Luis Alvarez/DigitalVision via Getty Images

Buying into rapidly growing companies can be a double-edged sword. If you buy in at the right time and at the right price, the upside potential can be significant. On the other hand, it also entails a large amount of risk, especially if the company in question is unable to generate a profit or at least positive cash flows. One company that falls into this tricky category is Warby Parker (NYSE:WRBY). As a pioneer in the direct-to-consumer eye care market, the company has carved out for itself a rather significant chunk of revenue. However, its bottom line performance leaves a lot to be desired. In particular, shares of the business do look rather pricey, even if management achieves the upside that they are forecasting for the current fiscal year. While the company does have potential moving forward, I find myself deterred by how expensive the stock is, and, as a result, I have decided to rate it a ‘hold’ for the moment.

An innovative firm in the eye care space

As I mentioned already, Warby Parker operates as a direct-to-consumer player in the eye care market. To be more specific, the company focuses on producing a variety of vision care products. First and foremost, it produces eyeglasses and sunglasses. These are designed by the company itself and provided for sale to its customers through its online channel. In any given year, the company launches no fewer than 20 new collections, with products made from everything under the sun ranging from ultra-lightweight titanium to cellulose acetate. The frames the company produces come with impact-resistant polycarbonate lenses that block 100% of both UVA and UVB rays. And all of them have scratch-resistant and anti-reflective coatings applied to their lenses.

The company also offers other products and services for its customers. Since 2019, the company has made available contact lenses for those who prefer that approach to eye care over glasses. It also provides eye exams and vision tests, including through no fewer than 107 of the 169 retail stores that it has set up over the years. Although the company does have this physical footprint, it has always positioned itself as a direct-to-consumer play with a special emphasis on its e-commerce operations.

Customers have the ability to shop online through the company’s website or through its app. They are then sent frames at their homes in order to try on, after which the company will send the completed glasses to its customers directly. During the company’s 2021 fiscal year, 46.1% of its revenue came from its e-commerce operations. This was up from 35% seen just two years earlier. The remaining 53.9% of its revenue, meanwhile, comes from its retail outlets. Although impacted by the COVID-19 pandemic, this segment of the company has continued to grow from a revenue perspective, climbing from $240.7 million in 2019 to $291.5 million last year.

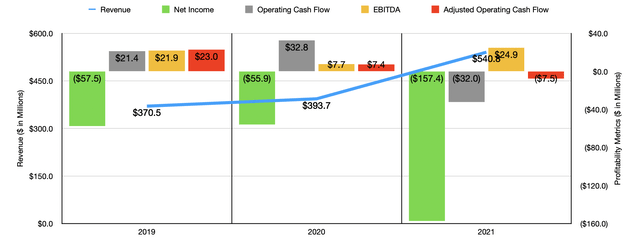

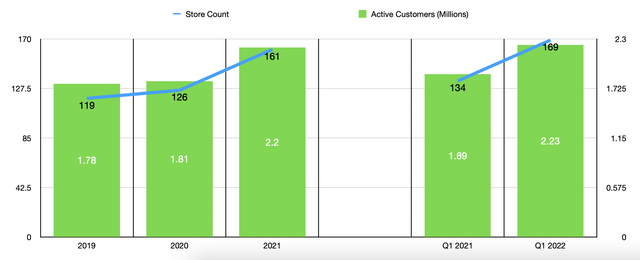

Over the past few years, the management team at Warby Parker has succeeded in growing the company’s revenue at a nice clip. Revenue increased from $370.5 million in 2019 to $540.8 million in 2020. Although it looks like sales spiked in 2021, it is worth noting the negative impact that COVID-19 had on the company’s retail operations. Revenue in 2020 associated with this segment of the business came in at just $156.3 million. That compares to the $240.7 million it accounted for in 2019. Without that decline, the growth of the company almost certainly would have looked steadier. Even if sales had matched what they were in 2019, revenue for 2020 would have been $478 million. It is worth noting what the drivers of this growth have been over this time frame. For starters, the retail portion of the company benefited from an increase in store count from 119 locations at the end of 2019 to 161 locations at the end of last year. The other contributor was a rise in the active customers using the company’s services. This number grew from 1.78 million in 2019 to 2.20 million last year.

