Leonid Ikan

PDC Energy (NASDAQ:PDCE) is an upstream operator with primary operations in rural Weld County Colorado. Colorado has had some issues with rapidly growing populated areas bumping into oil and gas operations with some less than stellar results.

The result of the rapid population growth has been the need to adjust both where populations can grow combined with the necessity to update oil and gas operations. Some of us covered for several years how operators were properly abandoning old wells that were never used after acquiring some of these properties so that the development of the property for other use became safe.

What was once considered allowable practice to simply “leave the well there” and move onto other prospects became dangerous from population growth. New abandonment techniques were needed to deal with that growth. Plus, Colorado had some of the oldest regulatory laws on the books that were just not adequate at the time. That regulation has been updated without a lot of the fears that were mentioned at the time. Still, it helps to operate far away from the large, populated areas which is exactly what this company does.

Weld County

Location is everything in this industry. This company has the location to bypass a lot of market assumed fears about operating in Colorado. As a result, the company stays out of the headlines. At least so far, the implemented safety measures keep the company out of the headlines. That reduces a whole lot of costs that the market fears when companies operate in this state.

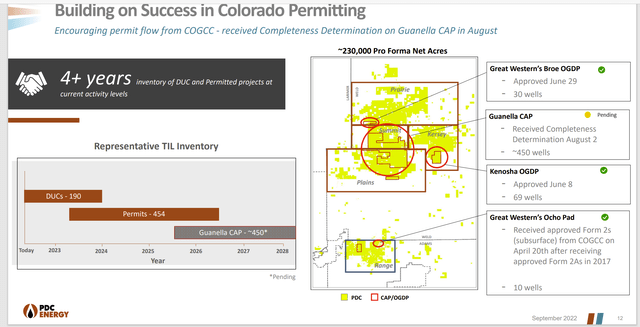

Summary Of PDC Energy Land Holdings And Permitting Success In Colorado (September 2022, Conference Presentation By PDC Energy)

As this part of the presentation demonstrates, the permitting process is more than reasonable. As shown above, this company has no trouble getting the permits approved to keep operations moving. Weld County is very supportive of the oil and gas industry. There are little to no fears from the local population when there is plenty of room for both the industry and people to exist without bumping into each other.

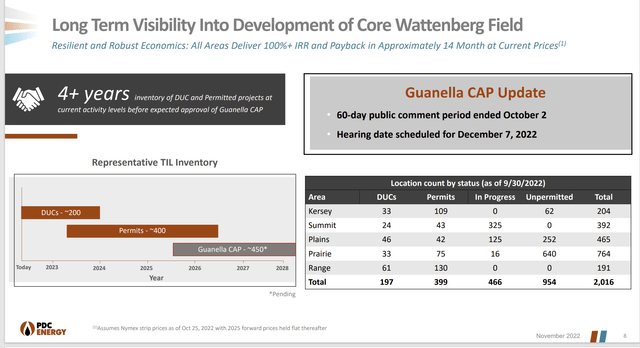

PDC Energy Third Quarter Update Of Permitting Process (PDC Energy Earnings Conference Call Presentation Third Quarter 2022)

Shown above is a later and slightly different take on the permitting process. Weld County does support the industry. So, there is not the holdup and sometimes extra work that can be expected elsewhere.

Weld County also has some of the more profitable acreage in a very low-cost basin in Colorado. The last boom part of the business cycle had the industry running into natural gas processing constraints that limited growth. So far that has not been an issue. But should rapid growth resume, then natural gas processing could again become an issue.

This is a basin with substantial natural gas production along with oil and liquids. The low costs that are part of production in this basin are very competitive with dry natural gas production combined with the advantage of significant oil and liquids production for a more valuable production mix. That feature makes this one of the lowest cost production basins in North America without the high acreage cost seen elsewhere like the Permian.

The Permian

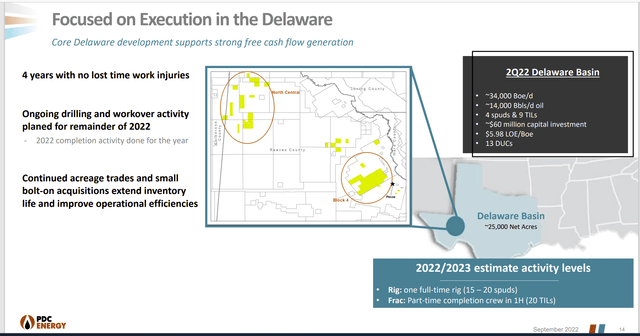

This company also has a smaller operation in the Permian Basin.

PDC Energy Summary Of Permian Operations (PDC Energy September 2022, Corporate Presentation For Conference)

The acreage position in the Permian is about one-tenth the amount of the acreage in Colorado. Still, the company managed to get acreage with lease operating expenses comparable to the Colorado acreage while obtaining a production mix that is at least as valuable a production mixture due to the oil and liquids percentage.

Both acreage positions will materially benefit from the ability of North America to increase the exports of natural gas and related products to a very strong (pricing) world market. As that export ability increases, North America is very unlikely to see the low prices of the last decade ever again because the world market has a pricing cycle that is generally higher.

Acquisition Strategy

This company, like many I follow, has a long-term strategy to be a consolidator. In May 2022, the company completed yet another acquisition in its major areas of operations.

