THEPALMER

Wabash National Corporation (NYSE:WNC), founded in 1985 as a dry van trailer manufacturer, with continuous development has become an innovative leader in the transportation, logistics, and distribution industries, which designs and manufactures a wide range of transportation solutions, such as dry freight and refrigerator trailers, platform trailers, and tank trailers, along with various transportation and distribution industry related equipment.

Over time, with strategic acquisitions, long-term growth vision, and continuous innovation, the company has attained a leadership position in the industry, which provides substantial negotiating power over the customers.

Also, to increase operating efficiency in 2020, the company developed a one-Wabash transformational plan. The company changed its alignment of the operating segments and established transport solutions and parts & services as two main reporting segments. In 2022, the company rebranded its brand portfolio to Wabash and significantly shifted its branding strategy, which might help it strengthen its brand in the upcoming years.

Also, focusing on strengthening the leadership position with a purpose-driven growth strategy has been helping the company to expand its business reach. And as per the management, the company’s focus on providing innovative solutions to first, middle, and final markets might provide the company with significant profit margins and adaptability.

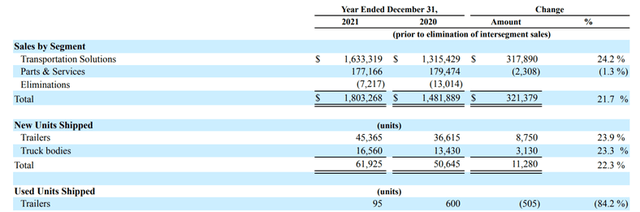

Reporting segments (Annual report)

Although the business model is substantially strong with considerable future growth prospects, various risks can affect the stock price in upcoming quarters. In my view, the stock is trading at a considerably higher valuation, which might be due to recent growth in the logistic segment, but the company operates in the cyclical industry, and any sign of a cyclical downturn might affect the stock price. Therefore, despite the robust business model, I assign sell ratings due to its higher valuation and cyclical operations.

Historical performance

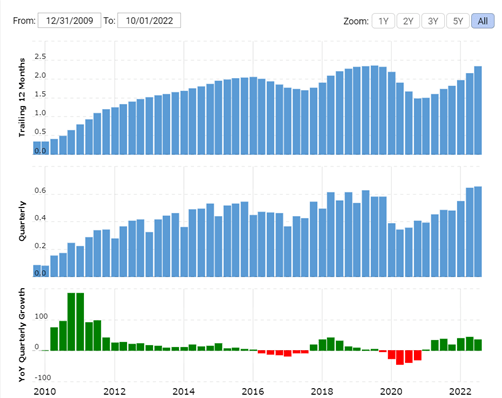

Revenue growth (macrotrends.net)

Over the period, revenue has seen significant fluctuations, from all-time high levels of $2.3 billion in 2019 to a considerable drop of approximately $1.5 billion by 2020; even in the last year, the company could not reach its 2019 levels. Although the net profits have been significantly volatile, the company has generated significant profits in the last ten years. Still, in the previous two years, as a result of covid related backdrops and an inflationary environment, the revenue and profitability have been affected significantly. But in the last nine months, revenue and margins seem to improve consistently.

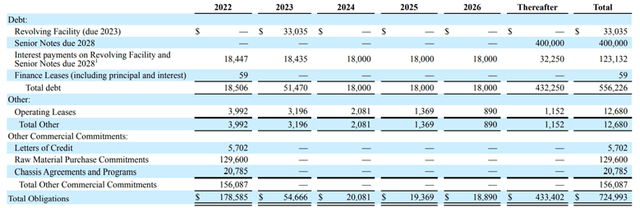

It should be appreciated that management’s buyback efforts have produced huge value for the shareholders. And as a significant amount of money has been infused in the working capital, the company has dependent on debt obligations to manage it; as a result, debt has been at considerable levels over time but having significant liquid assets provide the business model significant stability. Currently, as a result of supply chain constraints, inventory levels have risen to higher levels. As the condition stabilizes, the working capital levels might reach normal levels, which might help the company reduce its long-term debt.

Finally, the company has produced significant cash flows for a very long time, which shows the business model is substantially robust. However, the CFO in the recent quarter has dropped consistently due to higher working capital requirements; the company could produce massive cash flows going ahead. Generated cash has been used for CAPEX, acquisition, and share buybacks, resulting in desirable business growth and significant expansion.

Strength in the business model

Having a solid financial position provides substantial stability to the business model.

Growth-oriented management

Over time, management has positioned the company to capture the growing transportation and logistics industry through marketing and innovating various products such as EcoNex and Wabash cargo. Their focus on expanding to higher-margin products might bring significant value to the company in the upcoming years.

Strategic Capital allocation

With time, the company has entered into various acquisitions, such as the acquisition of supreme industries, which has helped the company expand its business reach. Furthermore, management’s focus on maintaining debt levels, higher spending on research and development, and opportunistic buybacks have made massive value for investors. Also, the efficient capital allocation has led to a significant gain in market share.

The company has also announced the Walk in Cargo van launch by 2023 to provide home delivery solutions, which might bring significant revenues for the company.

Strong financial position

Due to adverse economic conditions, various companies have been facing significant trouble refinancing debt facilities. In the case of Wabash, the company has significant liquid assets along with moderate debt, which provides substantial financial stability. As the supply chain issues resolve, the company could free up significant cash from working capital which could be used to pay the debt.

Risk factors

The company’s operations come in the transportation and trucking industries, which are subjected to significant cyclical fluctuations. Therefore, the company’s revenue is expected to fluctuate as per the industry, which might affect the company’s profitability.

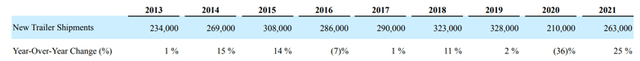

Trailer shipment (annual report)

Current revenue growth and profitability might not be sustained in the future; in the last few quarters, demand for shipments have increased significantly. As a result, the margins increased substantially, but the cyclical nature of the business and increased competitive pressure might affect the company’s margins. As the shipments have been volatile historically, in the future such volatility might affect the business performance.

Also, the stock has recently reached multi-year high levels, and from this price point, the stock might not give considerable returns. And there comes a significant risk of correction if margins get affected.

Recent development

Quarterly results (Quarterly reports)

Despite the significantly increased raw material cost, labor cost, and supply chain issues, the company has seen significant revenue growth and profitability growth in the latest quarter due to higher shipment activity and higher pricing.

Also, management has announced the launch of an acutherm portfolio of solutions for intelligent thermal management used in cold chain transportation. The company has also made investments to expand the manufacturing capacity of EcoNex, which will help the company drive revenue in the upcoming years.

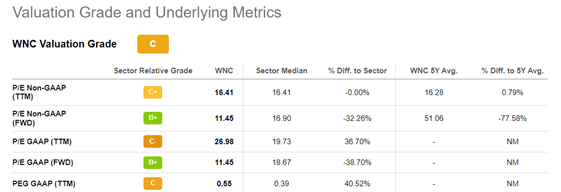

Valuation metrics (seeking alpha)

Although in the recent quarter, profitability has improved significantly, which is primarily attributed to increased shipments, in the future these margins might not be sustained. Also, currently, the company has been trading for $1.18 billion. In contrast, the net profits generated in the last nine months are about $70 million, which shows that the company has been trading for more than 16 times its nine months’ earnings; Such a valuation for a slow-growing cyclical stock does not provide any margin of safety. From this point, the stock may not produce any desirable returns for the investors. Therefore, I assign sell ratings.

Be the first to comment