AndreyPopov

Investment Thesis

Qualtrics (NASDAQ:XM) has a great product and a great reputation in a large and growing market. Nevertheless, its stock-based compensation plan, high valuation, and doubts about sustaining its previous growth levels make it a “hold” for me.

Introducing Qualtrics

Qualtrics offers an experience management (XM) platform for managing customer, employee, brand, and product experiences. The company was founded in 2002 and acquired by SAP in 2019. In July 2020, SAP announced its intention to take Qualtrics public, and the company began trading on the Nasdaq on January 28, 2021.

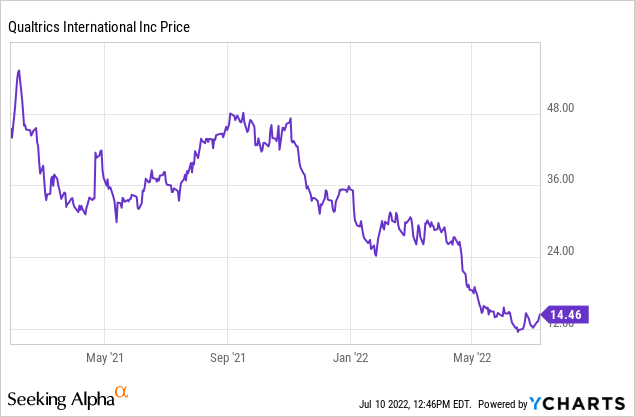

The stock has had a rather rough last 12 months. In the next section, we see that this could be attributed partly to widening losses.

Relating to Qualtrics, in this article I will analyze:

- Its historical performance

- Factors impacting future potential

- Overall statistics compared

- My overall take on Qualtrics

Historical Performance

Growth (year-over-year)

|

Dec-19 |

Dec-20 |

Dec-21 |

Last 4 Quarters |

|

| Revenues | 47.09% | 29.16% | 40.88% | 31.11% |

| Gross profit | 35.59% | 39.29% | 39.88% | 27.35% |

| Selling General & Admin Expenses | 334.58% | -47.54% | 148.26% | 64.75% |

| R&D Expenses | 267.27% | -12.11% | 52.33% | 47.80% |

| Net income | -2600.85% | -72.96% | -288.67% | -104.37% |

Source: Seeking Alpha

Margins (% of revenue)

|

Dec-19 |

Dec-20 |

Dec-21 |

Last 4 Quarters |

|

| Gross profit | 68.62% | 74.00% | 73.48% | 72.48% |

| Selling General & Admin Expenses | 195.83% | 79.54% | 140.16% | 137.97% |

| R&D Expenses | 40.96% | 27.87% | 30.14% | 31.33% |

| Net income | -170.45% | -35.69% | -98.46% | -98.20% |

| Free Cash Flow | -68% | -66% | -9% | -1% |

Source: Seeking Alpha

The historical performance tables show that both historical revenue and gross profit growth look very strong. However, R&D and SG&A expenses both grow at a significantly higher rate. The margins show that while the gross margin is excellent, the expenses are combined much higher than the revenues, leading to extremely high losses. The cash burn decreased in more recent periods.

Stock Based Compensation

The latest annual report of Qualtrics state that the high operating expenses are related to high stock-based compensation, which isn’t necessarily unusual in high-growth loss-making tech companies. While such stock-based compensations could improve long-term productivity and satisfaction of employees and management, it sure could increase stock dilution, which is a disadvantage for shareholders. While the stock-based compensation don’t have a direct impact on cash flows, in the latest earnings call management boasts of having an improved and positive operating cash flow. However they don’t mention how much stock dilution the stock based compensations will cause. The specific method of stock based compensation that Qualtrics uses, is called Restricted Stock Unit (RSU). A Restricted Stock Unit is a grant that is valued in terms of company stock but is not issued at the time of the grant. The corporation distributes shares, or the cash equivalent of the number of shares used to value the unit, after the receiver of a unit meets the vesting criterion.

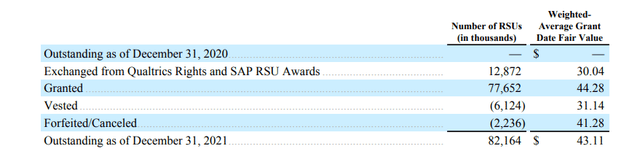

Overview restricted stock units (Annual report Qualtrics)

In the overview above, it can be seen that there are 82 million restricted standing units outstanding as of December 31, 2021. As of December 31, 2021, Qualtrics had 570 million shares outstanding. Hypothetically, if all restricted standing units were to be activated as of now, that would lead to a 14.4% increase of outstanding shares (dilution). Alternatively, the company could pay out a cash equivalent.

