kaptnali/iStock via Getty Images

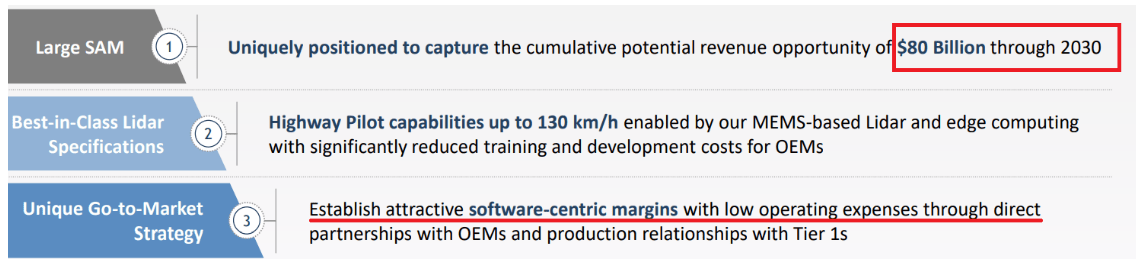

MicroVision, Inc. (NASDAQ:MVIS) expects to see its revenue grow from less than $11 million in 2022 to more than $2 billion in 2030. The target market is also expected to grow to approximately $80 billion by 2030. In my view, with a significant number of patents, MicroVision will likely be among the successful competitors in the automotive lidar market. I do see risks from the current concentration of clients and lack of many suppliers and manufacturers. With that, in my view, the market does not seem to be fair with MVIS. I believe that the fair price could be close to $8.22 per share.

MVIS: Massive Market And Massive Clients

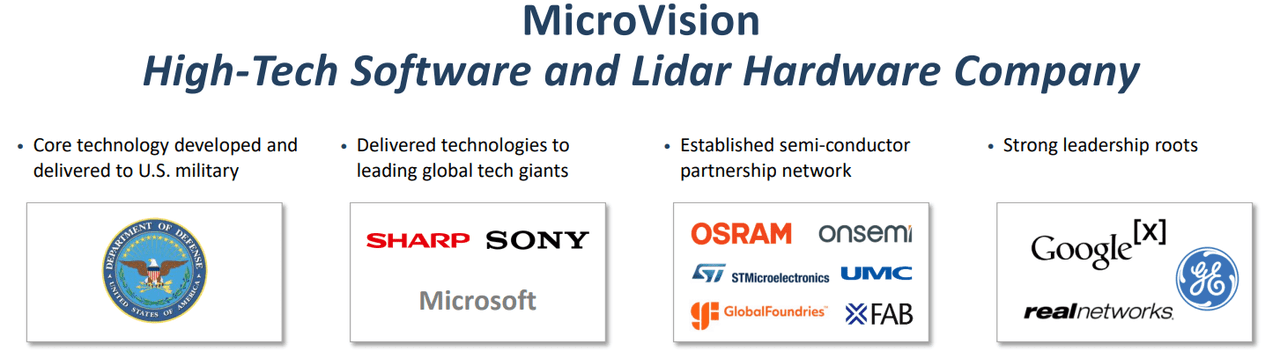

MicroVision, Inc. offers automotive lidar and advanced driver-assistance systems, and reports links with massive tech giants and U.S. military.

