aeduard

Just over four months ago, I wrote on Jaguar Mining (OTCQX:JAGGF), noting that while the stock might be tempting to some investors after a 75% decline, there were dozens of better ways to play the sector. Since then, the stock has slid another 18% from US$2.60 and continues to massively underperform juniors with more compelling stories like i-80 Gold (IAUX). The underperformance of Jaguar vs. the sector and sector leaders should not be surprising, with it continuing to be a marginal producer (YTD all-in costs north of $1,800/oz) and recently suspending its quarterly dividend. Let’s take a closer look at the Q3 results:

Jaguar Mining Operations (Company Presentation)

Q3 Production & Sales

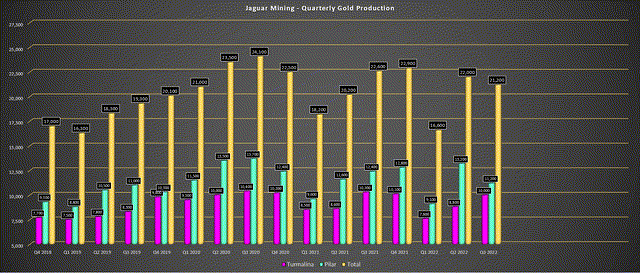

Jaguar Mining had another mediocre quarter in Q3, reporting a 6% decline in production to ~21,200 ounces of gold. This was related to fewer tonnes processed and lower head grades at both operations. Gold sales were also lower, with ~22,100 ounces of gold sold vs. ~23,200 ounces in Q3 2021. The combination of lower sales combined with a weaker average gold price negatively impacted revenue in the period, and quarterly revenue dove to $37.8 million, down from $40.7 million in the year-ago period. Meanwhile, from a production standpoint, Jaguar is set up for another significant miss vs. guidance this year, tracking to produce ~83,000 ounces in FY2022 vs. a mid-point of 90,000 ounces.

Jaguar Mining – Quarterly Gold Production (Company Filings, Author’s Chart)

The silver lining is that Jaguar noted that production should improve materially in Q4 and that this was one of the best quarters since 2021 for Turmalina. That said, even if the company has a blowout quarter in Q4 with the production of 23,000+ ounces, it is still tracking to miss the low end of its guided range (86,000 to 94,000 ounces) by a wide margin. The result is that cash flow from operations is expected to decline materially year-over-year when factoring in the higher operating costs due to inflationary pressures. The continued decline in operating cash flow on a full-year basis is especially disappointing, given that Jaguar is lapping very easy year-over-year comparisons (operating cash flow already fell 42% last year – FY21 vs. FY20).

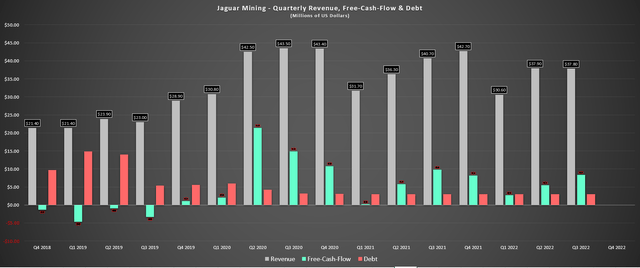

Jaguar Mining – Quarterly Revenue, Free Cash Flow & Debt (Company Filings, Author’s Chart)

Some investors might be encouraged by the fact that Jaguar continues to report positive free cash flow despite the weaker gold price environment and period of lower production, but this is due to the company’s choice to report free cash flow in the manner that it does. While larger producers report free cash flow as cash left over after subtracting sustaining/growth capital from operating cash flow like Barrick (GOLD), Jaguar only subtracts sustaining capital. This led to Jaguar reporting quarterly free cash flow of $8.4 million in the period, but on an adjusted and comparative basis to other producers, and after subtracting out growth capital, free cash flow was just ~$2.5 million.

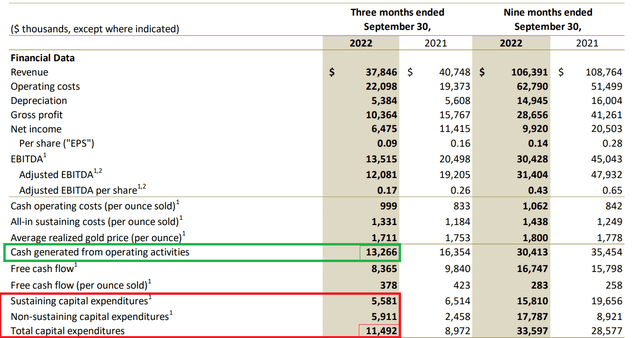

Jaguar – Quarterly Financial Results (Company Filings)

Free cash flow includes a $0.68 million credit for asset retirement obligation vs. total capital expenditures of $11.5 million.

