Avalon_Studio

Despite its dominant brand identity, Caterpillar (NYSE:CAT) stock is overlooked by many investors. The asset hosts tremendous ex-post returns and a compelling dividend profile, which places it in the upper echelon of investable securities.

Despite the stock’s solid historical performance, recession risk remains high, and Caterpillar’s cyclical attributes are worrisome. As such, we untangled the stock’s prospects to settle a necessary debate; here’s what we discovered.

10Y Total Return (Seeking Alpha)

Issues At Hand

Cyclicality Playing A Role

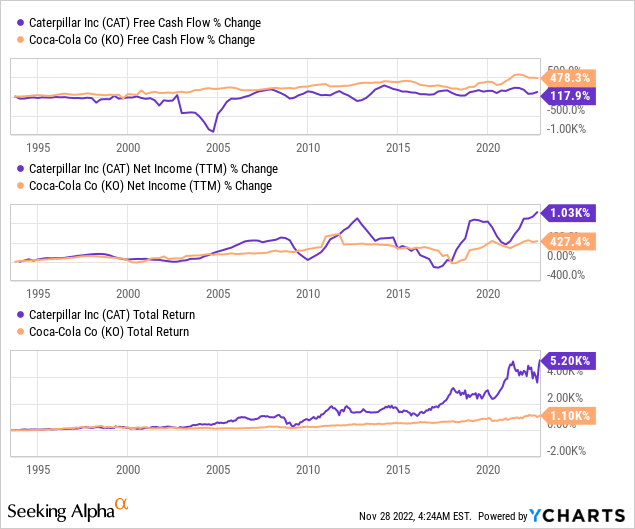

Caterpillar forms part of the industrial sector, meaning it possesses excess sensitivity to the economic cycle. Thus, the company’s stock is what’s called a cyclical asset. My claim is corroborated by observing the company’s net income, free cash flow, and stock price movements relative to Coca-Cola (NYSE:KO), a countercyclical consumer staples stock.

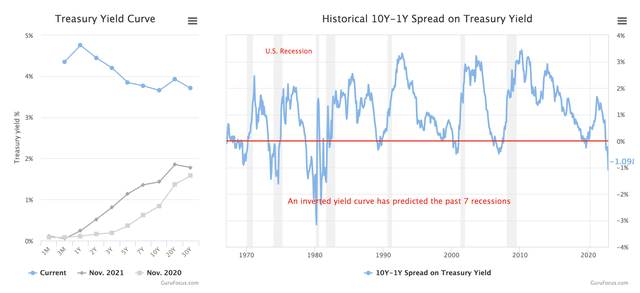

The yield curve and qualitative research suggest we could be heading into a global recession in 2023, which might leave cyclical assets exposed. The yield curve’s inversion implies policymakers will need to apply expansionary monetary policies in the medium term due to the risk of severe demand destruction. Furthermore, factors such as the war in Ukraine, hyperinflation in areas like Turkey and Argentina, the energy crisis in Europe, and global geopolitical tension could dent industrial production in the coming years due to waning household balance sheets.

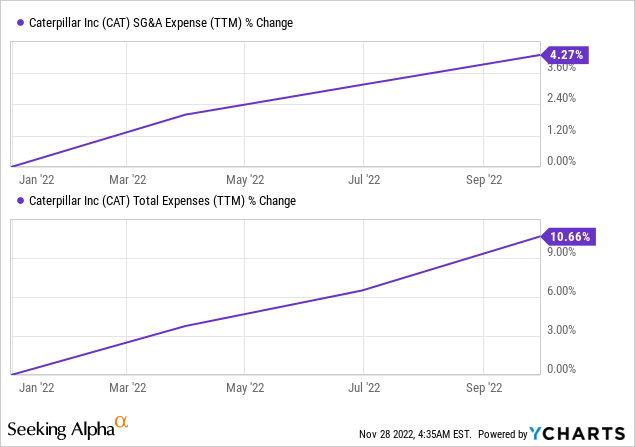

Caterpillar stock is severely exposed to supply-side inflation. The company revealed a staggering 20.95% year-over-year growth in its latest report; however, the firm’s expenses rose significantly as global price level growth remained resilient. Sustained inflation could result in demand destruction for Caterpillar while costs remain elevated, leading to a fading income statement.

Valuation Concerns

At face value, the company possesses relative valuation concerns. In fact, Caterpillar recently fell subject to a valuation-driven downgrade from UBS (NYSE:UBS). According to the investment bank, Caterpillar could face valuation headwinds amid rising interest rates and subsequent margin compression.

UBS’ argument is largely objective and has a reasonable basis, as Caterpillar’s price multiples seem elevated. However, the majority of Wall Street analysts anticipate staggering earnings-per-share growth in the next three to five years, which could justify elevated multiples.

| Price-to-Earnings | 18.56 |

| Price-to-Book | 7.87 |

| Price-to-Cash Flow | 19.05 |

| EPS Growth Forecast 3-5 Years CAGR | 13% |

Source: Seeking Alpha

The EPS ratio plays a key role in determining a stock’s fair value, thus, prompting us to expand on the topic.

