Marcus Lindstrom

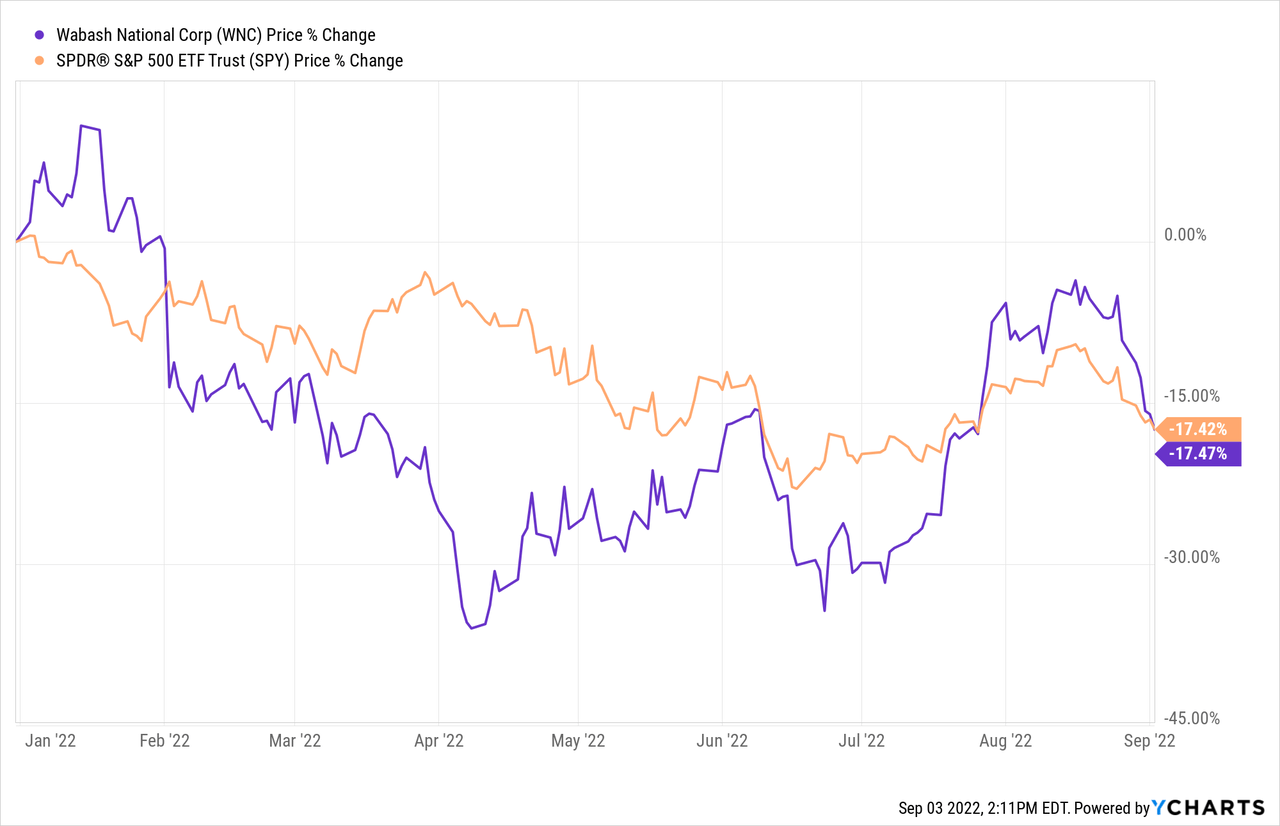

After a strong start to 2022, Wabash National Corporation’s (NYSE:WNC) stock has recently pulled back and is now slightly underperforming the broader market on a YTD basis.

