200mm/E+ via Getty Images

Brian Dress, CFA — Director of Research, Investment Advisor

For the final three weeks of March, we saw renewed optimism in financial markets, as we finally started to see investors build positions, especially in growth stocks. We saw that enthusiasm derailed a bit this week, as hawkish commentary from a number of Federal Reserve Board governors created renewed caution among market participants, breaking the market’s three-week winning streak following heavy selling on Tuesday and Wednesday.

As we have argued throughout 2022, we think there is still reason for hope, but we should next expect the market’s recovery to be easy or linear. There is plenty of news for investors to digest and market leadership seems to change on a dime, a phenomenon we have previously called the “whack-a-mole” market. On days of heavy selling, often it feels that no sector is safe.

Persistent inflation and higher interest rates have dominated the investing landscape for many months and this week was little exception. Many asset classes, from bonds to growth stocks, price implicitly off of moves in the US 10-year Treasury rate. This week, we observed a move basically straight up in 10-year rates from just over 2.3% to roughly 2.65% on Thursday. Remarkably, rates have moved nearly a full percentage from 1.7% on March 1.

For the three weeks preceding this one, we had been heartened by the apparent decoupling of 10-year rates from the movement in growth stocks. This week the vicious negative correlation between rates and growth stock fortunes reappeared and we noted a nearly 3% decline in the growth-heavy NASDAQ Composite index.

In these pages, we always try to sift through the carnage of a negative market and identify those sectors that are working. Over the last 6 months, healthcare has been one of the sectors we have favored, given the industry’s pricing power and defensive nature. We had been somewhat disappointed that the thesis had underwhelmed in the first quarter of 2022. However, over the last month, healthcare stocks have begun to find their footing and the Healthcare Select Sector SPDR Fund (NYSEARCA:XLV) gained nearly 4% in value despite selling in the broader market.

Worryingly, “risk on” sectors took another step back this week. Among this week’s losers were technology, Bitcoin and cryptos, transports, and semiconductors were especially under fire this week and we will discuss that more fully in “What’s Not Working?” In this week’s letter, we will cover healthcare and consumer stocks in more depth.

Finally, the consumer has been on our minds throughout 2022, with 70% of the US economy directly tied to consumer spending. Certainly, consumers face major issues with the price of goods and services throughout the economy, rising mortgage rates, and many other issues. We did see strength in some segments of retail this week, but the picture is still quite mixed. We will take the issue straight on later in the newsletter.

With that all being said, let’s get into it!

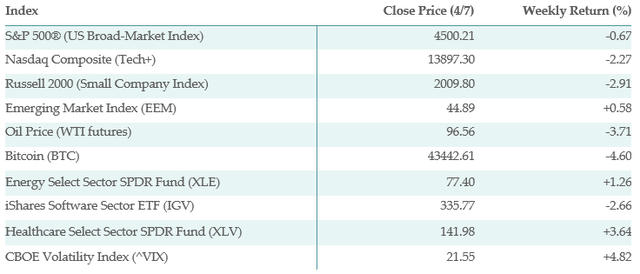

Below is the performance data of key indices, ETFs for the five trading days between 4/1/22 and 4/7/22:

What’s Working?

Of our top 20 ETFs in our list this week, nine of them come from the healthcare space in one form or another, as a result, we will cover healthcare winners in a later section this week.

With treasury rates rising rapidly (and bond prices falling), it should come as no surprise that Direxion Daily 20+ Year Treasury Bear 3X Shares (TMV) was the strongest ETF in our list this week, up more than 14%. Not far behind was United States Natural Gas Fund ETF, LP (UNG), which gained some 13.8%. Natural gas has been persistently strong throughout the year, as Western sanctions on Russia have reduced supply and European nations scramble to develop capacity to receive liquified natural gas (LNG) imports from the US and Australia.

Defensive sectors were the main beneficiaries of this week’s bearish action in the overall stock market. Among our top performing ETFs (outside of healthcare, another defensive sector) were the Consumer Staples Select Sector SPDR Fund (XLP) and the Utilities Select Sector SPDR Fund (XLU), which are historically two of the most defensive sectors in all of the S&P 500. As our CEO Noland Langford often says, the defense is back on the field in the markets this week, which is clearly a negative sign for those of us that are optimistic about the market’s fortunes in 2022.

Finally, we saw strength in the Real Estate Select Sector SPDR Fund (XLRE), despite a rise in interest rates. This ETF contains many of the country’s largest Real Estate Investment Trusts (REITs), which have begun to find favor as investors look for alternative vehicles to park cash with the bond market performing so poorly.

What is not Working?