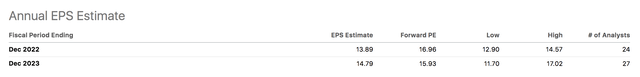

The diagram below is a summation of analysts’ EPS consensus. We interpolated the two estimates to determine a 12-month EPS as of Q3 2023 and discovered a figure worth 14.57x. By utilizing an expanded price-to-earnings forecasting model, which multiplies expected EPS by the 5-year average PE, we determined a Q3 price target worth $273.91, deeming Caterpillar undervalued at its current market price.

Analysts’ EPS estimate (Seeking Alpha)

Positive valuation feedback demands further analysis of Caterpillar stock as it contradicts various bearish fundamental underpinnings.

What Sets Caterpillar Apart?

Sustained Demand As An Industry Leader

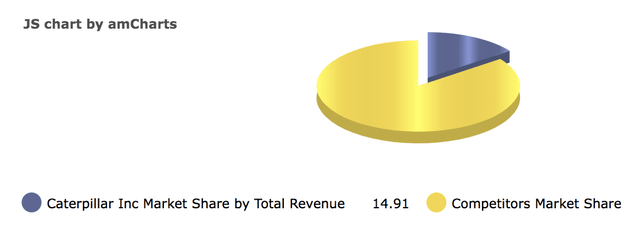

According to CSI Market, Caterpillar hosts nearly 15% cross-segmental market share, conveying its robustness. As previously mentioned, industrial companies exhibit excess sensitivity to the economic cycle; however, firms with large market shares often exert pricing and bargaining power to sustain profitability in woeful economic periods. As such, Caterpillar could stroll through trying times with minor damage inflicted.

Caterpillar Market Share (CSI Market)

Promising Commercial Developments

Caterpillar is ‘earning today’s currency’ by delving into the electric truck space. In recent years, the mining industry has been criticized for its environmental implications. Thus, the sector has consciously explored renewable energy solutions, and a key consideration is battery-powered trucks.

Caterpillar recently demonstrated a battery-powered truck at its Green Valley test site, which has received early support from mining companies. According to Denise Johnson (A Group President): “Our global team came together to develop this battery truck at an accelerated pace to help our customers meet their sustainability commitments,”.

We believe an early pivot into the electric truck space could cause Caterpillar’s broad-based market share to surge amid political pressure on industries to adopt environmentally friendly procedures.

Recent Q3 Earnings Beat

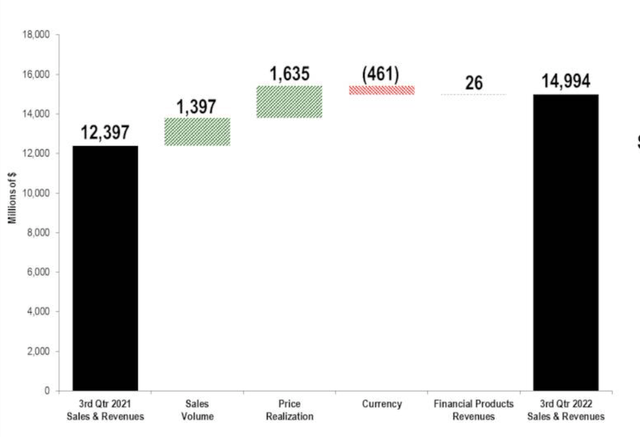

Caterpillar beat its third-quarter earnings target comprehensively, revealing an earnings-per-share beat of 78 cents per share and a revenue triumph worth $619.93 million.

Much of the company’s quarterly success was driven by year-over-year growth in price realization and higher sales volumes. Despite a strengthening dollar, the company experienced a loss in quarterly FX translation, which we believe can be backed out of its core earnings.

Cross-segmental performance remains robust. Firstly, the company’s construction profit surged by 40% during the past year amid higher demand. However, investors must take notice that much of the surge in profits was due to higher price realization in Latin American nations, struggling with extraordinarily high inflation.

Resource industries experienced an 81% year-over-year surge in profit. Proliferating profits. Higher manufacturing costs and generally input expenses were trumped by robust demand.

Since last year, the firm’s energy and transportation profits have skyrocketed by 32%. We believe post-pandemic lockdown oil and gas maintenance and upgrades demand contributed to the segment, which could be a sustained phenomenon amid energy shortages in the EU that need to be attended to with higher production.

