imaginima

Investment Thesis

Vanguard Total International Stock ETF (NASDAQ:VXUS) offers investors a broad, foreign-asset focused fund which benefits from an exceptional asset selection process. The fund’s merits are further buoyed by an effective management team and unique ETF provider in the form of The Vanguard Group.

However, a difficult macroeconomic environment combined with exposure to unique but nonetheless key risks makes predicting the right time to invest particularly difficult.

Together we will explore the funds key metrics using The Value Corner’s (TVC) professionally developed ETF Analysis Structure to provide you with a new-found understanding of this particular investment tool.

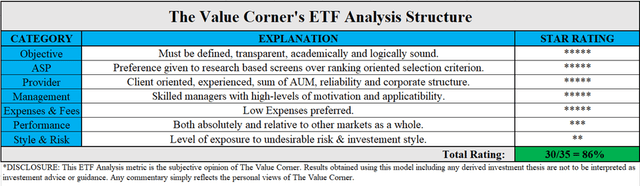

TVC’s ETF Analysis Structure

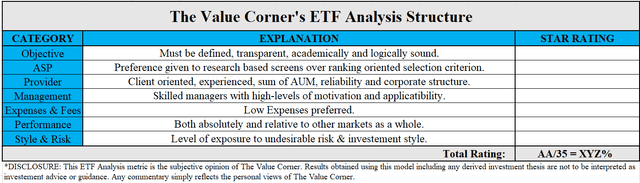

Below is an explanation of our professionally developed ETF Analysis Structure. For each metric an ETF can be awarded up to five stars, five representing a ‘good’ score, one representing a ‘poor’ score.

The final score assigned to each firm is an aggregate of the number of stars earned in each category divided by the maximum possible score, multiplied by 100 and expressed as a percentage.

The Value Corner

Fund Objective – *****

The Vanguard Total International Stock ETF aims to track the performance of the FTSE Global All Cap ex US Index, which measures investment returns of stocks issued by companies outside of the United States (US).

The primary objective is to offer investors a passively managed ETF with broad exposure to developed and emerging non-US equities markets. The asset class structure aligns with the typical expectations for a foreign large-blend category.

The fund currently comprises of 7985 companies located in 48 markets with a median market cap of $26.7B. A healthy spread of small-, mid- and large-cap companies are included in the index with a target average earnings growth rate of 9.4% for the fund as a whole.

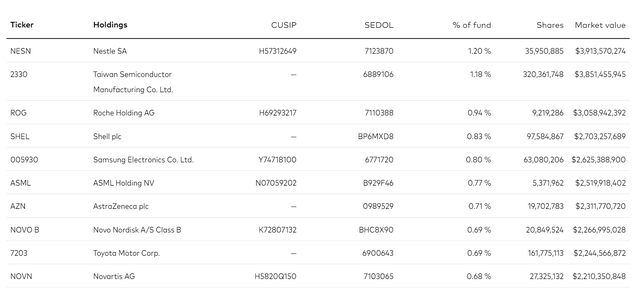

Exposure to the largest equity held by the firm is Nestlé SA (OTCPK:NSRGY)(OTCPK:NSRGF)(SWX: NESN) which rests at 1.20% of the total fund worth.

This incredibly broad ETF provides investors with the opportunity to diversify their portfolios with a versatile blend of non-US equities. Furthermore, the index weighs equity holdings by market cap which allows the fund to follow market prices accurately.

The fund’s core objective is well defined, professionally comprehensive and transparent to investors. This earns the fund’s objective a FIVE STAR rating in our analysis structure.

Asset Selection Process (ASP) – *****

The fund captures 98% of the world’s investable market capitalization by replicating the FTSE Global All Cap ex US Index. This mean a significant number of key restrictions and screens are in place to ensure accurate net asset value (NAV) of each equity holding as well as core ETF composition is maintained at the highest possible standards.

Equities are initially weighted according to their free-float market cap. Securities with a free float of 5% or lower are excluded from the index. The fund also excludes equities which do not achieve the requirement for more than 5% of company voting rights resting in the hands of unrestricted shareholders.

Any equity which fails to meet these primary criteria are ineligible to be included in the fund.

These key investability screens align with those of the FTSE Global All Cap ex US Index which ensures the Vanguard Total International ex US ETF tracks their FTSE benchmark accurately.

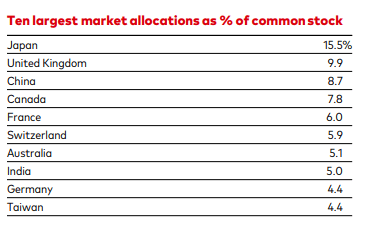

The regional exposure is heavily biased towards developed countries with a particular focus on Asian, European and North American markets. The largest individual countries represented in the index are Japan (15.5%), The United Kingdom (9.9%), China (8.7%), Canada (7.8%), France (6.0%) and Switzerland (5.9%).

The Vanguard Group – VXUS Fact Sheet

This is due to the restrictive ownership and large market-cap biased screens associated with the index the fund is tracking favoring larger equities which are most commonly found in more developed countries.

