CreativaImages

If the Gabelli Multimedia fund (NYSE:GGT), $6.54 current market price, isn’t the worst risk/reward in the markets today, I don’t know what security is.

It’s bad enough that anyone would pay $6.54/share or a 69% premium for a fund whose liquidation value is only $3.87, but the real problem is how is GGT going to maintain a $0.22/share quarterly distribution when the annualized NAV distribution is now 22.7%?

That’s based on an $0.88/share annualized distribution divided by the current $3.87 NAV (XGGTX). That’s almost one-quarter of GGT’s value being paid out in distributions each year if the NAV didn’t change.

The fact is it can’t, particularly in the market we are in. And if you do the calculations, GGT has already well overpaid its 10% NAV distribution policy this year already with its first three $0.22/share quarterly distributions. So technically speaking, GGT should have no fourth quarter distribution when declared around the 2nd week of November.

Gabelli (GAMCO) obviously won’t do that, but there’s no question that GGT is looking at a major distribution cut from $0.22/share due to its astronomical 22.7% NAV yield. Just to give you an idea of how high that is, I red-flag funds in my Equity CEF Performance spreadsheet which have NAV yields over 12%, so 22.7% is in another stratosphere.

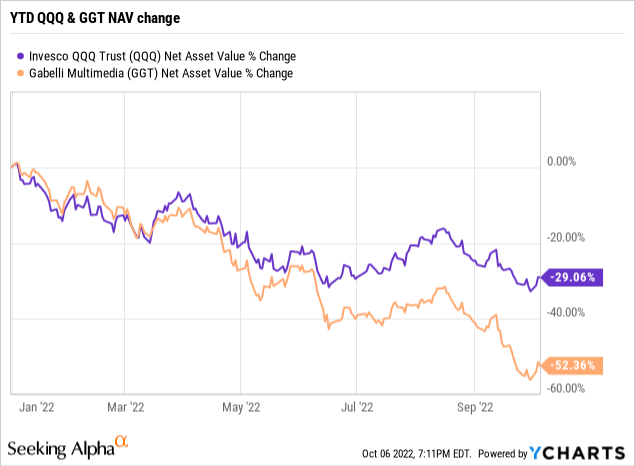

But why has GGT’s NAV been halved this year (not including distributions), starting from an $8.25 NAV on 12/31/2021 to $3.87 today, way worse than the Nasdaq-100 (QQQ), $279.76 current market price, which is down -29.1% YTD

Because a). GGT is a HIGHLY leveraged large cap growth and multimedia stock fund whose sectors have been out-of-favor this year and b). Because of the fund’s 10% NAV distribution policy that has jumped to 22.7% due to the substantial loss of NAV.

Note: A fund’s NAV is its true net worth, i.e. its liquidation value, taking into account all of the fund’s assets minus liabilities

Here’s the top 10 holdings list for GGT as of 9/29/22:

GAMCO

Now imagine going 40% on margin this year owning these and other multimedia growth stocks. That’s like turbo charging the downside of your portfolio in a bear market. So why would anyone pay $6.54 for a fund only worth $3.87 when every other growth and technology CEF is trading at a discount?

Good question. Maybe they think growth and technology is going to turn around. But if that’s the case, why not buy another technology CEF at a discount that also has turnaround capability? Or why not simply replicate GGT’s portfolio and not have to pay a 69% market price premium for the fund’s assets?

The fact of the matter is that most buyers of GGT right now have no idea what the fund’s NAV is, or that the fund is in dire need of a distribution cut. All they see is the Gabelli name and a 13.5% current market yield and they say, “Where do I sign up?”

I’ll tell you where to sign up. How about a fund that also is all stock but doesn’t use leverage and instead, sells individual options against its mostly large cap value-focused S&P 500 portfolio.

That’s what the Madison Covered-Call & Equity Strategy fund (NYSE:MCN), $6.71 current market price, does and a heck of a lot more. The portfolio managers of MCN also add an S&P 500 Put spread, with long Puts in-the-money on just about the entire notional value of the portfolio while also selling S&P 500 Puts out-of-the-money to help defray the long Put expense.