Source: MicroVision 4Q21 Earnings Deck

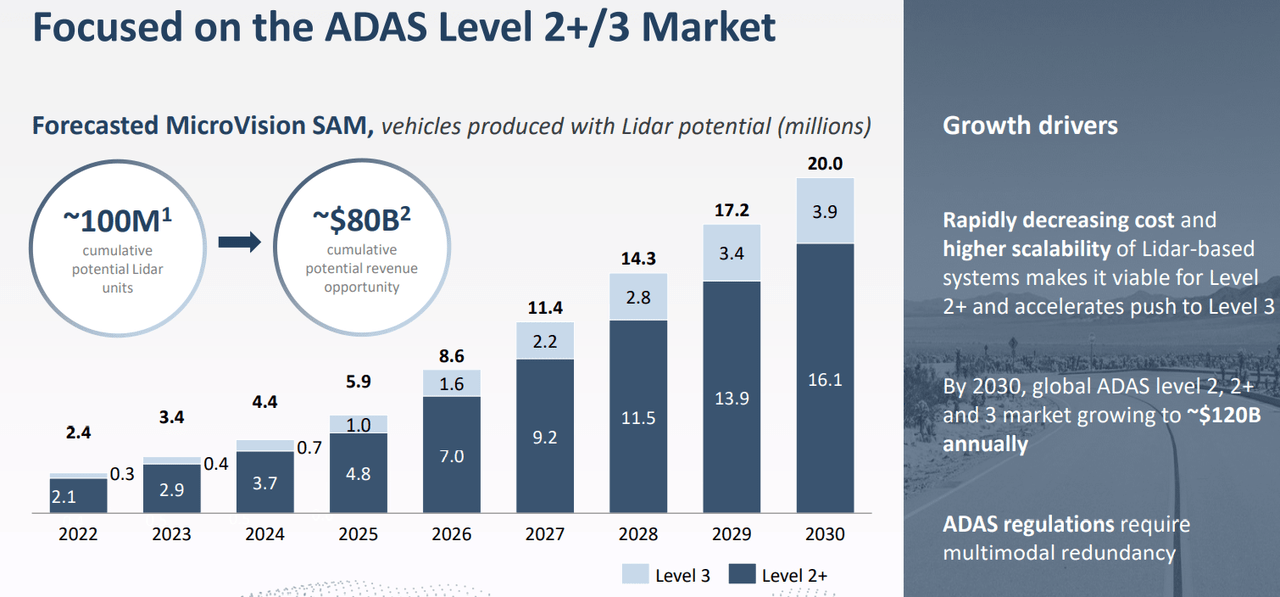

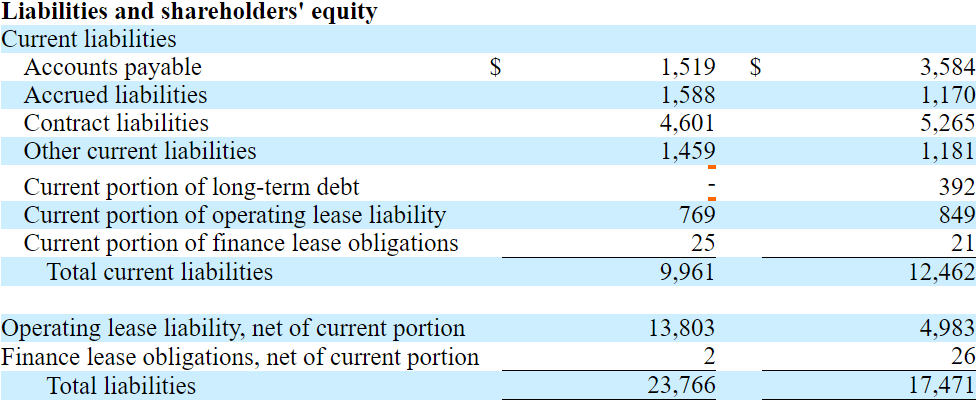

I believe that MVIS is interesting because the revenue opportunity is expected to grow massively until 2030. Decreasing costs and higher scalability will likely play a role in the growth of the market. Among all the information given in recent presentations to investors, the following slide is what matters the most.

Source: MicroVision 4Q21 Earnings Deck

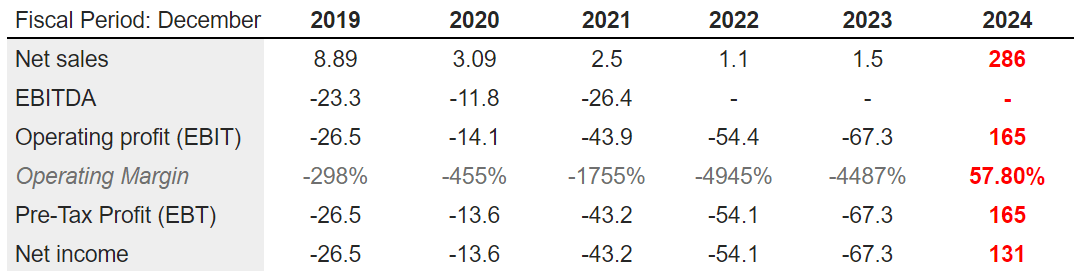

Expectations From Analysts

I believe that the work of other analysts reveals significant business potential. Analysts expect 2024 net sales of $286 million with 2024 operating profit of $165 million, together with an operating margin of 57.80%. In addition, 2024 pre-tax profit would stand at $165 million, and 2024 net income would be $131 million. In 2022, the company is expected to deliver negative net income, but the numbers for the year 2024 seem quite attractive.

