RapidEye/E+ via Getty Images

In a recent Wall Street Journal article, Chip Cutter and Katherine Bindley wrote:

Labor Day marks the line in the corporate sane. Many company leaders say the end-of-summer holiday represents the best chance to finally lean on workers to return to the office this year.

The writers point out that:

[E]mployers including Apple Inc. (AAPL), Prudential Financial (PRU), and BMO Financial Group (BMO) plan broader September returns at their U.S. offices. Some companies such as Ally Financial (ALLY), have sent notes in recent weeks reminding workers to come into the office consistently.

I’m writing this article at my office, although I’m not required to do so.

Although, I’m also the CEO so I can make these decisions myself, and I get my best inspiration while typing at my office computer. Perhaps that’s because the refrigerator is twenty feet away or I enjoy the luxury of a large computer monitor at my office.

Fortunately, I have a job in which I can literally work from anywhere in the world, and I’m not forced to work the traditional 9 to 5 hours. The WSJ writers went on to explain:

Fears of a recession or job cuts could give employers an upper hand, but some remain reluctant to tell workers they will be fired for not showing up – even if companies are reserving the right to do so as a last resort.

I don’t know about you, but I’m excited to be getting out of the house and seeing people on a regular basis. I’ve seen my productivity increase ten-fold and of course whenever us humans are moving around more, we’re using one of the most important assets on the planet: REAL ESTATE.

We’re seeing this paradigm playing out across most all sectors of commercial real estate:

- Shopping Centers

- Malls

- Outlets

- Casinos

- Restaurants

- Hotels

- Medical Office Buildings

- Hospitals

- Warehouses

Oh yes, office buildings are going to get busier too.

Maybe they don’t get back to normal utilization any time soon (or possibly never), but they will certainly not become extinct, which is a reason I’m still recommending names like Highwoods (HIW), Brandywine (BDN), SL Green (SLG), and even Vorando Realty (VNO).

As you know, Labor Day is a federal holiday celebrated on the first Monday in September to honor and recognize the American labor movement and contributions and achievements of laborers in the US.

I plan to relax myself, perhaps layout by the pool and begin working on my new book (I’ll share that with members at iREIT on Alpha). And of course, the great thing about my job, as a dividend investor, is that I am getting paid continuously, even while I’m sleeping well at night.

While I always tune into inflation, rising rates, and the war in Ukraine, I find it a waste of time to stress out over the next recession. We know they come around every few years, and I don’t care to waste any energy on predicting when the next one will hit.

As long as I focus on high quality stocks that grow their dividends, I can protect against inflation because the dividend payments are likely to increase faster than the rate of inflation.

Also, and I cannot stress this enough on Seeking Alpha: dividends provide a solid indication of whether a company is performing well, because the company must have the cash flow to make the dividend payment.

Yesterday I provided readers with three higher risk REITs that should be avoided at all costs, and not just because the dividend is a “sucker yield”, but also because there is no “moat” that protects their business from competitors.

Our team at iREIT on Alpha and Dividend Kings spend considerable time analyzing moats, recognizing that if the business does not offer unique competitive advantages, the dividend is most likely not sustainable.

A company that can consistently increase its dividend over time is a clear indication that profits are growing, and the company is less likely to cut its dividend. I know you’ve heard me saying this before, and I’ll say it once again:

The safest dividend is the one that’s just been raised.

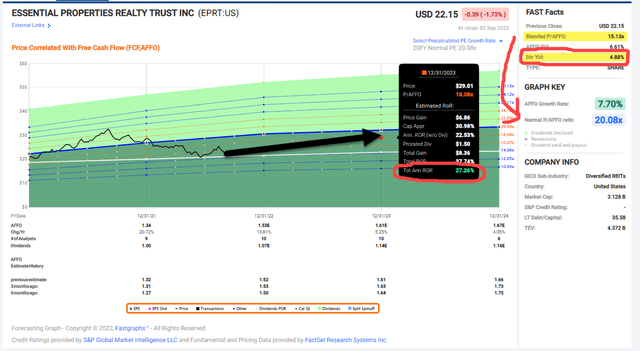

Essential Properties Realty Trust (EPRT)

EPRT is a net lease REIT that owns 1,545 free-standing properties in 46 states. The diverse portfolio includes 323 tenants with an average weighted remaining lease term of 13.9 years (longest in the peer group).

Around 62% of the portfolio is master leased and 99% of the tenants provide unit-level sales reports (like STOR). EPRT’s average investment per property is around $2.3 million, which makes the business model less reliant on its top tenants (19% of revenue is generated from the Top 10 tenants).

That explains part of EPRT’s moat (scale advantage) but the company also has a highly disciplined balance sheet supported by its 100% unencumbered capitalization with no debt maturities until 2024. Net debt to Annualized Adjusted EBITDAre was 4.6x (3rd lowest in the peer group) which has allowed the company to generate impressive investment spreads.

In Q2 EPRT’s AFFO totaled $50.6 million, up $10.7 million over the same period in 2021, which on a fully diluted per share basis was $0.38, an increase of 12% versus Q2-21. The company boosted its 2022 AFFO per share guidance to a range of $1.52 to $1.54 from a previous range of $1.50 to $1.53.

EPRT expects to grow AFFO per share by over 13% in 2022, and in June the company announced it increased its dividend by ~4%, from $.26 per share to $.27. Analysts are expecting the company to grow by another 7% in 2023.

In terms of valuation, EPRT is trading at $22.15 per share with a P/AFFO of 15.x, below the normal range of 20.1x. The dividend yield is 4.9%, well-covered with a growing earnings stream.

We recommend buying EPRT at $27.55 or below, which makes this holiday pick a Strong Buy, that could result in annual returns of 25% or higher. Also not that Bank of America recently upgraded EPRT based on a “recent equity raise that eliminates equity funding risk during a period of volatile equity capital markets.”

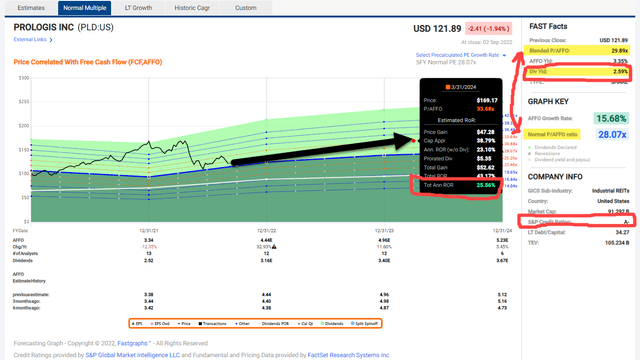

Prologis, Inc. (PLD)

Our next Labor Day pick is Prologis Inc., a warehouse landlord that remains one of iREIT’s top conviction picks.

PLD’s global portfolio includes 3,230 buildings on the US, 314 buildings in “Other Americas”, 924 buildings in Europe, and 264 buildings in Asia.

Needless to say, PLD has wide moat “scale advantage” that is unrivaled. In addition, the company has over 10,000 acres of land and over $180 billion of Assets under Management.

The land portfolio has significant embedded value, with a total buildout of another $30 billion with an overweight in the markets that matter the most. Covered Land Plays (or CLP’s) – acquisitions of income generating assets with the intention to redevelop for higher and better – are targeted at 5% or higher.

In addition to scale advantage, PLD also has a significant “wide moat” cost of capital advantage, which is reflected in iREITs perfect “100” quality score and A-ratings from two agencies (Moody’s and S&P).

PLD’s balance sheet remains strong with 4.9x Debt/Adj. EBITDA excluding development gains (+20bps q/q). During Q2-22, PLD and its JVs issued $5.1B of debt at a weighted average interest rate of 1.4% ($4.0B refinancing/$1.1B new issuances) and the company has $5.2B in cash and availability.