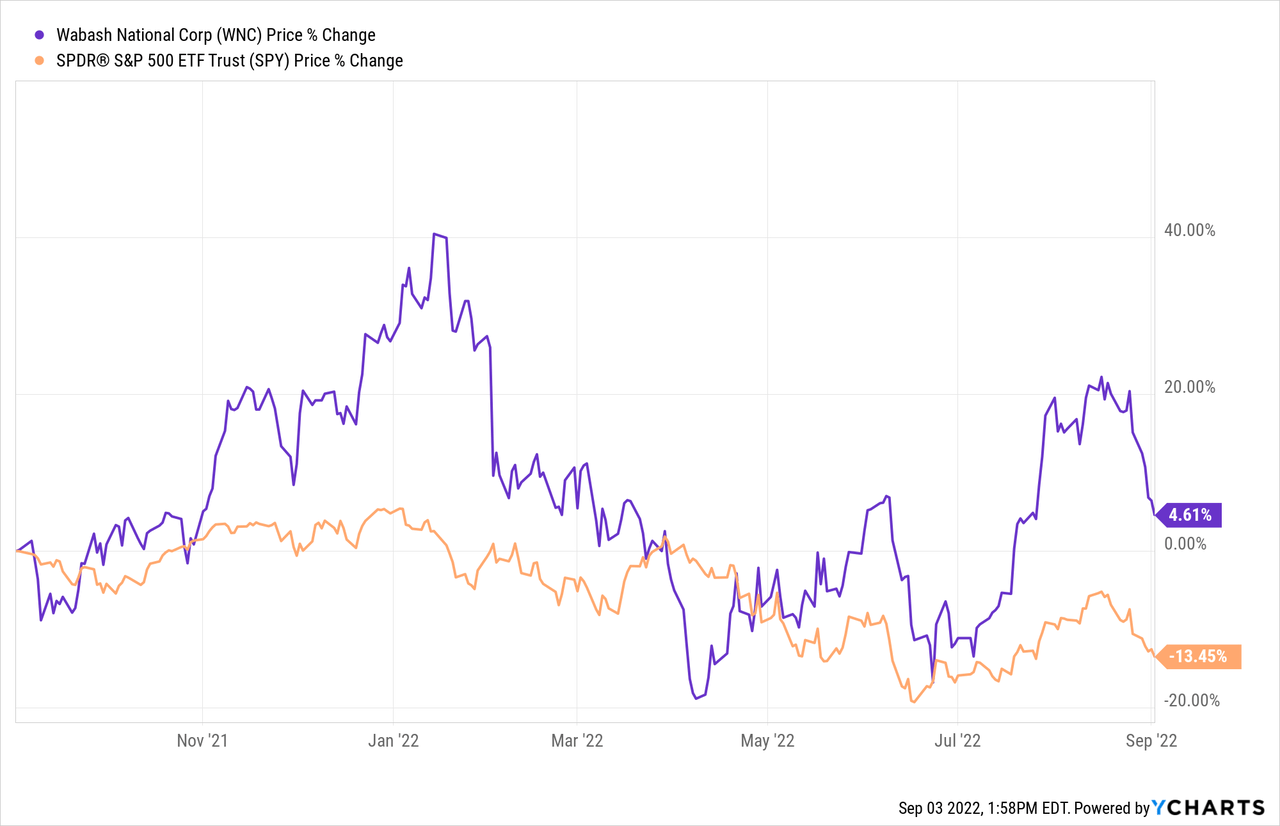

Looking back, however, the stock has outperformed the broader market by a wide margin over the last year.

Wabash is a cyclical, small-cap company, so the current underperformance for the stock price compared to the broader market should be expected given the backdrop but, looking forward, I plan to stay long WNC shares as I believe this small-cap company still has great long-term business prospects. Moreover, it helps that Wabash has what it will take to weather a storm, that is, cash and a strong balance sheet.

Investment Thesis

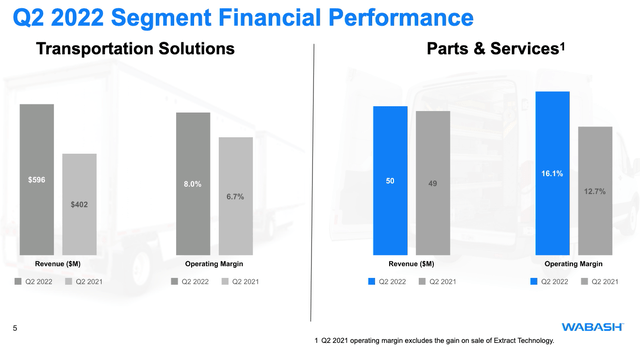

Wabash is a diversified transportation and logistics manufacturer with two main operating segments: Transportation Solutions and Parts & Services. The company completed several tuck-in acquisitions over the last few years to further diversify its business while management was also able to effectively navigate Wabash through the global disruptions created by the pandemic to better position the company for the future. To this point, Wabash is well-positioned to weather a downturn in the economy, if necessary, but the company also stands to benefit from a strengthening backdrop if the U.S. is able to avoid a significant downturn.