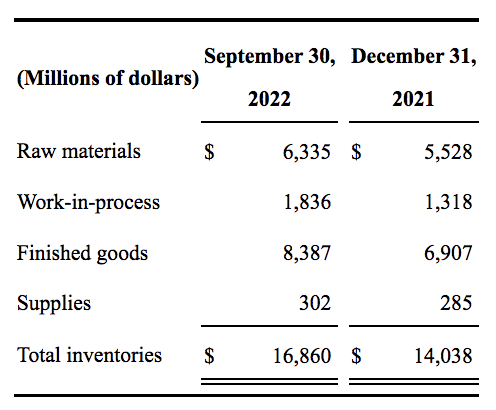

Furthermore, broad-based microeconomic aspects point towards continued growth in sales. A company’s inventory provides much insight into its demand expectations. For instance, Caterpillar’s build-up in raw materials and work-in-process inventory indicates that the company expects robust demand leading into 2023.

Investors should consider the other side of the pendulum: companies have stocked up amid supply-chain skepticism. Nonetheless, we consider Caterpillar’s inventory build-up a positive.

Caterpillar 10-Q

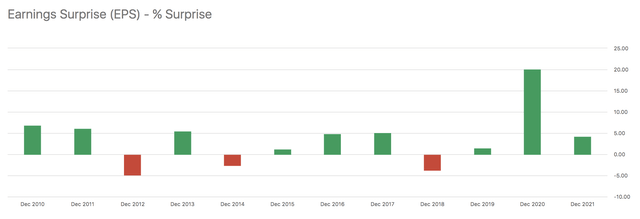

Lastly, Caterpillar exhibits evidence of sustainable positive earnings surprises. On top of that, a favorable Beneish M-score of -2.47 indicates conservative accounting measures, suggesting the company could smooth earnings in prospective quarters, leading to further accrual-based earnings beats.

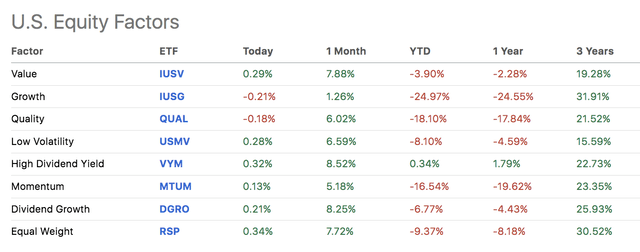

Factor Positives

Successfully assessing key variables requires a parsimonious vantage point, which factor analysis provides. This year has taught us that investors prefer high dividend-paying, low volatility, and value stocks during uncertain market circumstances.

We believe 2022’s zeitgeist will resume into 2023 amid recession risk, resulting in the same pockets outperforming the broader market. Fortunately for Caterpillar investors, the stock aligns with a risk-off market as it exhibits low volatility and dividend growth attributes.

Caterpillar’s low beta coefficient (0.91) means its sensitivity to the broader stock market is low, thus, presenting investors with a risk-off bet. Despite its low beta, investors need to keep in mind that Caterpillar operates in a cyclical industry, attaching excess recession risk to its stock.

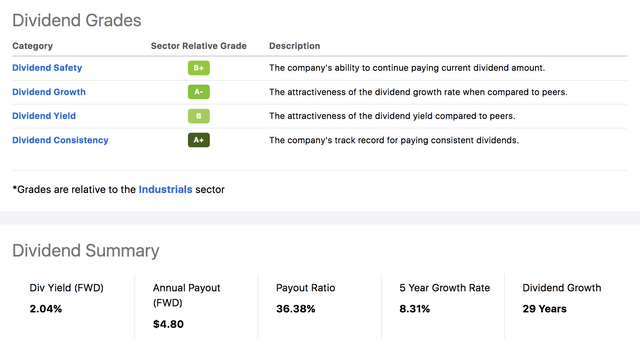

Another attribute that could act in Caterpillar’s favor is its dividend profile. According to Seeking Alpha’s data, the stock’s dividend is both lucrative and sustainable. As previously mentioned, dividend stocks generally provide hedging properties during uncertain economic times.

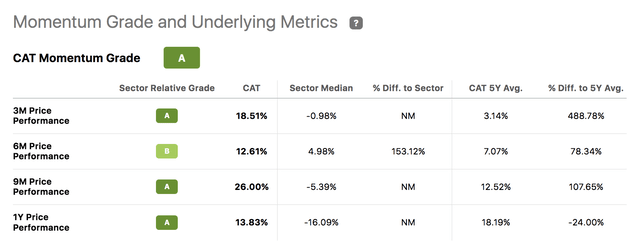

Lastly, Caterpillar could benefit from the momentum anomaly as it has exhibited cross-sectional momentum during the past twelve months. As such, a herding effect could settle in, causing the stock to outperform the broader market in 2023.

Concluding Thoughts – Buy Rating Assigned

Although recession risk remains high and Caterpillar’s cyclical exposure is a significant risk, the company possesses certain “best-in-class” qualities that could see its stock rise throughout 2023. The firm’s robust market share, innovation initiatives, and dividend profile might bolster its demand over the next twelve months.

Be the first to comment