Hispanolistic/E+ via Getty Images

Bright Horizons Family Solutions Inc. (NYSE:BFAM) offers early education and childcare services to over 1,300 major corporations. Its differentiated business model has allowed the company to grow rapidly while reducing risk.

The COVID pandemic dealt a major blow to BFAM from which it still hasn’t fully recovered. Occupancy levels remain 20% below pre-pandemic levels and the company’s growth plans have been put on hold.

Based on analysts’ financial forecasts, BFAM still screens expensive. Until we see concrete signs of improving margins on the back of improving occupancy or the stock price falls further into attractive levels, I believe investors should steer clear of BFAM.

Company Overview

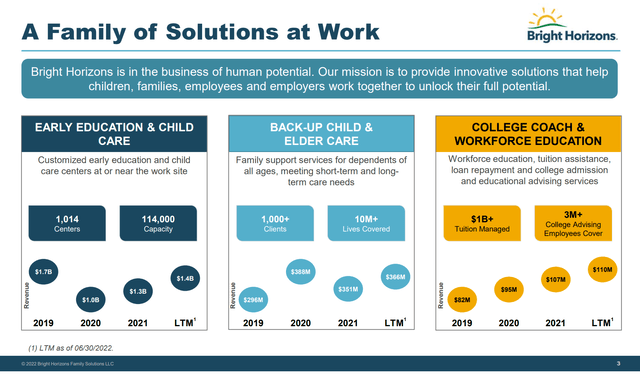

Bright Horizons Family Solutions Inc. is a leading provider of early education and childcare, back-up care, and workplace education services. Bright Horizons operates over 1,000 early education and childcare centers in the United States, the United Kingdom, the Netherlands, Australia and India, and partners with more than 1,350 of the world’s leading employers to provide child-care services to their employees.

Figure 1 – BFAM overview (BFAM investor presentation)

Differentiated Business Model

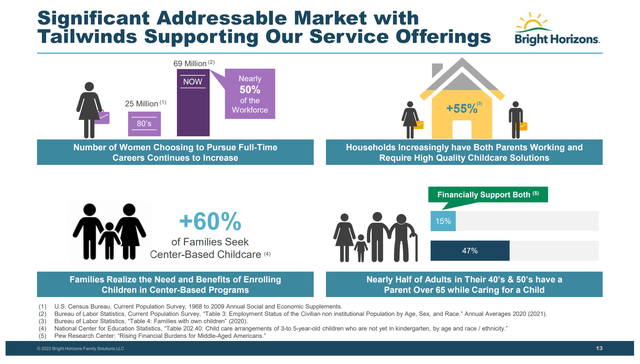

The childcare business has significant demographic tailwinds as an increasing number of households have both parents working, boosting the demand for high quality childcare. In addition, academic studies show that children enrolled in center-based programs generally develop better social interaction skills at a younger age (Figure 2).

Figure 2 – Childcare demographic tailwinds (BFAM investor presentation)

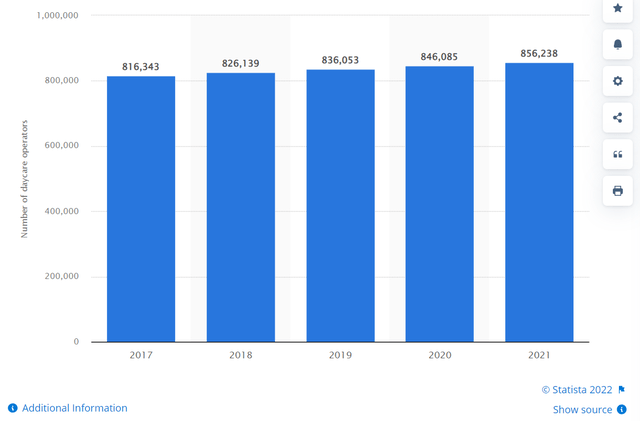

While childcare is an essential service, it has low barriers to entry, with over 800,000 childcare centers in the U.S. (Figure 3).

Figure 3 – Number of daycare operations in the U.S. (Statista)

With low barriers to entry, the childcare business was historically not very profitable, with some estimates of owner profitability ranging in the tens of thousands of dollars.

