tilo/iStock via Getty Images

Clean Energy Fuels Corp. (NASDAQ:CLNE) was once a promising alternative fuels concept to power transportation fleets. Now, the company has seen the world bypass natural gas as a fuel for electric vehicles with a quick pivot to electric vehicles. My investment thesis remains negative on the stock due to the lack of a clear sight to profits.

Volume-Focused

The biggest problem with Clean Energy remains the business being focused on low-margin volumes. Energy prices around the world are soaring due to a lack of supply of oil and natural gas coming off cutbacks and the Russian invasion of Ukraine, yet the transportation fuels company just reported a very weak Q1’22.

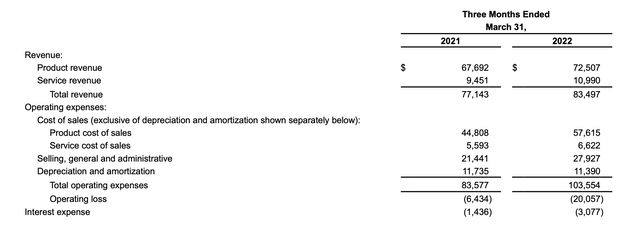

Revenues were just $83.5 million and adjusted EBITDA dipped to only $3.3 million, down from $11.6 million last Q1. Clean Energy delivered 95.8 million gallons of fuel for a very minimal 3.7% increase from the prior year. Key renewable natural gas (RNG) only grew 7.3% in the quarter to 39.7 million gallons.

The biggest issue facing the company has always been the very low margin obtained in the fuel sold. Clean Energy is very much more like a gas station with low margins on fuel without the benefit of the high-margin items sold within the convenience store.

Whether or not Clean Energy is delivering the alternative fuel of the future has always been irrelevant when the margins were so low and the costs were so high. On the Q1’22 earnings call, CFO Robert Vreeland confirmed the margin per gallon goal remains around a quarter per gallon:

Our margin per gallon for the first quarter of 2022 was $0.25. Our margin per gallon a year ago was $0.26. Our internal target for the first quarter of 2022 was $0.26. So we had anticipated a little pullback in the first quarter of 2022 from the trends that we were seeing at the end of ’21, but it pulled back maybe $0.01 more than what we had planned.

Quarterly product revenues were $72.5 million, but the gross profit from the segment was only $14.9 million. Despite all the work done to build an LNG and CNG transportation fueling network, Clean Energy only produces ~$15 million in fuel gross profits. Gas prices are soaring with an average price topping $5 and diesel facing shortages, yet this company isn’t even profiting due to saving customers over $1 per gallon versus pocketing a premium by supplying a clean fuel.

The company has another $11.4 million in depreciation and amortization expenses that nearly wipe out all of the profit from the sector before even considering the SG&A costs. With quarterly SG&A costs far above the remaining profit, the profit picture has always been dismal for Clean Energy.

Clean Energy Q1’22 Earnings Release

The whole problem with the focus on adjusted EBITDA is that these depreciation charges were real costs never charged to the business. The interest expenses can’t be ignored either.

Clean Energy ends up with ~$12 to $13 million worth of charges worthy of being stripped from the income statement. The most important charges that really shouldn’t be included in the income statement are the $8.3 million worth of stock-based compensation and the $3.8 million charge for the Amazon warrants. In both cases, the real charge to Clean Energy is the additional shares outstanding that jumped to 222.6 million in the last quarter, up from 199.0 million last Q1.

Industry Shift

The major problem with Clean Energy is that the company has spent the last decade mostly failing to gain much traction using natural gas as an alternative clean fuel. The whole transportation sector appears headed to using battery electric vehicles and other potential fuel sources in the future.

In essence, Clean Energy isn’t even generating a profit yet and the market wants to change to a different solution due to a perception that BEVs are a better alternative. Either way, the company hasn’t produced the profitable growth to warrant an investment.

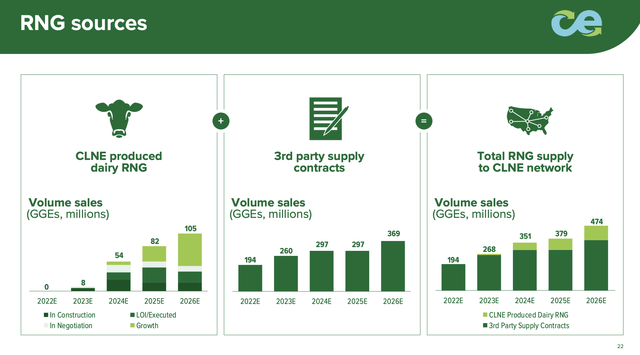

The company is now staking the business on developing RNG from dairy to generate massive sales volumes growth. A big positive to this opportunity is using the RNG internal supplies for electric generation which could fuel the EVs of the future and make the company less reliant on fueling stations.

A lot of the dairy projects under construction now don’t come online until 2024, and one has to really question the ultimate profits in obtaining RNG from dairy farms when current LNG/CNG has limited margins. The story is compelling enough to watch, but Clean Energy needs to deliver either the volume growth or margin expansion to actually reward shareholders.

Takeaway

The key investor takeaway is that RNG from organic waste has a lot of potential in finding a sustainable fuel to lower carbon emission. Clean Energy Fuels still needs to prove the profit picture works out as forecast, and investors must painfully wait another couple of years to really get a full picture.

Investors should stay on the sidelines for now.

Be the first to comment