Justin Sullivan/Getty Images News

Intro

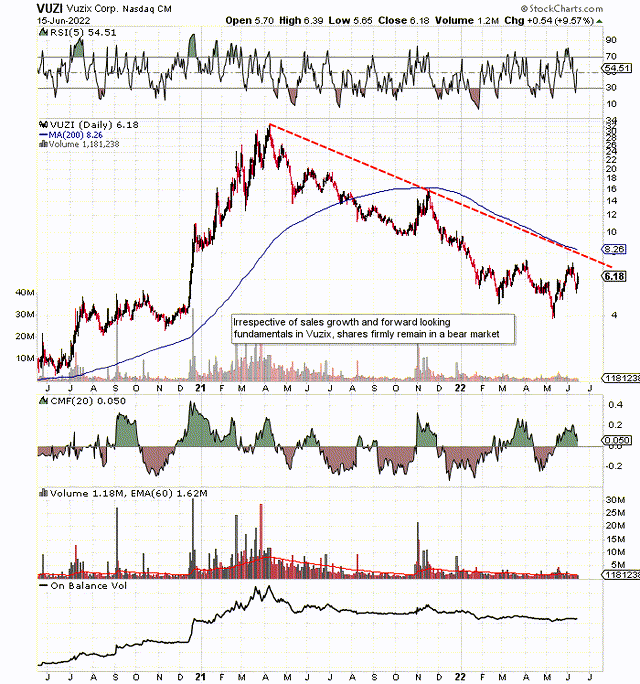

If we look at a technical chart of Vuzix Corporation (NASDAQ:VUZI), we can see that shares have been printing consistent lower lows for the best part of fourteen months now. Shares did try to take out their 200-day moving average in November of last year but did not have sufficient momentum to be able to push through. Suffice it to say, Vuzix’s 200-day moving average (which corresponds with the depicted downcycle trend-line) remains the line in the sand for this play in that as long as shares remain below this resistance level, the stock will remain in a bear market.

Vuzix Technical Chart (StockCharts.com)

Vuzix Q1 Sales

The one ray of light Vuzix had going for it coming into the company’s fiscal first quarter was its topline growth rates. Up until the end of fiscal 2021, for example, topline sales had grown by 44% on average per year over the previous five years. This trend changed, however, in the first quarter of fiscal 2022 when sales of $2.5 million came in 36% lower over the same period of 12 months prior. The CEO tied to ensure on the earnings call that the fundamentals remain very strong for Vuzix and that the poor topline print had more to do with macro conditions and the Ukrainian war which resulted in multiple orders (which would have normally been booked in Q1) being pushed out in time.

The company’s second quarter topline estimate comes in at $2.99 million which, if met, would constitute a 2.6% rolling quarter growth rate. However, the real growth is expected in the final two quarters of this year with 32% and 52% being the current topline projections for Q3 and Q4, respectively. The CEO remains adamant that smart glasses sales in fiscal 2022 will come in significantly higher over fiscal 2022. In saying this, the company’s forward-looking quarterly earnings estimates for as far as the eye can see continue to come in negative which is worrying considering the sales growth discussed above. The problem here from an investor’s standpoint is the more sustained dilution continues, the less potential overall for the investor.

Potential Inflection Point

Suffice it to say, the market needs to see a clearer path to bottom line growth which it simply has not seen up until now. This means the market remains unconvinced that the company can transition from a current enterprise smart glasses provider to a more diversified player where OEM, as well as SaaS solutions, will make up a far bigger percentage of the company’s sales. Furthermore, the company is banking on an inflection point when the Augmented Reality industry will really start to scale. Vuzix continues to prepare for this turning point by increasing production capacity in order to meet the expected elevated amount of new business.

Preparing Through Sustained Investment

This is what long-term holders will like. Although the float has been expanding at an accelerated clip, Vuzix’s priority remains to continue to invest in international sales teams, display engines as well as waveguides. Bears may say here that the company is putting the cart before the horse to an extent that is true to some degree. We state this because the company’s profitability comes in a distant second to the potential Vuzix sees, for example, in OEM, healthcare and now in defense given the fact that the non-compete concerning the defense markets has expired. Despite the sustained cash burn, Vuzix is expected to have 3 next-generation offerings on the market by the end of the year. Furthermore, the CEO hinted toward near-term acquisitions to remain at the cutting edge which again demonstrates the belief that Vuzix will transition into a major success.

Over the near term, we will be watching how much traction the company’s newly created OEM platform will gain among OEM players. Building a large OEM business has to be a top priority as the OEM players themselves act as sales organizations for Vuzix’s technology. Therefore, from a momentum standpoint, it is vital that market conditions will open up for the rest of the year to ensure Vuzix can take full advantage of the clear tailwind in the OEM space.

Conclusion

Therefore, to sum up, there is no doubt Vuzix has potential and also has no difficulty in raising cash to keep operations going at full pelt. Given the AR tailwind, the total addressable market is significant for Vuzix but timing remains a clear issue. Given the sustained pattern of lower lows, Vuzix remains a hold for us at present. We look forward to continued coverage.

Be the first to comment