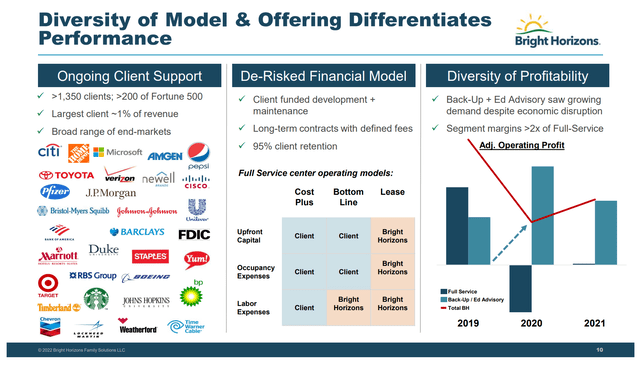

Bright Horizons was able to institutionalize the childcare business by partnering with leading employers to offer on-site childcare. For Bright Horizons, corporate clients help fund development and maintenance expenses, as well as provide long-term contracts with well-defined fees. This significantly de-risks the business model for BFAM (Figure 2).

Figure 4 – Partnering with corporations de-risk BFAM’s business (BFAM investor presentation)

For the client, they get to use childcare as an employee attraction/retention tool, as childcare is often one of the most important considerations for young families when they are deciding where to work. Having on-site back-up childcare also reduces employee absence, as caring for a sick child is often one of the main reasons employees take sick days.

COVID Was A Big Hit To The Business

Based on its differentiated business model, BFAM was a wildly successful company since 2013. By the end of 2019, the company’s stock had returned over 8x its IPO price of $22 (Figure 5).

Figure 5 – BFAM stock price (stockcharts.com)

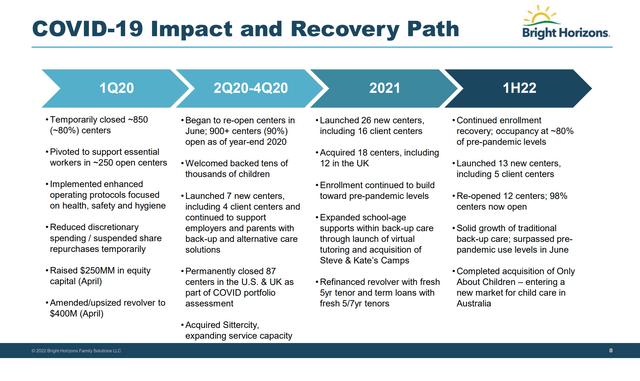

However, the 2020 COVID pandemic was a rude awakening for the company. First, 80% of the company’s centers were closed in the early days of pandemic due to lockdown measures. Then as centers re-opened in 2020 and 2021, they were faced with lower occupancy as many office workers chose to work from home (“WFH”). Finally, labour shortages meant BFAM’s operating costs went up, as the company fought to attract and retain qualified early childhood educators (Figure 6).

Figure 6 – COVID impact to BFAM (BFAM investor presentation)

Even in H1/2022, BFAM’s occupancy has only returned to 80% of pre-pandemic levels, pressuring the company’s profitability.

Financials

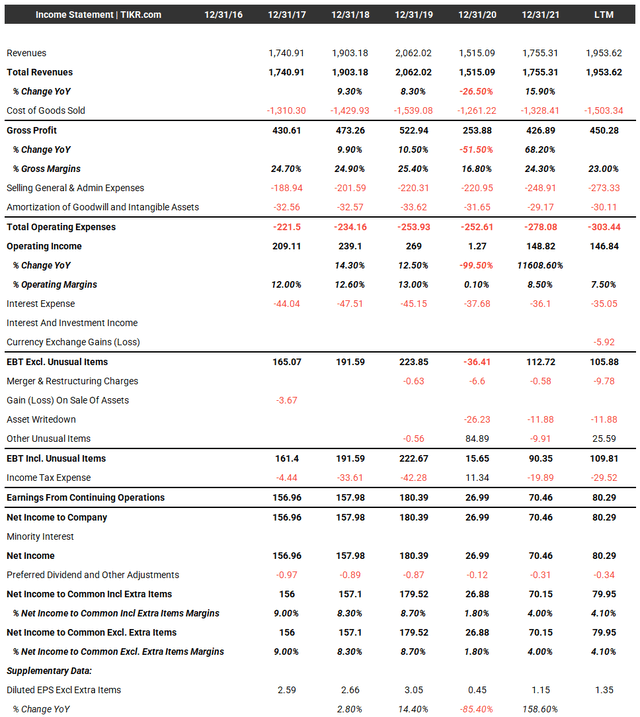

Financially, BFAM took advantage of its low-risk / high return business model to grow rapidly. At the end of 2019, BFAM operated close to 1,100 facilities and generated $2.06 billion in revenues and $269 million in operating profit or 12.5% operating margin. Per facility operating profit was ~$240,000, far superior to the single facility profitability I cited earlier in my article (Figure 7).

