nielubieklonu/iStock via Getty Images

Investment thesis

W&T Offshore (NYSE:WTI) is a small, independent oil and natural gas producer in the Gulf of Mexico. The company has grown through the acquisitions of mature properties, divested by bigger players as non-strategic. W&T’s production is currently about 40,000 boe daily, of which slightly over 50% is gas.

This article updates my earlier investment thesis:

W&T Offshore: Value Play Vs. Debt Trap

W&T Offshore Looks Promising After De-Risking Event, Recent Correction

In summary, I saw W&T as discounted relative to its net asset value (or NAV), but I was initially hesitant in view of its debt situation. However, the company eventually pushed out some of its debt maturities through a successful securitization transaction.

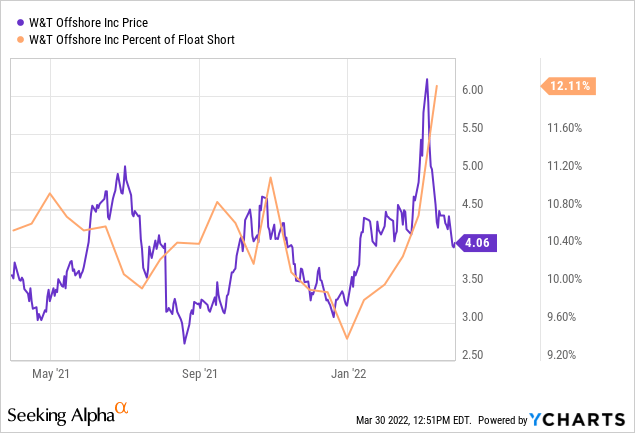

As my analysis from a year ago was based on $60 oil/$3 gas, I am even more bullish now with $90-$100 oil (OIL) and $5-$6 gas (UNG). Interestingly, while the stock price went up from mid-$3s to above $6 over this period, in the last couple weeks, it almost retracted to where it was last spring.

In my view, this is mostly related to short selling, which increased as the stock ran up above $6. However, the fundamentals have only been improving since May 2021:

-

The strip pricing is much higher and the discount to NAV has only gotten larger; W&T’s long-lived inventory will also be an advantage as less capex in the inflationary environment is needed to maintain production.

-

Near-term cash flow is improving as the adverse oil hedges are almost gone; gas hedges are still a drag, but W&T partially mitigated their effect by purchasing calls.

-

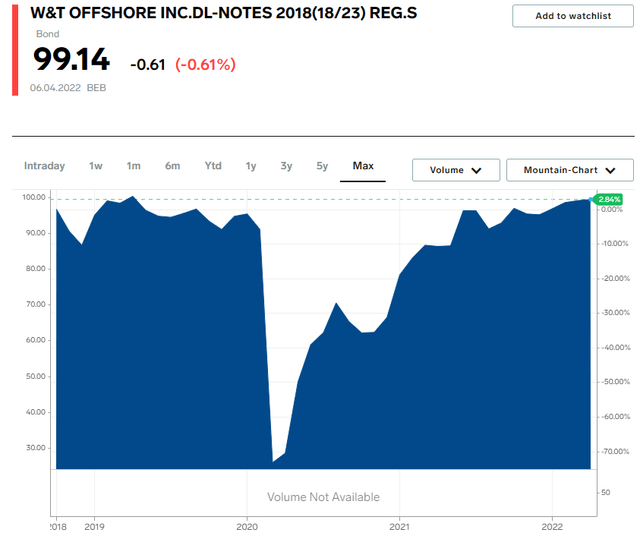

The 2023 bonds are trading almost at par, showing that the refinancing risk is being mitigated even further.

The move above $6 made sense given these positive developments, and there is no logic in the shares dipping back below $4, where they were last spring. I used the opportunity to add on to my long position.

Discount to NAV

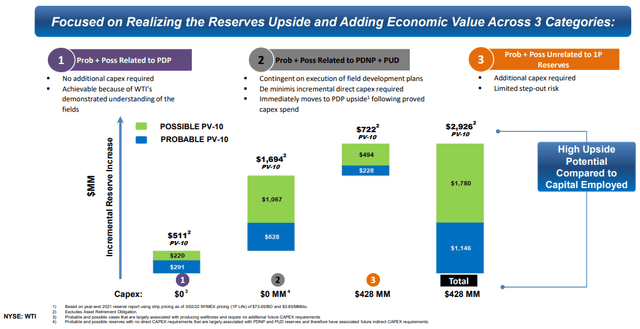

W&T can generate incremental production from 2P (or probable) and 3P (or possible) reserves because of the company’s geological advantages and superior drive mechanisms in the Gulf of Mexico. Since this future production isn’t initially recognized under the SEC reserve booking system, over time, W&T can move some 2P/3P reserves into the 1P (proved) category without additional drilling. The potential upside from 2P/3P is significant, and the company believes it can add $2 billion in PV-10 (asset value measure) without material capex:

For comparison, W&T trades at close to only $1 billion enterprise value (or EV).

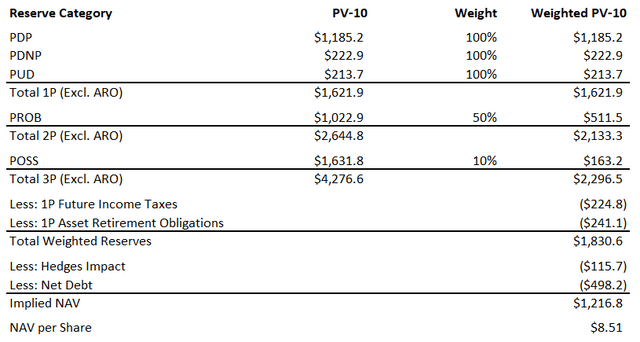

After probability weighing W&T’s PV-10 figures using 100%/50%/10% weights and adjusting for asset retirement obligations (or ARO), income taxes, hedges and net debt, I arrived at approximately $8.50 implied NAV per share:

W&T Data; Author’s Calculations

Further, this result is based on the 2021 year-end SEC pricing of $66 oil (CL1:COM) and $3.60 Henry Hub (NG1:COM). W&T reports in its presentation an alternative scenario based on the higher NYMEX strip as of March 2022. Based on a simple linear interpolation, I estimate each $10 increase in the oil price could add $5 to the NAV per share.

Despite the shortcuts in my calculation (e.g., I can’t estimate 2P/3P taxes or ARO based on the limited data points presented by the company), the bottom line is that at $70 oil the NAV per share exceeds the market price at least twofold. If the long-term oil price averages $90 or higher, we are probably looking at a 4-5x discount. From NAV perspective, W&T is likely one of the cheapest companies out there.

W&T’s reserves also translate into a generous reserve life index:

| Definition | Reserves | Estimated Life |

| PDP only | 138.8 mmboe | 9.6 years |

| 1P (PDP + PUD) | 159.5 mmboe | 11.1 years |

| 2P (PDP + PUD + Probable) | 236.2 mmboe | 16.4 years |

Source: W&T presentation, author’s calculations

Just proved developed reserves (or PDP) are equivalent to almost 10 years for production. This longevity could be a key competitive advantage in the present inflationary environment that will make capex more expensive for many producers.

Long reserves lives are usually associated with Canadian oil sands producers such as Canadian Natural Resources Limited (CNQ), and W&T’s offshore reserves aren’t as long-lived, but likely exceed the potential of most U.S. shale producers. Last, W&T’s assets sit right at the Gulf of Mexico, which provides insulation against U.S. “pipeline politics” which ultimately drives significant pricing differentials for Canadian producers and for many U.S. shale players. In 2021 W&T’s averaged realized oil price differential was 97% of West Texas Intermediate and basically 100% of Henry Hub. The company’s market access is as good as it gets, and structurally this will be a big plus in the longer term.

Cash flow is improving despite the hedges

W&T is a good value buy not just from NAV perspective, but also relative to its short-term cash flow. According to SA’s valuation metrics, W&T is priced at 3x EV to forward EBITDA and 1.7x market cap to forward (operating) cash flow. These metrics are assigned A and A+ ratings, respectively.

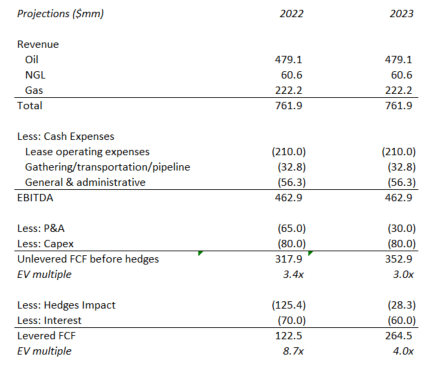

Assuming $90 oil/$5 gas, I estimate that W&T trades at about 3x EV to 2023 unhedged & unlevered free cash flow (or FCF) or 4x hedged & levered FCF. The 2022 year may also be an outlier because of a large plug & abandonment (P&A) cash outlay to make up for expenditures delayed in the prior couple of years:

We also have capital allocated for three shelf drill wells, as well as supporting capital for facilities, leasehold seismic and recompletions. In addition, our P&A budget has increased compared to prior years and is being driven by obligations and prior deferrals, mainly due to COVID-19 on terminated leases with BSEE.

Source: W&T earnings call transcript

That is why I would expect the P&A cost to drop in 2023 closer to the historical averages.

Author’s calculations for $90 oil & $5 gas based on W&T 2022 guidance

An elephant in the room is the huge drag from the hedges in 2022. The good news is that oil hedges have almost run out and are only 3,000 bbl/d out of 15,000 bbl/d total oil production.

The gas hedges will remain until 2028 though and much of that is driven by last year’s financing arrangement through the special purpose vehicle (or SPV). Luckily, W&T had the prescience to purchase some calls when they saw which way the winds were blowing:

We — fortunately, we bought a bunch of calls on the gas, which ameliorated a lot of our unrecognized gains and losses with regard to gas going into the next several years. So we’re hedged on — we bought calls up until 2025 so on the gas and that’s proven to be fairly prophetic. It was — we spent, I don’t know, $20 million or so on that and it was a hard decision to make at the time, but it turned out to be a pretty good answer.

Source: W&T earnings call transcript

In summary, the cash flow view seems to confirm the NAV conclusion that W&T is very cheap.

Refinancing prospects have improved

When I first looked at W&T, oil was $60 and the refinancing of the 2023 notes was a potential concern. At $90 oil/$5 gas, W&T is at close to 1.0x net debt/EBTIDA, which should be very favorable in any refinancing discussions.

Liquidity is also good at $245.8 million of cash plus $50.0 million available under a new credit facility.

The bonds market is also noticing the improvements and the until recently problematic 2023 notes are now trading close to par for the first time in a while:

W&T’s CEO Tracy Krohn also sounded quite optimistic during the earnings call:

Jeff Robertson (analyst)

And then last question, if I can. Can you talk about what you’re or shedding light on what you’re thinking about with respect to the notes that mature next year and how you’ll look at refinancing those?

Tracy Krohn (the CEO)

Yeah. I will — to an extent, I mean, I think, that the situation is better than it was a month ago and a hell of a lot better than it was a year ago. We have higher prices. We have more cash flow. The bonds are trading at par right now and that’s the first time in a long time that that’s occurred. So I’m very optimistic that we’ll come back with a better solution than we had before.

W&T is indeed behind the curve compared to many E&Ps who are already almost debt-free and have moved towards returning cash to the shareholders. However, for this same reason, W&T can appreciate a lot more in the future. The worst is clearly in the past, but I believe the de-risking hasn’t been fully processed by the stock market yet.

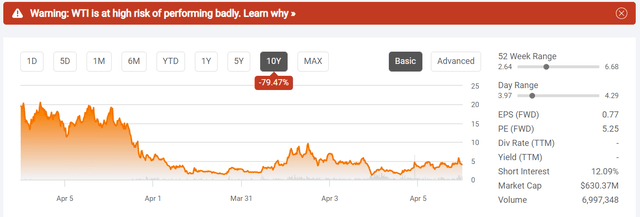

The recent drop is a buying opportunity

W&T certainly doesn’t score well on momentum indicators. In fact, the SA quant indicator, with which I vehemently disagree here, has it flagged as having a “high risk of performing badly”:

In my view, the negative momentum is related to the frequent short selling:

The short interest in W&T was never low, but it definitely increased rapidly as the stock ran up above $6.

To be clear, I am not pushing forward any “short squeeze” argument. However, given the fundamentals have only been improving since May 2021, I don’t see any merit to the short thesis and view the periodic drops as a buying opportunity. I happily added to my position below $4 recently and will be buying more on dips. I think as long as the stock is in the $4 to $4.50 range, it is a “no brainer.”

Conclusion

W&T Offshore’s assets in the Gulf of Mexico are well-positioned to benefit from the current bull markets in both oil and natural gas. The company is significantly discounted on both a NAV and cash flow basis, and has greater appreciation potential compared to oil & gas producers that are further ahead on the debt repayment curve. The recent price drop appears driven by short-selling and presents an excellent buying opportunity for long-horizon investors.

Be the first to comment