Source: marketscreener.com

Balance Sheet

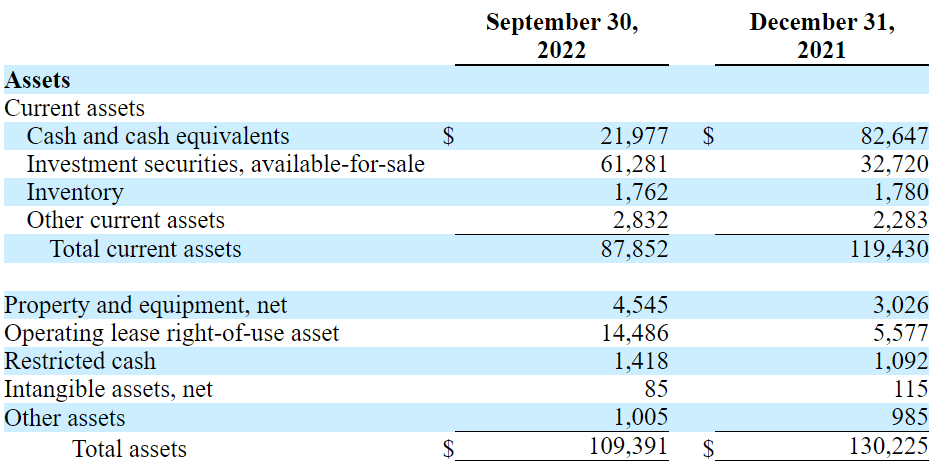

As of September 30, 2022, MVIS reported cash worth $21.977 million and investment securities of $61.281 million. Total current assets stand at $87.852 million, almost 9x the total amount of liabilities.

With property and equipment worth $4.545 million and operating lease rights of use assets of $14.486 million, total assets stand at $109.391 million. The asset/liability ratio stands at close to 4x, so I would say that the balance sheet stands in good shape.

Source: 10-Q

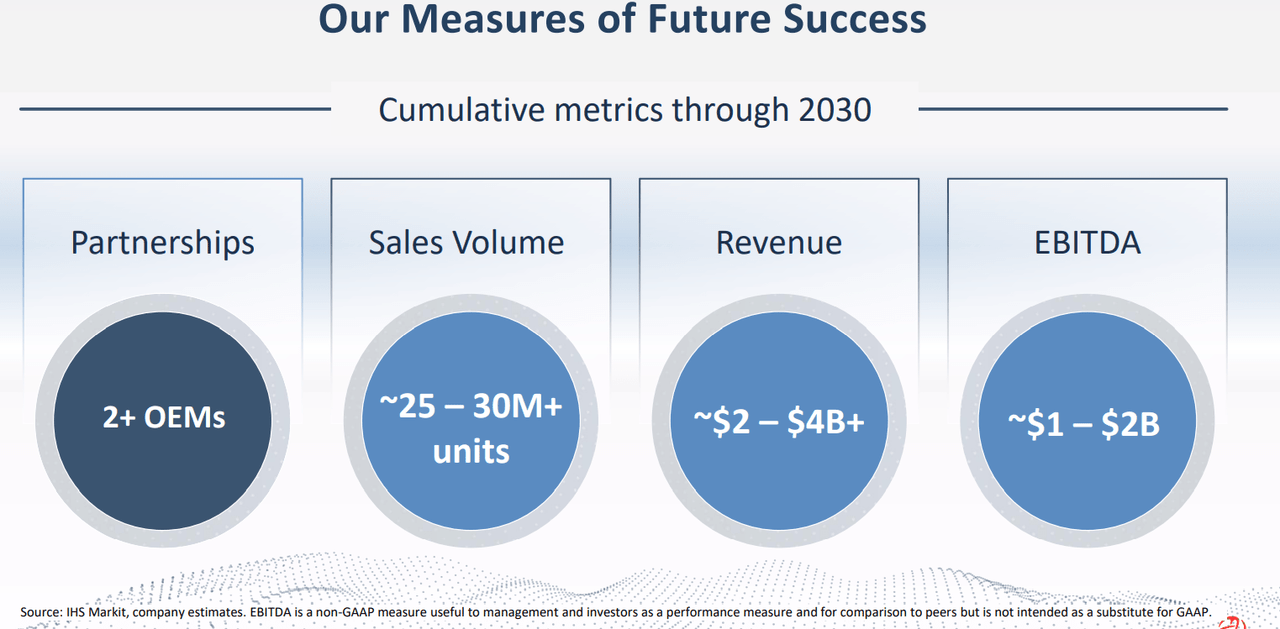

The liabilities include the accounts payable worth $1.519 million along with accrued liabilities of $1.588 million. In addition to contract liabilities of $4.601 million and other current liabilities worth $1.459 million, total current liabilities were equal to $9.961 million. Finally, with other operating lease liability worth $13.803 million, total liabilities stand at $23.766 million. I believe that the list of liabilities will likely not worry investors.

