Patcharapong Sriwichai/iStock via Getty Images

Thesis

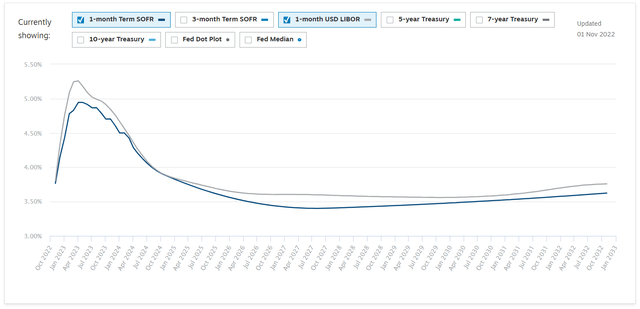

The Invesco Senior Income Trust (VVR) is a closed end fund focusing on leveraged loans. The asset class has been one of the few beneficiaries from higher risk-free rates in 2022. Leveraged loans are floating rate instruments. That means the interest received by the underlying collateral started to increase as the Fed raised rates. We are talking about real cash flows here that are received by the trust. A run-of-the-mill BB leveraged loan prices at LIBOR/SOFR plus 400bps, which when short-term rates are low (say 0.5%) translates into a net cash yield of 4.5%. When rates are at 4.25%, the same instrument now pays the CEF an interest rate of 8.25%! Quite the difference. We are not going to go into the details of LIBOR/SOFR in this article, suffice to say they are closely tracking the expected Fed Funds rate:

We can see how the market forward curve peaks mid-2023 around 5% for the 1-month LIBOR and SOFR rates. This translates into even higher cash yields to be received by the underlying collateral.

Higher cash in the CEF structure has translated into a dividend hike:

ATLANTA, Oct. 31, 2022 /PRNewswire/The Board of Trustees (the “Board”) of Invesco Senior Income Trust (NYSE: VVR) (the “Fund”) approved an increase in the monthly distribution amount payable to common shareholders pursuant to the Fund’s Managed Distribution Plan (the “Plan”). Effective October 1, 2022, the Fund will pay its monthly dividend to common shareholders at a stated fixed monthly distribution amount of $0.032 per share, an increase from a stated fixed monthly distribution amount of $0.026 per share.

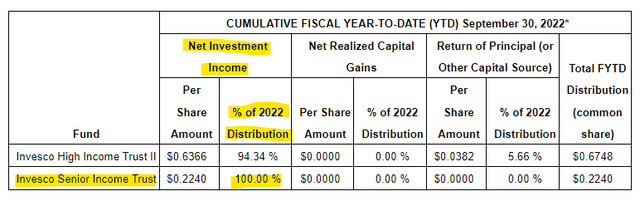

The announced hike is a true cash flow based dividend hike. Many CEFs utilize ROC as a gimmick to increase yields and thus investors’ attention. Not here. VVR distributes now only what it makes:

This should really pique an investor’s interest because we do not see this very often in 2022. A CEF structure is ultimately just a way to transform, using leverage, various asset classes’ returns into dividends. Equities and convertibles have been crushed in 2022, hence we see a propensity for related CEFs to now utilize ROC. Floating rate loans have been the only asset class that has benefited from a true cash flow perspective from higher yields. Higher rates have directly translated into higher cash amounts received by the trust that now translates into a higher dividend.

Through its managed distribution plan, the CEF tries to smooth out any temporary shortfalls in net investment income if the distribution due is higher than the received cash:

The Plan is intended to provide shareholders with a consistent, but not guaranteed, periodic cash payment from the Trust, regardless of when or whether income is earned or capital gains are realized. If sufficient investment income is not available for a monthly distribution, the Trust will distribute long-term capital gains and/or return of capital in order to maintain its managed distribution level under the Plan. A return of capital may occur, for example, when some or all of the money that shareholders invested in the Trust is paid back to them. A return of capital distribution does not necessarily reflect the Trust’s investment performance and should not be confused with “yield” or “income.”

We expect higher rates to persist for longer, hence the current increase in the fund’s dividend is to persist for at least 18 months forward. It is a true dividend yield increase.

