Thesis Summary

The Vanguard Total International Stock ETF (VXUS) can be used to gain exposure to equity markets outside of the U.S. Diversifying your portfolio is especially useful during a correction. Having said this, upon further analysis of the fund, we believe there are better alternatives out there to help investors balance out their portfolios.

Overview

The VXUS is a Vanguard ETF that invests in equity markets across the globe, except the U.S. It seeks to replicate the performance of the FTSE Global All Cap ex-US Index. In turn, the FTSE Global is a market-cap-weighted free-float index. The index invests in companies that are in the top 98% of each region by full market cap. Investments methodology is based on a series of classifications based on, amongst other things, market cap, geographical region, and economic classification.

The fund offers a cheap and easy way to gain exposure to markets outside of the U.S., something that can serve well as a diversification tool, especially in a bear market.

Holdings

The first thing we must understand about the VXUS is that it is incredibly diversified. The index has positions in 7369 stocks. The top 25 holdings account for under 15% of the total portfolio. The largest stake is in Alibaba Grou Holdings Inc (BABA), a company that we already reviewed here and are big fans of.

Perhaps a more interesting breakdown of the fund would be to see the exposure it has to each country.

Source: Investor.vanguard

Interestingly, Japan and UK are heavily represented, with a combined weighting of over 1/4 of the portfolio. Overall, the top countries are for the most part European, while China, Taiwan, Korea, and India represent the Asian market.

While there are investments in emerging markets, the weighting of these is much smaller, In general, the index invests in large-cap companies in developed economies. The fund is made up of 68% large-cap, 18% midcap, and 12% small-cap stocks, adding up to the 98% market figure we mentioned before.

So how does the fund fare against the U.S. market and other international investments?

Recent Performance

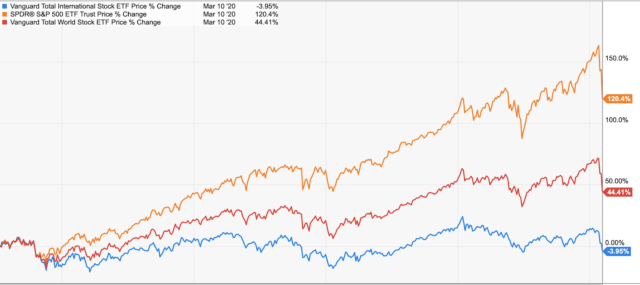

Source: ycharts.com

As we can see by comparing the VXUS to the SPDR and the Total World Stock ETF, returns are far from impressive. Performance is so poor you would have lost nearly 4% investing in this ETF over the last 10 years. Furthermore, the fund doesn’t even offer reduced volatility or a better beta. Correlation with the US market is still quite high. This is unsurprising given that the UK and Japan are where the fund is most invested.

The fund doesn’t appear to offer many advantages on the surface. It simply tracks the global market while being weighed down by underperforming indexes around the globe. Since the fund isn’t cutting it, let’s have a look at some potential alternatives.

Some better alternatives to the VSUX

While it is hardly sensible to avoid investing in U.S. equities, it is important to keep a diversified and balanced portfolio. Here are a couple of funds that can indeed provide you with some variation while providing decent returns.

Fidelity International Index (FSPSX)

FSPSX tracks the MSCI EAFE index, which consists of more than 900 non-U.S. stocks across 21 developed markets. The expense ratio for FSPSX is a low 0.045 percent, and it does not have an investment minimum. In it, we can find household names such as Nestle S.A (OTCPK:NSRGF), Novartis AG (NVS), and Toyota Motor Corp. (TM)

Mathews Emerging Asia Investor

Matthews Asia is a mutual fund company that specializes in Asian stocks, which means they have experience and knowledge of investing in countries like China, India, Singapore, Hong Kong, and the Philippines.

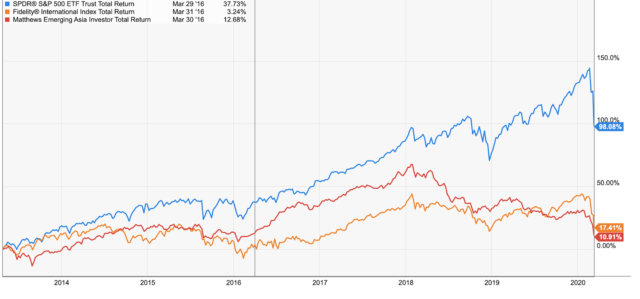

Here’s the total return price, forward adjusted over the last 7 years.

Takeaway

Source: Ycharts

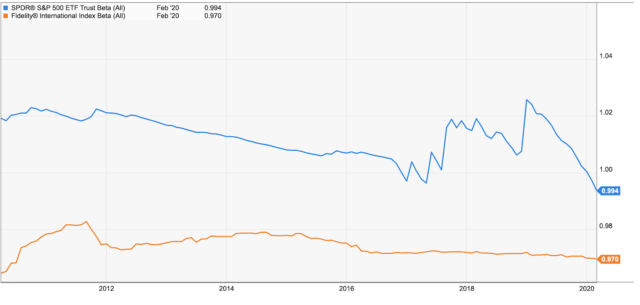

Again, the U.S. equity market has outperformed most others in the last decade, so returns are far from what the S&P 500 offers, but there are some advantages. For one, the Asian fund shows much less correlation to the S&P 500. Furthermore, the fidelity international index is smoother and has lower volatility which can balance out your portfolio. Looking at the Beta for the S&P and the FSPSX we can corroborate this.

Source: Ycharts

Takeaway

I would not recommend investing in the Vanguard Total International stock. As mentioned above, correlation with U.S. equities is still very high and returns are incredibly poor. Meanwhile, the other funds mentioned above could be better options to hedge risk and diversify your portfolio. Asian stocks overall have been falling since 2018, which could mean they are better prepared to face this coming correction. On the other hand, FSPSX has decent returns and lower implied volatility.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment