JayLazarin/iStock Unreleased via Getty Images

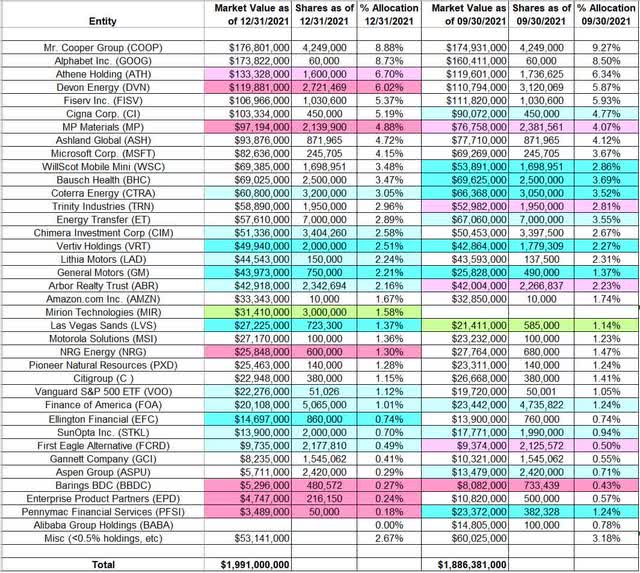

This article is part of a series that provides an ongoing analysis of the changes made to Leon Cooperman’s 13F stock portfolio on a quarterly basis. It is based on his regulatory 13F Form filed on 2/14/2022. The 13F portfolio value increased ~6% from ~$1.89B to ~$1.99B this quarter. Recent 13F reports have shown a total of around 60 individual stock positions in the portfolio although many of which are minutely small. The largest five stakes are Mr. Cooper Group, Alphabet, Athene Holding, Devon Energy, and Fiserv. They add up to ~36% of the entire portfolio. Please visit our Tracking Leon Cooperman’s Omega Advisors Portfolio series to get an idea of their investment philosophy and our previous update for the fund’s moves during Q3 2021.

Note: Regulatory filings since the quarter ended show them owning 10.1M shares (6.2% of the business) of Sierra Metals (SMTS). This is compared to 3.44M shares in the 13F report.

New Stakes:

Mirion Technologies (MIR): MIR is a 1.58% of the portfolio position purchased at prices between $9.84 and $11.76 and the stock currently trades well below that range at $7.72.

Note: Mirion Technologies came to market through a SPAC merger with GS Acquisition II that closed in October 2021.

Stake Disposals:

Alibaba Group Holding (BABA): The 0.78% BABA position was established over the last two quarters at prices between ~$206 and ~$271. The disposal this quarter was at prices between ~$112 and ~$178. The stock is now at ~$110.

Stake Increases:

Coterra Energy (CTRA), previously Cabot Oil & Gas: The ~3% of the portfolio stake in CTRA was primarily built last quarter at prices between $14.40 and $22.55. The stock currently trades at $27.10. This quarter saw a minor ~5% stake increase.

Chimera Investment Corp. (CIM): The bulk of the 2.58% CIM stake was built in Q1 2019 at a cost-basis of ~$19 per share. Q4 2019 saw a ~25% selling at prices between ~$19.50 and ~$21.50. Since then, the activity has been minor. The stock currently trades at $12.11.

Vertiv Holdings (VRT): VRT is a 2.51% of the portfolio position built in H2 2020 at prices between ~$17 and ~$20. Last four quarters have seen a ~55% stake increase at prices between ~$18 and ~$28. The stock currently trades below those ranges at $14.58.

Lithia Motors (LAD): LAD is a 2.24% of the portfolio position established in Q2 2021 at prices between ~$313 and ~$403 and the stock currently trades below that range at ~$301. There was a ~9% stake increase this quarter.

General Motors (GM): The 2.21% of the portfolio GM position saw a stake doubling over the last two quarters at prices between ~$48 and ~$65. The stock currently trades below that range at ~$43.

