ipopba

If there are no dogs in Heaven, then when I die I want to go where they went.”― Will Rogers

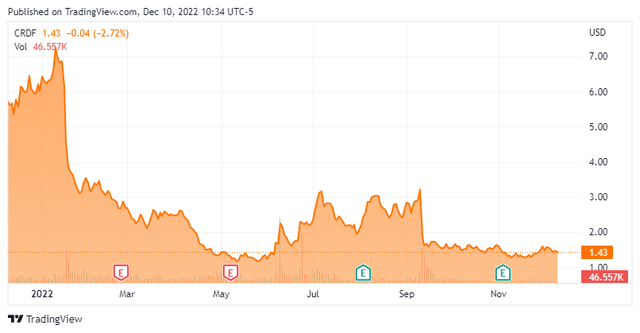

We are checking back in on small cap developmental concern Cardiff Oncology (NASDAQ:CRDF) today. There has been a lot of news flow around Cardiff since we last posted an article on this name in August. An updated analysis on Cardiff follows below.

Seeking Alpha

Company Overview

Cardiff Oncology is a small clinical stage oncology focused concern headquartered in San Diego. The company was formerly known as Trovagene, Inc. and changed its name to Cardiff Oncology in 2012. The stock currently trades just under $1.50 a share and sports an approximate market capitalization of $65 million.

