FrankRamspott/E+ via Getty Images

Overview

The Vanguard Total Stock Market ETF (NYSEARCA:VTI) provides exposure to large, mid, and small-cap companies diversified across growth and value. The fund seeks to track the performance of the CRSP US Total Market Index.

As of 31/10/2022, the fund was invested in 4028 different holdings which includes popular names such as Apple and Microsoft.

The fund has an expense ratio of 0.03% per annum which is remarkably cheap and a hallmark of Vanguard ETFs.

Fund performance

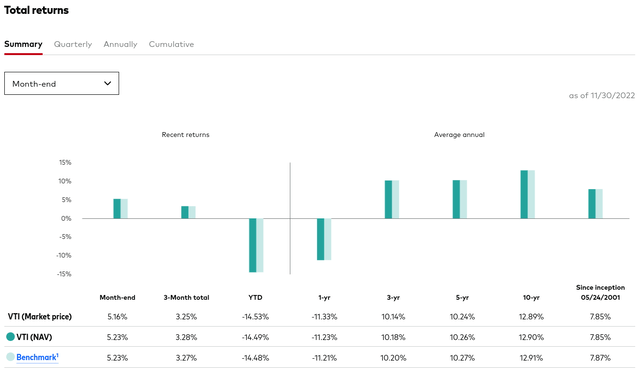

The VTI fund has returned 7.85% per annum since its inception in 2001, with a minimal index tracking error of 0.02% per annum.

Overall, the return has been lower than the S&P 500 average return of 11.88% per annum since 1957. At the same time, the VTI fund is more regionally diversified than the S&P 500 fund, which compensates for the lower return.

The fund’s performance can be seen below:

Portfolio

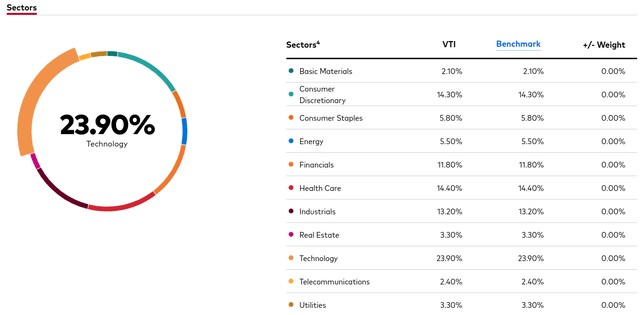

The VTI fund is heavily weighted towards the Technology sector which is the largest sector exposure at 23.90%. Combined with Healthcare (14.40%) and Industrials (13.20%), these three sectors constitute more than 50% of the portfolio exposures.

On the other hand, the fund has very low exposure to Basic Materials (2.10%) and Telecommunications (2.40%) representing less than 5% of the portfolio combined.

The fund’s sector breakdown can be seen below:

The fund has some large single stock exposures, notably Apple and Microsoft. These two companies are the top two holdings of the fund and make up about 10% of the portfolio combined.

Global Economic Outlook

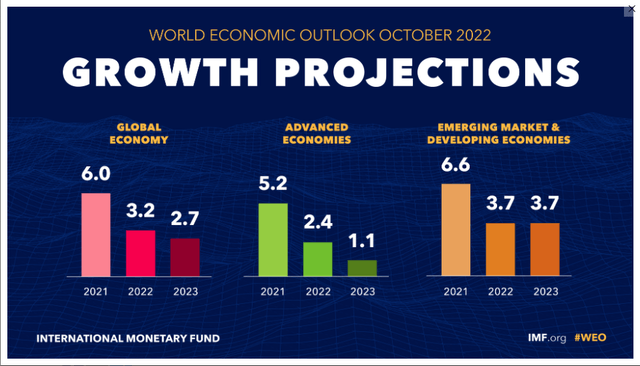

The IMF recently published its world economic outlook and forecasted that global economic growth is expected to slow in 2022 and 2023.

The primary drivers behind the downbeat forecast are: the Russian invasion of Ukraine, a global cost-of-living crisis caused by inflationary pressures, and the slowdown in China.

The IMF projects a global economic slowdown from the 2021 peak. The global economy is forecast to slow to 3.2% in 2022 and 2.7% in 2023.

