naphtalina/iStock via Getty Images

Thesis

In this article, I’m sorting through the opinions of analysts from three major banks on how serious Walmart Inc.’s (NYSE:WMT) problems are. After critically appreciating their conclusions and conducting my own analysis, I conclude that the Walmart problem most likely indicate that the peak of inflation is already imminent. On the other hand, WMT’s profit margins have been sacrificed, so the company’s shareholders have no reason to rejoice yet. In my opinion, Walmart’s valuation should come down even further before considering buying the stock. Otherwise, there is a risk of catching a falling knife.

Walmart Stock – The Street’s Voices & My Thoughts

An event as significant to the market as profit outlook cuts of the country’s and the world’s largest retailer could only cause excitement among investors, which naturally led to increased interest on the part of individual banks to express their opinions. I came across analyst reports from three major investment banks sent to their clients a few hours ago. Let us find out their opinion together and try to figure it all out.

G. Carbone, K. Katai, and J. Taylor from Deutsche Bank have written a 1-page report in which they conclude, using Walmart as an example, that a wave of full-year guidance cuts from US-based apparel retailers is coming:

In our view, the company’s announcement is likely to be a negative readthrough for our apparel retailers, particularly those with high exposure to the lower income consumer – (BURL), (ROST), (TJX), (KSS), (AEO), (GPS).

We think WMT’s comment on the back half signifies that soft sales trends and elevated promotional activity will likely continue for discretionary categories. To that end, we expect full year guidance cuts from our apparel retailers as most guided to an acceleration in sales and margins in the back half. All in all, we anticipate sentiment to remain negative on the group with investors needing to see meaningful guidance cuts in order to get comfortable with back half numbers.

Source: Deutsche Bank’s report [07/25/2022]

In my opinion, DB’s assessment of the persistently negative market sentiment for this group of companies only really makes sense for a broader sample – the Consumer Staples sector as a whole. Many retailers complained as early as mid-May that they had too much of the wrong stuff in their warehouses, and it was clear that they would have to be sold at a discount at some point. But because unemployment was low enough, I think the market continued to believe that consumers would have enough money to continue to buy these goods. And some analysts still think so.

After yesterday’s guidance cut, Goldman Sachs (GS) analysts (K. McShane, L. Jordan, M. Jordan, and P. Hollander) wrote that they acknowledge the company’s longer path to profitability improvement. They still maintained their Buy rating, lowering their price target from $138 to $135 per share (+12% to the pre-market price):

We acknowledge the company’s improving profitability profile will now take longer to come to fruition (we estimate beginning in FY23), but we reiterate our Buy rating (on CL) for WMT given strong top line trends supported by market share gains, the incremental cost pressures are largely temporary with solid visibility into the path towards improvement, and the long-term algorithm (+4% top line and even better operating income growth) remains intact.

Source: Goldman Sachs [07/25/2022]