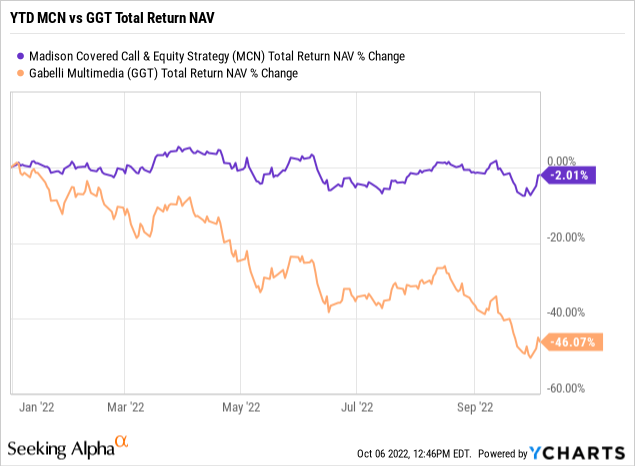

This is a VERY defensive strategy and a big reason why MCN’s NAV is only down -2.0% YTD. You read that right. Only -2.0% YTD (see graph below). No other S&P 500 focused fund comes even close to that level of outperformance. And unlike GGT, MCN offers a sustainable 10.6% current market yield, also paid quarterly.

Here is MCN’s stock portfolio and option overlay as of 8/31/22:

As you go through the slides, you’ll first see the roughly 35 stocks in MCN’s diversified portfolio. What you will notice is that the portfolio is not over-loaded in the mega-cap technology names, but rather represents a broad cross section of companies and industries.

The next page shows the current level of cash, 31.9% that the fund was carrying at the end of August after a rally that month. But cash can vary substantially due to market conditions. At the end of June, when the markets were close to their lows, cash was only 11.6% as more cash was put to work. Another strong bonus for owning the fund.

Then on page 3 you see the written Call options in place for September on out to December. And finally, on page 4, you see the S&P 500 Put spread.

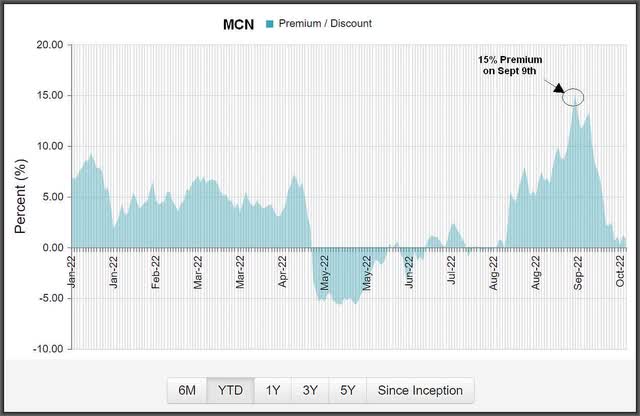

The bottom line is that MCN is very downside protected fund and frankly, should be trading at one of the highest premiums of all CEFs considering its 10.7% current market yield and slight discount.

Executive Summary

So where are we? We have two equity only CEFs that trade at almost the same market price, $6.71 for MCN and $6.54 for GGT, but yet have wildly different liquidation values (NAVs) of $6.74 for MCN and $3.87 for GGT, as well as wildly different NAV total return performances YTD, -2.0% for MCN and -46.1% for GGT.

So I ask you. Is there any logic whatsoever with how these CEFs are priced based on their comparative valuations? And is there any question at all which one of these funds should really be trading at a premium valuation in this market environment?

Absolutely not. And this is what makes CEFs so opportunistic. I’ve often said that CEFs can do some pretty crazy things in the short run but in the long run, they are the most predictable asset class I know. And this is an opportunity to get in front of that longer term trend, in my opinion.

Even if the markets rallied from here into the end of the year, you would still be far better off in MCN than GGT just based on that valuation difference as well as the fact that GGT will still need to cut its distribution in the 4th quarter.

And it’s not like MCN can’t trade at a premium. In fact, MCN was at a 15% market price premium just in early September and has traded at a premium most of this year.

CEF Connect

I can’t think of a more deserving fund than MCN but could MCN trade at a 69% market price premium? Well, that would put it at $11.15, a significant gain from its $6.71 current price. But even at that $11.15 market price, MCN would still offer a 6.5% market yield.

That may not happen but it’s certainly not out of the question for a small $142 million fund that is built for a bear market. But one thing is for sure, MCN certainly deserves it more than GGT.

Be the first to comment