Jetlinerimages/E+ via Getty Images

Investment thesis

The post-pandemic recovery of air transport service demand has generated strong profit for companies severely impacted in 2020, and Alaska Air Group (NYSE:ALK) is one of them. The company has successfully weathered the crisis with the help of management actions, and the company’s medium-term strategy will allow it to significantly improve financial performance in the coming period.

The outlook on the US air transport industry

2020 became a shock to the global economy, with the travel sector being the hardest hit. The airlines had to temporarily freeze the business, while fixed costs, such as fleet maintenance and salaries, remained unchanged. The carriers began to recover only in 2021, following mass vaccination and disease incidence decline.

As of Q1 2022, air transport service demand has almost recovered up to 2019 levels. The number of passengers has returned to pre-pandemic levels with domestic traffic being the main driver. In this respect, the USA is significantly outperforming other regions.

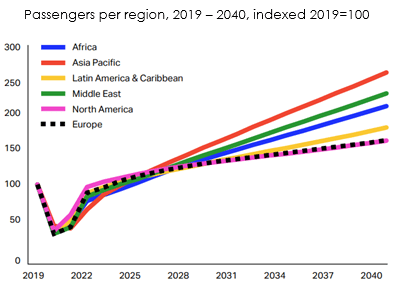

Source: IATA Air Passengers Forecast, June 2022

The long-term outlook for the industry is linked to the real income growth and demographic indicators. According to the IATA forecast, the total number of passengers in the world will increase at an average rate of 3.3% per year. However, the USA, being a developed country, will start to underperform other regions in terms of passenger growth rates.

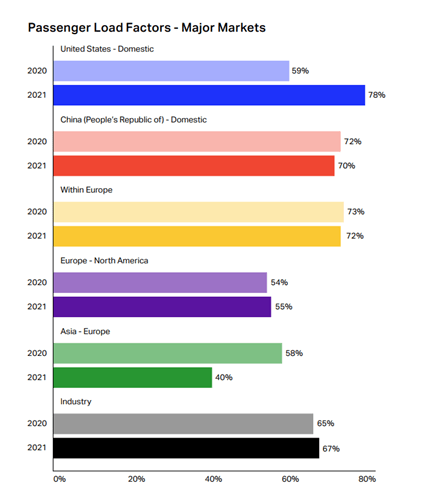

The US domestic load factor is already 78% at the end of 2021 showing 19% increase since 2020. In 2018 and 2019, the US load factors were at around 82%, meaning there is still potential for growth.

Source: IATA Air Passengers Forecast, June 2022

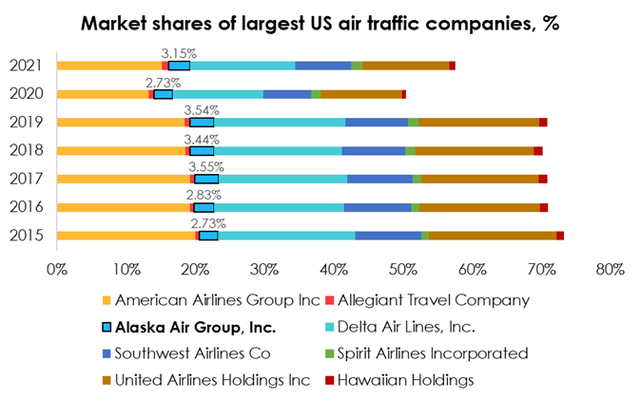

The US commercial air transport market is highly competitive. There are 59 airlines in America, 18 of which are considered as large and have annual revenues of more than $1 bln. The key players are:

The air transport market has remained stable over the last few years (according to Zippia). There is no active competition for the consumer, the players have occupied their price and geographic niches. New players are unlikely to enter the market as the industry is very capital-intensive, the entry threshold is high, and the registration procedure is complicated and costly in terms of both finances and time.

Source: the companies’ data, Zippia

In 2020, the total share of large players decreased compared to 2015-2019. 8 companies used to represent around 70% of the market, but in 2020 it was 50% and 58% in 2021. This was due to the fact the number of international flights had decreased much more than domestic flights. The influence of smaller regional representatives temporarily increased. In future, we expect the major carriers to keep regaining their influence through the recovery of international traffic and fleet renewal.