Given the limited free cash flow generation year-to-date despite relatively low greenfield exploration and evaluation spending ($4.5 million year-to-date), it’s little surprise that Jaguar elected to suspend its dividend, which it shouldn’t have been paying in the first place. This dividend yield of more than 4.0% was one very minor consolation to owning the stock through a 75% decline in its share price, with the total return at least being a little less painful after dividends were paid to shareholders. However, with the dividend cut to focus on growth, the stock is now just an average marginal Tier-2 jurisdiction junior producer vs. one that at least previously paid a dividend.

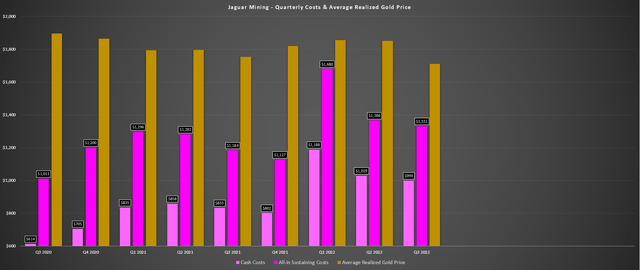

Costs & Margins

Moving over to operating costs, there wasn’t much to like here either, with Jaguar reporting cash costs of $999/oz, a 20% increase from the year-ago period. Meanwhile, all-in-sustaining costs [AISC] soared to $1,331/oz (Q3 2021: $1,184/oz), and this was despite lower sustaining capital expenditures in the period ($5.6 million vs. $6.5 million). The result is that Jaguar’s AISC margins plummeted to just $380/oz with a further impact from a weaker average realized gold price. While I would expect some sequential improvement in margins in Q4 with the gold price rebounding and a better quarter ahead, the strength in the Brazilian Real vs. the US Dollar (UUP) isn’t helping as of late.

Jaguar Mining – Operating Costs & Average Realized Gold Price (Company Filings, Author’s Chart)

While the improvement sequentially in margins from ghastly levels in Q3 is positive, it’s important to note that all-in costs are sitting north of $1,800/oz year-to-date, with Jaguar operating at a negative margin on an all-in cost basis ($1,822/oz costs vs. a $1,800/oz gold price). This reinforces the point that Jaguar is a very marginal producer at current production levels, and it doesn’t have the balance sheet to support aggressive investments to lower costs or acquire high-margin projects/mines to offset future costs like some of its peers. Meanwhile, although its exploration success has been solid, I wouldn’t call the results game-changing to the point that they would morph the company into a low-cost producer.

Based on the fact that production is likely to come in below the low end of guidance and the worse-than-expected inflationary pressures (materials, labor, consumables), Jaguar’s FY2022 AISC could come in closer to $1,400/oz than its guidance of $1,150/oz to $1,250/oz. This would result in another 14% plus unit cost increase (FY2021: $1,215/oz) and its worst cost performance in years. So, with limited free cash flow generation and its AISC margins down from ~$700/oz in FY2020 to less than $400/oz potentially in FY2022, it should be no surprise at the poor share-price performance over the past two years.

Valuation

Based on ~74 million fully-diluted shares and a share price of US$2.15, Jaguar trades at a market cap of $160 million. At first glance, this is a very reasonable valuation for a junior producer, especially with the company sitting on ~$30 million in cash. However, Jaguar continues to be one of the more marginal producers sector-wide, with all-in costs of ~$1,800/oz year-to-date. Plus, while it may be a future growth story, this looks to be a post-2025 opportunity, and there is no shortage of growth stories in the junior producer space. Two examples are i-80 Gold and Karora Resources (OTCQX:KRRGF). Hence, Jaguar certainly wouldn’t make the cut if I were looking for a company capable of growing revenue and cash flow per share in a flat gold price environment.

Assuming a conservative figure of ~$48.0 million in operating cash flow in FY2023 and a cash flow multiple of 3.5 to reflect Jaguar’s position as a small-scale producer with industry-lagging margins in a Tier-2 jurisdiction (Brazil), I see a fair value for the stock of $168 million. After adding in $25 million in net cash and dividing by ~74 million fully-diluted shares, I see a fair value for Jaguar of US$2.60 per share. This doesn’t point to nearly enough upside to justify taking on the risk of owning a micro-cap name, especially with investors no longer being paid to wait following the quarterly dividend being removed.

Summary

Jaguar Mining is on track for another miss vs. annual output guidance (86,000 to 94,000 ounces), which is not surprising given that the company also missed by a wide margin last year. Meanwhile, the company’s costs are expected to come in miles above guidance ($1,150/oz to $1,250/oz) and could come in as high as $1,400/oz. This isn’t a company-specific issue, with many producers struggling. Still, when it comes to owning smaller producers, I only want to own the best, and Jaguar does not fit that mold with rising costs, flattish production partially offset by solid exploration results. To summarize, I see far better ways to play the sector elsewhere. That said, the stock could certainly go on a nice run if the gold price cooperates in this period of more favorable seasonality.

Be the first to comment