Ninoon

Building a Portfolio Based on Valuation

Valuation always matters. In fact, some say we value investors make our money when we buy, not when we sell. Why? Because buying at favorable pricing levels gives us a fighting chance to enjoy the benefits of company growth over longer periods of time.

The reverse is also true: share buyers at inflated valuation levels may be setting themselves up for future disappointment as the price may languish.

The idea over the long term is to make stock selections based on some version of valuation: what is the stock worth? One way to patiently build a growing portfolio is to purchase when shares are below their own normalized valuation, and be willing to rotate out of shares when valuations are stretched.

The Trick is to Buy Bleak News – and Be Patient

In order for us to take advantage of company improvement, we must be willing to buy when the news is bleak and the price reflects bad news. Of course, this requires the ability to go against the crowd.

The second requirement is patience — that is, the willingness to buy and then hold for reasonable periods as the company responds to the environment and conditions improve. For long-term value investors, that means patient holding periods measured in months and years, not hours, days or weeks.

What to Expect from this Article

This article presents Universal Health Services (NYSE:UHS) as an attractive candidate in the healthcare services space. The company has a history of growing fundamentals and the stock price is currently favorable based on the company’s own history.

The article describes UHS performance year-to-date, several reasons the stock price is depressed, catalysts for future improvement, and a valuation model to suggest shares are attractive right now. Lastly, estimated 5-year upside possibility and downside risk are shared for your consideration.

Quick Company Profile

Universal Health Services owns and operates acute-care and surgical hospitals, behavioral health centers, and surgery/radiation oncology centers. The company operates 40 outpatient facilities and 363 inpatient centers in 39 states.

With a market cap of $7.7 billion and 89,000 employees, the firm operates in the healthcare sector and medical facilities industry. S&P rating is BB+.

Stock Price Underperformance Year-to-Date

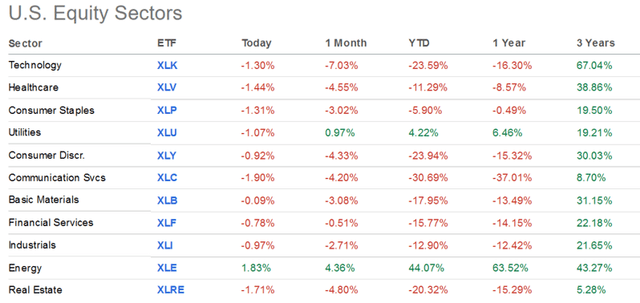

UHS has been pummeled as shares have sold off sharply year-to-date on bleak news and overall market downward pressure. As you can see in the summary below, the healthcare sector is down 11.3% year-to-date.

Sector Performance Year-to-Date (SeekingAlpha)

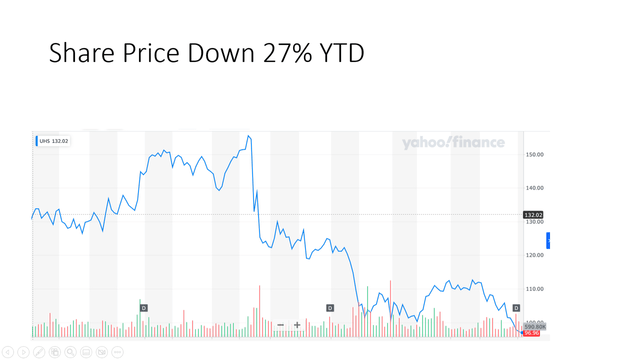

The UHS stock price, however, has underperformed significantly compared to the sector with a 27% sell-off.

UHS Stock Price YTD (Yahoo! Finance)

Is this price decline an opportunity for patient value investors, or a trap? To begin, let’s explore several reasons for the stock sell-off, as well as possible catalysts for improvement.

Reasons the Stock Price is Down

Simply put, the forecast is for EPS pressure and continued earnings headwinds. While revenue was up compared to last year, labor costs and other operational expenses will continue to hamper earnings. Labor contracts and rising benefit expenses and difficulties recruiting and retaining quality staff will dampen are a primary driver, and additional operating costs to treat Covid-19 are expected. Management expects these pressures to continue through perhaps 2023 before abating.

Catalysts for Future Improvement

Three factors likely will improve the picture: First, assertive cost-cutting efforts are under way via contract negotiations with third-party payors. Secondly, the company is pursuing additional operational efficiencies to make work more efficient and maximize labor productivity. Lastly, Covid-related impacts are expected to slowly abate 12-18 months in the future which is expected to improve earnings.

