SvetaZi/iStock via Getty Images

A cult is a religion with no political power.”― Tom Wolfe

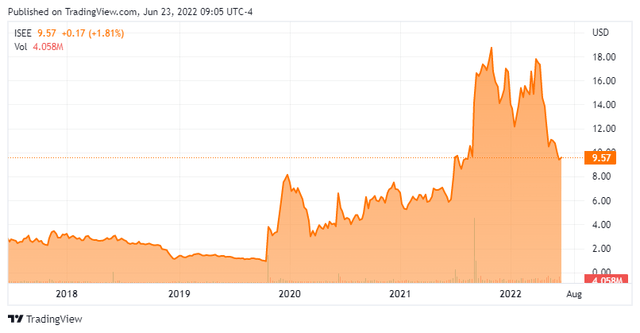

Today, we put IVERIC bio, Inc. (NASDAQ:ISEE) in the spotlight for the first time. Like so many small biotech stocks, the shares have been almost cut in half so far in 2022.

Company Overview:

IVERIC bio, Inc. (ISEE) is headquartered in New Jersey. This clinical stage biotech firm is focused on discovering and developing novel treatments for retinal diseases, with a focus on age-related and orphan inherited retinal diseases (IRDs). The stock current trades just south of ten bucks a share and sports an approximate market capitalization of $1.1 billion.