It is tough to know where to begin sometimes with “What’s Not Working?” on a negative week like this one, but most measures of “risk on” fell this week and some of the moves were astonishingly large. For instance, the iShares Transportation Average ETF (IYT), which contains such large operators as Union Pacific Corp (UNP), United Parcel Service (UPS), and Southwest Airlines (LUV), was off 9.5% just this week alone. Generally speaking, transport stocks are a leading indicator of economic activity, so we find the weakness here quite worrying as we contemplate whether the economy is headed for recession.

In the office over the past 2-3 weeks, we have openly questioned whether we are coming to the end of the cycle in semiconductors. Since the beginning of the pandemic, this has been one of the market’s leading sectors, benefitting greatly from the shortage of microchips used in the manufacture of almost everything. Our concern is that a glut of chip supply is on the horizon, given that there have been 2 years pass since the shortage begin, essentially equivalent to the amount of time it takes to build new production facilities. The market appears to agree, with the SPDR S&P Semiconductor ETF (XSD) down 8.84% this week. Semiconductors have historically been highly cyclical, so we think folks who are allocated there need to consider whether rocky times are on the horizon.

The final sector we want to highlight here is homebuilders, which fell sharply for the third week straight. Despite the fact that the supply of homes is clearly constrained, homebuilders face pressures on both sides of their business: rising rates threaten to cut into housing demand, while inflationary pressures on the cost of raw materials weigh on their profitability. The SPDR Homebuilders ETF (XHB) fell another 3%+ this week.

Healthcare: Finally Awakening from a Slumber?

At the beginning of 2022, we came in with a clear strategy to focus on a few key sectors for allocation: energy/materials (which have worked well), financials (disappointing performance given the direction of interest rates), and healthcare. The traditionally defensive healthcare sector has confounded us, only just getting back above water for a year-to-date return in the last week.

To review our thoughts on healthcare, we like it for a number of reasons. First, healthcare businesses have strong pricing power, so they should perform in an environment of high inflation. Second, healthcare stands to benefit as a sector with the winddown of the pandemic: hospitals and other medical businesses have deemphasized their more profitable business lines over the last two years as they fought to handle Covid-19. Third, healthcare stocks are usually defensive and should work in a down market.

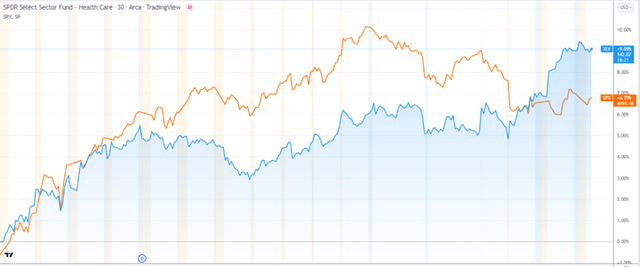

To illustrate the shift in attitudes toward the healthcare sector, we are enclosing a 1-month chart of the Health Care Select Sector SPDR Fund (XLV; blue) against the S&P 500 (orange). Action in the XLV over the past month has been persistently positive and the trend continued this week, even as the broader market sold off. This is the way we expected healthcare to perform earlier this year, so there may still be time to get in here:

This week we saw strength all through the value chain from a healthcare perspective. Among our strongest performing ETFs this week were the Invesco Dynamic Pharmaceuticals ETF (PJP) and Health Care Select Sector SPDR Fund. Pharmaceuticals fall into a category of businesses that generate a lot of cash, which is indicative of the type of security many investors are embracing with bonds performing so badly.

We have stepped up our research on companies like AbbVie (ABBV), Amgen (AMGN), and Pfizer (PFE) to determine whether they are good investments for the current situation.

One trend really caught our eye this week. Biotech stocks are generally a “risk on” indicator. This week, despite weakness in other risks on indicators like crypto and the ARK Innovation ETF (ARKK), the SPDR S&P Biotech ETF (XBI) advanced by more than 3% on the week. For us, this was a potential indicator that the fundamentals facing the healthcare sector are beginning to win out in investors’ eyes and this is a theme that we will be watching closely in the coming weeks, as we seek to identify a sector where we can feel comfortable investing.

What Is Going on With the Consumer?

I can’t speak for anyone else, but I personally believed that as pandemic restrictions subside, consumers would be enthusiastic to get out and spend, buoyed by some of the highest levels of savings we have seen for US consumers in decades. Anecdotally, malls are full of shoppers and people are getting back out and traveling with abandon.

But we recognize also that there are headwinds for consumer stocks. Clearly, the prices of gasoline, housing, food, and other essentials are on the rise, which necessarily puts a squeeze on consumer discretionary income. Consumer sentiment is basically in the tank with inflation rampant and a war raging in Eastern Europe. This is despite historically low rate of unemployment (3.6%) and the household savings I alluded to previously.

With these crosscurrents in mind, the Consumer Discretionary Select Sector SPDR Fund (XLY) is off roughly 14% year-to-date. This underperformance in retail stocks suggests to us that investors are forecasting a recession on the horizon. To be completely transparent, I still think there is potentially value here, with companies like Best Buy Co., Inc. (BBY), Macy’s, Inc. (M), Bath & Body Works, Inc. (BBWI), and Crocs, Inc. (CROX) all trading at Price/Earnings multiples lower than 10x! While we are not recommending investors to go out and buy these stocks today, they do seem extraordinarily cheap to us.

Not all is lost as regards retail. We are seeing strength in more “essential” type retailers, though some could argue that this, too, is a signal of recessionary pressures. This week, we saw positive returns for Costco Wholesale Corporation (COST), Walmart Inc. (WMT), and Dollar Tree, Inc. (DLTR), all of which seem to have better ability than your average retailer to absorb inflationary pressures. Another business in the same category that we follow closely, Target Corporation (TGT), had been lagging, but has gained roughly 10% in value over the past week.

We are beginning to see stark separation between winners and losers among consumer-driven stocks. As earnings season approaches (our favorite time of year), we expect to get still more clarity here.

Takeaways from this Week

We saw the three-week winning streak in the S&P 500 fall to the wayside this week, with tech and other “risk on” sectors leading the decline. Small caps again showed palpable weakness.

Traditionally, defensive sectors like consumer staples, utilities, and healthcare were this week’s winners, while a sustained rally in natural gas continues with geopolitical and supply concerns alike. We are seeing healthcare begin to exhibit some sustained momentum, which helps confirm our earlier thesis.

What’s Not Working is led by homebuilders, semiconductors, and transports, all of which concern us as we assess the probability of a recession in the coming months. Consumer discretionary is clearly quite a mixed bag and we are looking to earnings season for more clarity there.

DISCLAIMER: This report contains views and opinions which, by their very nature, are subject to uncertainty and involve inherent risks. Predictions or forecasts, described or implied, may prove to be wrong and are subject to change without notice. All expressions of opinion included herein are subject to change without notice. Predictions or forecasts described or implied are forward-looking statements based on certain assumptions which may prove to be wrong and/or other events which were not taken into account may occur. Any predictions, forecasts, outlooks, opinions, or assumptions should not be construed to be indicative of the actual events which will occur. Investing involves risk, including the possible loss of principal. The opinions and data in this report have been obtained from sources believed to be reliable; neither Left Brain nor its affiliates warrant the accuracy or completeness of such, and accept no liability for any direct or consequential losses arising from its use. In addition, please note that Left Brain, including its principals, employees, agents, affiliates and advisory clients, may have positions in one or more of the securities discussed in this communication. Please note that Left Brain, including its principals, employees, agents, affiliates and advisory clients may take positions or effect transactions contrary to the views expressed in this communication based upon individual or firm circumstances. Any decision to effect transactions in the securities discussed within this communication should be balanced against the potential conflict of interest that Left Brain, its principals, employees, agents, affiliates and advisory clients have by virtue of its investment in one or more of these securities.

Past performance is not indicative of future performance. The price of securities can and will fluctuate, and any individual security may become worthless. A high or favorable rating, rating outlook, gauge, or similar opinion is not indicative of future performance, and no user should rely on any such rating, rating outlook, gauge, or similar opinion to predict performance or potential for return. Future performance may not equal projected or forecasted performance or potential for return. All ratings and related analysis, as well as data, statistics, analysis and opinions contained herein are solely statements of opinion and are not statements of fact or recommendations to purchase, hold, or sell any security or make any other investment decisions.

This report may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will materialize. Reliance upon information herein is at the sole discretion of the reader.

THE REPORT IS PROVIDED ON AN “AS IS” AND “AS AVAILABLE” BASIS WITHOUT REPRESENTATION OR WARRANTY OF ANY KIND. Left Brain Investment Research LLC DISCLAIMS ALL EXPRESS AND IMPLIED WARRANTIES WITH RESPECT TO THE REPORT, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

The Report is current only as of the date set forth herein. Left Brain Investment Research LLC (LBIR) has no obligation to update the Report or any material or content set forth herein.

LBIR is an affiliate of Left Brain Wealth Management LLC, an investment advisor registered with the Securities and Exchange Commission. LBIR is an affiliate of Left Brain Capital Appreciation Fund, L.P., Left Brain Capital Appreciation Offshore Ltd, and Left Brain Capital Appreciation Master Fund, Ltd., all of which are hedge funds managed by Left Brain Capital Management, LLC. The general partner of these hedge funds, Left Brain Capital Management, LLC, is an affiliate of LBIR. LBIR is also an affiliate of the Left Brain Compound Growth Fund (LBCGX), a registered fund subject to the Investment Company Act of 1940.

© 2022, Left Brain Investment Research LLC. All rights reserved. Reproduction in any form is prohibited.

Be the first to comment