November Company Presentation

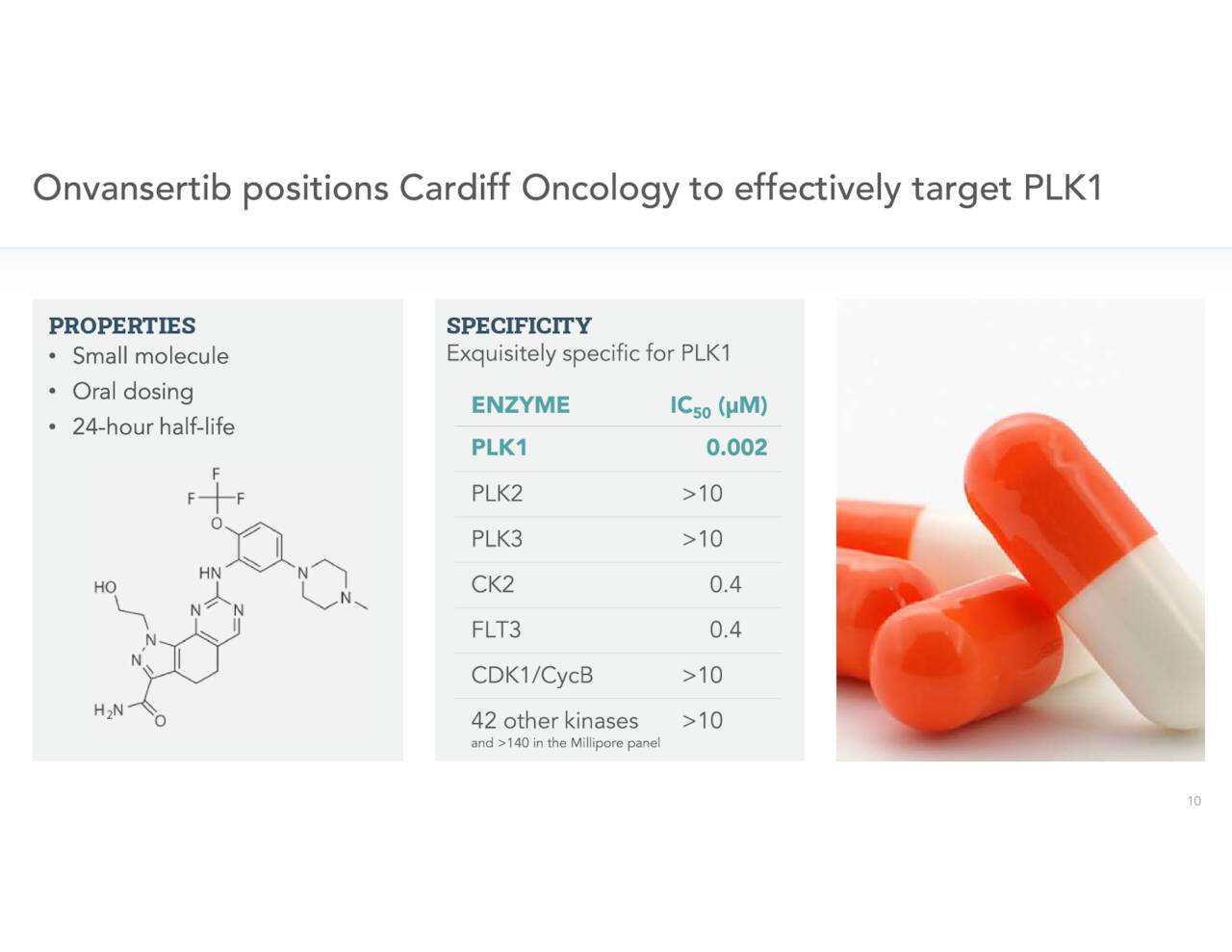

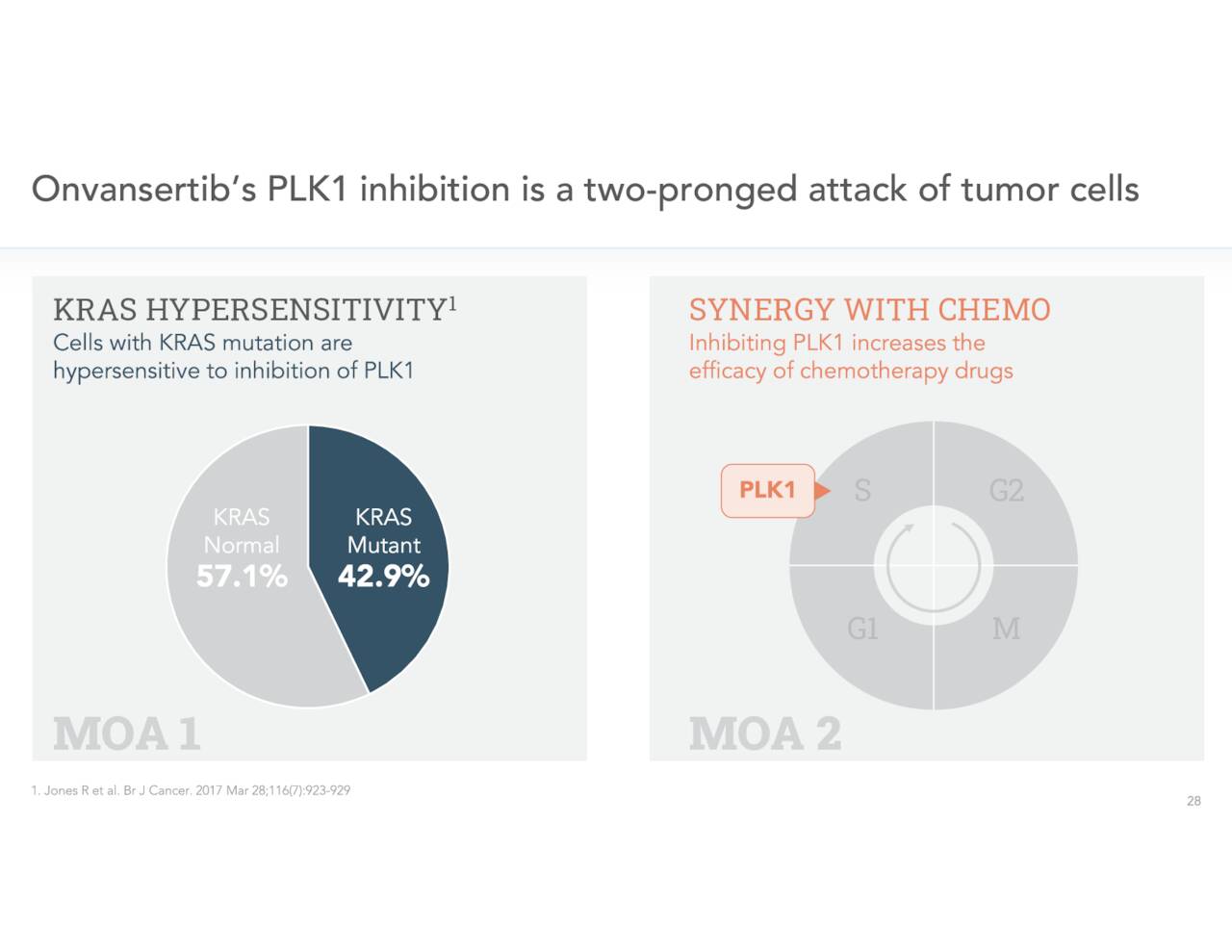

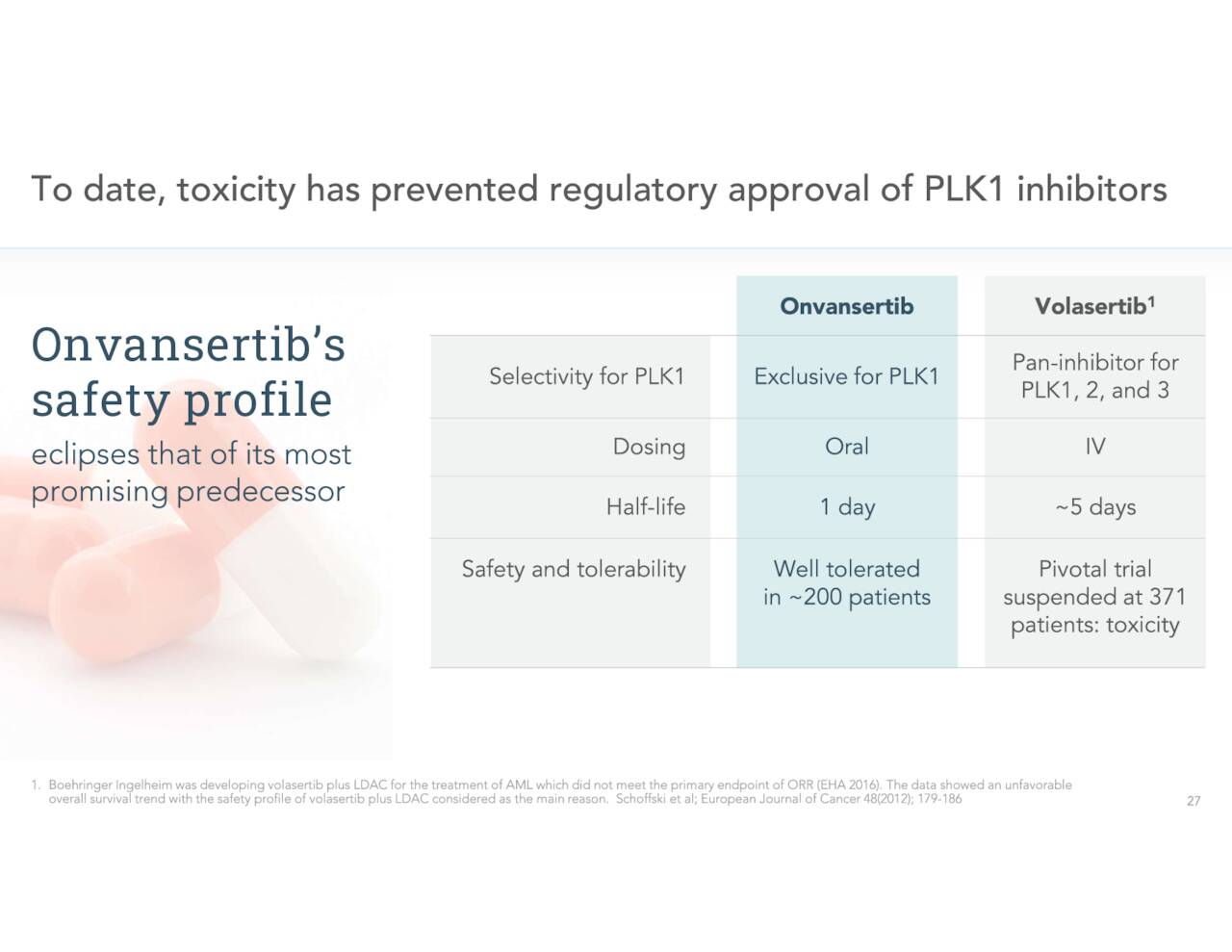

The company’s key asset in development is called Onvansertib, which is an oral and highly selective inhibitor of Polo-like Kinase 1 or PLK1. PLK1 is substantially overexpressed a variety of different cancers including colorectal and breast cancer. Cardiff is intent on utilizing Onvansertib in combination with standard of care (SoC) therapies targeting cancers with KRAS-mutations, to improve current available treatments.

