company and its peers from creating an additional shareholder value in the foreseeable future.

Be the first to comment