In addition, the long-term investments that management made over the last few years (i.e., funds that went toward infrastructure and working capital, and of course the acquisitions) are starting to bear fruit and should allow Wabash’s stock to outperform its peer group.

The Latest: Challenging Environment But Good Results

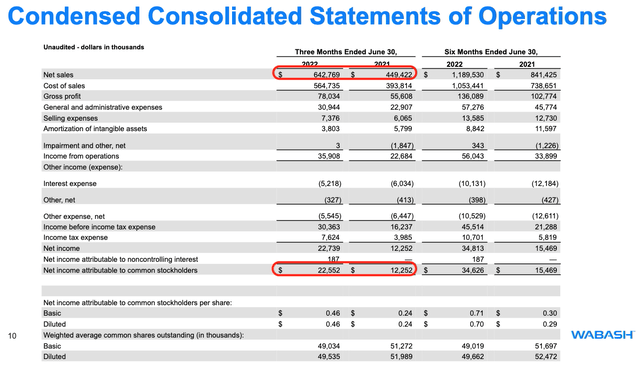

Wabash recently reported Q2 2022 results that missed on the bottom line but handily beat the consensus topline estimate. The company reported Q2 2022 EPS of $0.46 (missed by $0.01) on revenue of $642.8mm (beat by $23.5mm), which also compares favorably to the same period of the prior year.

Highlights from the quarter:

- Revenue increased by 43% YoY (acquisitions are coming into play).