However, the coverage of non-US nations is very comprehensive and thanks to the aforementioned eligibility screens, offers the investor a maximized opportunity for profitable market exposure.

The Vanguard Group – VXUS Overview

Overall holdings composition according to NAV is incredibly diversified. The top 10 equity holdings account for just 9% of total asset value which decreases the risk to investors if any one specific equity performs poorly.

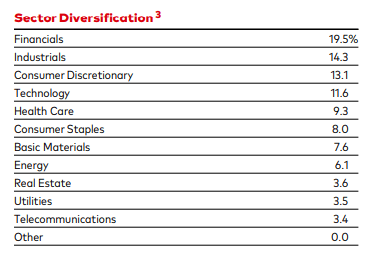

Diversification of holdings by sector exposure is equally broad. The largest single portfolio exposure rests at just 19.5% towards the financials sector. This is followed by industrials (14.3%) and consumer discretionary (13.1%). Technology as a sector is found in fourth place by weighting (11.6%).

The Vanguard Group – VXUS Fact Sheet

More defensive equities such as those in the health care or consumer staples sectors are less represented in the fund.

Overall, the fund has comprehensive selection criteria when screening equities for eligibility. This is largely due to its benchmark being the FTSE Global All Cap ex US Index.

Equities are chosen objectively based on merit with little to no subjective input taking place. I rate Vanguard’s Total International ex-US ETF as having a FIVE STAR ASP.

ETF Provider – *****

Vanguard Homepage

This fund is provided to the investor by The Vanguard Group. Vanguard is the only asset-management firm owned entirely by the funds managed by the company. This is to say, the firm is therefore owned by its clients.

Over the last 50 years, Vanguard has grown to become the largest provider of mutual funds and the second largest provider of ETFs. The firm currently has approximately $8.1T in accounts under management (AUM).

The corporate strategy of placing their investors interests first allows the fund to remain efficient and cost-effective. This is further motivated by the reality that their clients own the firm.

Thanks to The Vanguard Group’s unique corporate structure and excellent client services, the firm receives a FIVE STAR provider rating.

Management Team – *****

In general, Vanguard’s investment managers are incredibly skilled and successful at their jobs.

Vanguard fully discloses that their managers receive a pre-tax bonus that factors the gross performance of all funds managed in the past twelve months. This keeps motivation levels high and ensures the interests of managers and their clients are aligned.

This fund has two Investment Managers: Vanguard Principals Michael Perre and Christine D. Franquin.

Michael has been with Vanguard since 1990 and began advising the fund back in 2008. He has extensive experience as a portfolio manager and leads many of Vanguard’s largest index-tracking funds.

Christine also manages multiple ETFs being one of the key players in launching Vanguard’s UK ETF and Canadian ETF line-ups.

Combined, these two key managers bring excellent knowledge, industry experience and guidance to the fund both with regards to its overall strategy and day-to-day operations.

Thanks to the exceptional experience and managerial structure found at this fund, I assign the management team with a FIVE STAR rating.

Expenses & Fees – *****

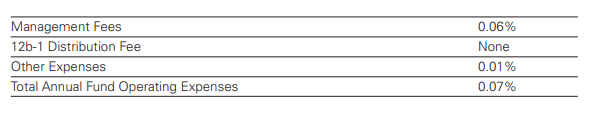

Investors in the Vanguard Total International Stock ETF enjoy incredibly low annual fund operating expenses. These expenses are paid each year by the investor as a percentage of the value of their investment.

Vanguard VXUS Fact Sheet

Total annual expenses to the investor amount to just 0.07% of total investment value. This represents a -82% difference to the median of all ETF’s (0.39%). Most international funds average an expense ratio of 1.23% which emphasizes just how low the expenses for Vanguard Total International Stock ETF really are.

It comes as no surprise that Seeking Alpha’s Quant has provided an “A” expense grade which I would have no issue promoting to an “A+” status.

Considering the incredibly high quality of the ASP for this fund, a 0.07% fee is an entirely acceptable and warranted expense ratio warranting a FIVE STAR rating on the analysis structure.

Performance Metrics – ***

Recent returns have been less than stellar with YTD prices having fallen by -16.97%. The global market including the US (as tracked by the Vanguard Total World Stock ETF (VT) have been approximately identical at -16.88%. In the same period, the S&P 500 returned -15.71%.

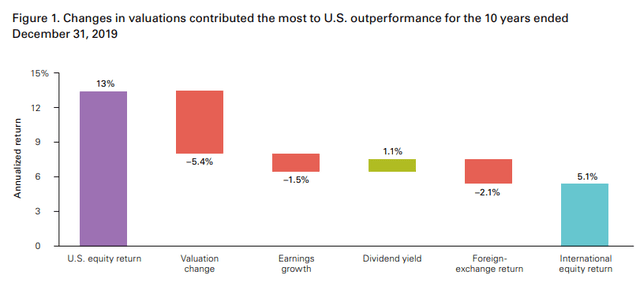

Over the past decade, international equities have been outperformed by the US market by 7.9% according to Vanguard’s own public research papers. This has largely been due to an appreciating dollar as well as the US having a higher GDP growth rate than most other nations.