Recent Developments:

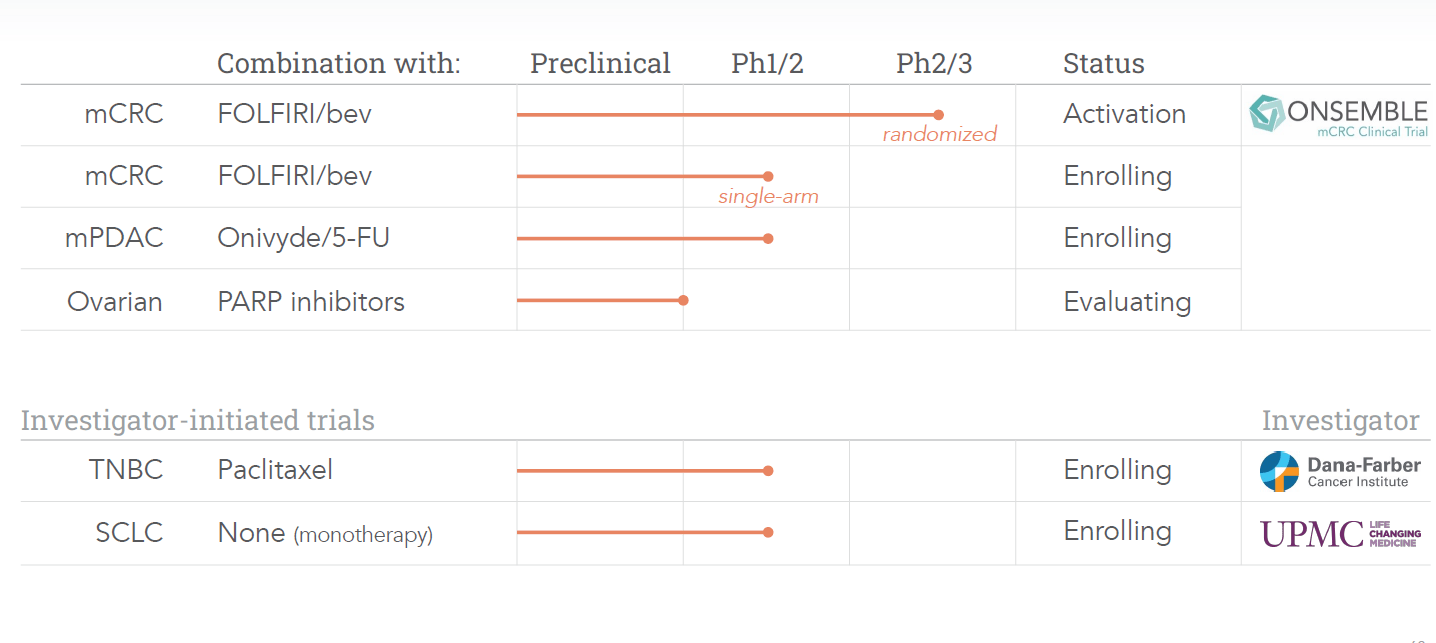

In mid-September, the company announced after completing a strategic review of clinical data that it would be discontinuing its clinical studies positioning Onvansertib to treat metastatic castrate-resistant prostate cancer (mCRPC). Cardiff will focus its developmental efforts on metastatic colorectal cancer (mCRC) and metastatic pancreatic ductal adenocarcinoma (mPDAC). The company is open to reopen efforts in mCRPC if it finds a funding partner it should be noted. This news caused a large sell-off in the stock after the news hit.

