USD/JPY, AUD/USD, Dow Jones Futures, Trump Nation Address, Coronavirus – Talking Points

- U.S. President Donald Trump addresses nation on coronavirus pandemic

- Markets appeared underwhelmed after Wall Street entered bear market

- USD/JPY, AUD/USD and Dow Jones futures continue their path lower

USD/JPY, AUD/JPY, Dow Jones Futures Sink on Trump Nation Address

The anti-risk Japanese Yen gained as sentiment-linked Australian Dollar declined alongside Dow Jones futures after U.S. President Donald Trump addressed the nation amid the coronavirus outbreak. Over the past 24 hours, Wall Street entered bearmarket territory with global growth increasingly at risk. The markets were thus looking for details of fiscal support with monetary policy already at its limits worldwide.

Mr Trump announced that the country is suspending all travel from Europe over the next 30 days, excluding the United Kingdom. He then turned to Congress, asking to take legislative action on relief such as increasing funding by $50b to SBA (Small Business Administration). Another major policy is calling on the House for immediate payroll tax relief. He also instructed the Treasury to defer some tax payments, offering about $200b in liquidity.

Following his speech, S&P 500 futures extended their rout, dropping in excess of 2% during Asia trading hours. This is as the Nikkei 225 declined over 2.7% as the ASX 200 plummeted almost 5%. European futures are also pointing notably lower. With that in mind, risk aversion may be in the cards for the remainder of the day as investors flock into Treasuries. Sentiment-linked crude oil prices are aiming lower.

S&P 500, Nikkei 225 Decline with USD/JPY After Trump Speech

Japanese Yen Technical Analysis

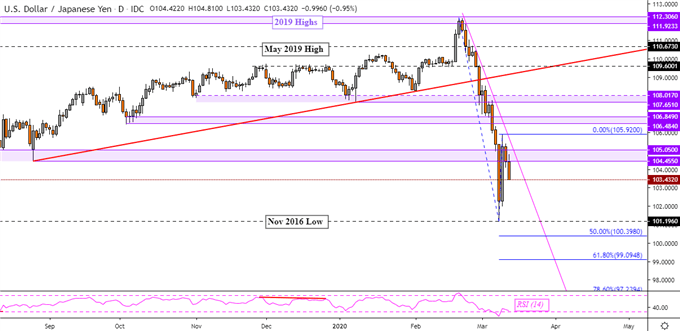

USD/JPY prolongs its downtrend from February’s top with falling resistance maintaining the trajectory – pink line on the chart below. The pair is once again aiming for the low from November 2016 at 101.19. In the event of a turn higher, keep a close eye on lows from August 2019 which may reinstate themselves as new resistance. That would be a range between 104.45 to 105.05.

USD/JPY Daily Chart

Australian Dollar Technical Analysis

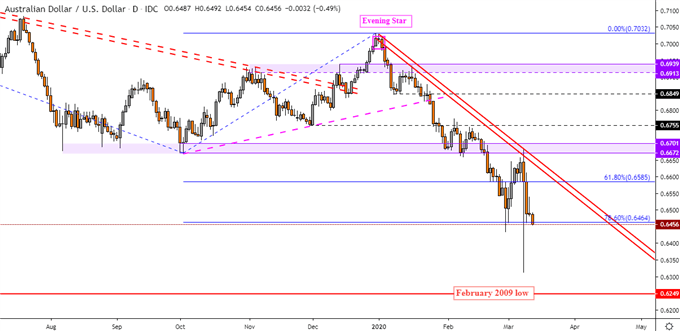

The Australian Dollar continues to aim lower against the US Dollar, with AUD/USD targeting lows from February 2009. Prices are attempting to breach the 78.6% Fibonacci extension at 0.6464. Maintaining declines in the medium-term could be falling resistance from December in the event of a bounce – red lines on the chart below.

AUD/USD Daily Chart

Dow Jones Futures Technical Analysis

Dow Jones futures are fast approaching lows seen towards the end of 2018 with the weekly chart aiming to confirm a close under rising support from 2015 – blue lines below. That will expose long-term rising support from 2009 where the index could see downside momentum slowed – red lines.

Dow Jones Futures Weekly Chart

— Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Be the first to comment