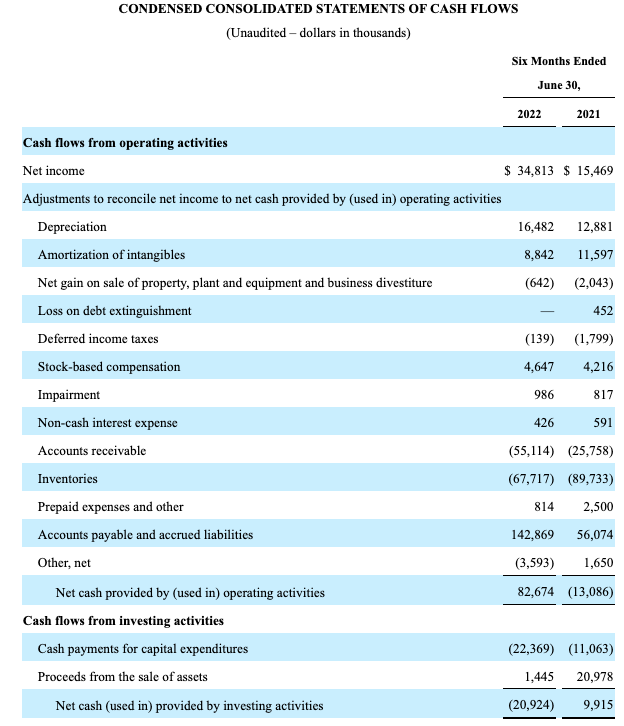

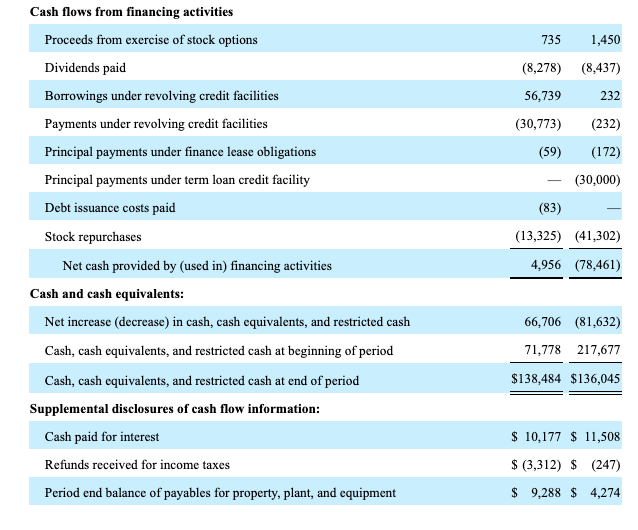

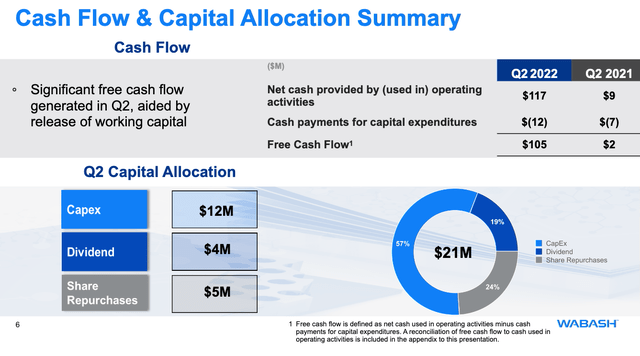

- Operating cash flow and free cash flow came in at $82.6 million and $105.0 million, respectively, which was significantly higher than the operating cash flow of $(13.1) million and FCF of $2.0 million reported for the year-ago quarter (more on this below).

- Backlog at the end of Q2 2022 was $2.3bn, which is a record and ~71% higher than the same period of the prior year.

The company reported strong(ish) results almost across the board, especially considering the challenging operating environment, as both operating segments had YoY revenue growth and expanding margins.

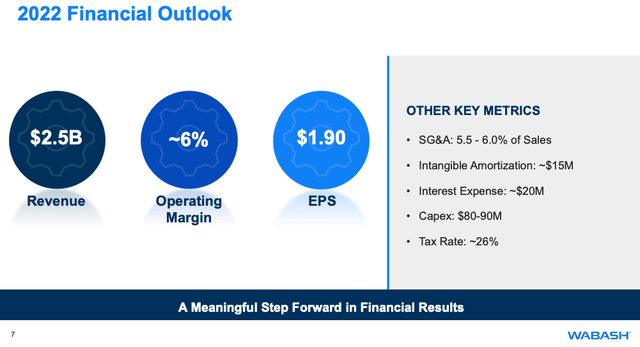

The company saw volume growth and improved pricing dynamics in the most recent quarter, but management did mention during the conference call that they viewed market conditions as largely being “mixed” as the team looks forward. That is, investors shouldn’t expect for Q3 and Q4 2022 to be anything to write home about. On the other hand, management still anticipates for the company to finish the current year strong with topline growth (largely fueled by previous acquisitions) and some margin improvement.

I do think it is important to remember that things could change (quickly) and management’s current guidance may eventually turn out to be too bullish. I say this because it is looking more likely that times may get tough for Wabash, and other small cyclical companies, as the economy continues to deal with several significant headwinds (global political tensions, high inflation, rising rate environment, etc.). However, any way you look at it, there was a lot to like about the Q2 2022 results (and management commentary). But, let’s not forget about what really matters at this stage of the business cycle, cash flow metrics and how the company is positioned, financially.

Cash Is King

Given the current U.S. recession fears, it makes sense why investors are keeping risk factors front of mind and asking questions about the company’s cash flow metrics and balance sheet strength (or lack thereof).

WNC shareholders can rest easy, in my opinion, as Wabash continues to improve its cash flow results. For example, and as mentioned above, operating cash flow was $82.6mm for the most recent quarter.

Q2 2022 10-Q Q2 2022 10-Q

Additionally, the company’s free cash flow significantly improved when compared to the year-ago quarter.

And the positive news doesn’t stop there, as management has worked hard since early 2020 to improve Wabash’s balance sheet.