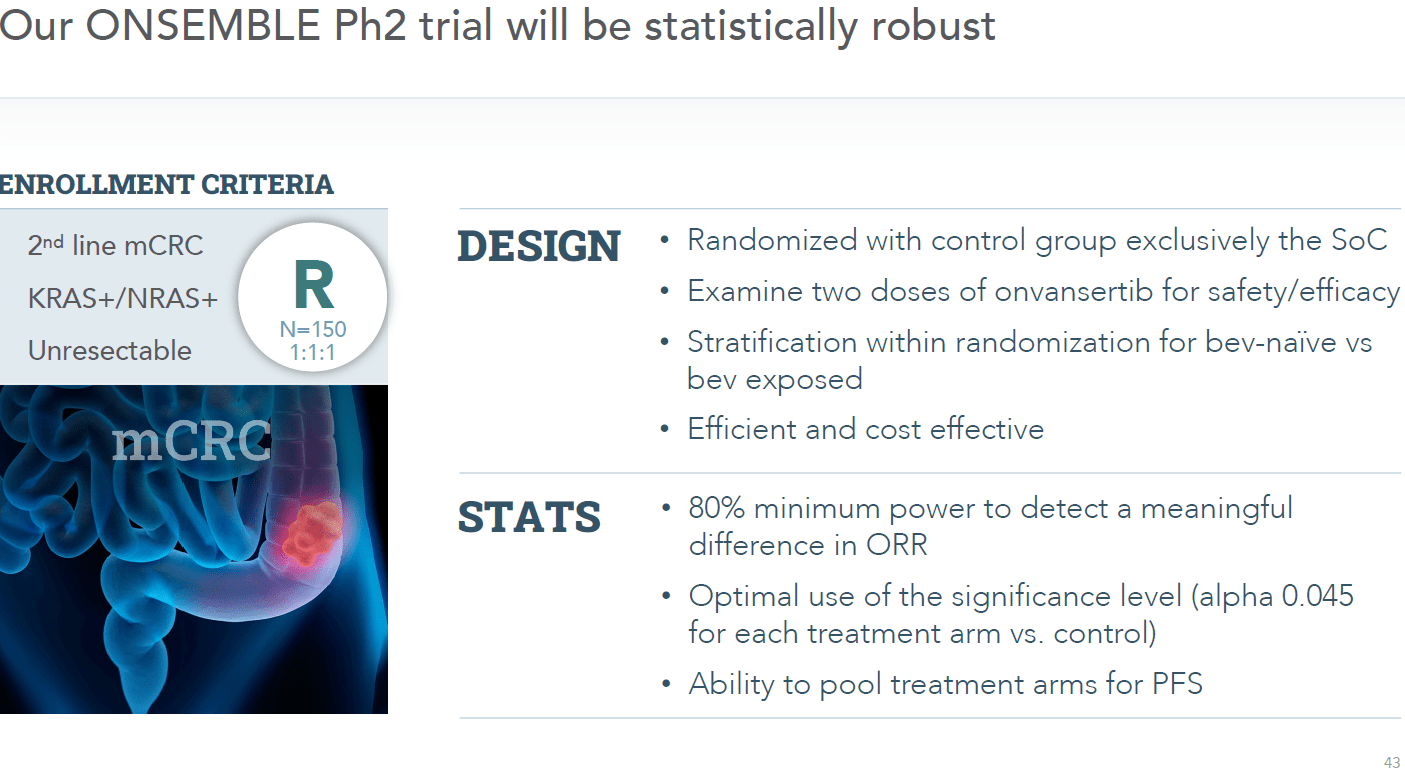

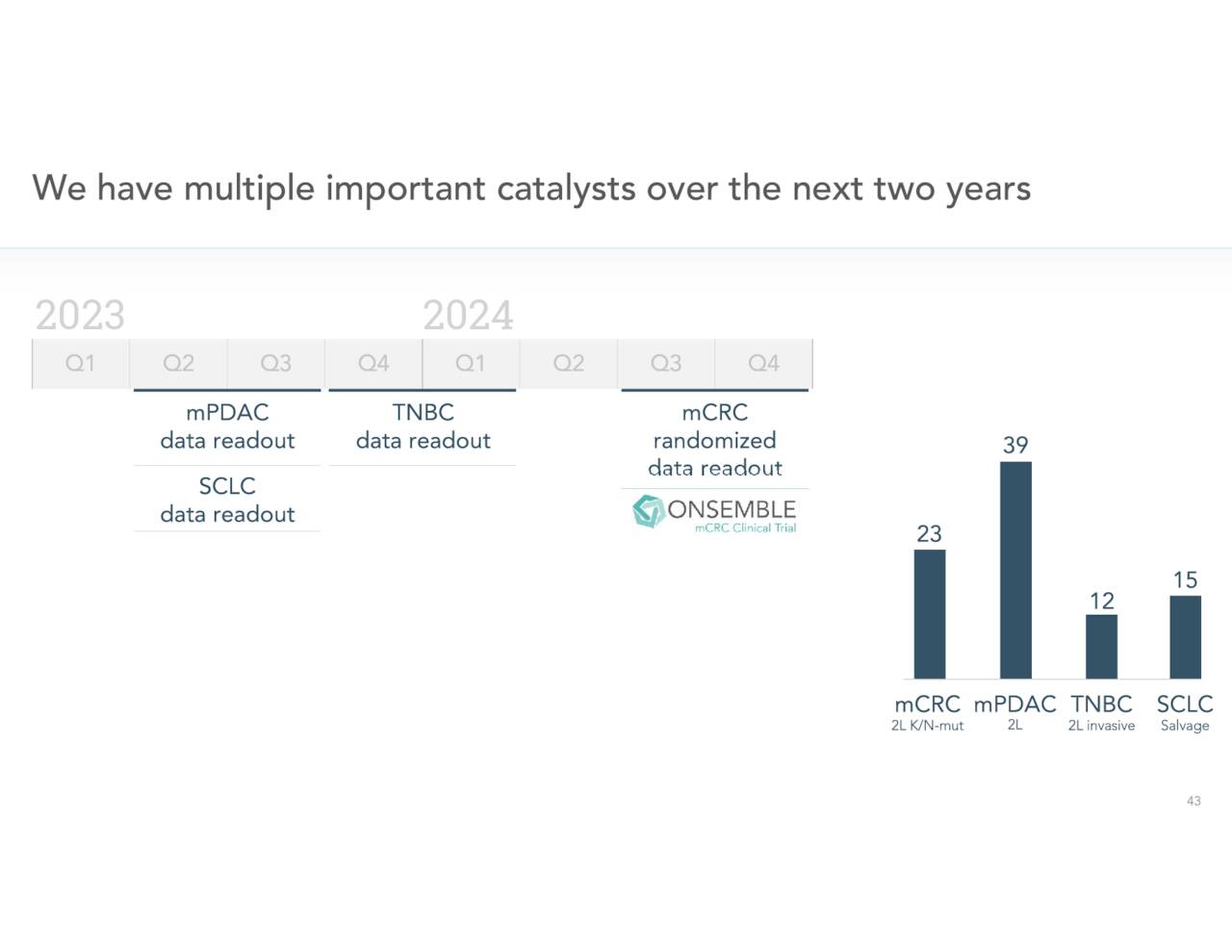

Interestingly, the day before the stock move up nicely after Cardiff presented positive Phase 1b/2 data for Onvansertib in patients with KRAS-mutated metastatic colorectal cancer in a second-line setup at the European Society for Medical Oncology (ESMO) Congress 2022. At the same time, management announced its intends to start a randomized Phase 2 trial to evaluate Onvansertib in patients with KRAS-mutated mCRC in a second-line setup in combination with SOC FOLFIRI/bevacizumab. Topline data will not be available from this trial to sometime in the second half of 2024.

November Company Presentation