Source: 10-Q

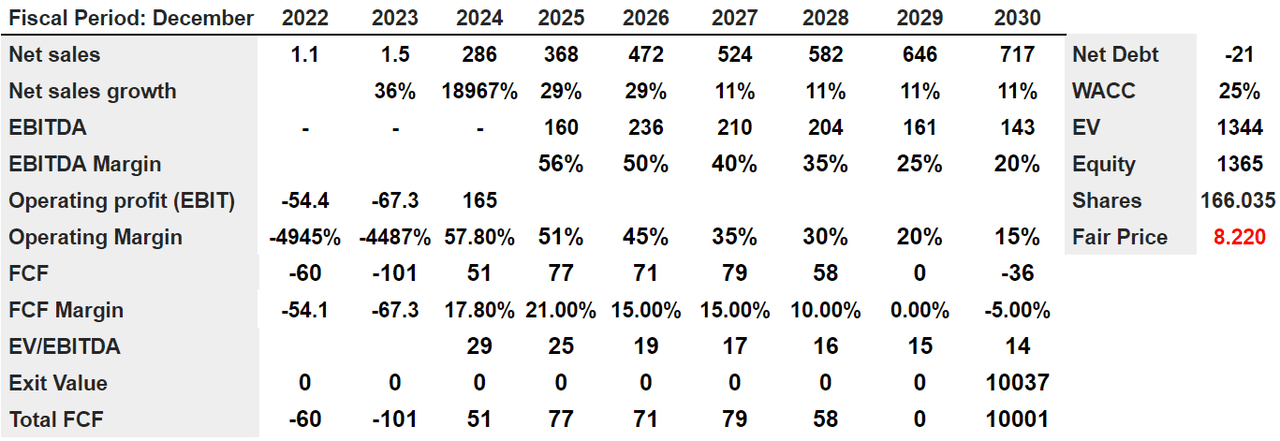

My Standard Case Scenario Resulted In A Valuation Of $8.22 Per Share

Considering that the LiDAR market is expected to grow at a CAGR of close to 28.5% until 2030, I believe that MVIS may see similar sales growth.

The global automotive LiDAR market growth is expanding at a compound annual growth rate of 28.5% over forecast period and is expected to be worth around USD 4.5 billion by 2030. Source: Automotive LiDAR Market Size

Under this scenario, I used some of the figures delivered by MVIS, and significantly reduced some of the expectations. I wanted to be extremely conservative. MVIS expects to deliver 2030 EBITDA of $1-$2 billion and revenue around $2 billion and $4 billion. My conservative figures included 2030 net sales of $700-$800 million and 2030 EBITDA close to $143 million.

Source: MicroVision 4Q21 Earnings Deck

I also assumed that MVIS will likely capture a significant portion of the company’s target market, which is said to be close to $80 billion. Besides, I believe that the company’s margins will likely be significant because MVIS expects to sign direct partnerships with OEMs.

Source: MicroVision 4Q21 Earnings Deck

Finally, under this scenario, I also assumed that the company’s 430 patents and research and development efforts will be valued by clients. Let’s note that the company does not report a lot of revenue right now, but its presentations talk about a significant amount of intellectual property accumulated.

Source: MicroVision 4Q21 Earnings Deck

I foresee 2030 net sales of $717 million with a net sales growth of 11%. In addition to an EBITDA of $143 million and an EBITDA margin of 20%, I also expect operating profit of $165 million with an operating margin of 15%.

From 2022 to 2028, I believe that the FCF would stand at close to $51 million and $77 million, and 2030 FCF would be close to -$36 million. Together with an EV/EBITDA of 14x, I obtained an exit value of $10.037 billion

Source: Author’s Work

With net debt close to -$21 million and a WACC of 25%, the enterprise value would stand at close to $1.344 billion with an equity valuation of $1.365 billion. Finally, the fair price would be close to $8.22 per share.