Great market opportunity

Experience management is the business discipline of helping organizations connect with their customers and employees. A report by PwC states that more and more customers prioritize their experience and demands more when it comes to experience. I could only imagine it’s the same for employees. Despite this, most companies are not able to manage the experience well enough. Thus, the experience management market opportunity is huge and it can be found in every business, in every sector, in every country. Experience platforms offer a solution to such issues.

Amazing product

The Qualtrics XM Platform is its main software platform, allowing for the design and continuous improvement of the four core experiences of any organization: customer, employee, product, and brand. Qualtrics enables the management of all four experiences on a single, integrated platform:

• CustomerXM — reduce churn, boost engagement, and increase customer lifetime value (LTV) by listening to customers across all channels and acting on their input.

• EmployeeXM – boost employee retention, engagement, and productivity by continually listening to employees and providing improved working experiences.

• ProductXM — create goods that people want, save time to market, and improve share of wallet by identifying and acting on user wants desires, and expectations.

• BrandXM — create a bedrock of loyal followers, acquire new customers, and increase market share by ensuring that your brand resonates at each critical touchpoint and attracts target buyers.

Unlike some other experience services on the market, Qualtrics does more than gather post-transaction data to track satisfaction patterns. Instead, its XM Operating System is a single, secure, cloud-native platform that enables organizations to bring together all of their structured and unstructured experience data, analyze it with native advanced AI-powered analytics, and take real-time action to continuously improve the experiences they deliver across customer, employee, product, and brand.

With the acquisition of Clarabridge in 2021, Qualtrics strengthened its ability to help enterprises uncover what their customers and workers are saying, wherever they are saying through it, including social media, emails, support calls, chats, and product reviews.

Market Leader

Because of the quality of its products, the Qualtrics XM Platform is trusted by more than 16,750 customers, including 89% of the Fortune 100, according to its latest annual report. Furthermore, the company wins plenty of awards for its platform and scores high reviews on review websites.

Nevertheless, there are also other respected companies in the experience management market, such as Medallia and Momentive Global (MNTV) which own SurveyMonkey. While Momentive is more focused on smaller businesses, they are trying to get into the enterprise market as well. Also, Medallia scores quite well in the enterprise segment. While Qualtrics is the leader in the enterprise market, these players are still something to watch out for.

Another bit of a concern I have is that its high historical growth rates could decrease in the coming years as there are fewer potential enterprises left to be acquired in the U.S.

According to its latest earnings call, Qualtrics does invest a lot to gain exposure in other countries than the United States. However, this brings certain risks as new markets require different demands and they will have to compete with different companies.

Overall, there are excellent opportunities in the market and Qualtrics does have the product to take advantage of them. However, sustaining its previous growth rates will be challenging.

Overall statistics compared

I computed several basic statistics of Qualtrics. As a benchmark, I used Momentive Global.

| Price/Sales | Price/Gross Profit | Revenue growth (3Y) | Gross margin | Net income margin | |

| Qualtrics | 6.66 | 9.19 | 38.84 | 72.30% | -98% |

| Momentive Global | 3.08 | 3.69 | 20.39 | 83.50% | -28% |

Source: Seeking Alpha

First of all, I want to make a note regarding the price to sale and price to gross profit ratios. These ratios are calculated without taking the unvested stocks (from the stock based compensation plan) into account which I referred earlier to. For Momentive Global, the impact of their unvested stock is pretty close to zero, as they don’t have a lot of them right now. However, as stated before, for Qualtrics their unvested stocks could impose serious dilution. Hypothetically, if they were all to be activated (14% of total current shares outstanding), this would lead to a price to sales ratio and price to gross profit of 7.7 and 10.8 respectively.

With or without the potential future dilution, Qualtrics is very high-priced compared to Momentive Global when it comes to the price-to-sales ratio. Furthermore, as Momentive has a higher gross margin, according to the price to Gross profit, Qualtrics is even more expensive. Furthermore, due to its high operational expenses, its losses are much higher than for Momentive Global. On the other hand, Qualtrics has had an extremely high historical revenue growth rate.

If Qualtrics could cut its stock-based compensations by a lot, it would come closer to the net income margin of Momentive. Nevertheless, that wouldn’t make a difference for the price to sales and price to gross profit valuation.

My overall take on Qualtrics

The experience market is very important and large and that only seems to increase in the future. Qualtrics seems to be a very respected player in the market with an excellent product. This has resulted historically in a very high revenue growth level. However, this comes with a heftier price tag, according to the valuation multiples. Time will tell whether the geographical expansion will lead to success, whilst its U.S. enterprise revenue growth could slow down a bit. Furthermore, very high stock-based compensation could lead to high stock dilution or high cash outflow. With these negative aspects in mind, I wouldn’t pay the high valuation, especially considering that players such as Momentive Global and other high-growth players in the overall stock market can be found for much cheaper. The stock price has to drop more in order for me to consider buying it.

Be the first to comment