Arbor Realty Trust (ABR): ABR is a 2.16% of the portfolio position built in Q1 2019 at prices between ~$10.50 and ~$13. The stock is now at $17.30. Last several quarters have seen only minor adjustments.

Las Vegas Sands (LVS): LVS is a small 1.37% of the portfolio position established last quarter at prices between ~$35 and ~$52. There was a ~25% stake increase this quarter at prices between ~$34 and ~$43. The stock currently trades at $39.52.

Finance Of America (FOA): The ~1% stake in FOA was purchased at prices between ~$7.30 and ~$11.60 and it is now well below that range at $3.07. Last two quarters have seen a ~15% stake increase at prices between $3.85 and $7.65.

Ellington Financial (EFC), First Eagle Alternative Capital BDC (FCRD), SunOpta Inc. (STKL), and Vanguard S&P 500 ETF (VOO): These small (less than ~1.20% of the portfolio each) stakes were increased during the quarter.

Note: They have a ~7.2% ownership stake in First Eagle Alternative Capital BDC.

Stake Decreases:

Athene Holding: Athene was a large (top three) 6.70% of the portfolio position first purchased in Q3 2020 at prices between ~$30 and ~$37. There was a ~60% stake increase in Q1 2021 at prices between ~$41 and ~$52. This quarter saw a ~8% reduction.

Note: Apollo Global (APO) acquired Athene in an all-stock (1.140 shares of Apollo for each Athene stock held) deal that closed in January.

Devon Energy (DVN): DVN is a large (top five) ~6% of the portfolio stake established in Q1 2021 as a result of their acquisition of WPX Energy that closed in January. Cooperman had ~6.19M shares of WPX Energy for which he received these shares (all-stock deal at exchange ratio 1:0.5165). DVN currently trades at $60.35. There was a ~13% trimming this quarter.

MP Materials (MP): The large ~5% MP stake was built in H2 2020 at prices between ~$10 and ~$35.50. The stock currently trades at $56.54. There was a ~10% trimming this quarter.

Note: Fortress Value Acquisition merged with MP Materials in a ~$1B EV SPAC deal that closed in November 2020.

NRG Energy (NRG): NRG is a 1.30% of the portfolio position established in H1 2021 at prices between ~$32 and ~$44 and the stock currently trades at $38.40. There was a ~12% trimming this quarter.

Barings BDC (BBDC), Enterprise Products Partners (EPD), and PennyMac Financial Services (PFSI): These minutely small (less than ~0.30% of the portfolio each) stakes were reduced this quarter.

Kept Steady:

Mr. Cooper Group (COOP), previously WMIH Corp: COOP is currently the largest position at 8.88% of the portfolio. The original small stake was doubled in Q4 2018 in the mid-teens price-range following its 12-for-1 reverse stock-split and name change transaction. That original stake was since sold down but a larger stake was built during Q4 2019 & Q1 2020 at prices between ~$6 and ~$14.50. There was a ~15% trimming in Q1 2021 at prices between ~$27 and ~$37. The stock currently trades at $45.48.

Note: Regulatory filings from last week show them owning 3.25M shares (4.41% of the business) of Mr. Cooper Group. This is compared to 4.25M shares in the 13F report.

Alphabet Inc. (GOOG): GOOG is currently the second-largest position in the portfolio at 8.73%. It was first purchased in Q2 2015 at prices between ~$525 and ~$545. The stake was sold in H1 2020 at prices between ~$1072 and ~$1521 but was rebuilt next quarter at prices between ~$1445 and ~$1645. The stock is now at ~$2814.

Fiserv, Inc. (FISV): FISV is a top-five 5.37% of the portfolio position. The position goes back to a large stake in First Data Corporation purchased in Q4 2015. Fiserv acquired First Data in an all-stock deal (0.303 of Fiserv for each First Data share) that closed in July 2019. At the time, the 2M share stake in Fiserv was the largest position in the portfolio at ~13%. There was a ~50% selling in Q1 2020 at prices between ~$82 and ~$122. The stock currently trades at ~$103.