Even after suspending its work in prostate cancer, the company has several ‘shots on goal‘ remaining. Colorectal cancer is a top five cancer indication, impacting some 150,000 Americans a year.

November Company Presentation

It is even more prevalent in Europe. Just over 40% of colorectal cancer cases involve KRAS mutations.

Seeking Alpha Article

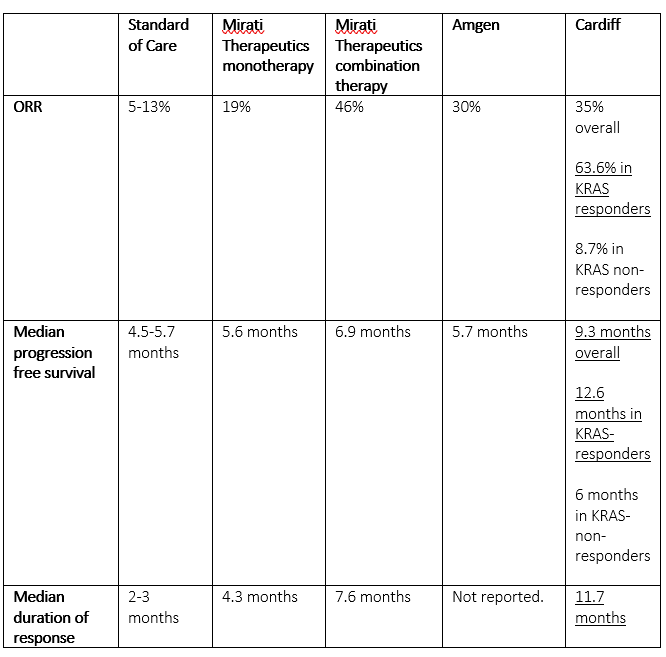

Cardiff is in the process of initiating that randomized placebo-controlled Phase 2 trial ‘ONSEMBLE’ in mCRC which the company is positioning to garner accelerated approval from the FDA is results are successful. A recent article on Seeking Alpha pointed out how Cardiff’s trial data to date show superiority to efforts from Mirati Therapeutics (MRTX) and Amgen (AMGN).