Performance

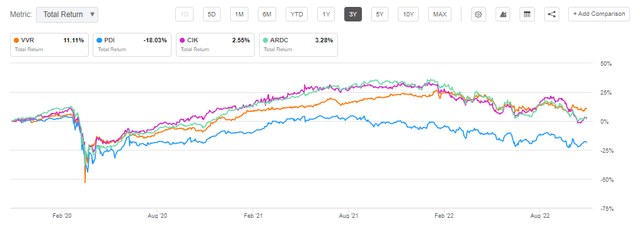

With floating rate loans a direct beneficiary of higher rates, VVR has outperformed:

YTD Total Return (Seeking Alpha)

VVR is at only -8% on a total return basis year to date. The CEF has crushed performance-wise other HY CEFs, including the vaunted CLO paper fund ARDC. The fund is down nonetheless due to the fixed income component embedded into the collateral. A loan that pays LIBOR +4% still has the fixed component associated with the 4% spread, hence it will still lose some value as rates rise.

VVR outperforms on a 3-year term as well:

3Y Total Return (Seeking Alpha)

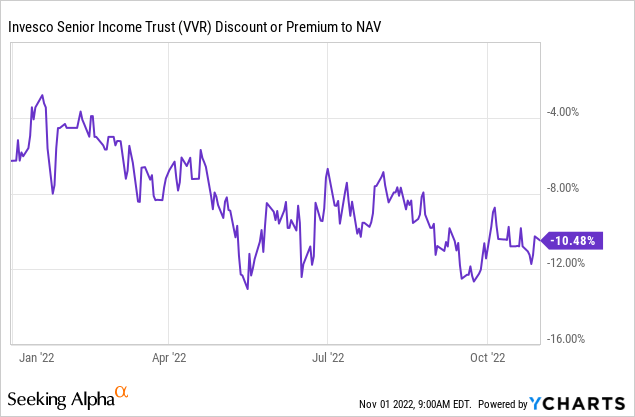

Premium/Discount to NAV

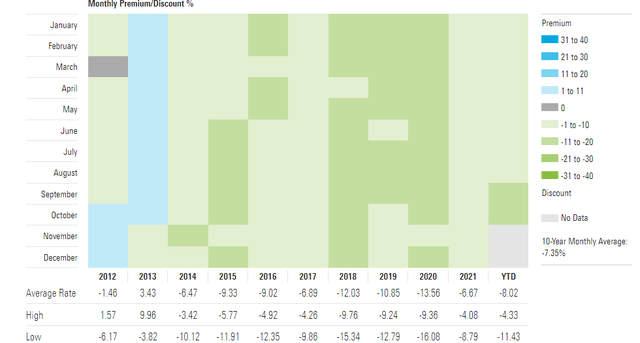

The fund has historically traded at a discount to net asset value:

Premium/Discount to NAV (Morningstar)

We can see that during the past decade the vehicle has traded at discounts to NAV. Surprisingly, even during the zero rates environment present in 2020 and 2021, the CEF did not move to a premium to NAV. It is also surprising to see the discount have a low beta to risk-on / risk-off environments:

For other CEFs, especially equity CEFs, we see a high volatility of the premium/discount to NAV as the market rallies or sells off. VVR seems to have settled in an -8% to -12% discount range. We feel the discount to NAV is too high here. We expect rates to stay higher for longer.

Conclusion

VVR is a closed end fund focused on leveraged loans. The fund has a classic composition with a 30% leverage ratio. Floating rate loans have been one of the few asset classes that have actually benefited from higher risk-free rates. With all-in cash yields now almost double the figures from the beginning of the year, many well-managed leveraged loans CEFs can now afford to increase their dividends. VVR just hiked what the CEF is paying, with the fund now exposing a true dividend yield exceeding 10%. The CEF is currently utilizing only investment income for its distribution. We expect higher risk-free rates to persist for longer, hence the current distribution hike is not temporary. Higher cash levels received by the trust have translated into an outperformance for VVR in 2022 when looking at the CEF’s total return versus other fixed income CEFs.

Be the first to comment