Falcor

Just over two months ago, I wrote on Orla Mining (NYSE:ORLA), noting that while the company had made a transformational acquisition at a very reasonable price, rallies above $3.30 before year-end would offer selling opportunities. This is because the stock had broken a major technical support level following its acquisition and was in the unfavorable post-acquisition period, which often leads to sharp rallies being sold to digest new share dilution, even if the deal is accretive. Evidence of this was clear in Kirkland Lake Gold’s acquisition of Detour, one of the best this cycle, yet it led to significant underperformance for KL in the year post-acquisition.

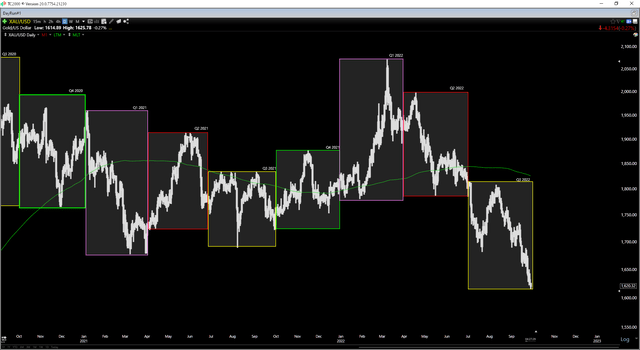

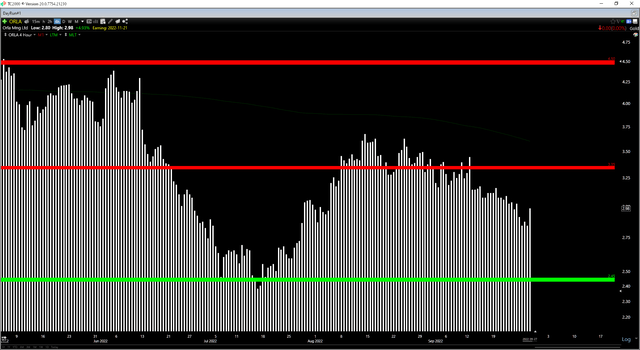

Since July, Orla rallied back above $3.30 but has since corrected by more than 22%, partially related to a break below the psychological $1,700/oz level for gold. The good news is that Orla continues to put up solid operational results, the company seems as confident as ever in its growth plan, and the stock remains above a rising 250-week moving average, more than can be said for most producers. So, with the valuation remaining attractive and the company set to maintain its spot among the top 10 lowest-cost producers, I see this as a name to keep near the top of one’s watchlist.

Camino Rojo Operations (Company Presentation)

Q2 Financial Results

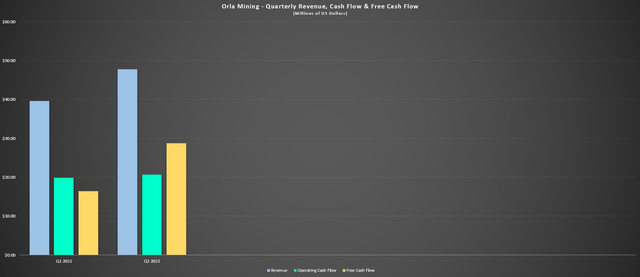

Orla Mining released its Q2 financial results last month, reporting quarterly revenue of $47.8 million, with ~25,400 ounces of gold sold at an average realized price of $1,872/oz. These strong results and record revenue (Q1 2022: $39.6 million) were helped by higher sales volumes at a much better price than current spot levels and by the exceptional operating results to date at the company’s new Camino Rojo Mine. In fact, Orla’s execution has been flawless to date, with no real teething issues that some new mines experience, and delivering project construction on time and under budget.