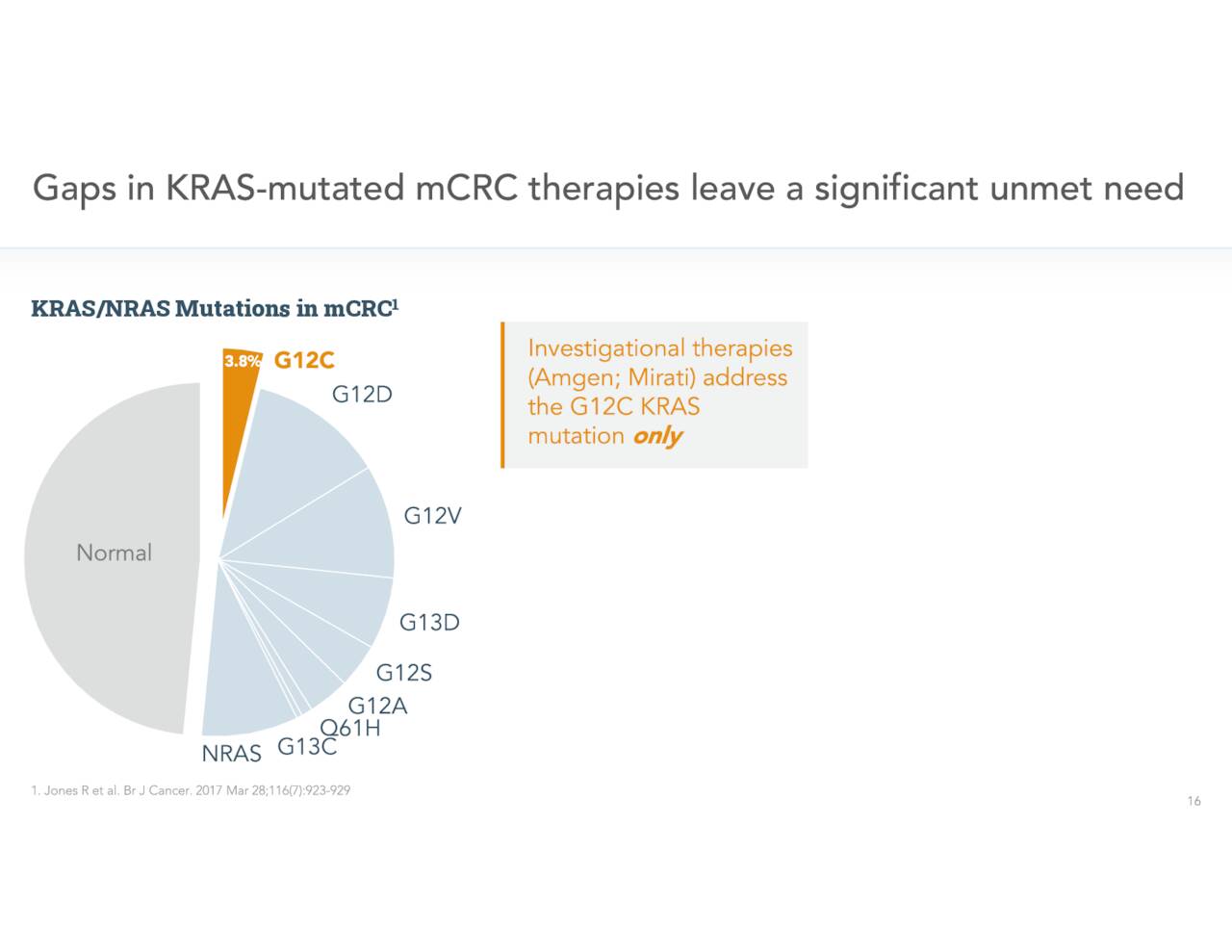

September Company Presentation

In addition, those efforts address a small portion of the overall mCRC population as they target only one of myriad KRAS mutations.