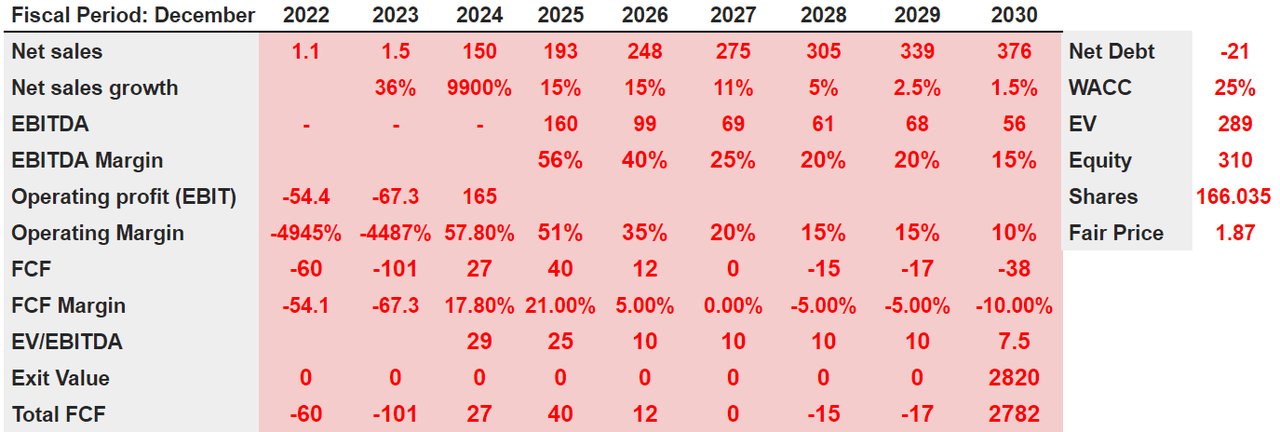

If MVIS Does Not Sign More Agreements With OEMs, And Does Find More Suppliers, I Believe That The Fair Price Could Be Close To $1.87 Per Share

In order to convince many investors out there, MVIS will have to sign new agreements with many more customers. Right now, the company reports a risk of client concentration, which may lower the potential for larger sales growth in the near future.

For the nine months ended September 30, 2022, one customer accounted for $664,000 in revenue, representing 100% of our total revenue. For the nine months ended September 30, 2021, the same customer accounted for $1.9 million in revenue, representing 100% of our total revenue. Source: 10-Q

I also identified a risk from suppliers. MVIS claims to have only a few manufacturers. Besides, management claims that new agreements with suppliers are time-consuming. There is also a limited number of suppliers with sufficient expertise. If MVIS’ suppliers decide to renegotiate prices, the company’s free cash flow margins may decline. As a result, I believe that the fair price of MVIS’ stock may diminish.

Historically, we have relied on single or limited-source suppliers to manufacture our products. Establishing a relationship with a contract manufacturer or foundry is a time-consuming process, as our unique technology may require significant manufacturing process adaptation to achieve full manufacturing capacity. Source: 10-Q

I believe that MVIS is trying to negotiate with massive corporations, which may have a lot of negotiating power and more resources than MVIS. In the worst-case scenario, MVIS may not be able to sign agreements with new clients or may sign unfavourable agreements.

Our potential customers are large, multinational companies with substantial negotiating power relative to us and, in some instances, may have internal solutions that are competitive to our products. These large, multinational companies also have significant resources, which may allow them to acquire or develop competitive technologies either independently or in partnership with others. Source: 10-Q

MVIS identified several patents held by competitors, which may limit the number of new patents that the company may obtain in the future. Besides, MVIS may have to pay royalties to third parties for using some of the technology already invented by others. Management discussed these risks in a recent annual report.

We are aware of several patents held by third parties that relate to certain aspects of light scanning displays and 3D sensing products. These patents could be used as a basis to challenge the validity, limit the scope or limit our ability to obtain additional or broader patent rights of our patents. Source: 10-k

With 2030 net sales of $376.5 million and net sales growth of 1.5%, I forecast 2030 EBITDA of $56.5 million and an EBITDA margin of 15%. Also, with 2030 operating profit of $165 million and operating margin of 10%, 2030 FCF would be -$38.5 million.

Source: Author’s Work

My results would include an exit value of $2.8 billion, net debt of -$21 million, and an EV/EBITDA multiple of 7.5x. If we also use a WACC of 25%, the enterprise value would stay close to $289 million, and the equity would be $310 million. Finally, the fair price would be $1.87 per share.

Conclusion

MicroVision is expected to enjoy a massive increase in its target market, which would be close to $80 billion in 2030. In my view, if management successfully signs direct partnerships with OEMs and new clients, revenue growth will likely trend north. I believe that economies of scale would most likely drive costs down, which would enhance future free cash flow generation. Considering the total amount of patents and know-how accumulated, I believe that MVIS may be successful. I also envision certain risks given the small number of suppliers and the fact that potential clients are large corporations. Besides, I dislike the current concentration of customers. With all that being said, I believe that the company does not seem correctly valued by the market. I believe that the fair price is close to $8.22 per share.

Be the first to comment