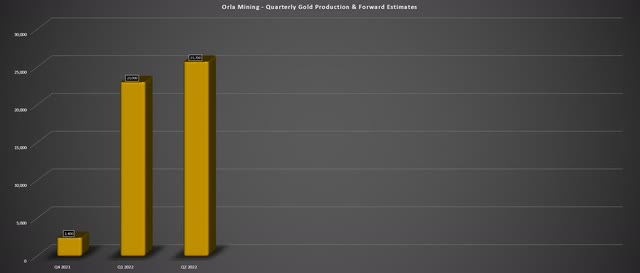

Orla Mining – Quarterly Gold Production (Company Filings, Author’s Chart)

Based on ~48,700 ounces produced year-to-date, Orla is tracking very nicely against its guidance mid-point of 95,000 ounces of gold production, with the potential to come in above the top end at 101,000 to 103,000 ounces given performance to date. Unfortunately, the slight increase in quarterly production (~26,000 ounces in Q3 and Q4) will be more than offset by the declining gold price, impacting revenue and cash flow generation in the period. That said, Orla is still on track to generate well over $70 million in free cash flow this year, an impressive feat for a small-scale producer with a single asset miner in Zacatecas, Mexico.

Orla Mining – Quarterly Revenue, Cash Flow & Free Cash Flow (Company Filings, Author’s Chart)

From a cash flow standpoint, Orla had a great quarter, reporting quarterly cash flow from operations of $20.7 million and free cash flow of $28.7 million, with free cash flow buttressed by value-added tax refunds. Even excluding this benefit, free cash flow is sitting at nearly $40 million heading into the second half of 2022. Finally, from a margin standpoint, Orla stands head and shoulders above its peers in the sector, reporting all-in-sustaining costs of $601/oz in Q2 2022, translating to an AISC margin of $1,271/oz, or 68%. Even assuming Orla’s average realized gold price drops to $1,700/oz in H2 2022, it should still enjoy 64% margins based on H2 AISC estimates of $600/oz.

Gold Futures Price (TC2000.com)

The last encouraging point worth noting is that Orla’s costs continue to track positively against its Feasibility Study, and stacking rates are also trending slightly above nameplate capacity. From a stacking rate standpoint, Orla saw stacking rates of ~18,200 tonnes per day in Q2, 1% above its nameplate capacity. Meanwhile, from a cost standpoint, G&A per tonne is 5% below Feasibility Study estimates at $1.53/tonne for the time being. Meanwhile, although it is seeing inflationary pressures in some consumables, it’s benefiting from slightly less diesel, power, and cyanide consumption, providing some offset vs. the sharp increases in unit costs experienced by some producers.

The Bigger Picture

While Orla did a phenomenal job in its first quarter in commercial production, the company’s future is the most exciting, with two major development projects in the wings in different countries (United States, Panama) and a third next door. These two projects are South Railroad in Nevada and Cerro Quema in Panama. Combined, they are expected to have average all-in-sustaining costs well below the industry average and near $900/oz (incorporating inflationary pressures), providing Orla with significant upside to its current growth profile while maintaining industry-leading costs.

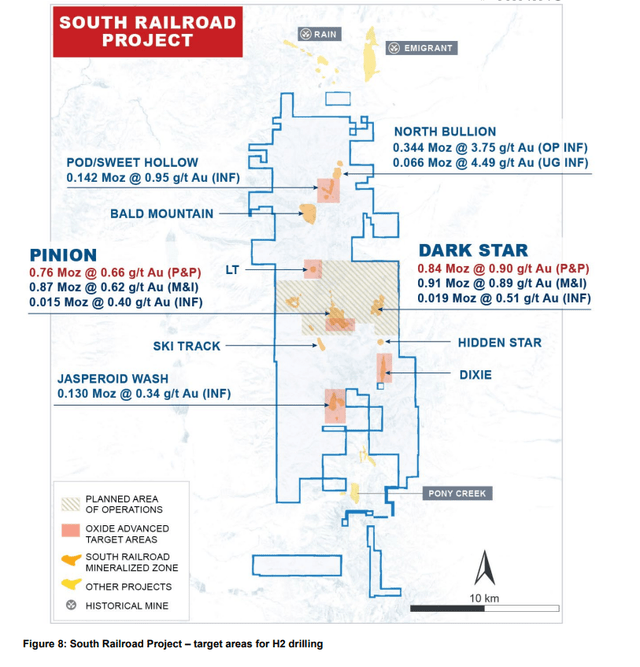

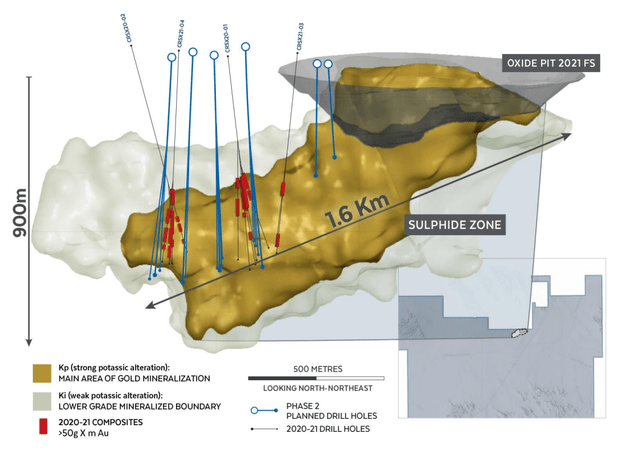

The South Railroad Project is expected to produce 150,000 ounces in its first four years and ~124,000 ounces over its mine life at costs of $1,021/oz. Even if we assume 5% cost escalation and costs of $1,070/oz, this future mine (assuming permits are granted) would have a profile nearly 20% below the estimated FY2025 industry average of $1,300/oz. The attractiveness of this asset is that it was sparsely drilled by its previous owner, with Gold Standard aggressively drilling for two years in a bull market for juniors but pulling back its growth exploration spend aggressively with the market becoming much less favorable towards junior miners in 2018-2021, except for a brief recovery from the March 2020 lows.

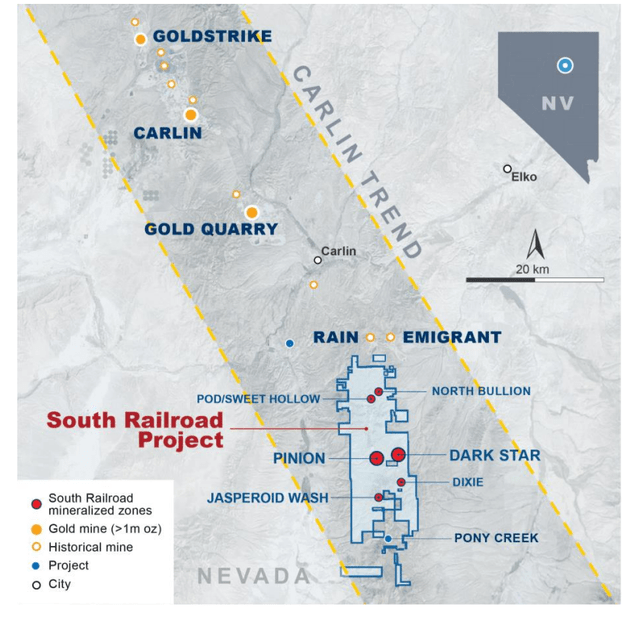

South Railroad Project (Company Presentation)

This suggests that while Orla has a relatively high-grade oxide project on its hands with a 10-year mine life, there is lots of opportunity to fill in this mine life with new discoveries and also look at mostly ignored sulfide opportunities, with the possibility of toll-milling later this decade. For those unfamiliar, Orla now has the second largest contiguous land package on the Carlin Trend with 20,000+ hectares acquired from Gold Standard, and there are multiple targets outside of the mine plan (Pinion/Dark Star), which include Hidden Star, Ski Track, North Bullion, POD/Sweet Hollow, and LT.

Project Area & Carlin Trend (Company Presentation)

Previously, Orla had budgeted $15.0 million for exploration this year, but the company noted in a recent presentation that it plans to spend $3.0 million in 2022 at Gold Standard to do some drilling on the project now that it’s in its possession. This is a nice bonus to the investment thesis here, and on a trend that’s this well-endowed in Nevada (80+ million ounces of gold produced since the 1960s), there’s certainly reason to be optimistic about potential discoveries and building on existing resources with a land package of this size that’s been relatively unexplored to date.

