Wolterk

Investment Thesis

So far, we see no reason to buy Walmart (NYSE:WMT). In terms of operating activities, the company looks good, but we do not share the market’s enthusiasm after the Q2 2023 report. Although economic difficulties are not hitting Walmart’s consumers and businesses hard, future financial results imply modest growth. At current prices, the company looks too expensive, and we think there is downside risk.

Walmart’s Q2 Fiscal 2023 Earnings Highlights

On August 16, Walmart reported Q2 2023 financials that were above our expectations. We made bets on a rapid decline in personal mobility and lower consumer activity, but the company’s data shows that purchasing power is still very high, which is the main driver of Walmart’s financial results.

We have highlighted several major takeaways from the Q2 report:

- Higher price growth in all product categories is affecting consumer preferences rather than basket size. Currently, customers choose more cheap products like semi-finished and canned food, which is replacing deli and fresh goods.

- The management is successful in terms of pricing. As of the end of the quarter, Walmart raised prices for most product categories, which is reflected in EBITDA margin.

- Fuel vouchers continue to be a very strong factor in attracting customers.

- Merchandise density is up significantly vs. last year. Walmart’s merchandising policy proved to be prudent, even despite a short-term strong negative effect on FCF.

Inflation and Consumer Activity

The inflationary pressures cycle has a strong impact on all sectors of the economy, starting from manufacturer cost, which has a negative impact on business profitability, to consumers forced to modify their spending due to higher prices for essential commodities.

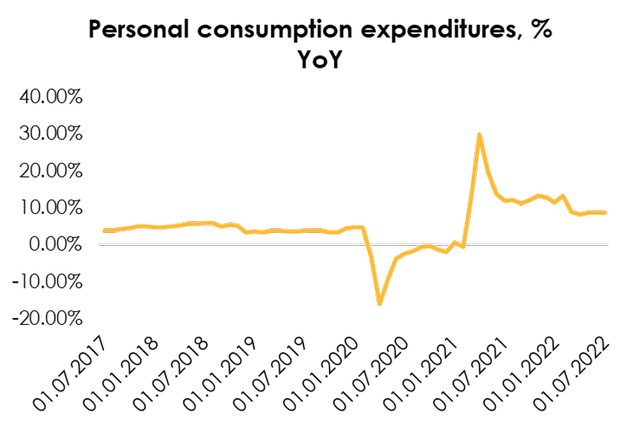

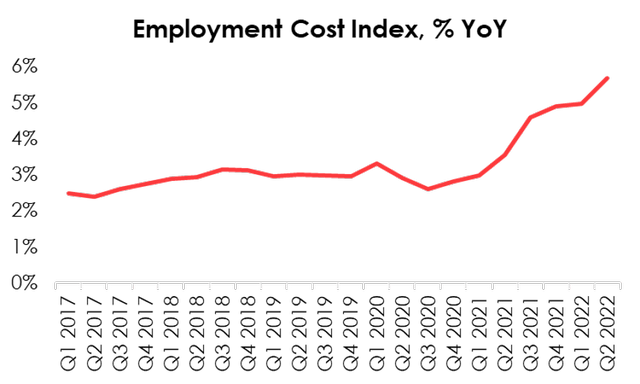

So far, the U.S. consumer is still maintaining a strong growth rate in personal expenditures (8.6% y/y in Q2), although it is lower than at the beginning of the year, according to the U.S. Bureau of Economic Activity. Consumption is supported by the strong labor market and higher wages, according to U.S. Bureau of Labor Statistics, so it looks like we shouldn’t expect a big drop in personal expenditures this year.

US Bureau of Economic Activity US Bureau of Economic Activity

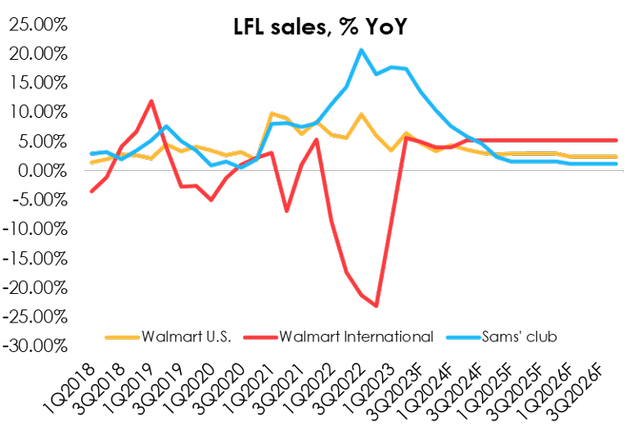

Walmart is the largest company in the world in terms of revenue and proxy for purchasing power. Therefore, its LFL-sales dynamics are very close to total expenditure. Customers, meanwhile, have been picking up more low-cost products like canned and semi-finished food, as the company’s management reported during the call.

We expect the trend of high LFL-sales growth to continue in the medium term due to high inflation and a wide product range. Walmart can offer a basket of goods in all price segments, so consumer outflow and strong decline in the ticket because of inflationary pressures look like an improbable scenario for the company.