Much of the industry believes it is cheaper to buy growth than to organically grow. Part of this is due to the market demand for returning capital to shareholders. That demand came about from the sizable oil price decline in 2015, the aborted recovery of 2018, and the final huge price-earnings ratio collapse of 2020 (which the industry has still not recovered from).

The market did not realize that there had been a change in industry conditions from the chronic production shortages that led to high prices until 2014. Therefore, money poured into the industry in 2018 when the need for new supplies was nothing like prior years. That led to a very fast recovery cycle followed by some severe punishment during the covid challenges.

But this company, like others with a strong balance sheet has found a way to grow earnings per share through accretive acquisitions using a mixture of stock and debt. That strategy is likely to continue until Mr. Market realizes that it is ok for the industry to grow production. What is not ok is for speculative money for stock and debt with no industry experience coming into the market to finance unprofitable projects. Those investors lost a lot of money in both 2019-2020 and 2015. As long as that money is not there, then the normal recovery cycle of the industry will prevail.

Balance Sheet

This is one of the stronger upstream operators in the industry.

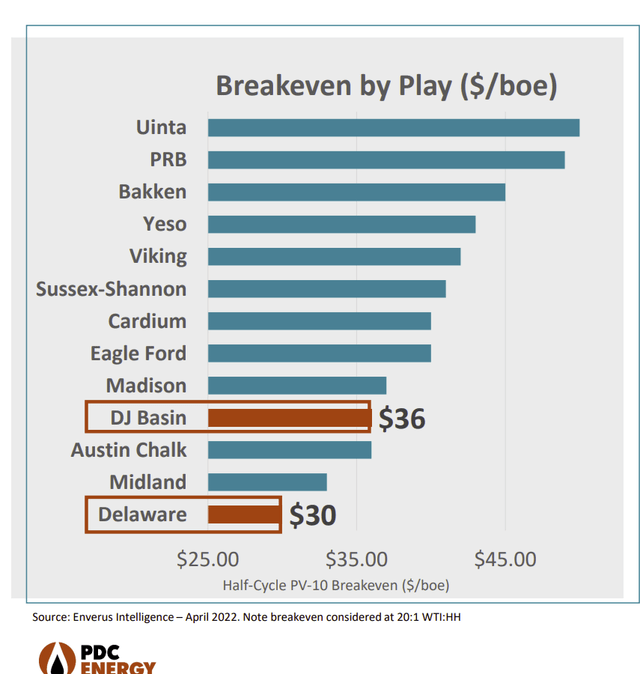

PDC Energy Presentation Of Breakeven Points By Basin (PDC Energy September 2022, Corporate Presentation For Conference)

One of the reasons for the strong balance sheet is the low breakeven points for wells shown above. That makes for generous cash flow at more commodity pricing points than is the case for many competitors. The breakeven is dependent upon the mixture of prices received for several commodity products because this company produces significant amounts of liquids and natural gas along with oil. That breakeven price shown is a weighted average price.

This company is influenced by natural gas prices more than competitors with larger oil percentage of production mix. That is also going to influence the position of the basins in the chart shown above. Because of the significant natural gas production, the company breakeven pointed has benefited materially from the rise in natural gas prices because that meant a lower oil price was needed to reach the breakeven point.

Companies that are primarily oil producers or dry gas producers are dependent upon one price. But a company like PDC with a mix of production products is really dependent upon a matrix of prices. The breakeven needed for any one price is materially dependent upon the prices received for other products in the production mix. That makes breakeven comparisons a little misleading.

The Future

This company has a lot of options because its production mix allows for good profitability in a wide variety of industry conditions. The consolidator strategy is likely to be maintained well into the future. That is going to allow for per share profit and cash flow growth in an industry that is really not growing much right now.

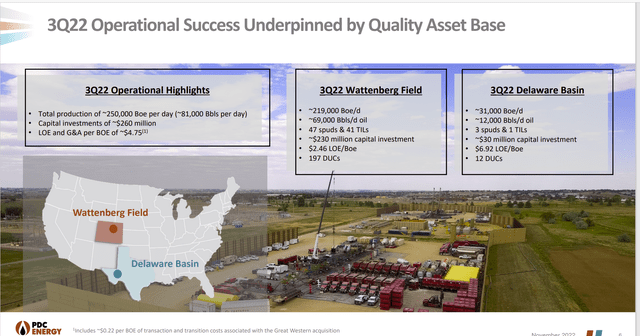

PDC Energy Summary Of Third Quarter Operating Results And Map Of Operation Locations (PDC Energy Third Quarter 2022, Earnings Conference Call Slides)

This company already has enough cash flow for the amount of debt shown with three months of the fiscal year left to go. That means that future refinancing is easily accomplished even during industry downturns.

The projected cash flow is about one-third of the market cap. That is typical of large swaths of the industry at the current time. The location in Colorado is unusually good. Therefore, this company is very unlikely to encounter some of the industry issues in the more urban counties.

But those kinds of headlines may keep this company cheap. Mr. Market may at some point figure out that the situation of this company is different. It is far more likely that this company will be acquired by a more diversified operator that the market will not punish as much for operating in Colorado.

I think in time, the market will come to realize that Colorado has moderate rules (nothing close to the rules in the Northeast for example) in which the industry can operate adequately. But it is going to take some time for that realization to come about. In the meantime, this is one of the better bargains in the industry.

Be the first to comment