Prykhodov/iStock Editorial via Getty Images

Apple (NASDAQ:AAPL) and Alphabet (NASDAQ:GOOG) are two of America’s biggest tech giants. One has a fanatical fan base and extreme brand loyalty, the other is the most ubiquitous company in the world. There’s a strong case to be made for owning both of them, and this author, at least, does.

However, it is worth exploring which of these two stocks is the better buy. First, it’s valuable as an intellectual exercise. Second, it can help you with position sizing. It’s easy enough to say “Apple and Google are both great companies,” it’s a different matter entirely to say how they should be weighted in your portfolio.

You can always just buy AAPL and GOOG via the Invesco QQQ Trust (QQQ), and enjoy both stocks at their market cap weightings. However, Google has historically had stronger growth than Apple, and if that continues, then those who overweight GOOG today will be rewarded.

So, between Apple and Google, which is the better buy?

There are many different opinions on this. Warren Buffett owns Apple but not Google, which implies he likes the former better. However, Buffett’s partner Charlie Munger recently commented that GOOG was a great stock that he and Buffett had “missed.” Li Lu, another top value investor, holds Google in addition to Apple.

As for me personally, I have Google at a higher portfolio weighting than Apple. I think they’re both great companies, but Google was much cheaper than Apple when I started buying the two stocks, despite having better growth. Google’s earnings growth is technically negative due to it owning a stock portfolio during a bear market, but its free cash flow growth is better than Apple’s. I think that Google will outgrow Apple for the foreseeable future, so I see its stock as a somewhat better buy.

Competitive Landscape

When comparing Apple and Google, we need to look at the competitive landscape they operate in. Both companies are giants in the tech sector, and they offer similar products, including:

-

Smartphone operating systems.

-

App stores.

-

Hardware.

Generally speaking, Apple is ahead of Google on hardware, but Google is ahead of Apple on software. In 2021, Apple sold 240 million iPhones, Google’s Pixel 6 reportedly didn’t sell well that year. However, Google’s software has a combined 4.3 billion users, while Apple has 1.65 billion total users. So, Google software has more reach than Apple’s combined hardware/software ecosystem does. Additionally, Android has about 75% of the smartphone market worldwide, while IOS has 25%.

The matter is more complicated when we look at revenue. Apple and Google both take revenue cuts from developers on their app stores, and the Apple app store generates way more sales than the Google Play store. In the first quarter, the app store did $21.8 billion in sales, while the play store did $10.7 billion. Android has more installs than IOS, but IOS users, who trend wealthier than average, are more willing to spend money on apps compared to Android users.

A few other items of note about the competition between Apple and Google:

-

Apple has an ecosystem of apps and hardware which integrate with each other, helping the company collect more revenue per customer.

-

Google also has apps that can work across different devices to create an ecosystem, but because Google software runs mostly on third party hardware, Google doesn’t achieve the full sweep of sales that Apple does (hardware + app downloads + services).

-

Apple and Google also compete in smart watches, a market where Apple has the greatest share out of all manufacturers.

In addition to the competition between Apple and Google, there are also areas where the two are aligned. Chiefly, in advertising. Google pays Apple $15 billion a year to be the default IOS search engine. So, both Apple and Google make money off of the success of Google’s advertising platforms. This gives the two companies an edge compared to Meta Platforms (META), which is currently losing $10 billion a year in revenue to Apple’s recent privacy changes.

Comparative Valuation

When we look at Apple and Google side by side, we can see clearly that they are both incredibly well positioned in the tech industry. It’s very difficult to say which of the two is better positioned. They both control mobile platforms, which make them less vulnerable to competitors than Meta, Snap (SNAP) and others. As for the comparison between Apple and Google: that’s less clear, because their structural advantages are very similar.

In order to break the tie between Apple and Google, then, we’ll have to do a comparative valuation. Assuming both companies are equally entrenched in the market, then the one that’s cheaper relative to intrinsic value is the better buy.

First though, we need to look at both companies’ trailing 12-month (“TTM”) financials side by side.

Financials

In the table below, I have presented some TTM financials for Apple and Google, courtesy of Seeking Alpha Quant:

|

Apple |

|

|

|

Revenue |

$386 billion |

$270 billion |

|

Gross profit |

$167 billion |

$153 billion |

|

EBIT |

$119 billion |

$82 billion |

|

Net income |

$101 billion |

$74 billion |

|

Free cash flow (“FCF”) |

$84 billion |

$52 billion |

|

Equity |

$67 billion |

$254 billion |

|

Long term Debt |

$103 billion |

$12.8 billion |

|

Current assets |

$118 billion |

$177 billion |

|

Current liabilities |

$127 billion |

$61.9 billion |

Using the table above, some key ratios for the two companies can be calculated as follows:

|

Apple |

|

|

|

EBIT margin |

30.8% |

30.3% |

|

Net margin |

26% |

27% |

|

FCF margin |

21.7% |

19.2% |

|

Debt to equity |

1.53 |

0.05 |

|

Current ratio |

0.92 |

2.9 |

As you can see, Apple takes the cake on 2 out of 3 profitability ratios, but Google has better debt to equity and current ratios. These data seem to suggest that Apple is more profitable, while Google has the better balance sheet. We can confirm my profitability analysis by looking at Seeking Alpha Quant’s ratios:

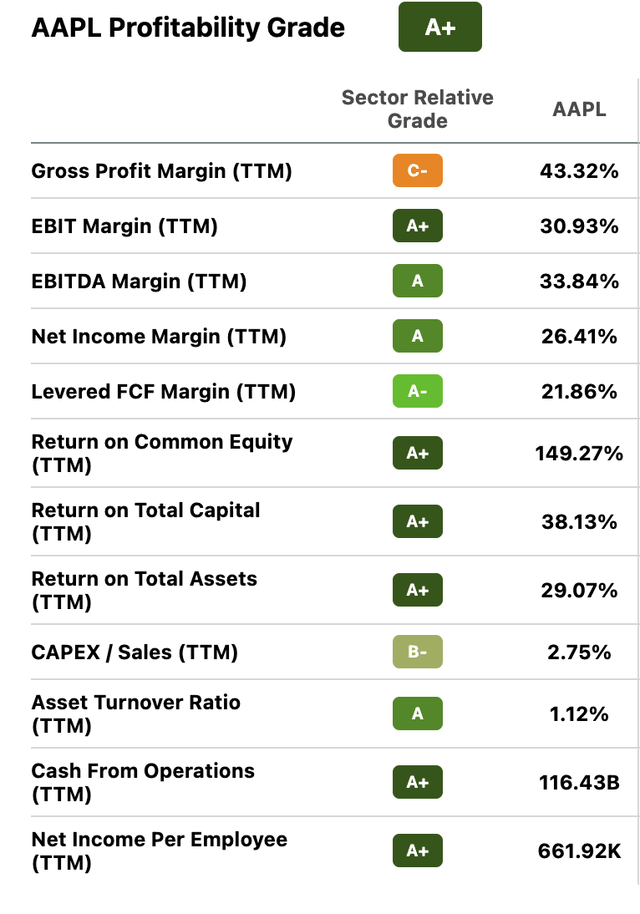

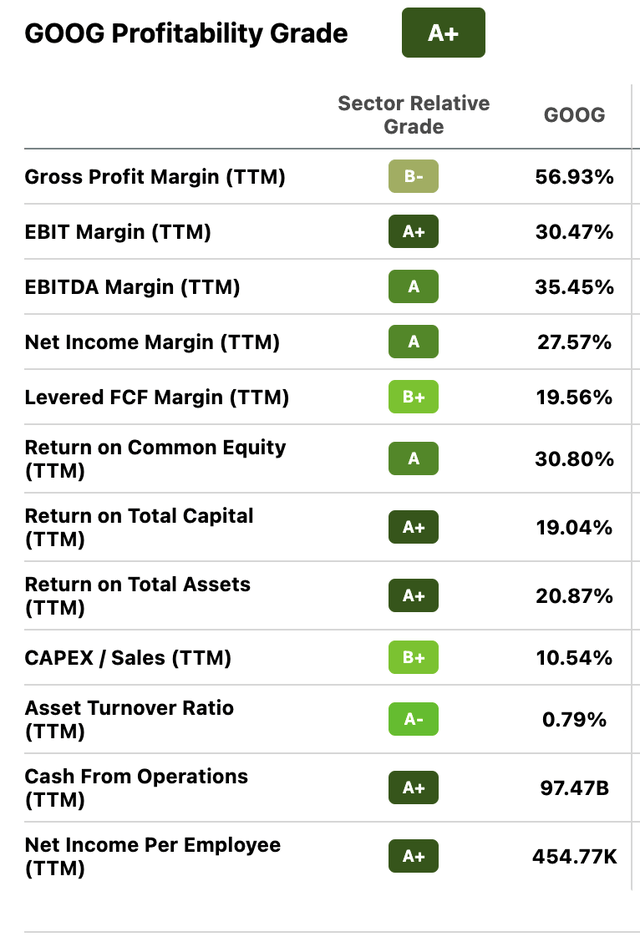

AAPL profitability (Seeking Alpha Quant) GOOG profitability (Seeking Alpha Quant)

The numbers from Seeking Alpha Quant differ from mine slightly, but basically agree that Apple and Google have similar profitability ratios. Apple has a vastly superior return on equity, though–near’s five times Google’s. Given the closeness of all the metrics apart from ROE and ROA, those can serve as tie breakers, giving Apple the win on profitability.