Although the revenue trajectory of the company has been impressive, the same cannot be said of profitability. Net income dropped from $57.5 million in 2019 to negative $55.9 million in 2020. In 2021, the company generated a net loss of $157.4 million. This was not the only area of the company to struggle. Operating cash flow went from $21.4 million in 2019 to negative $32 million in 2021. If we adjust for changes in working capital, it would have fallen from $23 million to negative $7.5 million. The only profitability metric that improved during this time frame was EBITDA. According to management, this number came in at $24.9 million last year. That was up from the $21.9 million reported in 2019.

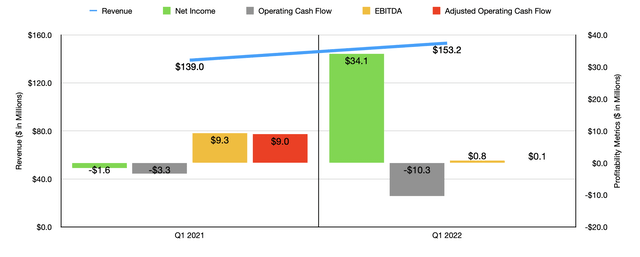

When it comes to the 2022 fiscal year, the picture has been quite a bit mixed. Revenue in the first quarter of the year totaled $153.2 million. That represents an increase of 10.2% over the $139 million reported just one year earlier. This came as the store count for the company increased from 134 locations to 169, and as the active customer count expanded from 1.89 million to 2.23 million. When it comes to the 2022 fiscal year as a whole, management expects growth to continue. They currently see sales coming in at between $650 million and $660 million. That comes even as they say that sales were impacted negatively at the start of the year to the tune of $15 million because of the omicron variant of COVID-19. Presumably, online sales are likely to continue expanding. However, the company also expects to open 40 new stores during the year, increasing its store count to 201.

Profitability has been all over the map. For instance, in the first quarter of the year, net income totaled $34.1 million. That compares to the $1.6 million loss generated one year earlier. On the other hand, operating cash flow for the company suffered, declining from negative $3.3 million to negative $10.3 million. Meanwhile, the adjusted figure for this, which ignores changes in working capital, went from $9 million to just $0.1 million. Even EBITDA worsened, dropping from $9.3 million to just $0.8 million. The only guidance management gave when it came to the 2022 fiscal year from a profitability perspective involved EBITDA. This should come in at $40 million for the year. Given that the company has no debt and has cash on hand of $230.3 million, I believe that EBITDA would also be a good proxy for adjusted operating cash flow.

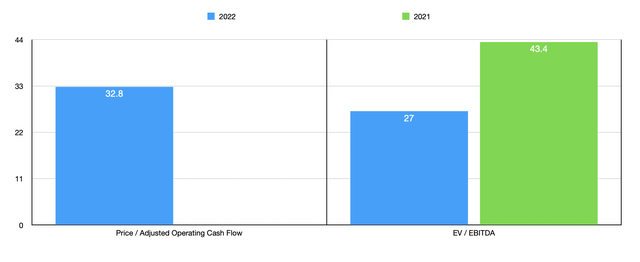

Using this data, we can value the company on a forward basis. For 2022, the price to adjusted operating cash flow multiple of the firm should be 32.8. The EV to EBITDA multiple should be even lower at 27. When it comes to the 2021 fiscal year, we actually can’t calculate the price to adjusted operating cash flow multiple since that figure came in negative for the year. But if we use the EBITDA for the company for its 2021 fiscal year, then we end up with an EV to EBITDA multiple of 43.4. I had thought about comparing the company to other firms. But given its business model and the instability of its bottom line, I do not believe that there are any realistic firms to compare it to. But what I will say is that these multiples, while seemingly improving, do still look very expensive.

Takeaway

Right now, Warby Parker continues to grow at a nice pace. Long term, I don’t see why this trend would change. According to management, only 8% of industry revenue for the eyewear industry came from online last year. That compares to 50% for consumer electronics. So it is highly probable that growth will continue for the foreseeable future. Having said that, shares do look very pricey, even factoring in this growth. But when you factor in the totality of the picture, with the strong sales growth the company is achieving and its improving bottom line, I believe that those items more or less balance out with how shares are priced right now. Because of this, I have decided to rate the business a ‘hold’ prospect but one that is definitely risky from a volatility perspective.

Be the first to comment