The projections also caveat a 25% probability that global economic growth could fall below 2% in a worst-case scenario.

The positive from the forecast is that the global economy is still expected to grow despite the current macroeconomic environment.

The Russian invasion of Ukraine has destabilized western economies and has prompted governments to re-design their energy sourcing policies.

The re-design will take time and energy prices are expected to remain elevated during this period. The importance of energy for the global economy cannot be understated as it impacts every part of our daily lives.

According to the IMF, global inflation is forecast to reach 8.8% in 2022 and gradually decline to 6.5% in 2023 and 4.1% in 2024.

Persistent and broadening inflationary pressures have caused serious hardship for low-income households, especially in the low-income countries.

A powerful appreciation of the US dollar against other currencies has further added to the domestic inflationary pressures experienced in emerging market economies.

A strong dollar makes imports more costly, which drives prices up further.

Although inflation is expected to peak this year, the elevated price levels are not going away. Prices pressures will continue albeit at a slower rate of increase.

Increasing inflationary pressures around the world have caused a rapid and synchronized tightening of monetary policy globally to help restore price stability.

In the next section, we will look at the risk of a monetary policy miscalculation on the global economic outlook and its subsequent impact on the VTI fund.

Monetary policy miscalculation remains a risk for 2023

The communication coming from the major central banks around the world has showed strong determination in taming inflation and restoring financial stability.

The pace of monetary policy tightening has been quite remarkable, especially from the Federal Reserve. However, there are risks of both under and over-tightening.

Under-tightening could cause inflation to become out of control and erode central bank credibility.

Looking back in history, the risk of under-tightening can be problematic and only prolongs the inflationary period.

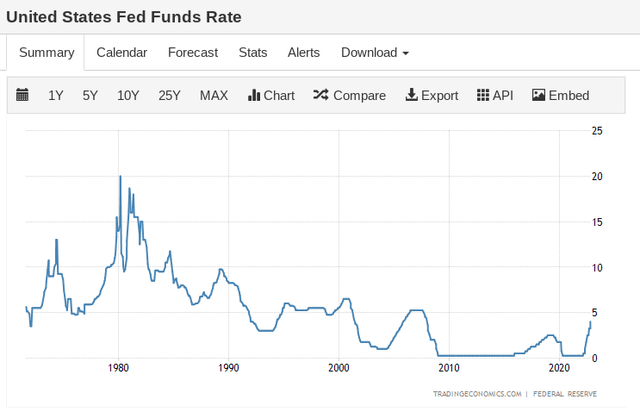

During the 1970s, inflation was a key economic challenge for the United States. The Federal Reserve tried to end the high levels of inflation experienced in the 1970s on multiple occasions unsuccessfully.

The Federal Reserve would always back down when complaints about the economic cost grew loud.

The risk in such a scenario is that central banks loosen monetary policy too early undermining the earlier efforts to quench inflation.

People would lose confidence in the central bank’s determination to tame inflation, which can de-anchor inflation expectations and prolong the issue.

It wasn’t until Paul Volcker became chairman of the Federal Reserve Board in 1979 that the United States was able to restore price stability.

However, it came at a great cost and Paul Volcker was vilified for years because of the steps he had to take to break the back of inflation.

During his tenure, the U.S. federal funds rate reached a peak of 20% and national unemployment rose to over 10%.

On the other hand, over-tightening risks pushing the global economy into an unnecessarily severe recession.

However, it is better to over-tighten as the risk of under-tightening is too high. Misjudging the stubbornness of persistent inflation can be detrimental to financial stability.

As economies start slowing down, there will be growing calls for a pivot towards looser monetary conditions.

However, central banks should maintain the course as history has taught us.

Conclusion

The risk of monetary policy miscalculation will remain a hot topic for 2023.

A monetary policy mistake will have a massive impact on the global economic outlook and eventually the VTI fund.

Investors should monitor the risk of under-tightening and re-assess their investment if a monetary policy mistake happens.

I would suggest a hold rating as the global economy is still expected to grow despite the current macroeconomic environment. However, until the risk of a monetary policy miscalculation subsides, I would not advise investing more in the VTI fund.

Be the first to comment