Figure 7 – BFAM financial summary (tikr.com)

However, with lowered occupancy and higher expenses, LTM revenues to September 30, 2022 were only $1.9 billion and $147 million, respectively, leading to operating margins of 7.5%.

2023 Return To Office May Offer Upside To BFAM But Wages Pressure Margins

Looking forward, 9 in 10 employers want their employees to return to the office in 2023, which could help BFAM’s occupancy and improve margins.

However, the company continues to battle an extremely tight labour market, with the latest jobs report indicating average hourly earnings (“AHE”) were rising at a 5.1% YoY pace in November.

Valuation Screens Expensive

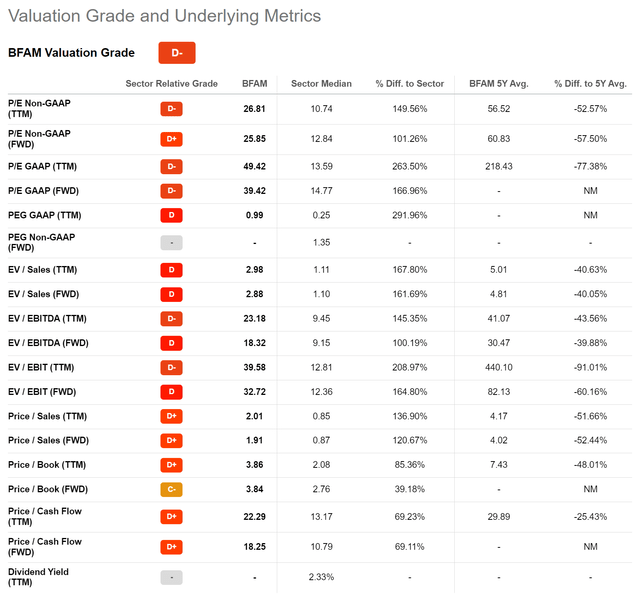

Despite BFAM’s stock price declining by over 60% from its peak, Bright Horizons still screens expensive on valuation metrics like Fwd P/E and Fwd EV/EBITDA, trading 25.9x and 18.3x respectively vs. the sector median of 12.8x and 9.2x (Figure 8).

Figure 8 – BFAM valuation (Seeking Alpha)

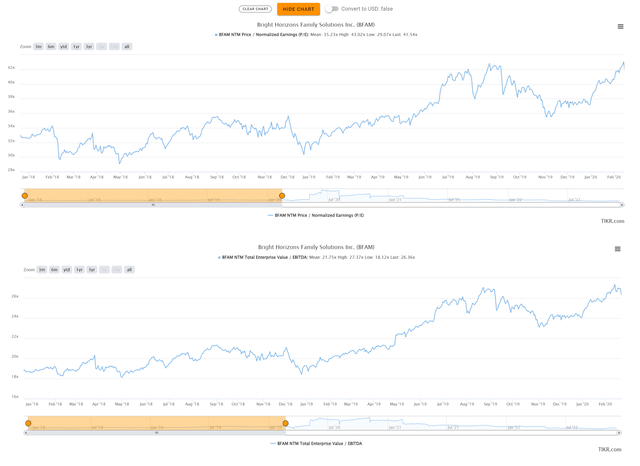

This is because BFAM was formerly a high-flying growth stock / market darling that traded at over 35x Fwd P/E and 20x Fwd EV/EBITDA prior to the pandemic (Figure 9).

Figure 9 – BFAM historical valuation multiples (tikr.com)

As growth slowed and margins compressed, BFAM’s valuation multiple fell, but still remains elevated.

Note, this is the key risk with investing in high-growth companies; if something goes wrong, the stock has a long way to fall before it becomes attractive on valuation.

Risks To BFAM

The downside risk to Bright Horizons is if the economy enters a recession in 2023 and employers start laying off employees, this will negatively affect BFAM’s occupancy and margins.

On the flip side, as we mentioned above, many employers have return to office mandates heading into 2023, which could help occupancy levels. However, until we see concrete signs of improving margins, it is probably still too early to turn bullish on BFAM.

Conclusion

Bright Horizons has institutionalized childcare services, partnering with major employers to offer on-site childcare facilities that generate above average margins for the company. The COVID pandemic dramatically reduced occupancy levels and stopped BFAM’s growth plans in its tracks. Although COVID restrictions have been lifted across the world, many employees still prefer to work from home, reducing the demand for childcare services. Based on near-term financial forecasts, BFAM still screens expensive. Until we see concrete signs of improving margins or the stock price falls further, I believe investors should steer clear of BFAM.

Be the first to comment