The takeaways:

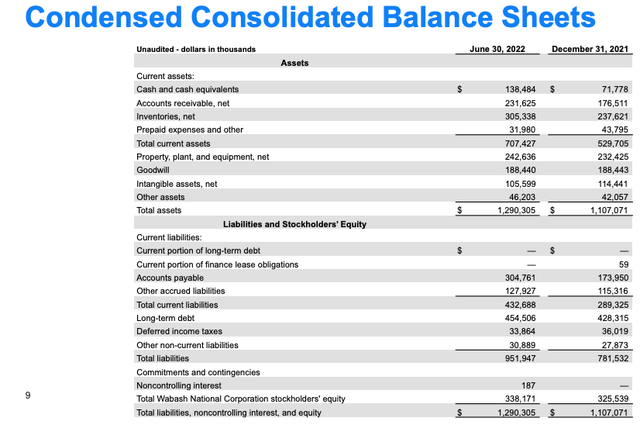

- Current ratio is ~1.6.

- No current long-term debt is due.

- Net debt of $316mm (down from $356mm at year-end 2021).

Something to watch as we move forward is the company’s growing accounts receivable, inventories and accounts payable balances. If a recession comes to fruition, investors may see Wabash’s need to write off amounts and/or report negative working capital dynamics that could impact the company’s cash flow metrics.

At the end of the day, Wabash is positioned to weather a downturn if the current recessionary fears turn out to be reality. Additionally, the company has a balance sheet that will allow management to navigate Wabash through potential business disruptions created by the macro environment.

Valuation

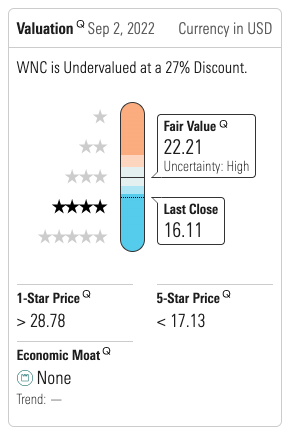

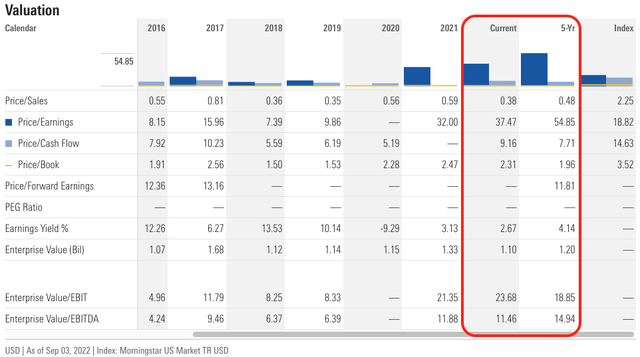

Wabash’s stock is trading well below its fair value (as determined by Morningstar).

Morningstar

Additionally, the stock is attractively valued based on several key metrics.

Investors should expect for Wabash’s stock to experience some volatility over the next few quarters, in my opinion, especially given the current environment, but I do believe that the risk is currently to the upside the longer you are willing (and able) to look out.

Risks

A U.S. recession will have a negative impact on Wabash’s business. More specifically, the company’s operations are heavily tied to economic activity, so its customers will likely purchase less of Wabash’s products and services if its business prospects appear to be declining. Therefore, a deep downturn would materially impact the stock price even at current levels. As such, investors should closely monitor current recession indicators because prolonged economic disruptions will cause downward pressure for Wabash’s stock.

Bottom Line

It is likely going to be a challenging operating environment for Wabash through at least the remainder of 2022, as the company contends with the uncertainty created by the many macro headwinds, but I believe this management team will be able to navigate this company through a potential downturn. Moreover, I believe that Wabash is currently positioned to create a tremendous amount of shareholder value once the macro environment gets on a more stable grounding.

It also helps the bull case that Wabash is well-positioned, from a financial perspective, as we look toward 2023 and beyond. As such, in my opinion, Wabash National should be viewed as a good long-term investment in the $15-$16 range, barring a significant downturn in the global economy.

Disclaimer: This article is not a recommendation to buy or sell any stock mentioned. These are only my personal opinions. Every investor must do his/her own due diligence before making any investment decision.

Be the first to comment