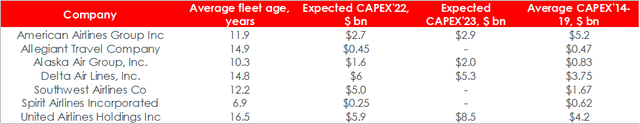

Source: corporate presentations, AirFleets

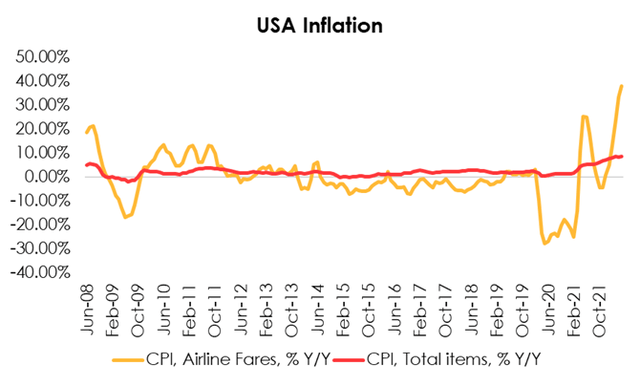

The headwind for the entire US economy right now is record inflation. Airlines, however, are in a more resilient position than trading and manufacturing companies because airline pricing is very flexible. Carriers easily pass on the cost of fuel and labor (which together constitute over 60% of airline costs) to the consumer. At the end of Q1, the airline cost index increased by 15.5% y/y and by 35% y/y in April and May, significantly outpacing the overall inflation rate in the USA.

In the short term, we believe the US airlines will look attractive compared to other sectors due to high pricing-power of the entire industry, but we generally expect fares to decline in H2 2022. In 2023, we expect further price reduction mainly due to the oil price normalization.

Why is Alaska Air Group a good option?

Purchase of airline shares is a bet on the ongoing market recovery from the COVID-19 epidemic. While much of the recovery has already subsided, the sector has good prospects for the next few years. Nevertheless, we do not consider all airlines to be attractive right now. We have decided to select Alaska Air Group and add to the portfolio, and these are the reasons:

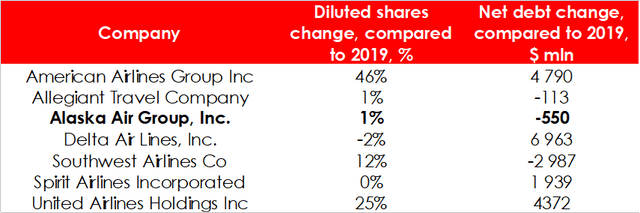

Alaska Air Group positively stood out among major players during the pandemic

During the crisis, the company’s management was able to effectively reduce operating costs. Alaska did not dilute the shareholder’s equity, and the amount of debt raised (about $1 bln) had negligible impact on the overall situation. The government subsidy and operational recovery in H2 2021 also benefited; as a result, Alaska Air Group even managed to reduce its net debt from $22 mln at the end of 2019 to $520 mln as of March 30, 2022. Today, the company remains one of the most attractive in the airline industry in terms of debt burden.

Alaska Air Group is a stable company during possible recession

Alaska Air Group’s core business is focused on the domestic US market. The company’s list of international routes consists of only four countries, so demand for Alaska services has recovered faster than for companies with larger amount of international routes. Fleet load levels are now almost back to pre-pandemic levels. During possible recession and decline in real disposable income, domestic destinations will also remain more in demand, as domestic tourism is usually cheaper than international trips. Business travel and visits to relatives, whose concentration within the country outstrips that of international destinations, are also added here.

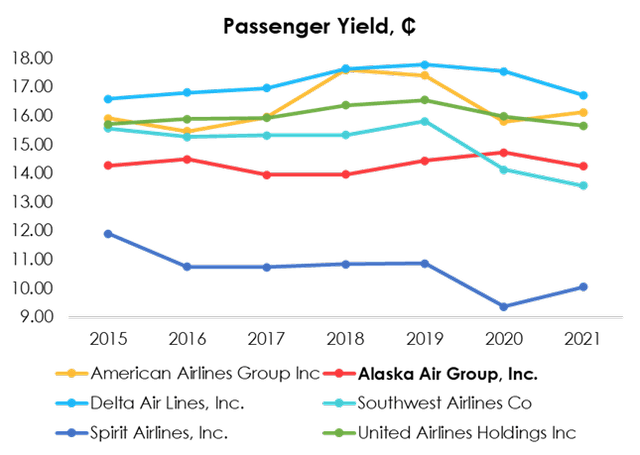

In terms of pricing, Alaska Air Group also looks more attractive. Although it is not a low-cost carrier, its fares have always been well below its competitors. We believe that during potential recession, demand for Alaska services will be stable.