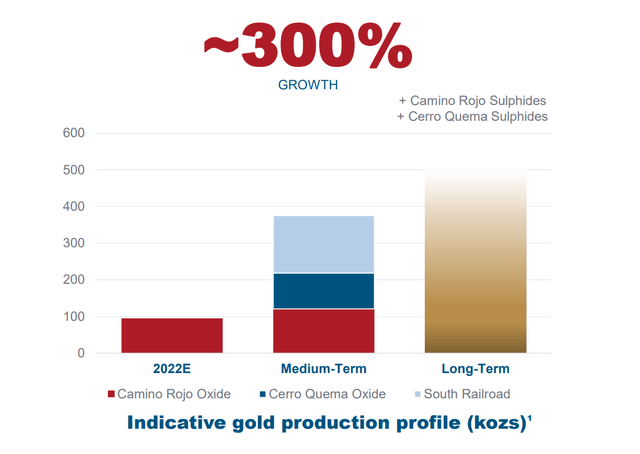

Meanwhile, moving back to Zacatecas in Mexico, Orla has a large opportunity both regionally and next door to its mine, with ~160,000 hectares of land that’s also relatively unexplored and its Camino Rojo Sulfides Project. The latter is home to a 7.0+ million-ounce gold resource in the measured & indicated categories, with a Preliminary Economic Assessment expected next year to understand the economics better. If we put this all together, Orla’s long-term goal is to increase production to ~500,000 ounces without needing to complete any future acquisitions. Medium-term, the goal is 325,000 ounces in 2026 with Cerro Quema and South Railroad online, assuming the timely receipt of permits.

Camino Rojo Sulfides Project (Company Presentation)

Normally, I would be skeptical of a growth plan this aggressive. Still, it’s important to note that Orla has a very strong team, as evidenced by its execution at Camino Rojo Oxides, it is churning out free cash flow, and its pipeline is relatively low capex and very similar to its current asset (small oxide projects). So, for investors looking for growth in an industry that doesn’t offer many options, Orla is certainly one of the few names to keep an eye on. Most importantly, that growth comes at a very attractive price due to the violent bear market in the sector.

Future Growth Potential (Company Presentation)

Valuation & Technical Picture

Based on ~346 million fully-diluted shares and a share price of US$3.00, Orla Mining trades at a market cap of $1.04 billion, which might seem like a very steep valuation for a company set to generate less than $80 million in free cash flow next year at spot gold prices. However, given its massive pipeline, the better way to value the company is on a P/NAV basis. Using this method and an estimated net asset value of $1.90 billion, Orla trades at just 0.55x P/NAV, a very reasonable valuation for a top-5 growth story sector-wide with an industry-leading cost profile. Based on what I believe to be a conservative multiple of 0.75x until it sheds single-asset producer status, I see a fair value of US$4.40.

ORLA 6-Month Chart (TC2000.com)

Unfortunately, while Orla trades at a deep discount to its estimated net asset value below $3.00 per share, the stock is currently in the upper portion of its expected support/resistance range. This is based on the stock’s strong resistance at $3.35 and no strong support until $2.45. Generally, when it comes to small-cap producers, I prefer a minimum 5 to 1 reward/risk ratio to justify entering new positions. With $0.35 in potential upside and $0.65 in potential downside, this is not the case currently. So, while I think ORLA is a very solid story with a team that is over-delivering, the low-risk buy point for the stock comes in below $2.60.

Summary

Orla will exit 2022 as one of the lowest-cost producers sector-wide by a wide margin and has another phenomenal year on deck in 2023, even if gold prices stay below $1,700/oz. This is because the company will enjoy $1,000/oz AISC margins and generate considerable free cash flow. Investors can look forward to multiple catalysts, including a PEA at Camino Rojo Sulfides and a steady stream of drill results from its three properties. That said, I prefer to bid lower than usual in the less favorable post-acquisition hangover period. So, while I think Orla is a name to keep a close eye on, I see the more attractive buy point being below $2.60.

Be the first to comment