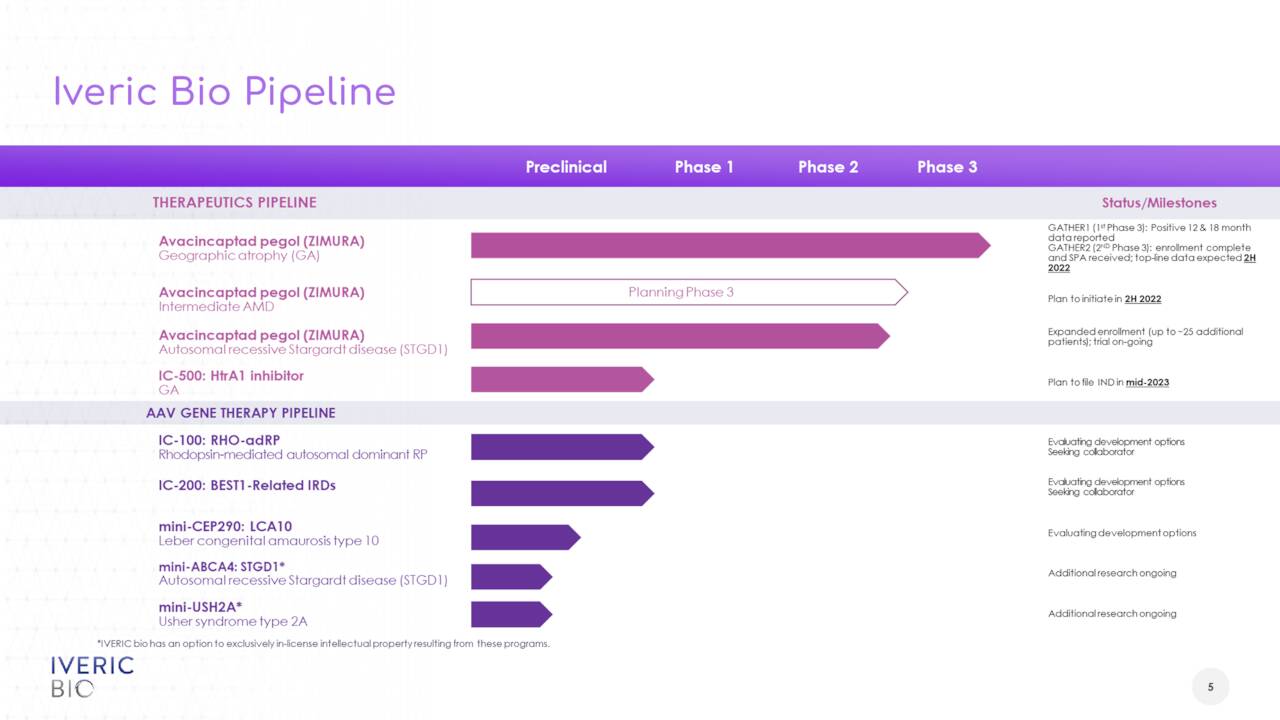

May Company Presentation

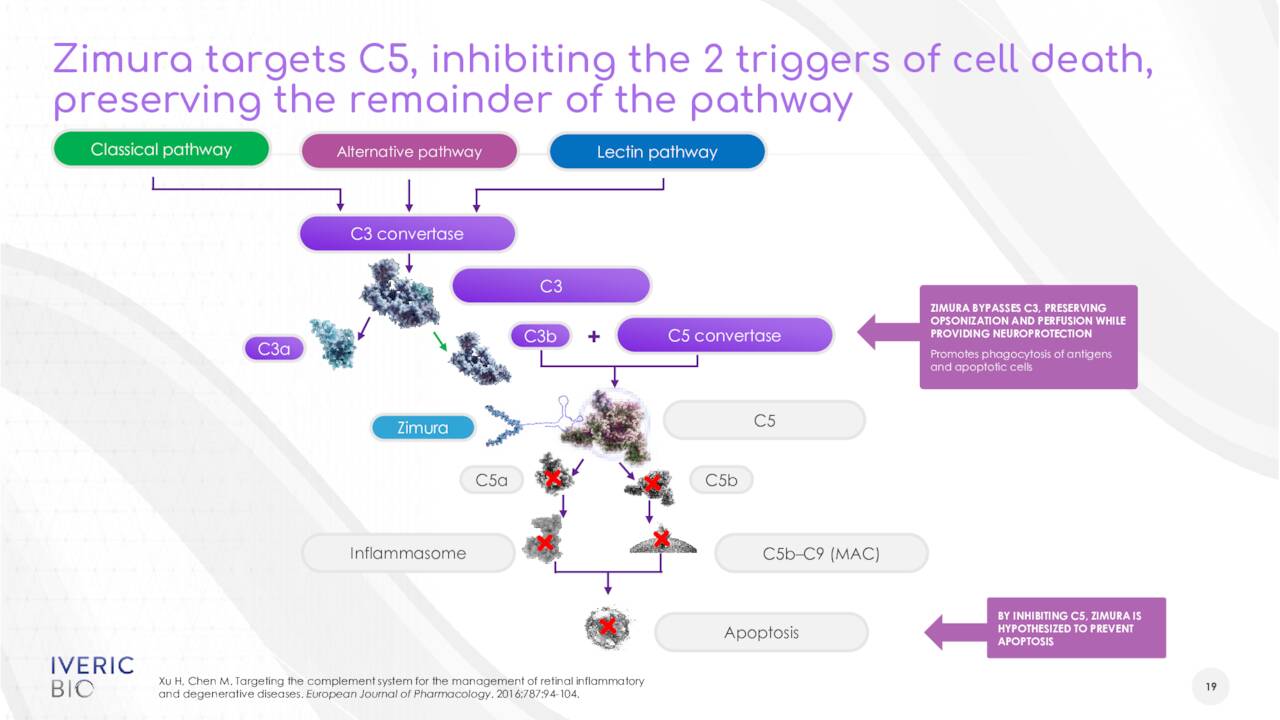

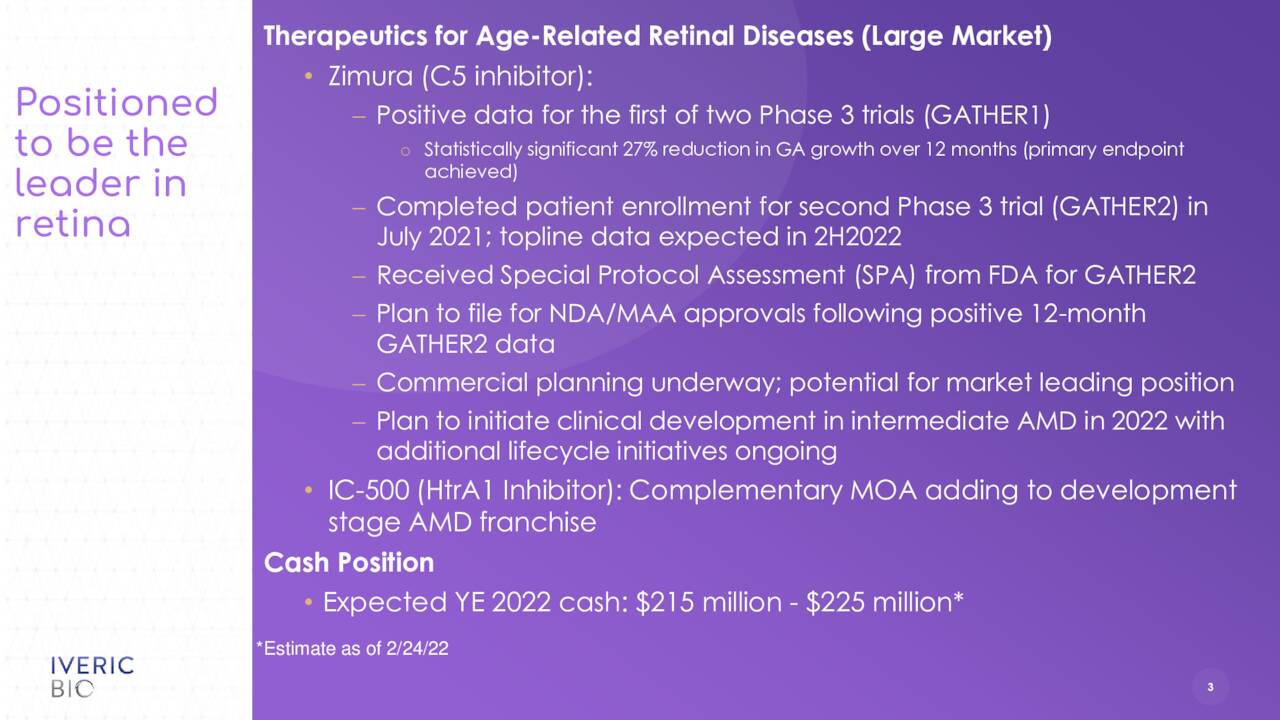

The company has several compounds in its pipeline. The focus of this article will be on Zimura, as it is the only candidate past the very early stages of development. Zimura, or avacincaptad pegol, is a novel complement C5 inhibitor. It is in development for the treatment of geographic atrophy or GA secondary to dry age-related macular degeneration [AMD], for which it has Fast Track designation from the FDA. GA is a late stage form of AMD which affects approximately five million people globally. The stock got a bit of boost last September when Pegcetacoplan, which is being developed by Apellis Pharmaceuticals (APLS) and is the chief rival in this indication, missed one primary endpoint and met another in its two Phase 3 trials to treat GA.

