fotokostic/iStock via Getty Images

Investment Thesis

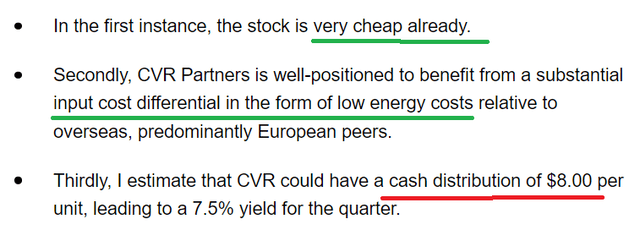

CVR Partners (NYSE:UAN) is a very attractive buy. In my previous article I noted the following:

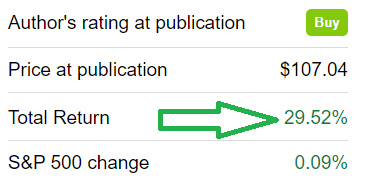

As you can see above, I made 3 arguments for why the stock was compelling. Since then we can see that I got two out of three points right.

The one mistake that I made was that I was too conservative with my cash distribution of $8.00 rather than the $10.05 that shareholders actually got in the end.

I believe that there are worse problems than building a margin of safety in my work.

Author’s work

Above is the return made on this stock in less than 90 days. Here’s why I rate this stock a buy, even now.

Why CVR Partners? Why Now?

UAN manufactures ammonia and urea ammonium nitrate (”UAN”) fertilizer products.

There are two main driven forces that are supporting the fundamentals for UAN. In the first instance, the Russian war and sanctions have materially impacted the amount of nitrogen fertilizer products reaching the market.

That has, to a large extent, been factored into the share price and I no longer believe that is where the bull case truly lies for this stock.

dtnpf.com

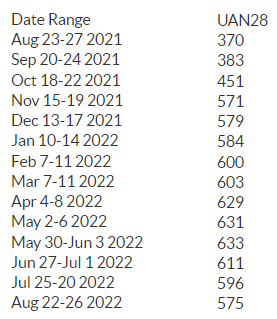

In fact, as you can see above, nitrogen fertilizer prices have already come down slightly as farmers start to push back against high fertilizer prices.

This is not where the bull case lies for UAN.

Where I believe the real bull case lies is in the second driving force. Natural gas prices in Europe have become sky high. There’s simply no way for European fertilizer producers to compete against US-based manufactured fertilizer.

Even if at the start of 2022 investors come to realize that, equity flows have pulled back and have migrated to other areas of the market. Why?

Because investors believed that since fertilizer companies had gone higher in the past year, they ”must” be fully priced already. However, I categorically argue that UAN is nowhere near fully priced. Here’s why.

With European natural gas prices so incredibly high, many companies are simply not able to operate at cost. It has got to the point where it costs more for companies to produce fertilizer, than the profits they make.

Up until very recently, European fertilizer companies were able to benefit from the very high nitrogen fertilizer prices available in the market. But in the last few weeks, this dynamic has changed, with European natural gas, the feedstock for nitrogen production going through the roof.

Consequently, this is the setup that we now find ourselves in. UAN is well positioned for higher fertilizer prices, while its main competitors in Europe simply cannot compete, as their input costs are too high.

This leaves US-based fertilizer companies with a large price advantage. And this nitrogen fertilizer company has a moat around its operations.

Your Cash, Coming Back, At Least +20% Annualized Yield

At the start of the article, I acknowledged that even though I’ve been vaguely right on my cash distribution assumptions from UAN, I have admittedly been too conservative.

Nevertheless, I do not plan to make a knee-jerk assumption leading to faulty future cash distribution. I prefer to continue to work with a margin of safety.

As a reminder, in my previous article, I said,

I believe that when CVR Partner reports its Q2 earnings, its balance sheet will have moved closer to $250 million of net debt.

This figure turned out to be too aggressive. As it stood at the end of Q2, net debt was in fact $394 million. That being said, management said on the call,

We are not currently planning to pay down any additional debt in the near term.

Consequently, we can see that UAN will now favor returning shareholders’ capital, rather than repaying debtors.

Furthermore, we know that there’s been a late season farming this year, because of the weather conditions.

Consequently, this implies that Q3 should at least see $80 million of net income, approximately double the net income of last year.

This figure is supported by the fact that nitrogen prices are approximately 50% higher than this time last year, despite nitrogen prices coming down in the past month.

Meanwhile, farmers continue to take advantage of very high food yields and buy fertilizer on dips to rebuild inventory for the upcoming season.

UAN Stock Valuation – Less Than 4x Net Income

As mentioned above, UAN has a moat around its operations. Its moat comes from the fact that its European-based competitors simply can’t compete against UAN as it costs European peers too much to produce nitrogen-based fertilizer.

With this in mind, paying less than 4x this year’s net income is simply a really low valuation for what’s on offer.

Here’s the assumption. UAN’s net income reached approximately $211 million during H1 2022. I estimate that Q3 2022 could make around $80 million, while Q4 could probably report $110 million. Altogether, this would see $400 million.

Given what we’ve discussed in terms of high and stable UAN32 prices, together with lower natural gas prices in the US giving UAN a moat around its operations, I believe that we are going to see UAN reporting at least as good an H2 as H1 2022.

However, in my calculations above, I’ve built in a margin of safety, so the actual figures for H2 that I projected are slightly lower than H1.

Altogether, I believe that UAN will see a net income of around $400 million in 2022.

This puts the stock priced at less than 4x net income.

The Bottom Line

UAN is a cyclical fertilizer company. Typically, you don’t want to pay low multiples to earnings for commodity companies, because that normally means peak earnings.

However, that’s not the case here. Not only are nitrogen fertilizer prices still very strong, but US-based companies have a strong moat around their operations.

There’s no getting around the fact that the US is very well positioned to embrace a high energy input cost deferential that puts North American companies at a very strong competitive advantage compared with Europe.

Paying $130 for UAN and getting around $8 of cash distribution, or 24% annualized dividends, is simply very attractive in this market.

Be the first to comment