However, the key here is the statement: past performance is no guarantee of future returns.

The US bias most investors have been operating in their portfolio’s is not expected by Vanguard’s Capital Markets Model (VCMM) to remain the most effective structure for the upcoming ten years.

Vanguard Research “A tale of two decades for U.S. and non-U.S. equity: Past is rarely prologue”

Vanguards VCMM suggests that expected international equity returns will outpace those of the US by 3.4%. This isn’t to say that earnings growth will be faster (the US is still expected to see earnings growths outpace those of international markets by 0.7%), but that annualized returns should be stronger outside the US.

The forecast annual returns for US equities is just 4.7% down 8.3% from the 13% experienced in the last decade. Vanguard attributes this slow-down to the already high market valuations present with most US equities. Therefore, the VCMM model suggests most international equities have more ‘room for growth’ compared with the US counterparts.

This suggests that while ex-US ETFs have not been popular over the past decade due to less than remarkable returns, the future looks significant brighter.

Of course, it must be noted that while the logical explanation and objective forecasting are academically sound, markets are inherently irrational and subject to black swan events which could render stability-based forecasts inaccurate.

Due to the significant uncertainty associated with future returns, combined with an underperforming past, the fund receives THREE STARS on the performance metric.

Investment Style & Risk – **

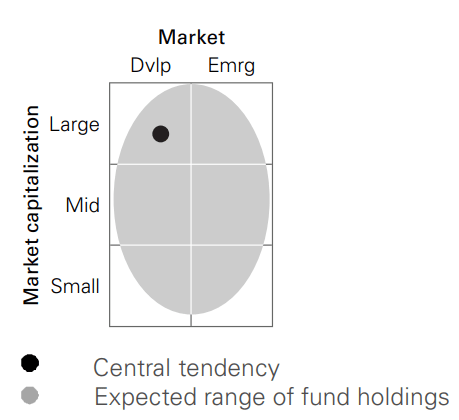

Vanguard’s Total International Stock ETF is classified as an aggressive fund due to its pure focus on non-US equities which are subject to price declines due to the changes in the value of the US Dollar in relation to foreign currencies.

The significant weighting towards non-defensive equity sectors also increases the potential volatility of the ETF. This has not been accomplished implicitly by management, but is rather a consequence of the favoring for larger market-cap equities.

Importantly, its broad asset allocation, high number of equities and regional diversity provide a welcome level of risk diversification for investors. The broad asset classes of their holdings also serve to expose the investor to all potential sources of increased returns in the future.

Vanguard VXUS Fact Sheet

The ETF is classified as having a focus on large-cap equities in developed countries. In practice this is absolutely the case, primarily induced by the aforementioned screening methods the fund uses. However, the fund also exhibits a healthy exposure to small-/mid-cap equities as well as exposure to emerging markets such as India, Brazil and South Africa.

Overall, the fund inherits a certain level of risk due to its focus on more volatile international equities and the ensuing potential for currency fluctuations. Nonetheless, its focus on large-cap equities with a primary regional bias towards developed nations means that its core holdings structure is relatively risk diversified and well protected against localized events of underperformance.

It is worth noting that the globe is currently facing an international-scale bear market which is currently affecting returns in almost all sectors and economies. The fear of a recession is also present with forecasts projecting Europe and Asia to be most affected by these economic slow-downs.

The threat of an international recession hurts the investment thesis of almost all tradable equities, and the Vanguard Total International Stock ETF is no exception. While long-term future returns (next decade) are expected to be positive, a difficult short-term environment may persist for approximately another 12 months.

Significant uncertainty with regards to internal political stressors in key fund exposure regions such as China further increase the levels of risk associated with the fund. While a total collapse of an economy is simply unaccountable for in an ETF’s analysis, the potential risk posed from being exposed to emerging markets is undeniable.

Due to the aggressive strategy pursued by the fund, combined with potential sources of significant short-term, as well as some long-term risk, the fund earns TWO STARS in the Investment Style and Risk metric.

Summary

The Value Corner

The Vanguard Total International Stock ETF provides potential investors with a broad, foreign-asset focused fund which tracks a high-quality index. The fund achieves an overall score of 86% on The Value Corner’s ETF Analysis Structure which is very good indeed.

A highly capable management team and client-oriented provider combined with exceptionally low expense ratios create an ETF which is above average in almost all metrics.

The last decade has seen the fund be outperformed by its purely US focused counterparts. However, compelling research-based evidence suggests the next ten years may see international equities significant outperform their US rivals.

Unfortunately, an uncompromising macroeconomic environment leaves most economies facing economic slowdowns with non-US markets expected to be hit especially hard. Therefore, while a truly compelling long-term investment thesis is present, timing an entry into a position in current market conditions is incredibly difficult.

As always, I personally pursue a dollar-cost-averaging approach to building a position particularly in a bear market. Therefore, I will be following the international markets keenly moving into the new year and will be continuously re-evaluating the motion to begin building a substantial position.

Be the first to comment