Financial performance outlook

Revenue

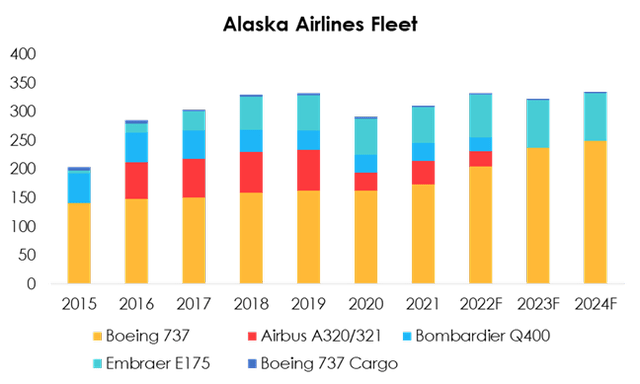

The US domestic market has almost recovered, so the main driver of Alaska Air Group’s growth now is fleet renewal and increase in the number of flights. The company’s management was forced to reduce the fleet in 2020, but the next two years are record-breaking in terms of capital investment. Management intends to substantially modernize the fleet, replacing all Airbus aircraft with the new Boeing 737 MAX.

Source: Alaska Air Group 1Q 2022 Quarterly Report

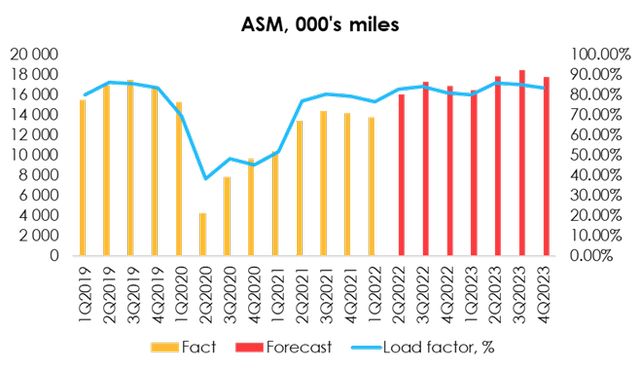

Fleet renewal, coupled with increased capacity utilization and ongoing recovery in demand for air travel, will increase Alaska’s ability to generate revenue.

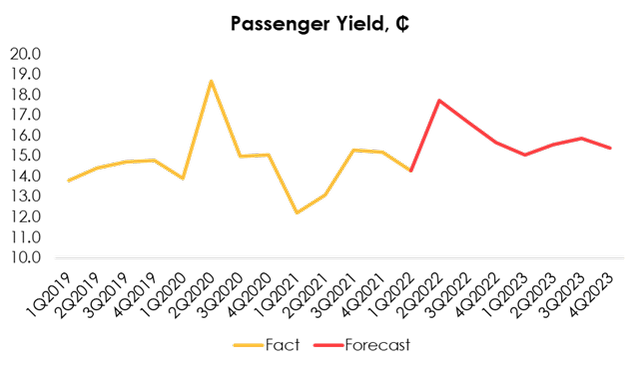

Source: company data, calculations by Invest Heroes

The dynamics of airline fares is much more volatile than the total inflation rate and is hitting historic highs in 2022, increasing by 15% y/y in Q1, and by 35% y/y in April and May, reflecting both record levels of overall inflation and fuel prices, as well as significant increase in demand for air travel compared to H1 2021. Nevertheless, volatility works both ways, so we expect fares to decline in the 2nd half of 2022 and further price reduction in 2023 due to the drop in oil prices.

Source: company data, calculations by Invest Heroes

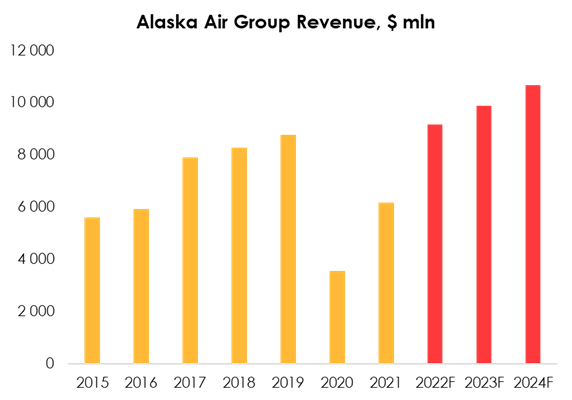

Thus, we expect Alaska Air Group revenue to be $9,169 mln (+48% y/y) in 2022 and $9,893 mln (+8% y/y) in 2023.