May Company Presentation

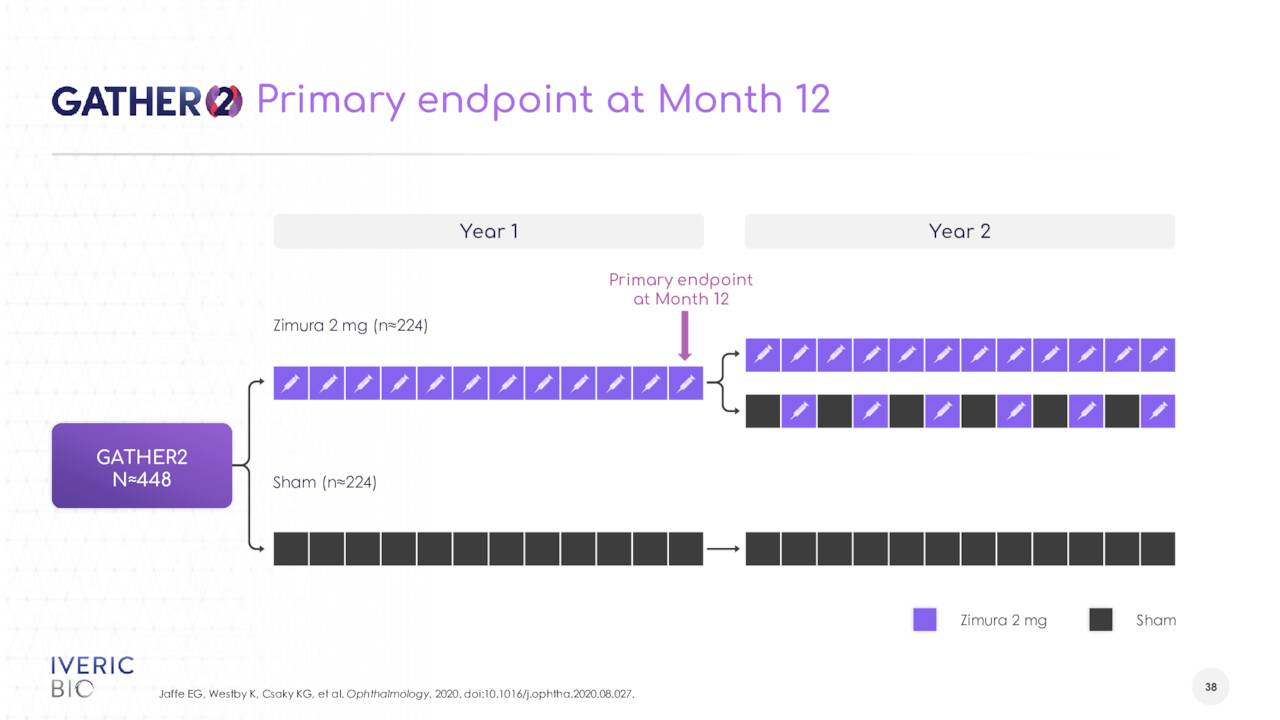

The company saw a 27% reduction in GA growth in a Phase 3 study (GATHER1) that met its primary endpoint. Enrollment has been completed in a second Phase 3 study (GATHER2) and trial should gather 12 months of data. Preliminary top line results from this trial should be out sometime in the second half of this. A successful study outcome will lead to marketing applications for this indication both in the U.S. and Europe.

May Company Presentation

The company plans to initiate a clinical trial studying Zimura in patients with intermediate AMD in the fourth quarter of this year after garnering regulatory feedback from the FDA and other regulatory authorities

Analyst Commentary & Balance Sheet:

Since early May, six analyst firms including Guggenheim and Credit Suisse have initiated or reissued Buy ratings on IVERIC bio. Price target proffered range from $18 to $30 a share. Two of these contained upward price target revisions. Here is the view from the analyst at Stifel Nicolaus, who bumped her price target from $22 to $28 on May 4th.

GATHER-2 topline results are on-track to read out in the third quarter, telling investors that the consistency of data generated through multiple post-hoc analyses gives her “increasing confidence” that the GATHER-2 results will replicate that of GATHER-1. The analyst now sees Zimura having an exclusivity runway to 2034, up from 2029 previously.”

B. Riley Financial seems to be the only pessimist on the stock right now, as they recently maintained their Hold rating and $12 price target on ISEE.

Nearly 9% of the outstanding float is currently held short. A director purchased 25,000 shares in the stock on June 13th. It was the first insider purchase in the stock since late 2019. Numerous insiders were frequent and significant sellers of the shares earlier this year when the stock was trading in the high teens.

The company ended the first quarter with approximately $345 million in cash and marketable securities on the balance sheet. The company raised approximately $150 million via a secondary offering in October of last year at $16.75 a share. Leadership projected on its first quarter press release that current funding levels will be sufficient to fund its planned capital expenditure requirements and operating expenses through at least mid-2024.

Verdict:

May Company Presentation

The company has some potential catalysts on the horizon and the recent insider purchase is a nice vote of confidence after the decline in the stock so far in 2022. The company seems to have enough funding in place to at least get Zumira to the commercialization stage for GA, provided study results lead to FDA approval. IVERIC bio also has solid analyst firm support at the moment.

That said, my experience with ocular related biotech concerns over the past few years has not been good. Rollouts always seem to be significantly slower than initial projections, which tends to batter the shares of the firms involved. Kala Pharmaceuticals (KALA) being one good recent example. Therefore, I have no investment recommendation around IVERIC bio at this time.

Madness is something rare in individuals — but in groups, parties, peoples, and ages, it is the rule.”― Friedrich Nietzsche

Be the first to comment