In Q2-22 PLD reported core FFOps of $1.11 (+12.4% y/y) and cash SSNOI was +8.2% y/y (vs. +8.7% in Q1-22), with cash releasing spreads at +27.5% (vs. +19.2% in Q1-22). It also raised 2022 core FFOps guidance to $5.14-5.18, implying +24.3% y/y at midpoint.

Remember that PLD increased its dividend by 25% last February, from $.63 per share to $.79 per share. PLD has maintained an industry-leading cost structure with expected ~60% AFFO payout ratio and $1.7B of free cash flow after dividends in 2022.

We recommend buying PLD at $150.00 or below, which makes this pick another Strong Buy. Shares are now trading at $121.89 with a P/AFFO of 29.9x (normal as seen below is 32.8x). The dividend yield is 2.6% and well-covered. iREIT believes that shares could return 25% over the next 12 months.

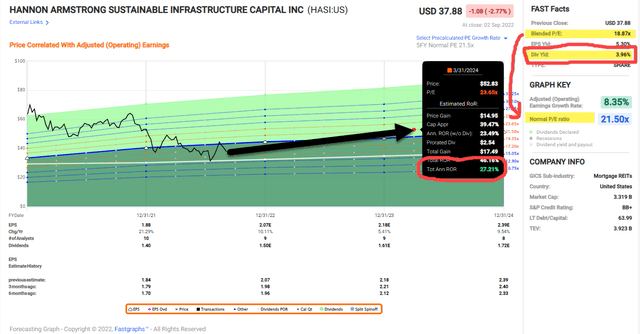

Hannon Armstrong (HASI)

Our final Labor Day pick is Hannon Armstrong, an outlier of sorts that invests in companies in the energy efficiency, renewable energy, and other sustainable infrastructure markets.

HASI’s goal is to generate attractive risk-adjusted returns from a diversified portfolio of projects that generate long-term, predictable cash flows from proven technologies that reduce carbon emissions or increase resilience to climate change.

HASI has a robust >$4b pipeline supported by deep relationships with leading clean energy and infrastructure companies. Similar to the other two REITs referenced, HASI also has scale advantage supported by 350 investments across ~10 asset classes. The average investment is around $11 million with a weighted average life of 18 years.

HASI’s key markets include behind-the-meter (yielding 7.7%), grid-connected (yielding 6.9%), and sustainable infrastructure (yielding 7.0%). The $3.9 billion portfolio is now yielding an average of 7.4%.

You may recall the 27-page short thesis published earlier this summer by Muddy Waters that focused on HASI’s cash flow projections. We provided iREIT on Alpha members with insight into the short and concluded that:

We find it unlikely that E&Y would overlook or purposefully ignore systematic errors (e.g. lies) in loan values and associated metrics that directly involve E&Y’s responsibilities as an auditor year after year.

(I personally took advantage of that selloff and shares are +12%)

HASI’s widest moat is perhaps its highly predictable earnings stream, that’s supported by credit rating of Baa3 / BB+/ BB+ (Moody’s / S&P / Fitch) underpinned by a prudent 1.8x debt to equity ratio and 93% fixed debt. From 2017 to 2021 HASI has delivered 10% EPS (based on CAGR) and 21% Distributable Net Investment Income of 21% based on CAGR).

More importantly, HASI has an outstanding credit history with de minimis defaults. This is extremely important to the “moat” that I’m referencing. The company has guided 5% to 8% annual dividend per share growth, and that’s important to my SWAN-style of investing.

Once more, HASI is a Strong Buy for team iREIT, as shares are trading well below our buy target. We trust the management team and remember that we have been following the company for many years (going back to 2015). The dividend is around 4.0% and our total return forecast is 25% over the next 12 months.

Don’t Sweat It

As I said earlier, I’ll be relaxing on Labor Day, celebrating all contributions and achievements of laborers in the US (that’s me too). I want to thank you for reading this article and for following me (and if you haven’t followed me, please scroll up to do so now).

Remember, as you enter retirement, you can put these trusted dividends to work for you, so you can enjoy Labor Day every day. Sit back, relax, and just remember what John D. Rockefeller said:

Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.

Happy Labor Day!

Be the first to comment