November Company Presentation

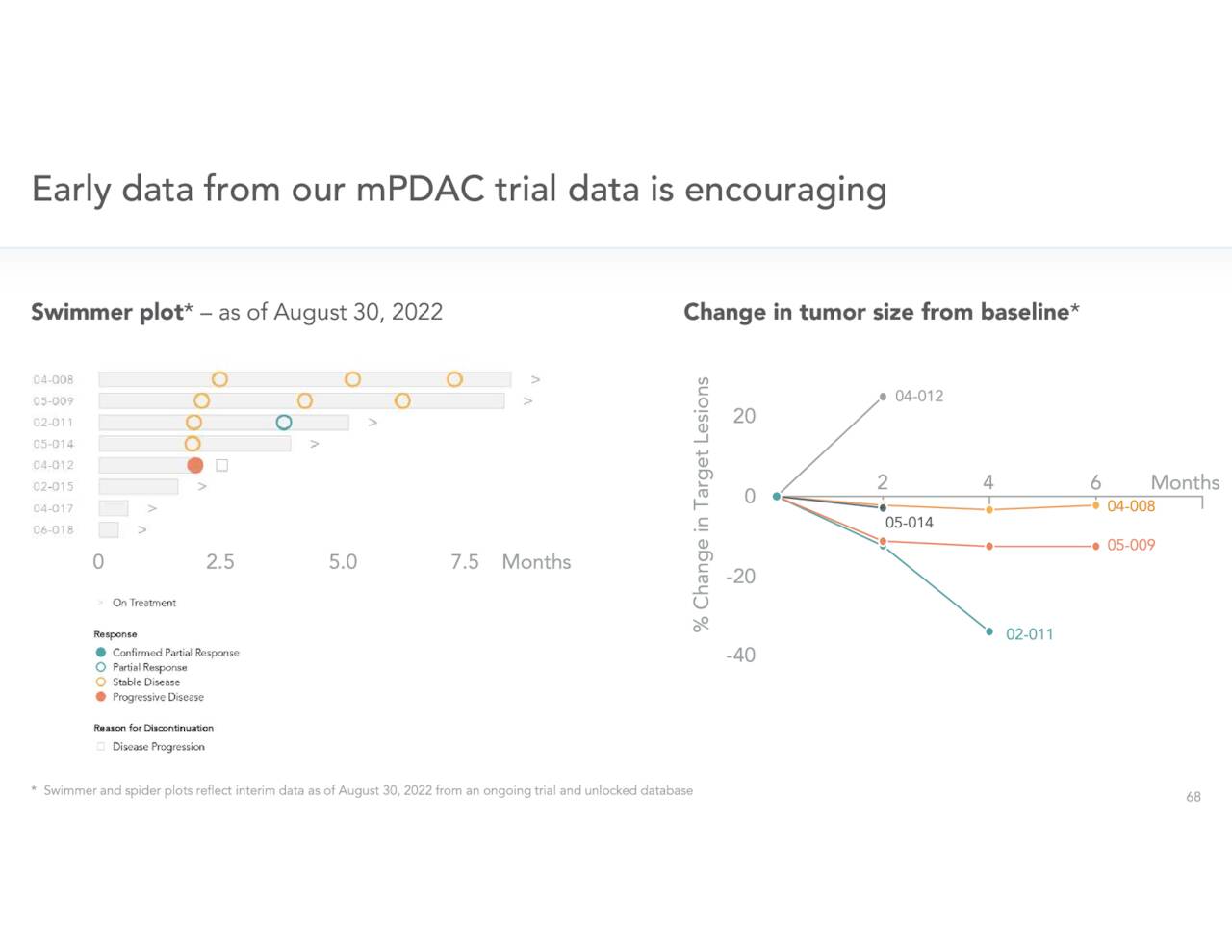

Cardiff’s developmental efforts in pancreatic cancer are earlier stage. Early results have been encouraging and nearly all pancreatic cancers contain KRAS mutations.

November Company Presentation

The company also recently announced two new early stage trials around Onvansertib: One in triple-negative breast cancer in combination with paclitaxel and as a monotherapy trial in small-cell lung cancer.

November Company Presentation

Analyst Commentary & Balance Sheet

Since we last touched on Cardiff, Piper Sandler lowered its price target to $5 on CRDF from $7 but maintained its Buy rating on the equity. Both H.C. Wainwright ($14 price target) and Robert W. Baird ($5 price target) reissued their own Buy ratings.

November Company Presentation

Approximately three percent of the outstanding float is currently held short. Several insiders including the CEO and CFO have purchased over $350,000 worth of stock since our piece on it in August. There has been no insider sales over that time. The company ended the third quarter with cash, cash equivalents, and short-term investments of nearly $115 million which leadership has stated provides a cash runway into 2025.

Verdict

November Company Presentation

Toxicity has prevented the FDA from approving PLK1 inhibitors to this point. Onvansertib’s safety profile to this point has been best in class. If ONSEMBLE’s results are positive, one would think accelerated approval from the government agency is likely given the high unmet needs in this indication.

Given the promise of Onvansertib and Cardiff’s minute market capitalization, one would think a buyout by a larger player is a distinct possibility as well. Pfizer (PFE), given its equity investment in Cardiff late in 2021, would seem the most logical acquirer.

November Company Presentation

Adding all this up, my view on Cardiff remains the same as the conclusion of my last article on this small oncology name.

The stock continues to have a favorable risk/reward profile even if it is in a high beta sector of the market. The equity still merits “watch item” status as the company continues to advance its primary drug candidate.”

The meaning of life is that it stops.”― Franz Kafka

Be the first to comment