Cigna Corp. (CI): The large 5.19% CI stake was first purchased during the three quarters through Q1 2019 at prices between ~$161 and ~$223. There was a ~22% reduction in Q3 2020 at prices between ~$162 and ~$191. The stock is now at ~$246. Last quarter saw a ~6% stake increase.

Ashland Global (ASH): ASH is a long-term stake that was first purchased in H2 2014 at prices between ~$48 and ~$59. Q2 & Q3 2015 saw a stake doubling at prices between ~$50 and ~$63. The position has wavered. Recent activity follows. H2 2018 saw a ~37% selling at prices between ~$67 and ~$86. Since then, the activity has been minor. The stock is now at ~$99 and the stake is at 4.72% of the portfolio.

Microsoft Corp. (MSFT): MSFT is a 4.15% of the portfolio position first purchased in Q4 2015 & Q1 2016 at prices between ~$44 and ~$55. The next four quarters saw a ~75% selling at prices between ~$50 and ~$65. The position was rebuilt in Q2 2017 at prices between ~$65 and ~$71. Q4 2018 saw a ~75% reduction at prices between ~$98 and ~$112. Since then, the stake has been steady. The stock currently trades at ~$309.

WillScot Mobile Mini (WSC): The 3.48% of the portfolio stake in WSC was built over the last four quarters at prices between ~$17 and ~$32 and the stock is now at $39.51.

Bausch Health (BHC): BHC is a fairly large 3.47% of the portfolio position built over the last two quarters at prices between ~$25 and ~$33. The stock currently trades at $23.04.

Trinity Industries (TRN): TRN is now a ~3% of the portfolio stake. It was first built in Q3 2017 at prices between ~$27 and ~$32. Q2 2018 saw a one-third stake increase at prices between ~$31.50 and ~$36. That was followed with a ~45% stake increase during Q2 & Q3 2019 at prices between ~$16 and ~$24. There was a ~30% reduction in Q1 2021 at prices between ~$26 and ~$33. The stock is now at $34.03. Last two quarters have seen a ~10% trimming.

Energy Transfer Equity (ET): ET is a 2.89% of the portfolio stake established during Q2 2017 to Q1 2018 at prices between ~$16 and ~$19. 2019 saw a ~125% stake increase at prices between ~$11.50 and ~$15.75. Q4 2020 also saw a ~30% increase at prices between ~$5 and ~$7. The stock currently trades at $11.52.

Amazon.com, Inc. (AMZN): AMZN was first purchased in Q3 2016 at prices between ~$720 and ~$830. There was a ~50% selling in Q2 2017 at prices between ~$885 and ~$1007 while Q4 2019 saw a similar increase at prices between ~$1740 and ~$1870. The stock currently trades at ~$3271 and the stake is at 1.67% of the portfolio. There was a ~13% trimming in Q1 2021.

Pioneer Natural Resources (PXD): The 1.24% PNQ stake was built in H1 2021 at prices between ~$114 and ~$170 and it is now at ~$253.

Citigroup (C): The 1.15% Citigroup stake was built in Q1 2018 at prices between ~$68 and ~$80. Q1 2020 saw a ~50% selling at prices between ~$37.50 and ~$81. The stock currently trades at $52.33.

Aspen Group (ASPU), Gannett Co. (GCI), and Motorola Solutions (MSI): These small (less than ~1.5% of the portfolio each) stakes were kept steady this quarter.

Note: They have a 9.85% ownership stake in Aspen Group.

Below is a spreadsheet that shows the changes to Leon Cooperman’s Omega Advisors 13F portfolio holdings as of Q4 2021:

Leon Cooperman – Omega Advisors’ Q4 2021 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment