imaginima

The Vanguard International High Dividend Yield ETF (NASDAQ:VYMI) makes a fine addition to a diversified, dividend-focused portfolio for American investors.

Most investors are aware of the “home country bias” that our portfolios tend to have. This is a natural result of interest in the areas and companies that are most familiar and visible to us. Investors in other countries tend to have similar home country biases, but it is especially tempting for Americans because we live in a big country with a big economy.

Even so, international economies and companies do sometimes outperform their American counterparts, so for the sake of a more balanced portfolio, it may make sense to diversify into international stocks.

That goes for dividend-focused portfolios as well.

That’s where VYMI comes in as a low-cost way to gain exposure to value-oriented, high-yield international dividend stocks.

Now may be a good time to add to VYMI on dips as it seems to enjoy momentum from falling rates of inflation and the US dollar index cooling down from its highs. What’s more, VYMI’s 5%+ dividend yield based on trailing twelve-month dividends makes it an attractive choice for those in search of high income.

Overview of VYMI

VYMI holds an enormous number of individual stocks, currently at 1,326 as of October 31st, 2022. And the ETF holds this massive basket of stocks for a relatively low expense ratio of 0.22%.

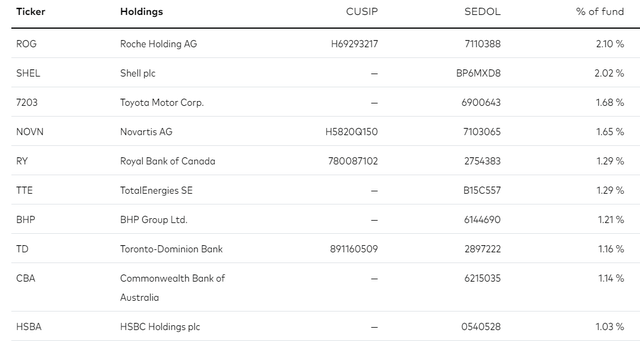

That said, this massive portfolio is pretty top heavy, as the top ten holdings make up 14.6% of the total.

The ETF tracks the FTSE All-World (ex-US) High Dividend Yield Index, which provides a tremendous level of diversification in multiple directions: country, sector, currency, etc.

The basic stock-picking methodology of the fund is to take the universe of large-cap and mid-cap non-US stocks in the FTSE All-World Index, omit US stocks from the list, then weight constituents by (1) dividend yield based on the forecasted one-year dividend and (2) market capitalization. The portfolio is reformulated semi-annually.

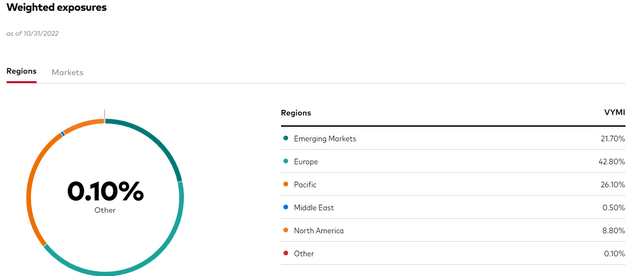

Across the world (outside the US), there is a huge number of public companies that have paid a dividend at some point in the past 12 months and are expected to pay another dividend in the next year. Thus, we find VYMI’s holdings domiciled in various regions around the world.

A plurality of holdings are domiciled in Europe, with around a quarter in Asia Pacific and a little over 1/5th in various emerging markets. Meanwhile, 8.8% are domiciled in Canada.

Vanguard VYMI Page

For those interested in an ex-US one-stop-shop solution for international dividend stocks, it’s interesting to note that VYMI owns both developed and emerging markets stocks. Often, ETFs specialize in either developed or emerging markets rather than holding both. VYMI effectively saves investors from having to own two different ETFs for international exposure, if they so choose.

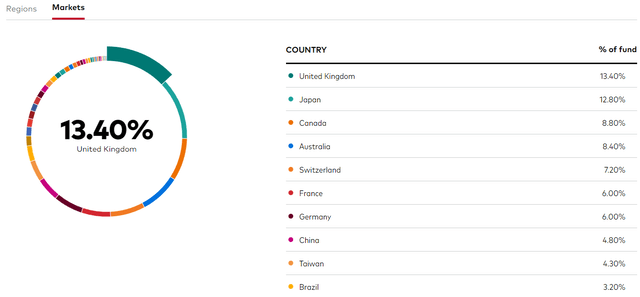

The largest single country is the United Kingdom, with fellow developed markets Japan, Canada, Australia, and Switzerland rounding out the top five.

Vanguard VYMI Page

Interestingly, though China is the second largest economy in the world by GDP, it makes up only 4.8% of VYMI’s portfolio, in terms of stocks domiciled in the country. Considering the questionable safety of Chinese stocks given vulnerability to changing government policy and the poor demographic outlook of China (not to mention manufacturers pulling out of the country and Forever COVID), I am personally glad to see a low exposure in this area.

About 1/3rd of stock holdings are in the “financials” sector, which is by far its biggest industry sector.

As far as the top ten holdings go, we find ample diversification, with names in biotech, energy, financials, materials, and consumer discretionary represented.

Vanguard VYMI Page

Generally speaking, the larger holdings tend also to be industry leaders in their respective spaces. This even though the index screens for and weights the highest yields and biggest market caps rather than measures of quality.

Here’s some data on the portfolio as of 10/31/22:

- P/E Ratio: 8.1x

- Price-to-Book Value: 1.2x

- Return on Equity: 11%

While not as high as the average return on equity for more growth-oriented funds, an 11% ROE is nothing to scoff at, especially considering the low 8.1x P/E ratio.

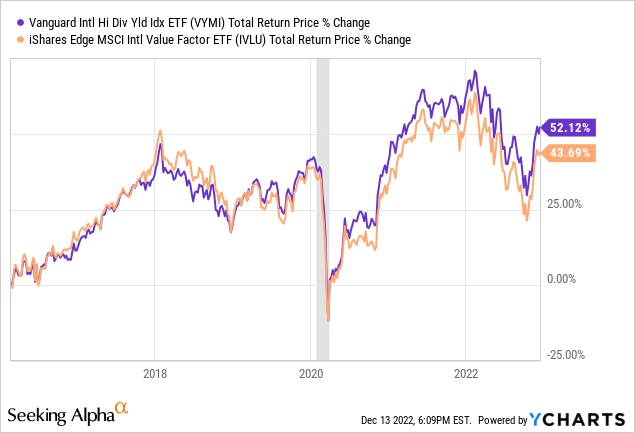

In fact, a year ago, I owned the iShares MSCI International Value Factor ETF (IVLU) instead of VYMI, but I noticed that the performance correlation between the two ETFs was extremely high:

Meanwhile, VYMI pays a higher dividend and has a lower expense ratio than IVLU’s 0.3%, so switching from IVLU to VYMI made sense.

Effectively, VYMI is a value fund that specifically filters for dividends.

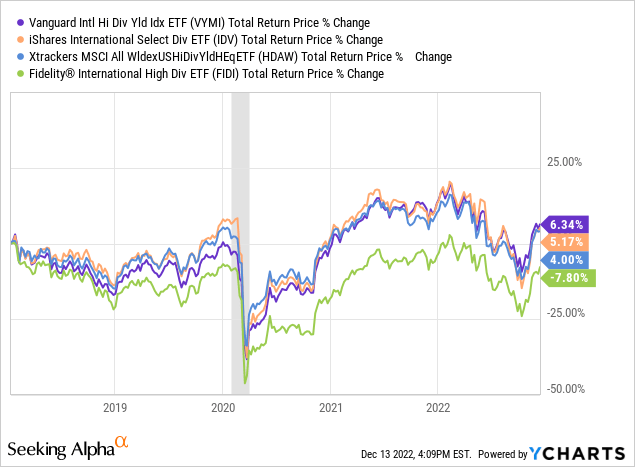

What about total returns compared to other international dividend ETFs? Consider VYMI’s total return performance compared to peers like:

- iShares International Select Dividend ETF (IDV)

- Xtrackers MSCI All World ex-US High Dividend Yield Equity ETF (HDAW)

- Fidelity International High Dividend ETF (FIDI)

For as long as all four of these similar funds have been in existence, VYMI has been the top performer, although IDV has sometimes pulled ahead of it. So what happens when we directly compare VYMI to IDV?

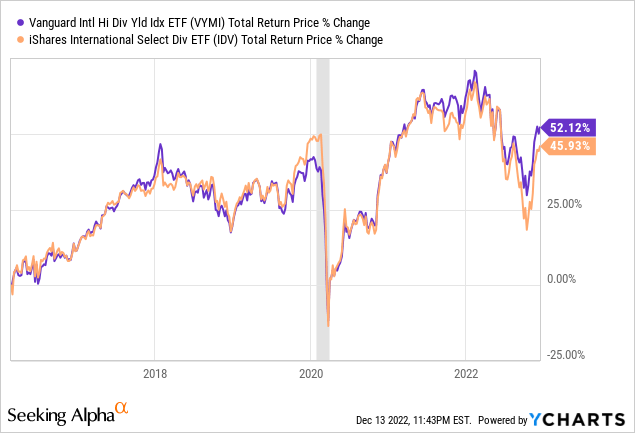

Here’s what:

VYMI has historically traded either in line with or ahead of IDV with the exception of late 2019 and early 2020. During that time, when interest rates were ultra-low, IDV’s slightly heavier tilt towards growth caused an outperformance over VYMI’s slightly heavier tilt towards value.

Bottom Line

VYMI is a great option to consider for dividend investors looking for wide and diversified exposure to international dividend-paying stocks to complement their US-concentrated stock portfolios.

Though VYMI has rebounded ~17% from its lowest point, the continued drop in inflation and the US dollar should continue to fuel international stocks’ recovery.

For those looking for a high-quality fund granting exposure to a wide swathe of dividend stocks in developed and emerging markets, VYMI is perhaps the best option to consider.

Be the first to comment