The Relationship between Earnings and Stock Price

To build a long-term portfolio, the approach is straightforward: valuation, valuation, valuation. The idea is to compare the relationship between earnings and the stock price over long periods of time, and then apply a normalized price-to-earnings ratio to derive a valuation.

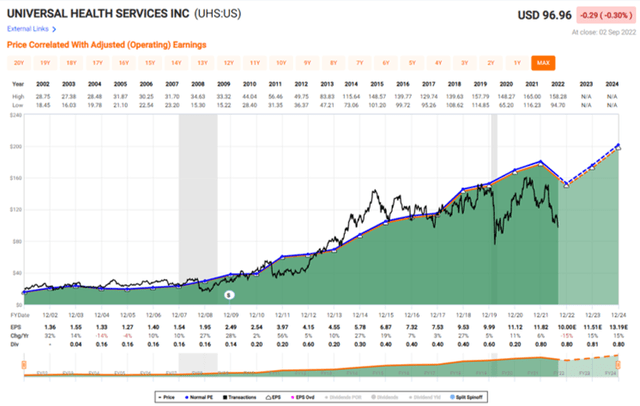

Check out the chart below. The orange line represents the long-term growth of earnings, and the black line represents the corresponding stock price.

We can see that UHS has a history of growing earnings over long periods of time as EPS has grown at a rate just above 10%.

Note also that the stock price has begun to reach levels not seen since Covid lows.

UHS Earnings and Stock Price Comparison (FastGraphs)

What Are UHS Shares Worth?

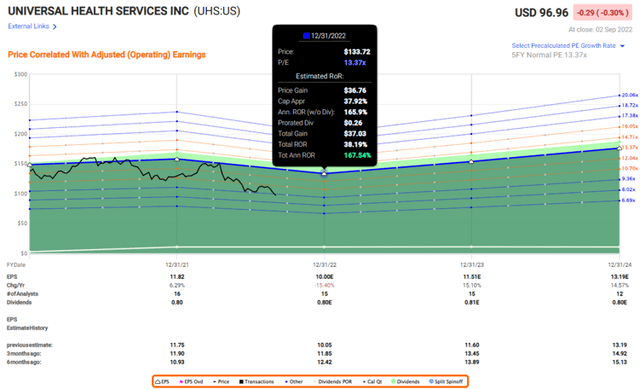

Historically, UHS has a normalized price-to-earnings ratio (PE ratio) of 13.3X earnings. Today shares are available for less than 10X.

If we apply the normalized 13.3X to expected earnings-per-share, it is reasonable to reach a valuation around $133 over the next year.

This estimate is demonstrated nicely on the graph below, as the blue line represents the normal PE and the black line is the stock price.

Estimated Valuation (FastGraphs)

With a stock price at around $96, is a $133 valuation outrageous? Well, it is true that the general healthcare news is bleak at the moment. But note that the stock price has reached highs well above $133 each of the last 5 years – on earnings well below estimates today.

Risk And Reward – An Estimate

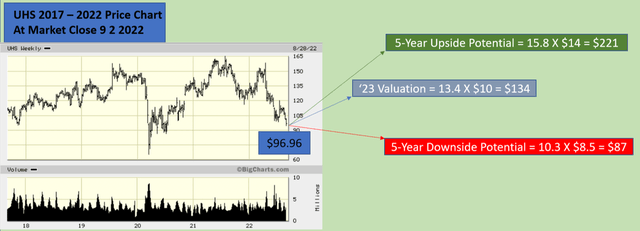

It is important to know what to expect from any stock we buy. In order to understand the potential range of the stock price over the next 5 years, one method is to apply a normalized 5-year “high” PE multiple and “low” PE multiple to expected high and low EPS forecasts.

When we apply an average high 5-year PE of 15.8X to estimated high earnings, this suggests a high-end stock price of $221 in the coming 60 months. At the same time, when we apply a low 5-year average PE of 10.3X, then $87 could be a low stock price.

My chart below is ugly, but it is useful to see a reasonable possible range going forward. At least we get some rational, numbers-based estimate on what to expect.

UHS High and Low Estimates (Bigcharts; author notes)

Final Thoughts

UHS is a quality company with a history of growing fundamentals. The healthcare space is bleak right now, with earnings under stress from staffing costs and Covid-related operational expenses. The current price to earnings relationship is favorable, and long-term value investors may be well-served to begin a position at these levels. Your account will likely thank you in the future.

Thank you for your time reading this article.

Be the first to comment