Source: company data, calculations by Invest Heroes

Transaction costs

More than 60 percent of airlines’ operating costs are fuel and labor costs. With the projected increase in capacity, we believe Alaska will continue to increase its staff with wage increases in line with national labor inflation.

Alaska Air Group has always hedged the future cost of fuel by buying options on Brent futures, so the fuel price for the company was different than the market one. Due to the inability to forecast strikes and option premiums on the company’s balance sheet, we do not consider the effect of fuel hedging over the forecast period and rely on our oil price forecast, expecting decline down to $90/bbl in 2023.

The company’s other expenses are tied to scaling of business and inflationary expectations.

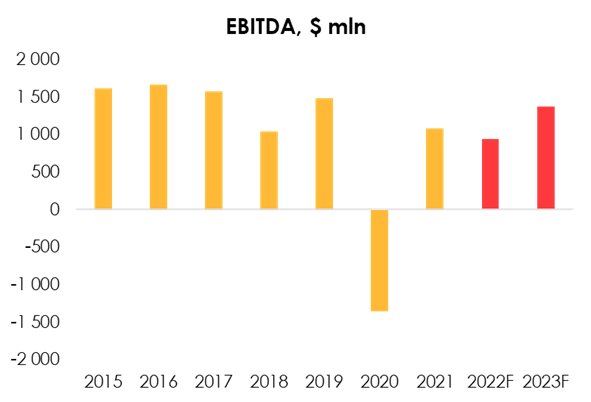

EBITDA

We project EBITDA of $936 mln in 2022 (-13.3% y/y) and $1,371 mln in 2023 (+46.5% y/y).

The expected decrease of EBITDA in the current year is explained by the fact that Alaska received $914 mln of government subsidies in 2021. Excluding the subsidies, EBITDAR growth in 2022 would be +467% y/y.

Source: company data, calculations by Invest Heroes

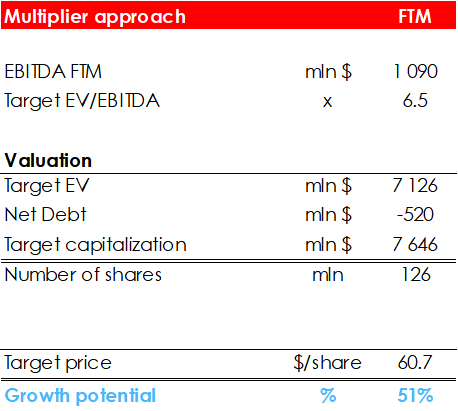

Valuation

According to our forecast, we estimate the fair value of the company’s stock to be $60.7 per share and expect it to be realized over the next 12 months. Thus, we give the company a BUY rating. Upside – 51%.

Although Alaska Air Group is a relatively small company, it holds a rather important place in the list of the US air carriers. As a domestic airline, the company has the audience loyalty because of its relatively low fares and high-quality service. Alaska’s management effectively controls the company’s cash flow, so historically the business has remained profitable in almost all years. The rapid recovery of the airline market has significantly improved the company’s financial results, and we believe the trend will continue in the medium term.

Invest Heroes’ calculations

The main drivers of the growth of quotations are:

- Continued recovery of the US commercial airline market and effective use of Alaska Air Group’s planned capacity renewal.

Risks

- Decline in demand for air transport service due to falling real income of consumers.

- Failure to meet management’s plan for new aircraft deliveries due to supply chain disruptions and slowdown in the company’s capacity growth.

- Operational risks of air accidents, which are common among carriers.

Conclusion

Due to the comfort levels of financial leverage and a reasonable management strategy, Alaska Air Group is our top-pick as a bet on the US airlines industry. The stock is cyclical and is mostly following benchmark, so we recommend to open a conservative weighted position and then increase the number of shares in your portfolio if the volatility decreases. To manage your positions, we strongly recommend you to follow Alaska Air Group’s quarterly earnings and airline industry reviews by IATA.

Be the first to comment