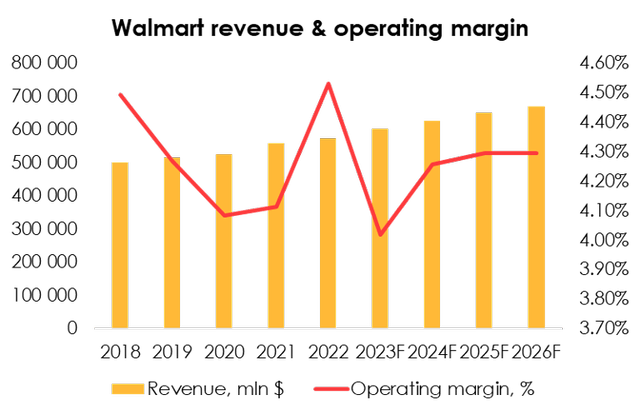

The average ticket growth is not only a strong factor behind higher LFL-sales but also supports the company’s profitability. At the end of Q2, the management increased prices in most product categories, so the operating margin increased to 4.48% vs. 3.76% in Q1. Overall, we expect operating margin to be 4.02% in 2023, slightly below the historical average of 4.30%.

While supermarkets tend to pass on inflation to customers, abnormal inflation will likely be a headwind for Walmart this year.

Sam’s Club

Sam’s Club operates as part of Walmart and has been strongly outpacing other divisions in terms of LFL sales growth for a year. Many investors have seen high potential of the chain, but we are not too confident owing to long-term prospects for discounter development and low profitability of the units.

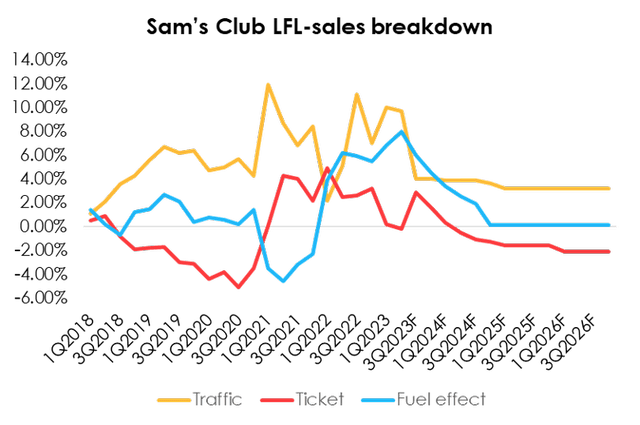

Sam’s Club’s growth strategy is now largely built around loyalty cards, which customers can use to get a discount on fuel. Sam’s Club membership is profitable in terms of gasoline costs, and the right to visit stores becomes a secondary factor. In Q2, the fuel effect accounted for nearly half of total LFL sales growth (8% out of 17.5% y/y LFL sales growth), but it will shrink with fuel price corrections.

Meanwhile, the chain has the lowest margin of all Walmart divisions. In Q2, operating margin of Sam’s Club was 1.75%. In the current economic environment, the discounter strategy is not working very well, as the pass-through of inflation to the consumer is more problematic for stores of this format.

Walmart will raise the price of club cards by ~10% in Q3, but the effect on profitability will be somewhat delayed by a large number of active cards. We expect annual unit operating margin to be 2.11% this year and its gradual improvement to 2.73% by 2024 (fiscal year).

Although discounter sales growth is now showing strong dynamics, we do not see much investment appeal in the segment. Traffic growth is largely driven by fuel cards, which attract customers only during periods of high oil prices. The business model itself remains low profit, even by the standards of retailers.

Valuation

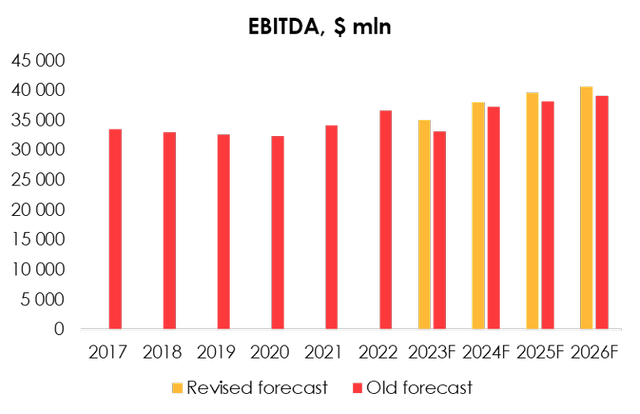

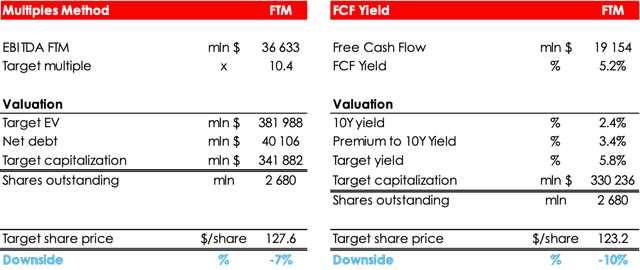

Based on the Q2 financials, we have revised our EBITDA forecast upwards. According to our estimate, EBITDA in 2023 (fiscal year) will be $35,122 mln (-4% YoY) and $38,092 mln (+8% YoY) in 2024. Walmart’s broad product range and strong customer base have a positive impact on its financial results.

According to our valuation, the fair value of the stock is $125.40 per share, so we consider the current market value to be fair and maintain a HOLD status. We project a potential downside of – 7%.

Conclusion

Despite a successful Q2 report, which was positively accepted by the market, we do not see the prerequisites for a strong increase in the target price. Although Walmart’s management is doing a good job in terms of pricing policy, and the state of the economy has not proven to be disastrous for business, Walmart stock is too expensive. We recommend refraining from purchasing Walmart stock and recommend waiting for a decline in its price.

To manage the position, we recommend keeping an eye on Walmart’s financial reports, key economic indicators and industry surveys (e.g., Placer or Nielsen).

Be the first to comment