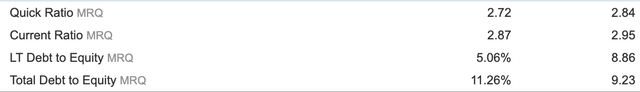

The balance sheet comparison isn’t close. Apple’s debt to equity ratio is 30 times higher than Google’s, while its current ratio is only a third of Google’s. These data suggest that Google is more liquid, and more solvent, than Apple. Below I’ve compiled some third-party ratios by MacroTrends, which agree with my analysis that Google has fewer liabilities relative to assets, both long term and current, compared to Apple.

Apple balance sheet ratios (Investing.com) Google balance sheet ratios (Investing.com)

The tables above clearly show that Google’s liquidity ratios are higher than Apple’s, and its debt ratios lower–this suggests higher liquidity and solvency.

Valuation

Armed with Apple and Google’s financials, we can now move on to valuation. So far, our comparison basically favors Google: it has a much better balance sheet than Apple does. But which stock is a better value?

According to Seeking Alpha Quant, some key valuation metrics for Apple and Google include:

|

Apple |

|

|

|

Price to earnings |

23.5 |

21 |

|

Price to sales |

6.17 |

5.7 |

|

Price to book |

34.84 |

5.5 |

|

Price to cash flow |

20 |

15.6 |

|

EV/EBITDA |

17.66 |

14.85 |

For a more forward-looking valuation, we can do a DCF model. Assuming an 8% discount rate, a 0% perpetual growth rate, and using 5-year historical FCF growth rates for both stocks, my DCF model yielded these fair values:

- Google: $2,702.

- Apple: $171.

Both get valuations above their current prices, but Google’s upside (20%) is higher than Apple’s (17.9%).

When we factor in both multiples and discounted cash flows, there’s no question:

Google wins on valuation.

All of the multiples are much lower for Google than for Apple, and Google’s fair value is higher. Additionally, Google has much higher historical revenue growth than Apple does. In the last 12 months, Google grew revenue at 37%, Apple at only 18.6%. In the most recent quarter, Google reported an earnings decline, whereas Apple’s earnings grew. However, Google’s earnings decline was mainly due to having stocks on its balance sheet. GAAP accounting rules require companies to count stock price fluctuations as part of earnings, which results in losses when stocks go down. It does not, however, reflect operating performance: Google’s operating cash flow grew 9% in Q1.

Conclusion: Google is the Better Long-Term Value

Having considered competitive, financial and valuation factors, I conclude that Google is a better value than Apple at today’s prices. To recap the results of each section of my analysis:

-

Competitive position: tie.

-

Profitability: slight win by Apple.

-

Balance sheet: huge win by Google.

-

Valuation: huge win by Google.

-

Growth: small win by Google.

Out of the five factors I’ve looked at, Google wins on three, Apple wins on one, and one is a tie. The former stock has more things going for it than the latter does. For this reason, I have Google overweighted in my portfolio relative to Apple.

Risks and Challenges

While my analysis shows that Google has more advantages over Apple than vice versa, I am heavily relying on quantifiable factors here. There’s a plausible case to be made that Apple beats Google on “soft” factors, such as marketing and branding. Everybody knows AAPL has a great brand – how much is it worth exactly? It’s hard to say. Brand recognition gives companies pricing power, and Apple has a lot more of that than Google does. It is possible that, over time, Apple’s brand power will prevail over Google’s ubiquity. There is no way to fit that possibility into a quantitative model, but it exists.

There’s also the possibility of short-term volatility in Google after this month’s earnings release. Both Apple and Google are releasing earnings in a few weeks, and Google is vulnerable due to its equity investments. When equities decline in price, their “losses” take a bite out of earnings for companies that hold them. This factor will work against Google in the upcoming release, as it holds positions in struggling stocks like UiPath (PATH).

There are also risks to investors choosing to go long both of these stocks. The Federal Reserve is raising interest rates this year, and rate hikes aren’t usually good for tech stocks. The higher the risk-free rate, the less valuable future growth is. High interest rates generally make value stocks more appealing than growth stocks, and neither Google nor Apple is really in ‘value’ territory just yet.

The Bottom Line

Taking a comprehensive view of things, it looks like Google and Apple are both buys right now, and that Google is the better buy of the two. They’re both incredibly dominant companies, Google being just a little cheaper and faster-growing. That doesn’t guarantee that these stocks will do well, though: things can always play out differently than any model can predict. All it would take would be a bigger than expected rate hike, or a Q2 earnings miss, to send either AAPL or GOOG tumbling. If you choose to buy either of these stocks, make sure you know what you’re getting into. It pays to play it safe.

Be the first to comment