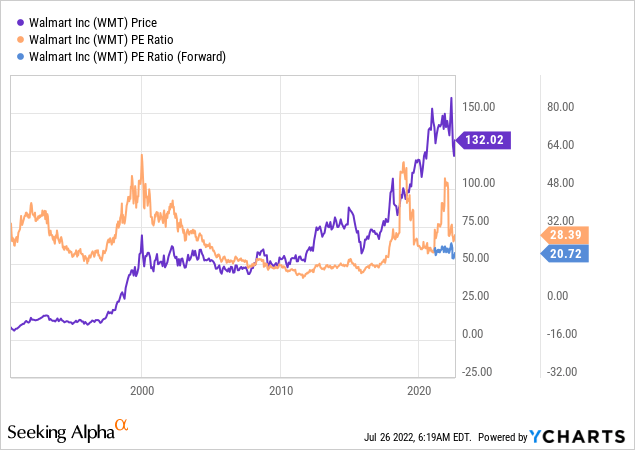

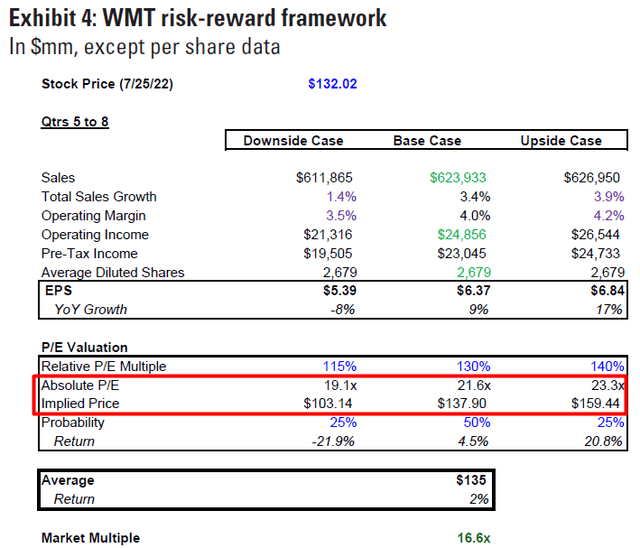

Analysts at GS primarily justify the changes in WMT’s price target with a higher (implied) market multiple of 16.6x (versus 15.7x previously), based on their risk-reward framework:

Pay attention to the sensitivity of their conclusions – a change in the absolute P/E multiple by only 150 points leads to an implied price change of almost 34% (base case vs. bear case).

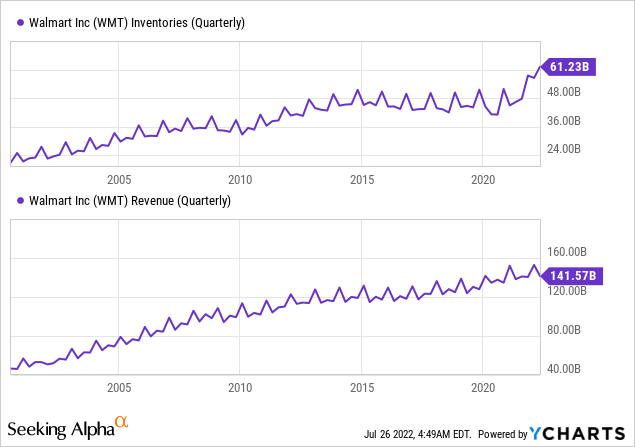

In my opinion, Walmart faces much greater risks of not achieving the sales growth estimates that Goldman Sachs analysts put into their model. First, the company’s inventories are currently at historically high levels in absolute terms, while revenues are also not lagging. This leads to a high base effect, where the company will be forced to sell goods from the warehouses at a discount (this has already been priced in by the pre-market), and relative revenue growth is likely to suffer more.

Second, after the pandemic there was a shift in consumer behavior towards services – people started to travel more, go to restaurants, shopping malls, etc. This led to increased demand for essential products sold in Walmart and Target stores (TGT).

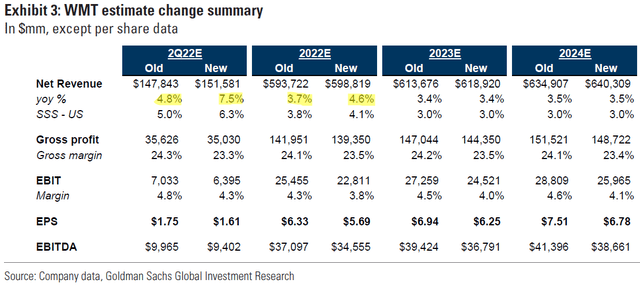

I’m afraid the combination of these two factors could lead to a negative earnings surprise, as analysts at GS have raised their revenue forecasts for both Q2 2022 and FY 2022:

However, the analysts at UBS (M. Lasser, A. Maheswari, and M. Carden) do not share my concerns. They reduced their 12-month price target by 8.55%, but at the same time confirmed their Bullish rating for the following reasons:

In a nutshell, the reduction to WMT’s guidance reflects: 1) more aggressive actions to move through its excess inventory; and 2) a sharper shift to consumables than it previously expected. The WMT US business is on pace to comp up 6%, which is slightly ahead of our prior 5% estimate (and 4.7% consensus). This reflects strength and market share gain in grocery & essentials, driven in part by DD food inflation. This is due in part to wallet share gains from its core customer and a trade down from its more occasional (and more affluent) customer. Yet, there’s several factors that are weighing on the velocity of turnover of its discretionary goods, including: 1) misjudging how much of the strength last year was due to stimulus (it was more than the retailer originally thought); 2) crowding out of dollars for its consumers that are available to spend on discretionary goods due to inflation on consumables; and 3) discounting due to the glut of inventory across retail. The retailer expects to make progress clearing out excess inventory by 3Q. This should put it in a better position for the holidays and beyond.

Source: UBS [07/25/2022]

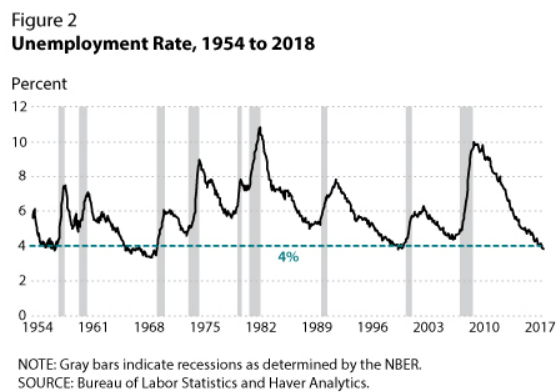

That sounds reasonable – the only question is to what extent Walmart will be able to clear out its inventories by the third quarter and how much higher demand we’ll see this year compared to last year. I think we should look at macro trends here, at unemployment, which I mentioned at the very beginning. The latest statistics show a sharp turnaround in U.S. unemployment claims – the fastest pace since November 2021:

ZeroHedge, Bloomberg data

Against the backdrop of increasing recessionary sentiment and staff cuts, the “bear” thesis that we are looking at a rapid rise in unemployment in the United States does not seem like such a crazy idea (emphasis added):

We believe the US economy is spiraling headlong into recession. On a real GDP basis, we think one has already begun due to today’s high inflation rate. Unemployment, a lagging indicator, is naturally the next shoe to drop.

Source: Otavio Costa, Crescat Capitals’ portfolio manager

Low unemployment, as a lagging indicator, is not a very reliable predictor of recessions, even in the medium term. Using the late 1960s as an example, we see that low unemployment does not protect the economy from a protracted downturn.

Federal Reserve bank of St. Louis, research paper [2018]

Given this risk, I think the implied P/E multiples for FY23 from Goldman Sachs (21.6x) and UBS (23.6x) are too high.

And given the relatively high base from last year, rising unemployment, and changing consumer behavior, it is unlikely that the company’s sales growth will reach GS’ and UBS’ forecasts of 4.6% and 4.55% (YoY), respectively. But even if the company succeeds in doing so, it is not certain that EPS will fall as gently as it is now priced in.

Bottom Line

Walmart stock is down a little more than 17% from its all-time high at the time of writing, and down about 26% from its pre-market advance. However, I do not believe this is a sufficient reason to buy the stock’s dip.

Clouds of uncertainty have gathered around Walmart. The planned sales of excess inventory at a discount will help bring down high inflation in the U.S. – most likely we are seeing clear signs of a peak now, which will likely cool in the coming quarters. However, this is good news for everyone except retail investors and especially Walmart shareholders. In my opinion, currently, analysts are giving overly optimistic forecasts – in terms of both historical valuation and absolute multiples, WMT stock still has room to fall. I recommend not betting on the falling knife, but waiting for a deeper decline to consider buying Walmart.

Final Note: Hey, we are about to launch a marketplace service on SA called Beyond the Wall Investing, where we will be tracking and analyzing the latest bank reports to identify hidden opportunities early! Click the subscribe button to stay tuned!

Be the first to comment